A Market-Structure Lens on Solana’s Rapid Ascent

For years, crypto narratives have followed a familiar rhythm. A new blockchain launches. It promises speed, low fees, and scalability. Developers migrate, traders speculate, and eventually the market decides whether the chain is infrastructure, speculation, or something in between.

Solana’s current moment feels different.

Rather than competing purely on throughput or cost, Solana is increasingly behaving like a marketplace for risk, capital, and experimentation. The better analogy may no longer be “Ethereum competitor,” but something closer to a financial exchange — specifically, the Nasdaq. A venue where new assets emerge quickly, volatility is embraced rather than avoided, and market activity itself becomes the product.

This framing helps explain why Solana has become a magnet for memecoins, consumer apps, DePIN projects, and high-velocity trading strategies. It also clarifies why congestion, outages, and speculative excess have not meaningfully slowed the network’s momentum.

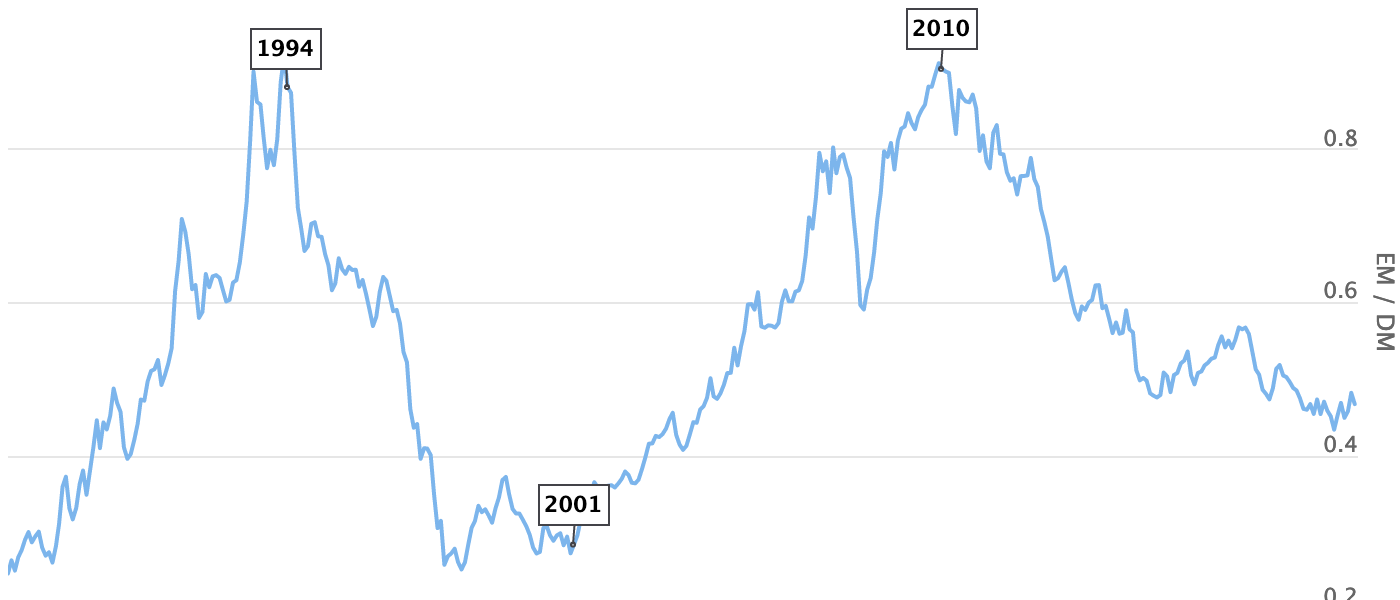

The question is no longer whether Solana is fast. It is whether Solana is becoming the preferred listing venue for crypto-native assets, much like Nasdaq became the home for high-growth, high-risk equities.

