Entrepreneurs don’t win by working harder. They win by leveraging structural shifts early.

Right now, that structural shift is Artificial Intelligence.

We are in the middle of the largest productivity expansion since the commercial internet. The founders who understand how to operationalize AI for business growth, automate intelligently, and deploy AI-powered trading strategies are building asymmetric advantages.

This guide is a practical blueprint showing how entrepreneurs can build revenue streams using AI automation, AI-driven marketing, and structured AI trading systems—including how I personally integrate AI into market strategy.

Why AI Is the Largest Entrepreneurial Leverage Opportunity in Decades

The rise of platforms like OpenAI, Google, and Microsoft signals a global capital shift toward intelligent infrastructure.

For entrepreneurs, this means:

- The marginal cost of production is collapsing

- Decision-making speed can be algorithmically enhanced

- Small, focused teams can outperform large incumbents

Founders who implement AI business systems today are creating compounding operational advantages that widen over time.

AI is not a trend layer. It is becoming core infrastructure.

Building Scalable Revenue with AI Automation

The fastest monetization path for entrepreneurs is AI automation for small businesses.

Local companies struggle with:

- Manual lead qualification

- Slow email follow-ups

- Disorganized CRM pipelines

- Inefficient onboarding

Using tools like Zapier and Make combined with models from OpenAI, you can build:

- Intelligent lead scoring workflows

- AI-powered response systems

- Automated proposal generation

- Structured onboarding sequences

Entrepreneurs are packaging these solutions into $2,000–$10,000 deployment contracts with monthly retainers.

The opportunity is simple: most business owners understand revenue but not automation architecture. If you translate inefficiency into scalable systems, you build recurring income.

This is one of the most accessible entry points into AI entrepreneurship.

AI-Driven Marketing at Scale

Marketing has transitioned from intuition-based to data-amplified.

With AI content marketing, entrepreneurs can:

- Generate high-conversion landing pages

- Rapidly test ad variations

- Analyze audience sentiment

- Identify content gaps in their niche

AI shortens the feedback loop between idea and validation.

Instead of launching campaigns blindly, founders can use AI to simulate positioning angles, refine messaging, and optimize for engagement before scaling ad spend.

When you deploy AI-powered business growth strategies, you reduce acquisition costs while improving conversion precision. That spread increases profitability without increasing workload.

This is leverage.

AI for Product Creation and Digital Assets

Digital products are ideal leverage vehicles because distribution is infinite while production cost is fixed.

Using AI, entrepreneurs can:

- Outline and draft structured online courses

- Develop niche-specific eBooks

- Create membership content frameworks

- Build prompt libraries for specific industries

- Design micro-SaaS concepts

The key is specificity.

Generic AI products drown in competition. Highly targeted solutions convert.

For example, instead of building a broad “AI marketing course,” you build:

“AI Systems for Real Estate Agents to Automate Lead Nurturing.”

This specificity drives clarity, authority, and sales.

Entrepreneurs who master AI product development can build assets that generate income long after initial creation.

AI-Powered Trading: How I Use AI in the Markets

One of the most powerful applications of AI is in structured market participation.

Financial markets are probabilistic systems influenced by:

- Liquidity flows

- Behavioral psychology

- Macroeconomic cycles

- Algorithmic activity

Human cognition alone cannot process multi-variable environments at scale.

Here is how I integrate AI trading strategies into my workflow:

Pattern Recognition

AI scans market structure across multiple timeframes to detect volatility compression, trend continuation probabilities, and breakout setups. This reduces emotional bias and increases consistency.

Sentiment Processing

AI-assisted tools evaluate news, macro data, and social sentiment to identify early shifts in narrative before full market pricing occurs.

Dynamic Risk Calibration

Instead of static position sizing, AI helps adjust exposure based on volatility regime, historical drawdown patterns, and correlation structures.

Accelerated Backtesting

AI compresses years of data testing into hours. Strategy refinement becomes iterative and evidence-based rather than intuition-driven.

When applied responsibly, AI in cryptocurrency trading and equity markets transforms decision-making from reactive speculation into structured probability management.

AI is not a guarantee of profits. It is an enhancement layer.

Risk management, position sizing, and psychological discipline remain non-negotiable.

For entrepreneurs who want a deeper breakdown of how I structure these AI-driven trading systems—including risk frameworks and crypto execution models—I outline the methodology inside EarnCryptoProfits.

It is built for founders who want systematic exposure rather than emotional trading.

You can review the framework at earncryptoprofits.com.

AI as a Competitive Moat

The long-term advantage is not merely using AI tools.

It is building proprietary feedback loops.

