Cryptocurrency markets may operate 24/7 and promise financial independence from traditional systems, but one truth has become impossible to ignore: crypto reacts strongly to U.S. monetary policy. For retail traders, understanding how Federal Reserve decisions—especially those made during FOMC meetings—impact crypto prices is no longer optional. It’s essential.

Whether you trade Bitcoin, Ethereum, or altcoins, interest rate decisions, liquidity conditions, and Fed messaging often dictate short-term volatility and long-term market trends. This guide breaks down how FOMC meetings affect crypto, what retail traders should watch for, and how to position yourself more strategically around these macro events.

Understanding the Federal Reserve and the FOMC

The Federal Reserve (the Fed) is the central bank of the United States, responsible for maintaining price stability, controlling inflation, and supporting maximum employment. While crypto was once considered outside the Fed’s influence, that assumption no longer holds.

At the center of Fed decision-making is the Federal Open Market Committee (FOMC). This committee meets eight times per year to decide on:

- Interest rate changes

- Quantitative tightening or easing

- Monetary policy guidance

- Liquidity conditions in financial markets

For crypto traders, FOMC meetings have become high-volatility catalysts, often triggering sharp moves across Bitcoin and altcoins within minutes of announcements.

SEO keywords used: Federal Reserve crypto, FOMC meaning for crypto, Fed interest rates crypto

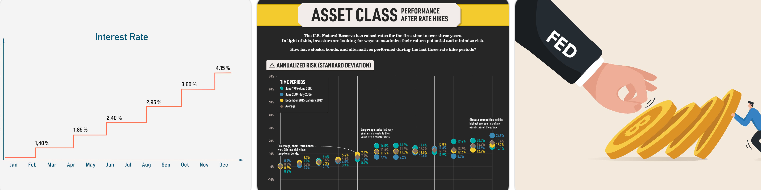

Why Interest Rates Matter for Crypto Markets

Interest rates influence every risk asset, and crypto is firmly categorized as a high-risk, high-reward market. When rates rise, borrowing becomes more expensive, leverage dries up, and speculative assets typically suffer.

Low Rates = Risk On

When the Fed lowers rates:

- Liquidity increases

- Investors seek higher returns

- Crypto prices often benefit

High Rates = Risk Off

When the Fed raises rates:

- Capital moves toward bonds and cash

- Leverage is reduced

- Crypto often sees drawdowns or choppy consolidation

Bitcoin’s behavior since 2020 shows a growing correlation with macro assets like tech stocks. Retail traders who ignore interest rate policy often find themselves on the wrong side of volatility.

SEO keywords used: interest rates and crypto, Fed rate hikes Bitcoin, crypto risk assets

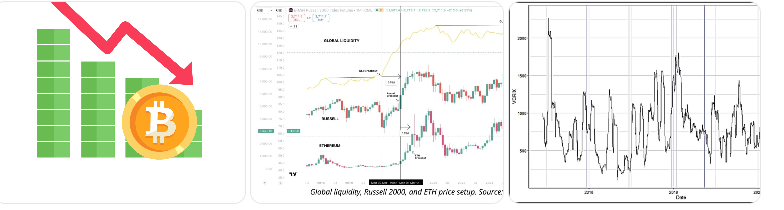

How FOMC Meetings Move Bitcoin and Ethereum

Two assets consistently react first to FOMC news: Bitcoin and Ethereum. They function as macro barometers for the entire crypto market.

Typical FOMC Market Phases

- Pre-meeting speculation – Low liquidity, fake breakouts

- Announcement volatility – Sharp wicks, stop hunts

- Press conference reaction – Trend confirmation or reversal

Often, the language used by the Fed Chair matters more than the rate decision itself. Words like “data-dependent,” “restrictive,” or “higher for longer” can move markets instantly.

Retail traders who understand this structure can avoid emotional trades and instead wait for confirmation after the initial volatility spike.