From “Ethereum Killer” to Market Infrastructure

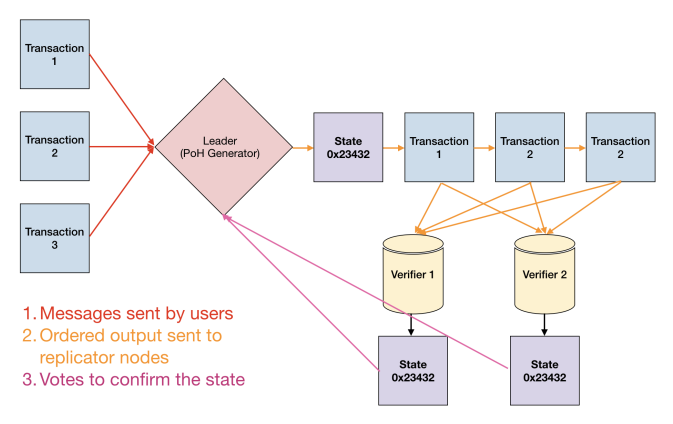

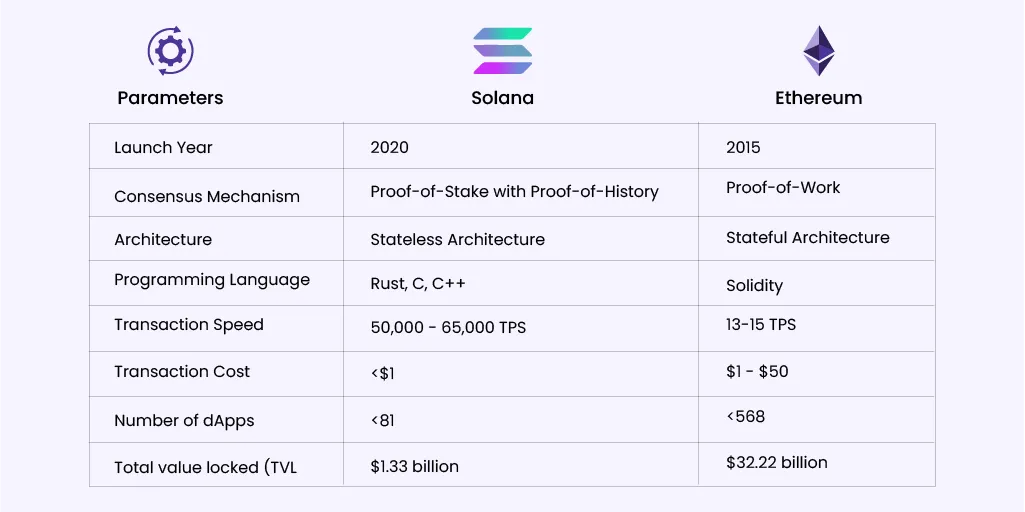

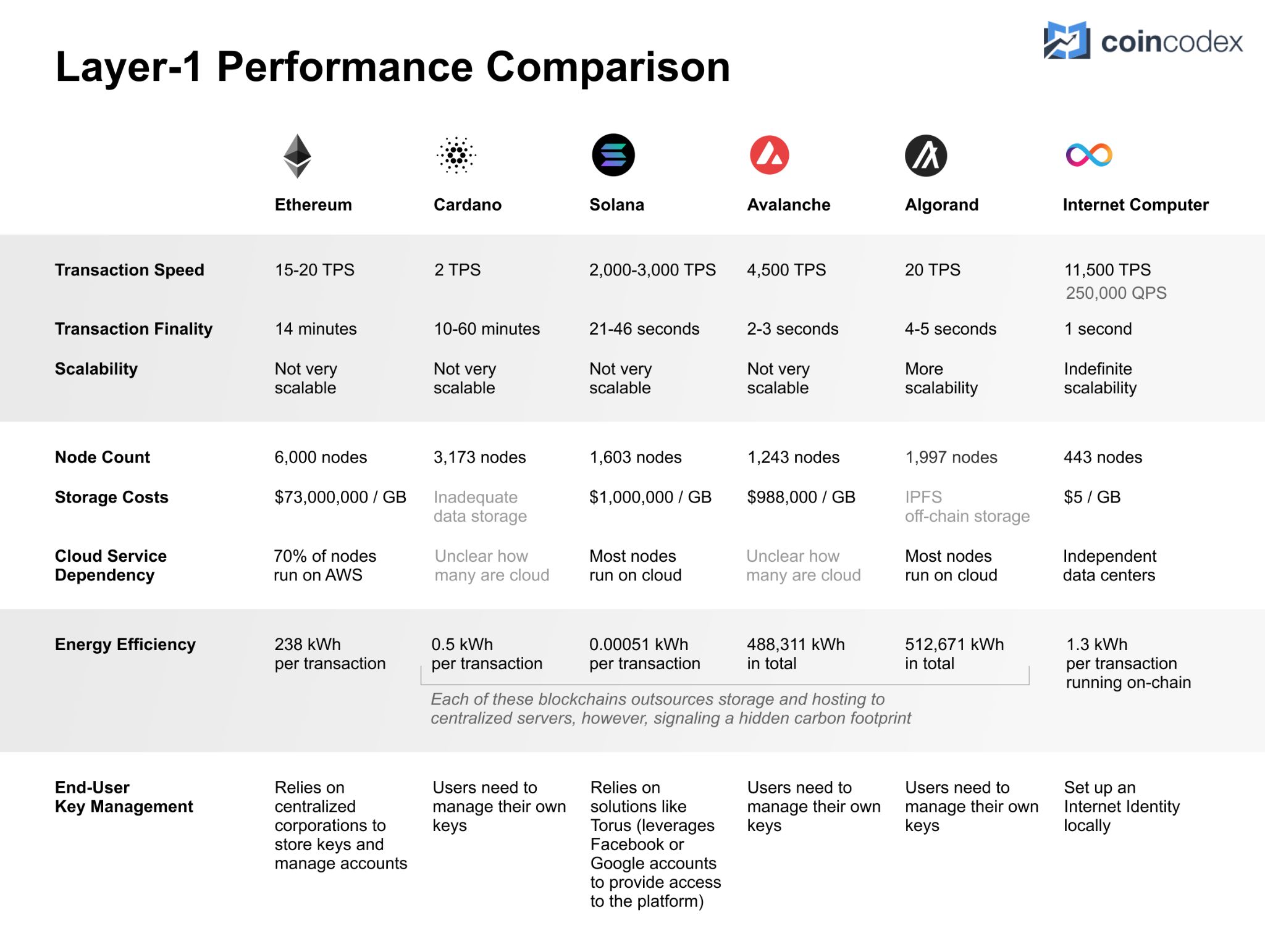

Early Solana discourse was framed almost entirely in opposition to Ethereum. Faster block times. Cheaper transactions. A different consensus model. That narrative, while useful in bootstrapping attention, underestimated how blockchains actually win.

Blockchains do not dominate because they are theoretically superior. They dominate because they aggregate activity.

Ethereum became dominant not because it was fast, but because it became the default settlement layer for value. Bitcoin became dominant not because it was expressive, but because it became the default store of value. Solana’s dominance, if it continues, will come from something else entirely: being the most efficient environment for launching, trading, and iterating on new crypto assets.

This shift explains why comparisons based purely on decentralization metrics or validator counts increasingly miss the point. Market participants are voting with usage, not ideology. Solana’s architecture optimizes for speed and composability in ways that favor high-frequency interaction, rapid feedback loops, and dense liquidity.

That is exactly what financial markets require.

Why the Nasdaq Analogy Fits

Nasdaq distinguished itself from the NYSE by leaning into technology, growth, and volatility. It became the home for tech companies not because it was safer, but because it was better suited to rapid innovation and speculative growth.

Solana is playing a similar role in crypto.

Where other chains emphasize security, decentralization purity, or institutional comfort, Solana emphasizes throughput, accessibility, and speed-to-market. Launching a token on Solana is cheap. Trading it is fast. Integrating it into wallets, bots, and consumer apps is frictionless.

This matters because crypto’s most explosive growth phases are driven by experimentation. Memecoins, social tokens, gaming assets, and on-chain financial primitives thrive in environments where iteration is fast and failure is cheap.

Like Nasdaq, Solana attracts:

- Early-stage, high-risk assets

- Speculative capital comfortable with volatility

- Developers optimizing for speed over caution

- Traders who value execution over guarantees

This does not make Solana “better” than other chains. It makes it structurally different.