Entrepreneurs who:

- Capture customer interaction data

- Feed it into AI refinement processes

- Continuously optimize product-market alignment

…create adaptive systems competitors cannot easily replicate.

Modern defensibility comes from intelligent iteration.

If your competitors use generic AI prompts while you train systems on proprietary user behavior, your advantage compounds.

That is how AI competitive advantage becomes durable.

Mistakes Entrepreneurs Make with AI

- Chasing tools instead of building systems

- Automating broken processes

- Ignoring compliance and data governance

- Expecting passive income without execution

AI automation for entrepreneurs is powerful only when integrated into structured strategy.

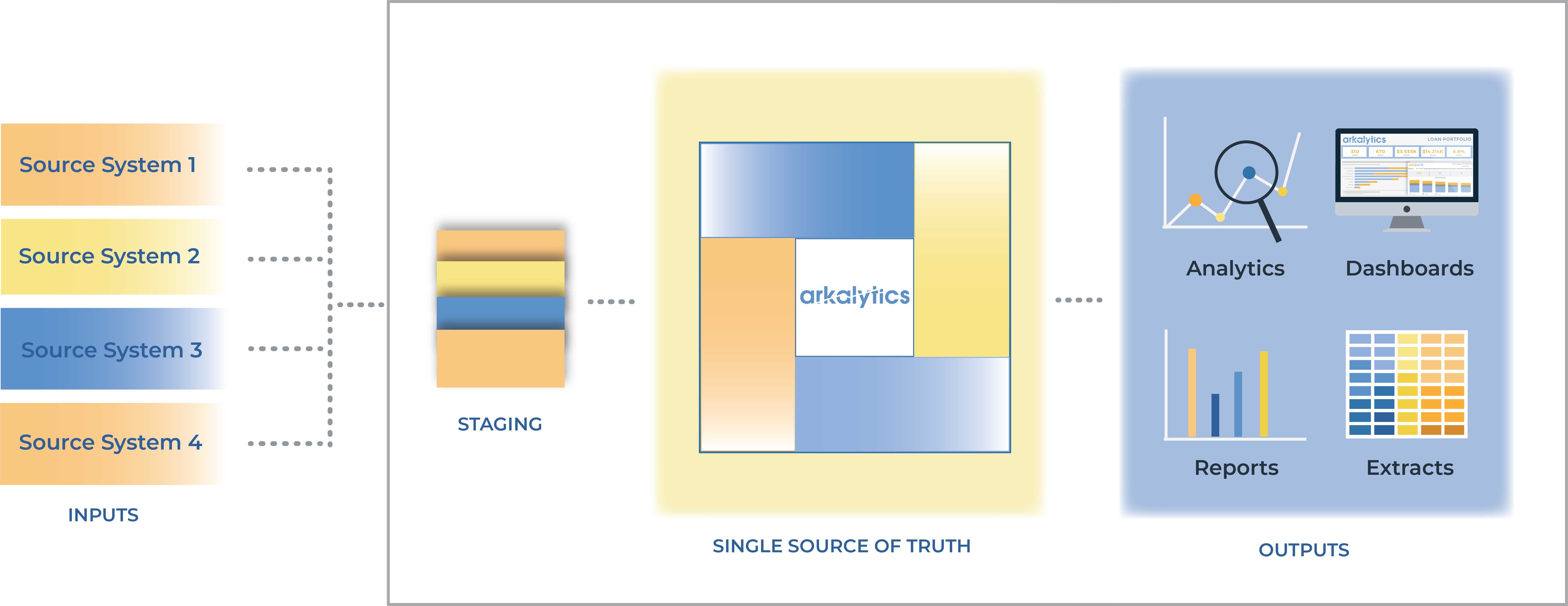

Think in systems:

Input → Processing → Output → Feedback loop

If the system design is flawed, automation magnifies inefficiency.

The AI Wealth Window Is Time-Sensitive

Early internet adopters built online empires.

Early social media adopters built attention assets.

Early AI adopters are building algorithmic leverage.

The convergence of AI automation, AI-driven marketing, and structured AI trading systems allows entrepreneurs to diversify revenue streams while maintaining lean operations.

This reduces risk concentration and increases scalability.

Final Thoughts

Entrepreneurship has always been about leverage.

Today, Artificial Intelligence for business represents the highest leverage tool available.

Use it to:

- Scale operations

- Enhance marketing precision

- Build digital assets

- Improve trading decision-making

- Create adaptive data systems

Entrepreneurs who integrate AI strategically—not emotionally—will outperform in the next economic cycle.

If you want to explore how I structure AI trading strategies within crypto markets using probability-based execution models, the full breakdown is available at earncryptoprofits.com.

Study the systems.

Apply disciplined execution.

Compound intelligently.