The legal saga surrounding Sam Bankman-Fried is far from over. After his 2023 conviction related to the collapse of FTX, the former crypto billionaire has launched a new legal offensive. In recent filings, he alleges that the U.S. Department of Justice under the Biden administration improperly pressured or “silenced” potential defense witnesses during his trial.

It’s a serious accusation. If proven, it could challenge the legitimacy of one of the most high-profile criminal cases in financial history. But legal standards are extremely strict — and winning a retrial is notoriously difficult.

In this deep dive, we’ll break down:

- What SBF is claiming

- The legal mechanism he’s using

- The role of Judge Lewis Kaplan

- The broader implications for crypto regulation

- Whether this strategy realistically changes anything

What Exactly Is Sam Bankman-Fried Claiming?

4

According to post-conviction filings, Bankman-Fried argues that prosecutors engaged in conduct that discouraged or prevented certain witnesses from testifying on his behalf.

Specifically, his motion alleges:

- Government pressure caused potential defense witnesses to decline testifying.

- Prosecutors influenced or shaped testimony from cooperating witnesses.

- Certain statements that could have aided the defense were withheld or altered.

- The prosecution created an environment of intimidation around potential testimony.

These claims are being raised as part of a motion for a new trial under Federal Rule of Criminal Procedure 33 — a rule that allows courts to grant a retrial “in the interest of justice” if new evidence emerges.

It’s important to understand: these are allegations in a legal filing, not findings of misconduct. No court has ruled that prosecutors silenced witnesses.

The Legal Tool: Rule 33 Motions Explained

Bankman-Fried’s team is using Rule 33 to seek a new trial. This is a rarely successful path.

To win a new trial based on newly discovered evidence, the defense must prove:

- The evidence was discovered after trial.

- The evidence could not have been found earlier with reasonable diligence.

- The evidence is material (not trivial).

- The evidence would probably lead to acquittal.

That final requirement is the hardest hurdle. Courts don’t grant retrials simply because new information surfaces — it must be strong enough to reasonably change the outcome.

In white-collar criminal cases, Rule 33 motions succeed in only a small fraction of attempts. Federal courts apply the standard strictly to preserve finality of verdicts.