Memecoins as the Canary in the Coal Mine

Memecoins are often dismissed as noise. In reality, they are stress tests for market infrastructure.

Memecoins demand:

- Extremely low transaction fees

- High throughput under load

- Rapid price discovery

- Deep integration with wallets and bots

- Social-driven, retail-heavy participation

Solana has become the dominant venue for memecoin trading not by accident, but by design. When activity spikes, users may experience congestion, but transactions still settle in seconds, not minutes. Fees remain predictable. Front-running is manageable. Bots and traders can operate at scale.

This mirrors Nasdaq’s early association with speculative tech stocks. Volatility was not a flaw; it was the feature that attracted liquidity. The same dynamic is playing out on Solana, where memecoins serve as a gateway for users, liquidity, and experimentation.

Once liquidity arrives, more serious projects follow.

DePIN, Consumer Apps, and “Listings” on Solana

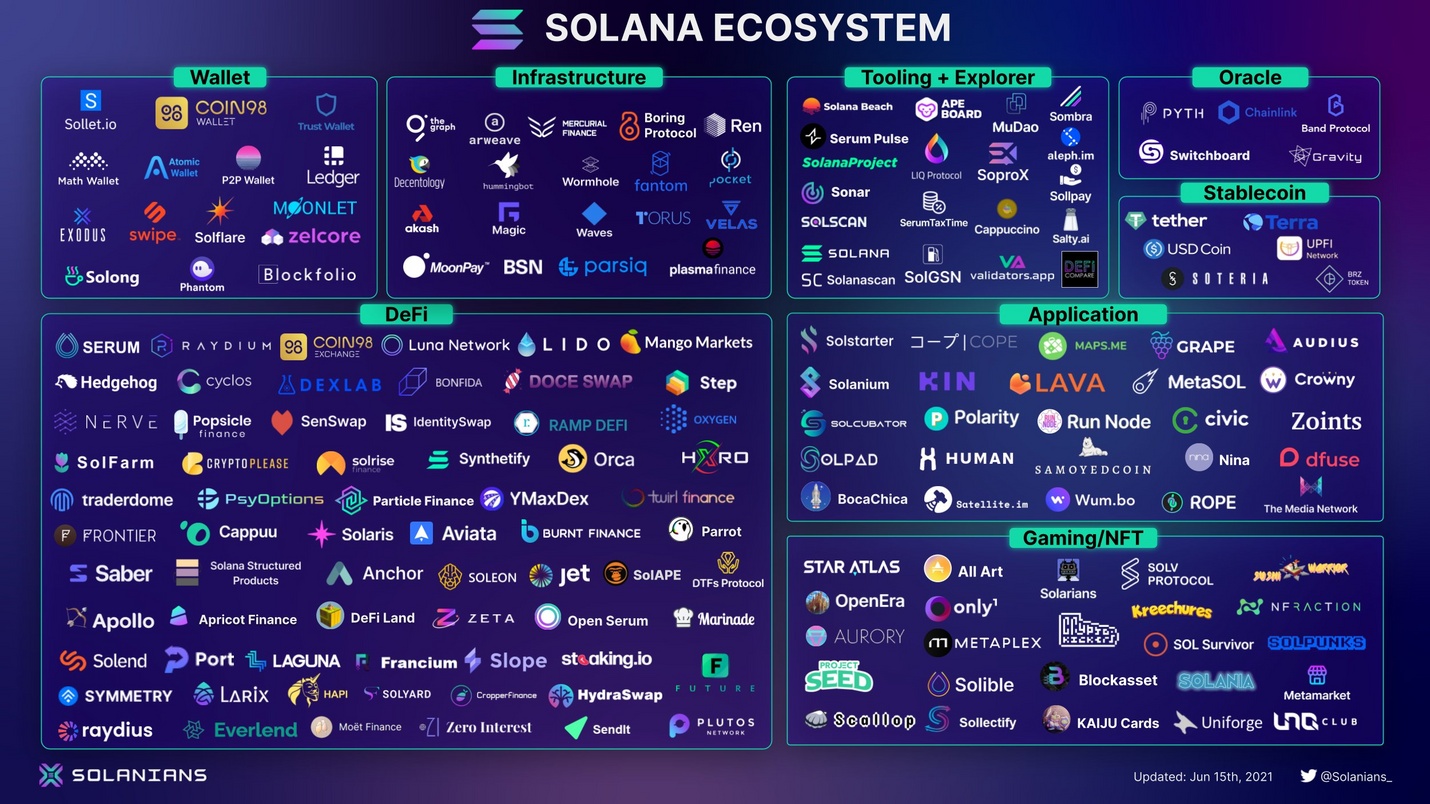

Beyond memecoins, Solana has quietly become a hub for consumer-facing crypto applications and decentralized physical infrastructure networks. These projects share a common need: high transaction volume at low cost, often involving non-financial interactions like messaging, location data, or device coordination.

This is where the Nasdaq analogy becomes especially useful.

On Nasdaq, companies “list” to access capital and visibility. On Solana, projects “launch” to access liquidity, composability, and users. The blockchain functions less like a static settlement layer and more like a dynamic marketplace where assets compete for attention and capital in real time.

The success of consumer apps on Solana reinforces the idea that blockchains can be markets first, protocols second. Users do not care how consensus works. They care that transactions are fast, apps feel responsive, and assets are easy to trade.

Solana optimizes for exactly that.

Congestion as a Feature, Not a Bug

Critics often point to Solana’s congestion during peak demand as evidence of fragility. This criticism misses a key insight from traditional markets: congestion signals demand.

Financial exchanges experience congestion during volatile periods because that is when participants want access the most. Circuit breakers, trading halts, and delayed executions are accepted realities of high-demand markets.

Solana’s congestion events are not signs of abandonment. They are signs that the network is being used aggressively. Importantly, the Solana ecosystem has treated these events as engineering challenges, not existential threats.

Upgrades, fee markets, and client diversity are all responses to the same underlying reality: Solana is operating closer to the limits of real-world usage than many of its competitors.

That is exactly where a market infrastructure platform wants to be.