SEO keywords used: Bitcoin FOMC reaction, Ethereum Fed meeting, crypto volatility FOMC

FOMC decisions are not just about numbers—they’re about tone.

Hawkish Signals (Bearish for Crypto)

- Focus on inflation risks

- Commitment to higher rates

- Reduced balance sheet support

Dovish Signals (Bullish for Crypto)

- Openness to rate cuts

- Emphasis on economic slowdown

- Softer inflation language

Retail traders should pay close attention to:

- The dot plot (future rate expectations)

- Powell’s Q&A responses

- Revisions to economic projections

Markets often reverse sharply when traders misinterpret these signals, creating opportunity for disciplined traders who remain patient.

SEO keywords used: hawkish dovish crypto, Fed policy signals Bitcoin, FOMC dot plot crypto

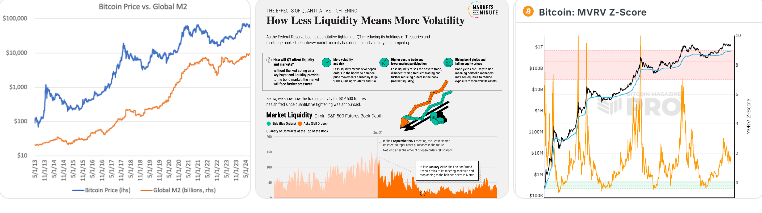

Liquidity: The Hidden Driver of Crypto Prices

Liquidity—not hype—is the true fuel behind sustained crypto rallies. FOMC policy decisions directly impact:

- Bank lending conditions

- Dollar strength

- Institutional risk appetite

When liquidity expands, crypto thrives. When liquidity contracts, rallies tend to fail.

This is why many experienced traders track macro liquidity indicators alongside technical analysis. If the Fed is draining liquidity through quantitative tightening, even strong crypto narratives can struggle.

Understanding this dynamic helps retail traders trade with the macro trend, not against it.

SEO keywords used: crypto liquidity Fed, quantitative tightening crypto, liquidity cycles Bitcoin

How Retail Traders Can Trade FOMC Weeks Smarter

Retail traders don’t need to predict Fed decisions to profit—but they do need a plan.

Practical FOMC Trading Tips

- Reduce position size before announcements

- Avoid leverage during press conferences

- Wait for post-FOMC trend confirmation

- Focus on Bitcoin direction first

Many successful traders use FOMC weeks to observe, not overtrade. The best opportunities often appear after volatility settles, not during the chaos.

If you’re looking to sharpen your trading approach and learn how to navigate macro-driven markets more confidently, platforms like earncryptoprofits.com offer trader-focused education, tools, and insights designed specifically for retail participants—not institutions.

It’s not about chasing every move—it’s about building consistency over time.

SEO keywords used: crypto trading strategy FOMC, retail crypto trading tips, Fed meeting crypto trades

Can Crypto Ever Decouple From the Fed?

Long term, many believe crypto will decouple from central bank policy as adoption grows. However, today’s reality is clear: crypto remains highly sensitive to U.S. monetary conditions.

Until crypto markets mature further and liquidity becomes more decentralized, the Fed—and especially FOMC meetings—will remain a dominant force.

Retail traders who accept this reality gain a major edge over those who ignore macro forces entirely.

SEO keywords used: crypto and Fed future, Bitcoin decoupling, long term crypto outlook

Final Thoughts: Macro Awareness Is a Trading Edge

FOMC meetings are no longer “traditional finance events” that crypto traders can ignore. They are major market drivers that shape volatility, trends, and sentiment across digital assets.

By understanding how interest rates, liquidity, and Fed messaging influence crypto, retail traders can:

- Avoid unnecessary losses

- Improve timing and risk management

- Trade with confidence during macro uncertainty

Crypto rewards those who stay informed, patient, and disciplined. If you combine technical skills with macro awareness—and continue refining your strategy using quality educational resources—you put yourself in a far stronger position for long-term success.