1. Overall Trend Structure

XRP’s price action typically exhibits:

🔹 A multi-year ascending trend with periodic corrections

🔹 Rotation between accumulation zones and breakout phases

🔹 Sensitivity to broader crypto risk sentiment

Right now, XRP is trading within a range defined by long-term support and resistance levels. The long-term trend remains structurally bullish, but with intermediate consolidation and short-term volatility.

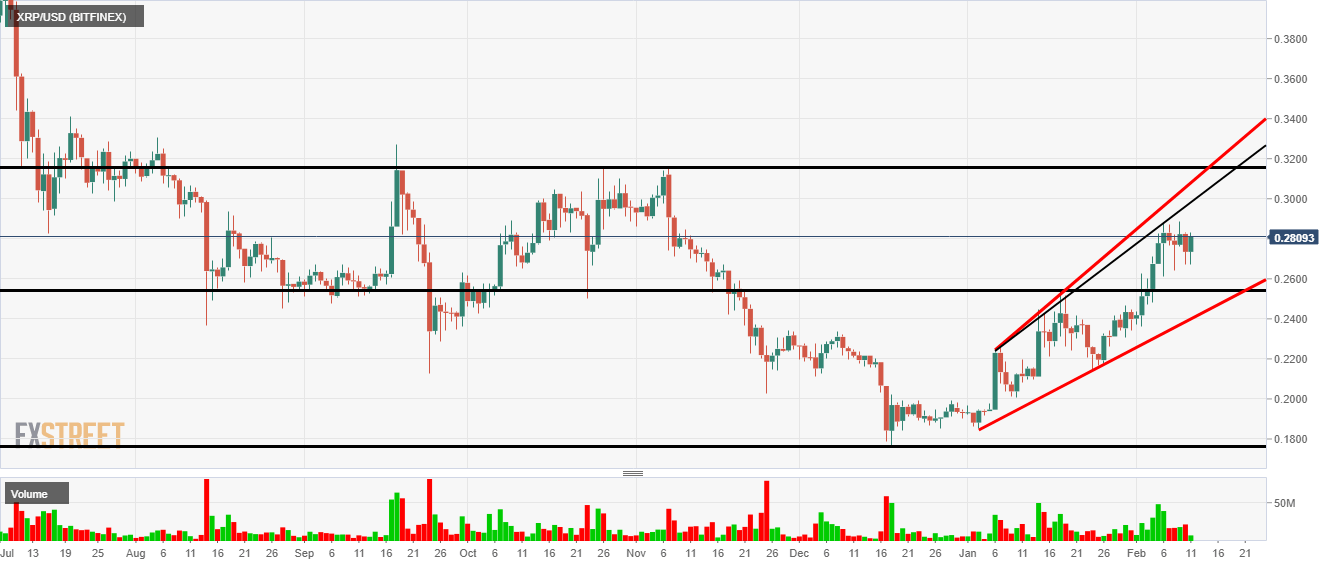

📉 2. Key Support & Resistance Levels

Identifying precise levels helps frame bias and potential pivot zones:

📌 Major Support Zones

- $0.85–$0.95 — Historically strong demand zone; multiple rejections

- $0.70–$0.75 — Secondary support from recent swing lows

- $0.60 — Psychological round number support

These levels act as areas where buyers have historically stepped in.

📌 Critical Resistance Levels

- $1.15–$1.25 — First line of overhead resistance

- $1.40–$1.50 — Broader medium-term supply zone

- $1.70+ — Next major resistance beyond recent highs

Breaking above these zones with sustained volume signals shifting bias.

📊 3. Chart Patterns & Structure

🟦 Range Bound

XRP has been trading sideways within a horizontal range — defined by near-term support and resistance.

This often indicates:

- Consolidation after a prior swing

- Indecision between buyers and sellers

- A buildup of liquidity for a directional move

A breakout above resistance suggests trend continuation. A breakdown below support suggests deeper correction.

🟨 Higher-Timeframe Trend

On the weekly chart, the higher timeframe trend remains neutral to mildly bullish so long as long-term support holds.

However, the failure to reclaim higher highs indicates loss of short-term momentum.

⏱️ 4. Moving Averages (MA)

Moving averages help gauge dynamic trend bias.

- 50-period MA (short-term) — Currently near the middle of the range; price fluctuates around it

- 100-period MA (medium-term) — Neckline level; acts as equilibrium point

- 200-period MA (long-term) — Still below current price, indicating structural support

If price stays above the 200 MA, trend bias remains intact. Sustained drops below 100 and 50 MA amplify bearish pressure.

📈 5. Momentum Indicators

📌 RSI (Relative Strength Index)

- RSI near neutral (40–60) signals range behavior without major trend conviction

- Escapes above 60 confirm bullish momentum

- Dives below 40 suggest bearish tilt

Look for RSI divergences (price higher highs vs RSI lower highs) as early reversal signs.