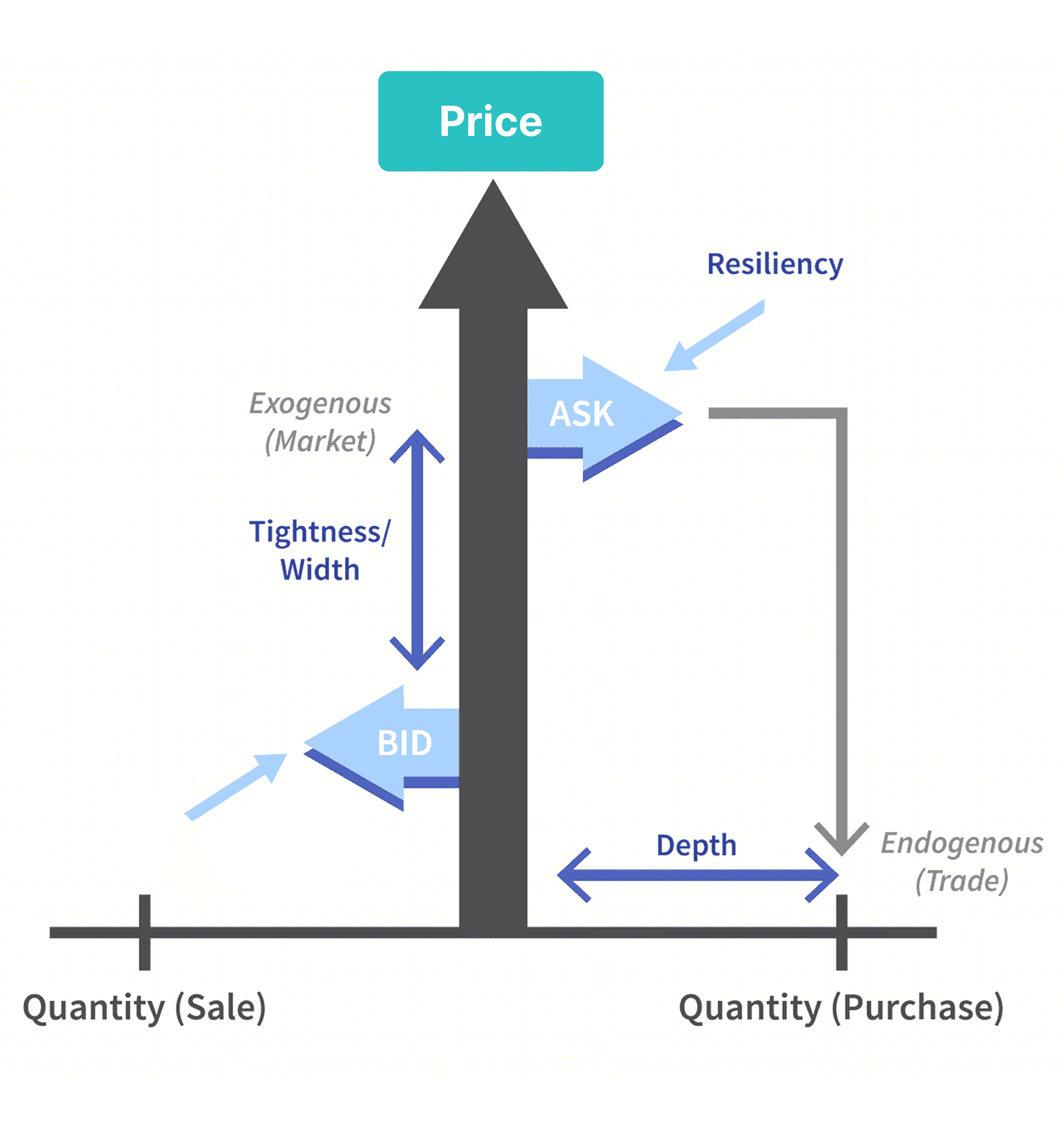

Validators as Market Makers

Another parallel with Nasdaq lies in the role of validators.

On Solana, validators are not passive security providers. They are economically incentivized participants in a high-throughput environment. Their performance, uptime, and configuration directly impact the quality of the market.

This begins to resemble market makers and exchange operators in traditional finance. Reliability matters. Latency matters. Infrastructure investment matters.

As Solana matures, validator economics may increasingly resemble exchange economics: competitive, performance-driven, and capital-intensive. This further reinforces the idea that Solana is evolving toward market infrastructure, not just decentralized computation.

The Risk Profile: Growth Over Guarantees

Nasdaq was never the safest market. It was the market for growth.

Solana occupies a similar niche in crypto. It is not the chain institutions choose first for conservative settlement. It is the chain builders and traders choose when they want speed, exposure, and rapid iteration.

This positioning carries risk. Outages, governance debates, and technical complexity are part of the tradeoff. But markets reward platforms that embrace their role rather than dilute it.

Solana’s willingness to accept volatility, speculation, and experimentation may ultimately be its strongest asset.

What This Means for Crypto Enthusiasts

For crypto enthusiasts, viewing Solana as the Nasdaq of crypto offers a more realistic framework for participation.

It suggests:

- Expect volatility, not stability

- Focus on liquidity flows, not narratives

- Treat congestion and hype as signals, not failures

- Watch launches, not just roadmaps

It also implies that Solana’s long-term value may derive less from being “the best blockchain” and more from being the most active marketplace.

Conclusion: A Marketplace Disguised as a Blockchain

Solana is no longer best understood as an Ethereum alternative or a high-speed experiment. It is emerging as something closer to a decentralized Nasdaq: a venue where assets are born, traded, stressed, and sometimes discarded at internet speed.

This does not guarantee success. Nasdaq itself survived bubbles, crashes, and skepticism before becoming indispensable. But it does suggest that Solana’s trajectory is aligned with how markets actually grow — through activity, risk, and relentless iteration.

For crypto enthusiasts willing to embrace that reality, Solana offers not just a blockchain, but a front-row seat to the most dynamic market in the digital asset economy.