The idea is seductive.

Start with $1,000.

Trade perpetuals aggressively.

Compound wins.

End the year at $100,000.

On platforms like Hyperliquid, where leverage is accessible and execution is fast, it feels possible. Crypto volatility creates massive opportunity. One good week can double an account. One strong trend can 5× it.

But turning $1,000 into $100K in 12 months with an 80% probability of winning trades?

That’s where the math, the psychology, and market structure collide.

This post isn’t here to crush ambition. It’s here to replace fantasy with a framework that actually compounds.

The 100× Dream: What It Really Requires

To go from $1,000 to $100,000, you need a 100× return.

That’s a 9,900% gain.

Let’s translate that into compounding terms:

- ~8% weekly compounded for 52 weeks

- ~1.9% daily compounded for 365 days

- Or periodic 20–50% account growth spurts without catastrophic drawdowns

That’s not “catch one good trade.”

That’s relentless precision over 12 months.

Now add leverage — which is common on Hyperliquid perpetual contracts — and volatility cuts both ways. Gains amplify. Losses amplify faster.

One 20% drawdown requires 25% just to recover.

One 50% drawdown requires 100% to recover.

The math punishes inconsistency.

Why an 80% Win Rate Doesn’t Guarantee Success

Many traders obsess over win rate.

But professionals focus on:

- Risk-to-reward ratio (R:R)

- Position sizing

- Maximum drawdown

- Risk of ruin

- Slippage & funding costs

You can have:

- 80% win rate

- 1:1 risk-reward

- Risking 10% per trade

And still blow up from variance.

Example:

If you risk 10% per trade and hit three losses in a row (which statistically will happen even at 80%), you’re down nearly 30%.

If you’re trading 10–20× leverage on Hyperliquid, those losses can become liquidation events.

An 80% edge is meaningless if your risk model is unstable.

The Leverage Trap on Hyperliquid

Hyperliquid offers fast, decentralized perpetual trading.

That’s powerful.

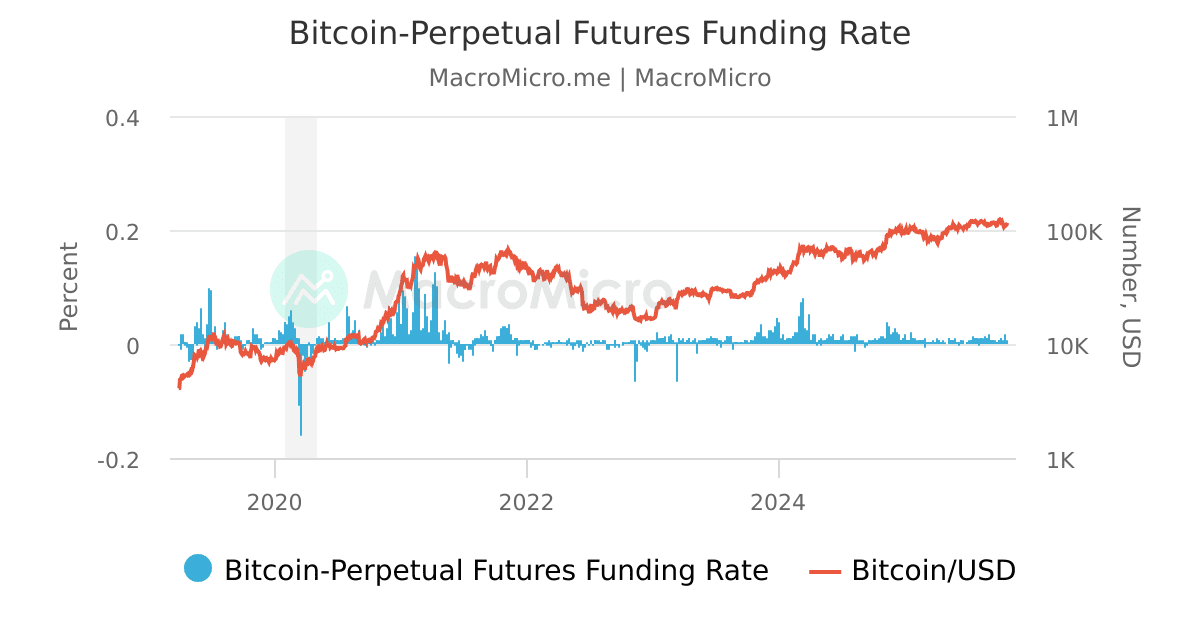

But perps introduce:

