Why Hyperliquid Is Quietly Taking Market Share From Centralized Exchanges

The crypto exchange landscape is shifting again. For years, centralized exchanges dominated everything: liquidity, leverage, onboarding, and global user growth. But in 2026, a new pattern is emerging. Traders—especially experienced ones—are migrating toward high-performance decentralized exchanges. And one name keeps coming up in serious trading circles: Hyperliquid. The rise of Hyperliquid decentralized exchange isn’t loud. […]

Bitcoin Capitulation: What the Current Price Drop Means for the Market

Bitcoin’s sharp sell-off has reignited one of the most emotionally charged concepts in crypto markets: capitulation. As prices fall through key psychological levels and sentiment turns decisively negative, traders and long-term investors alike are asking the same question: Is this just another correction — or are we witnessing full market capitulation? This article breaks down […]

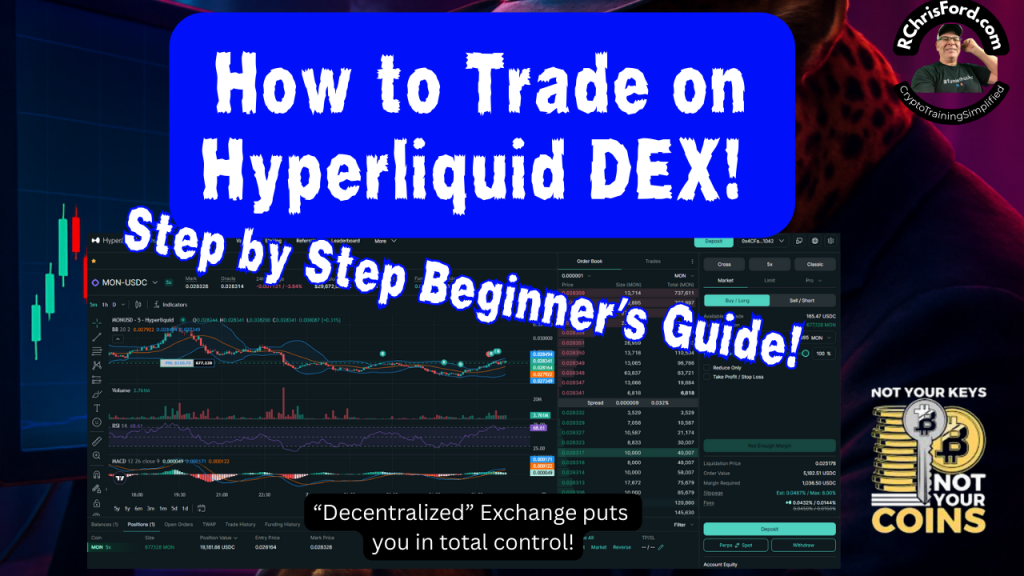

How to Use Hyperliquid.xyz: A Beginner’s Step-by-Step Guide to Trading on a Decentralized Exchange

Decentralized exchanges (DEXs) are transforming how people trade cryptocurrencies, offering self-custody, transparency, and permissionless access. One of the most popular new entrants in this space is Hyperliquid, a high-performance decentralized perpetuals exchange built for speed and low fees. If you’re a complete beginner, this guide will walk you step by step through everything you need […]

Government Shutdowns and the Crypto Market: What Investors Really Need to Know

Government shutdowns are recurring political events, particularly in the United States, that tend to generate fear, uncertainty, and speculation across financial markets. Each time headlines announce stalled budgets or furloughed federal workers, investors ask the same question: What impact does a government shutdown have on the crypto market? Some claim shutdowns are bullish for Bitcoin […]

Centralized Exchanges vs Decentralized Exchanges: What’s the Difference and Why It Matters

Cryptocurrency has fundamentally changed how value moves across the internet. But for most people, the first interaction with crypto is not with a blockchain—it’s with an exchange. Exchanges act as marketplaces where users buy, sell, and trade digital assets. There are two dominant models in the crypto ecosystem today: centralized exchanges (CEXs) and decentralized exchanges […]