📌 MACD (Moving Average Convergence Divergence)

MACD currently near signal line cross — a classic momentum inflection:

- Bullish crossover = potential trend revival

- Bearish cross underneath zero = increased downside risk

Watching MACD histogram cycles helps time entries/exits.

🔄 6. Volume Behavior

Volume is the fuel behind moves:

- High volume on upside moves strengthens breakout validity

- Low volume breakouts often fail and revert back

- High volume on support tests indicates absorption by buyers

Currently, volume contracting during consolidation suggests indecision — traders are waiting for a catalyst.

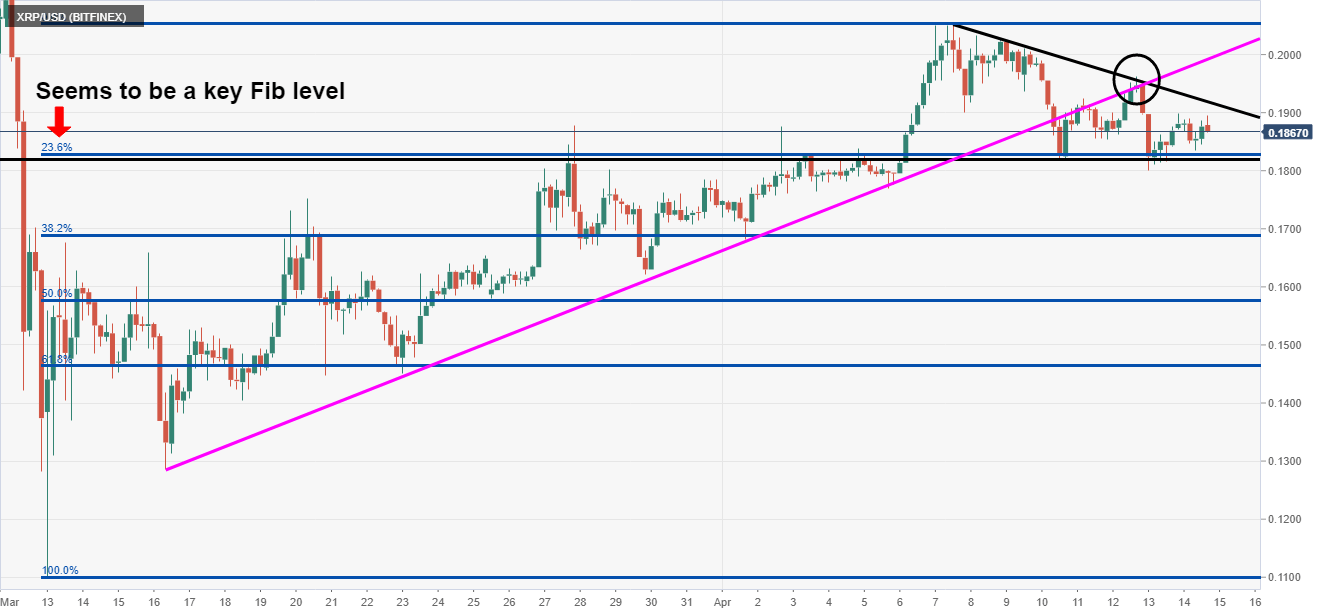

📊 7. Fibonacci Retracement Levels

Fibonacci levels from recent swing low to swing high can highlight retracement targets:

- 23.6% retrace = shallow pullback zone

- 38.2% retrace = moderate support zone

- 50% retrace = key psychological level

- 61.8% retrace = deep correction area

Price respecting these levels often signals trend discipline.

🧠 8. Potential Scenarios

🟢 Bullish Scenario

- Price breaks above $1.25 on strong volume

- RSI pushes beyond 60

- MACD crosses bullish

- Confirm breakout with retest-and-hold

Targets:

$1.40 → $1.50 → $1.70+

🔴 Bearish Scenario

- Price fails at resistance and breaks below $0.95 support

- RSI drops below 40

- MACD turns negative

- Increased selling volume

Targets:

$0.85 → $0.75 → $0.60

📌 9. Risk Management Levels

High-probability strategies involve layering risk:

- Stops below key support (e.g., 5–8% below entry based on volatility)

- Scaled entries on retests

- Profit tiers aligned with resistance levels

Risk management prevents one bad trade from dominating a portfolio.

🧾 10. Summary Bias

| Category | Current Bias |

|---|---|

| Short-Term | Neutral / Range |

| Medium-Term | Cautious Bullish |

| Long-Term | Bullish if support holds |

| Momentum | Flat / indecisive |

| Volume | Low; awaiting catalyst |

XRP is currently in a decision zone. Breakouts above resistance amplify bullish bias. Breakdowns below support shift bias toward correction.