- Funding rates

- Mark price vs index price differences

- Liquidation mechanics

- High volatility spikes

Let’s say you use 20× leverage.

A 5% move against you = 100% position loss.

Crypto regularly moves 5% intraday.

To achieve 100× in a year, most traders would feel pressure to:

- Increase leverage

- Increase position size

- Compound aggressively

- Trade frequently

That increases variance.

Variance increases probability of ruin.

Probability of ruin increases exponentially with leverage.

This is why most small accounts that chase 100× trajectories eventually reset to zero.

The Compounding Illusion

Here’s what most traders imagine:

- Win 10%

- Reinvest

- Win 10%

- Reinvest

- Repeat flawlessly

But markets move in regimes:

- Trending

- Choppy

- Liquidity sweeps

- News-driven volatility

- Funding squeezes

Your strategy’s performance shifts depending on regime.

To 100×, you would need:

- Near-perfect regime adaptation

- No emotional mistakes

- No revenge trades

- No FOMO entries

- No macro shocks

That’s not just technical skill.

That’s psychological mastery under stress.

What Actually Works Instead

4

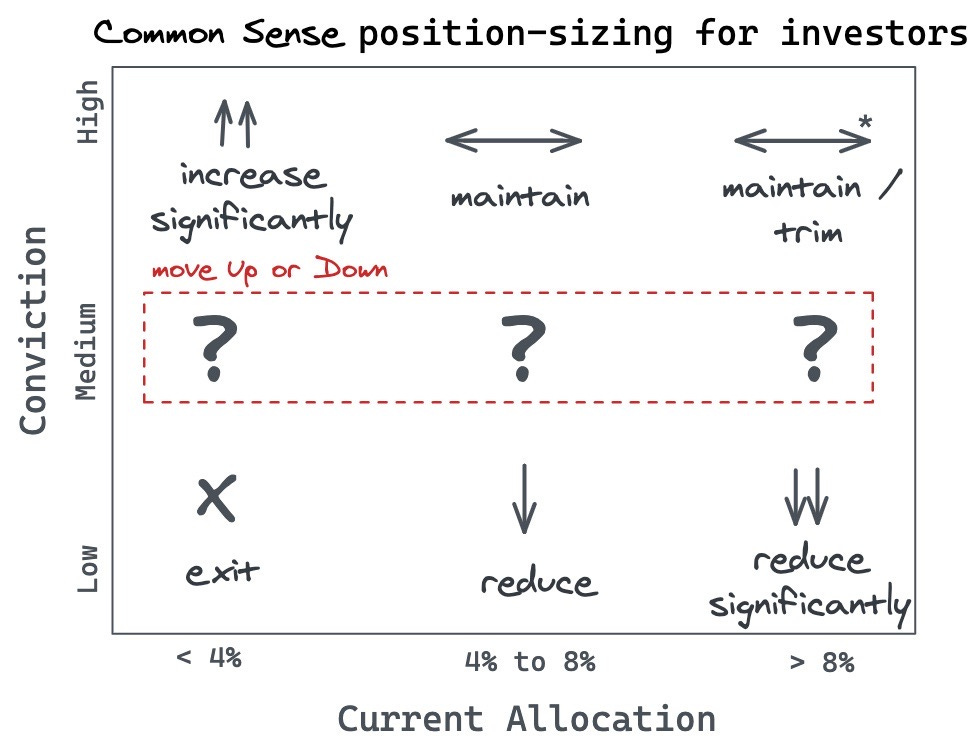

If 100× in 12 months is fantasy-level difficulty, what is realistic?