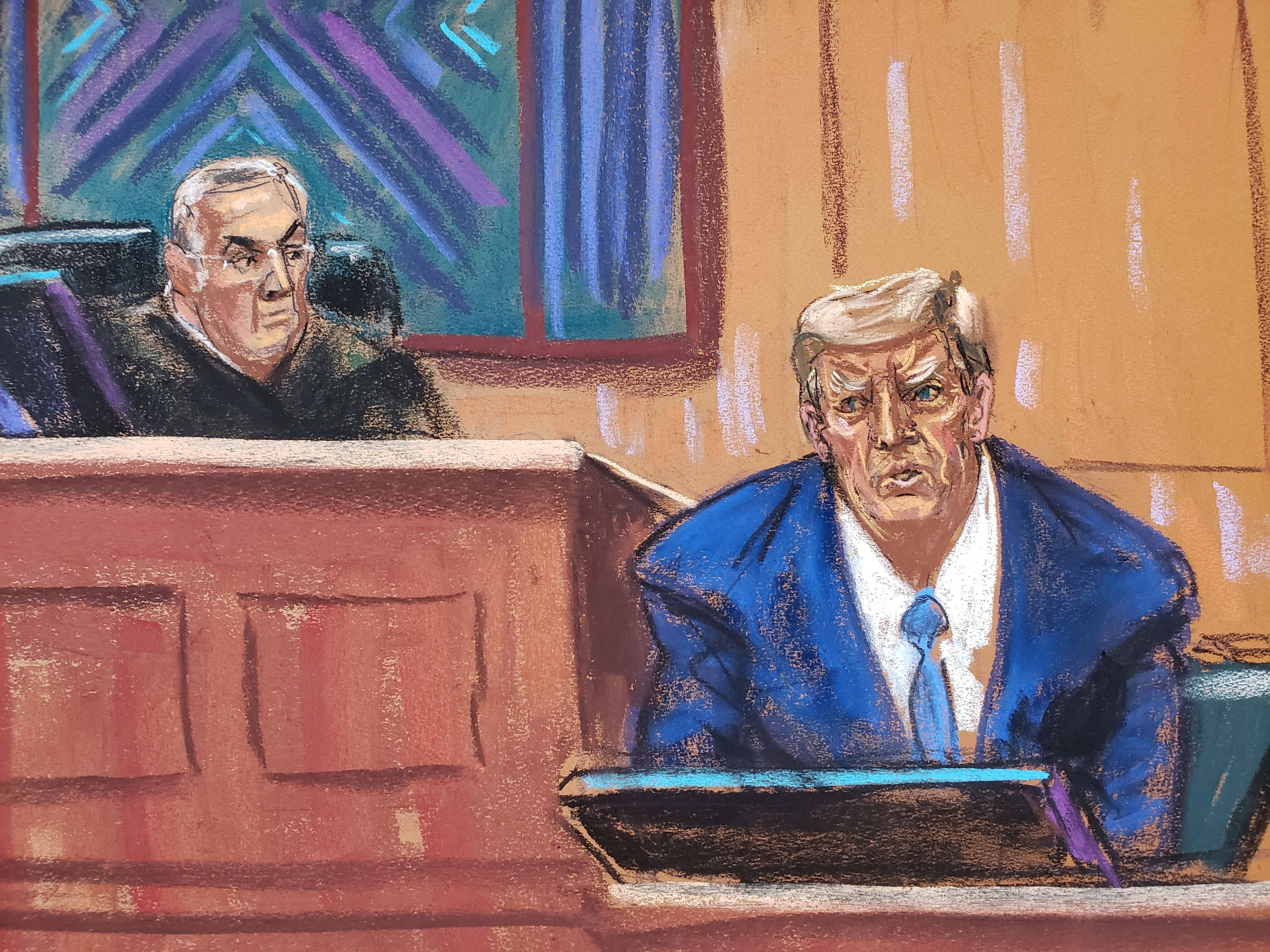

The Role of Judge Lewis Kaplan

The original trial was presided over by Lewis Kaplan, a senior judge in the Southern District of New York.

Kaplan is known for handling complex and high-profile financial and civil cases. During SBF’s trial, he made several evidentiary rulings that limited certain defense arguments — including attempts to frame FTX’s collapse as primarily a liquidity crisis rather than fraud.

Now, SBF’s legal team is also seeking Kaplan’s recusal, arguing potential bias or prejudgment. That is an uphill battle.

Judges are presumed impartial unless clear evidence demonstrates otherwise. Disagreement with rulings does not constitute bias. Appeals courts routinely reject recusal requests unless there is demonstrable personal prejudice.

If Kaplan denies both the recusal and the new trial motion, the case would then proceed to appellate review.

Who Were the Allegedly “Silenced” Witnesses?

Some filings reference individuals connected to FTX who did not testify for the defense but were involved in early investigations or cooperation agreements.

Among figures frequently discussed in the broader FTX narrative:

- Ryan Salame

- Nishad Singh

Both were involved in cooperation agreements with prosecutors.

SBF’s argument suggests that early statements from certain insiders may have evolved under prosecutorial pressure, or that potential witnesses were discouraged from offering testimony favorable to the defense.

However, it is common in federal cases for cooperating witnesses to enter plea agreements. Their testimony is scrutinized by both sides, and juries are typically instructed to consider possible bias when evaluating such testimony.

The question becomes: did prosecutors cross a legal line — or were they operating within standard plea-deal practices?

That distinction is critical.

Why This Matters for Crypto’s Public Image

The collapse of FTX was one of the most damaging events in crypto history. Billions in customer funds were lost. Public trust eroded. Regulators accelerated enforcement.

The conviction of Bankman-Fried became symbolic:

- For regulators, it validated enforcement action.

- For critics, it reinforced the “crypto equals fraud” narrative.

- For institutional investors, it marked a turning point toward compliance.

Now, if allegations of prosecutorial misconduct gain traction, it could reshape the narrative once again — from “crypto villain convicted” to “controversial prosecution under scrutiny.”

However, it is equally possible that courts reject the motion entirely, reinforcing the legitimacy of the original verdict.

Either way, the optics matter. Crypto remains politically sensitive. Enforcement actions are frequently interpreted through partisan lenses. Claims of DOJ overreach feed directly into that tension.

The Political Dimension

By framing the allegations as actions taken under the “Biden DOJ,” SBF’s legal strategy introduces a political layer.

High-profile prosecutions often become political narratives. Defense teams may emphasize potential governmental overreach to create public skepticism.

That does not automatically mean misconduct occurred. But politically charged framing can:

- Influence public perception.

- Shape media coverage.

- Fuel broader debates about regulatory hostility toward crypto.

The intersection of crypto, federal enforcement, and politics is now deeply intertwined. This case sits at that crossroads.

Realistically — What Are the Odds of a New Trial?

Statistically, the odds are low.

Federal appellate courts give substantial deference to trial judges. To overturn a conviction based on prosecutorial misconduct, a defendant must demonstrate:

- Misconduct occurred.

- It was material.

- It likely affected the verdict.

Given the extensive evidence presented at trial — including internal communications, financial records, and testimony — the burden is heavy.

That said, complex financial cases sometimes evolve during appeals. Sentences can be adjusted. Procedural rulings can be revisited.

But a full retrial? That remains a long shot.

What This Means for Traders and Crypto Investors

For active crypto participants, this case matters less for price action and more for structural perception.

Here’s what to watch:

- Whether courts entertain evidentiary hearings on witness pressure.

- Whether appellate courts issue significant commentary.

- Whether political rhetoric around crypto enforcement escalates.

Markets tend to move on liquidity, macro conditions, and ETF flows — not post-conviction motions. However, long-term institutional confidence is influenced by perceptions of fairness and rule of law.

If crypto is to mature into a globally integrated financial system, legal stability matters as much as innovation.

Final Assessment

Sam Bankman-Fried’s allegations that the DOJ silenced witnesses during the FTX trial represent a significant legal maneuver — but not yet a legal breakthrough.

At this stage:

- The conviction stands.

- The 25-year sentence remains.

- The burden of proof is on the defense.

- Courts have not validated any claim of misconduct.

The case now shifts from courtroom spectacle to procedural chess match.

For the crypto industry, it serves as a reminder: when exchanges operate at systemic scale, failures become national events. And national events become legal battlegrounds.

The coming months will determine whether this is merely a last-ditch appeal strategy — or the beginning of a deeper judicial review.

Either way, the FTX saga is not finished.