Elite retail traders aim for:

- 50%–150% annual returns in strong cycles

- Controlled 10–20% drawdowns

- Risk per trade between 1–3%

- Consistent R multiples (2R–3R setups)

Let’s say you target:

- 2% risk per trade

- 2.5R average winner

- 50–60% win rate

That edge compounds far more sustainably than chasing 80% win rates with tiny R multiples.

Over time, consistent 5–10% monthly returns outperform explosive but unstable growth.

The $1,000 to $10,000 Path (The Real Milestone)

The smarter goal:

Turn $1,000 into $10,000 first.

That’s 10×.

Still difficult — but achievable in a strong crypto cycle with disciplined risk.

From there:

- Withdraw profits

- Reduce leverage

- Scale carefully

- Protect capital

Wealth building in trading is asymmetrical:

Small accounts grow aggressively.

Large accounts grow defensively.

Hyperliquid Strategy Framework That Makes Sense

Instead of chasing 100×, here’s a grounded Hyperliquid model:

1. Trade Higher Timeframes

Avoid 1–5 minute noise.

Use 4H or Daily structure.

2. Use Low Leverage

3×–5× max for most setups.

Avoid liquidation dependency.

3. Risk 1–2% Per Trade

Let probabilities play out.

4. Focus on R Multiple

If your winners average 3R, you don’t need 80% win rate.

5. Journal Every Trade

Track:

- Entry reason

- Structure break

- Liquidity zone

- Emotional state

- Funding rate context

Professional behavior creates professional outcomes.

The Psychology of the 100× Obsession

Why do traders fixate on turning $1K into $100K?

Because crypto has produced extreme outliers.

Early Bitcoin holders.

Early altcoin rotations.

Low-cap explosions.

But those were:

- Spot holdings

- Multi-year holds

- Not leveraged perps

Perpetual futures are a different game.

Leverage compresses time.

Compression increases emotional intensity.

Emotional intensity destroys discipline.

The traders who survive long enough to compound are the ones who stop chasing miracle curves.

Risk of Ruin: The Silent Killer

If you risk:

- 5% per trade

- With 60% win rate

Your risk of ruin remains manageable.

If you risk:

- 15% per trade

- Even with 70% win rate

Your ruin probability skyrockets.

This is basic probability math — not opinion.

Aggression reduces longevity.

Longevity is required for compounding.

So… Is $1K to $100K Impossible?

Not technically.

In a perfect bull cycle with:

- High leverage

- No major drawdowns

- Extreme volatility in your favor

- Flawless discipline

It can happen.

But the probability of surviving that path is far lower than marketing headlines suggest.

The better play?

Build skill → Build consistency → Build capital.

Then let size create wealth — not lottery-level leverage.

The Aspirational But Grounded Path Forward

If you’re serious about trading on Hyperliquid:

- Master structure and liquidity

- Understand funding mechanics

- Control leverage

- Protect capital first

- Compound second

Chasing 100× is emotional.

Building 5%–10% monthly consistency is professional.

And professionals survive.

Want a Structured Framework?

If you want to learn:

- How to use 1 simple strategy to earn daily

- How to manage leverage responsibly

- How to build consistency instead of chasing hype

- How to follow what the chart tells you

You can join my free crypto trading bootcamp at:

👉 earncryptoprofits.com

Inside, we break down:

- Risk management models

- Position sizing formulas

- Realistic compounding math

- Trading psychology

- Execution frameworks

No fantasy promises.

Just probability-based strategy.

Final Thought

Turning $1,000 into $100,000 in 12 months sounds powerful.

But turning $1,000 into $5,000… then $10,000… then $25,000 with discipline?

That’s how real traders are built.

And once you’re built correctly —

The numbers take care of themselves.