The Rise of On-Chain Perpetual Futures

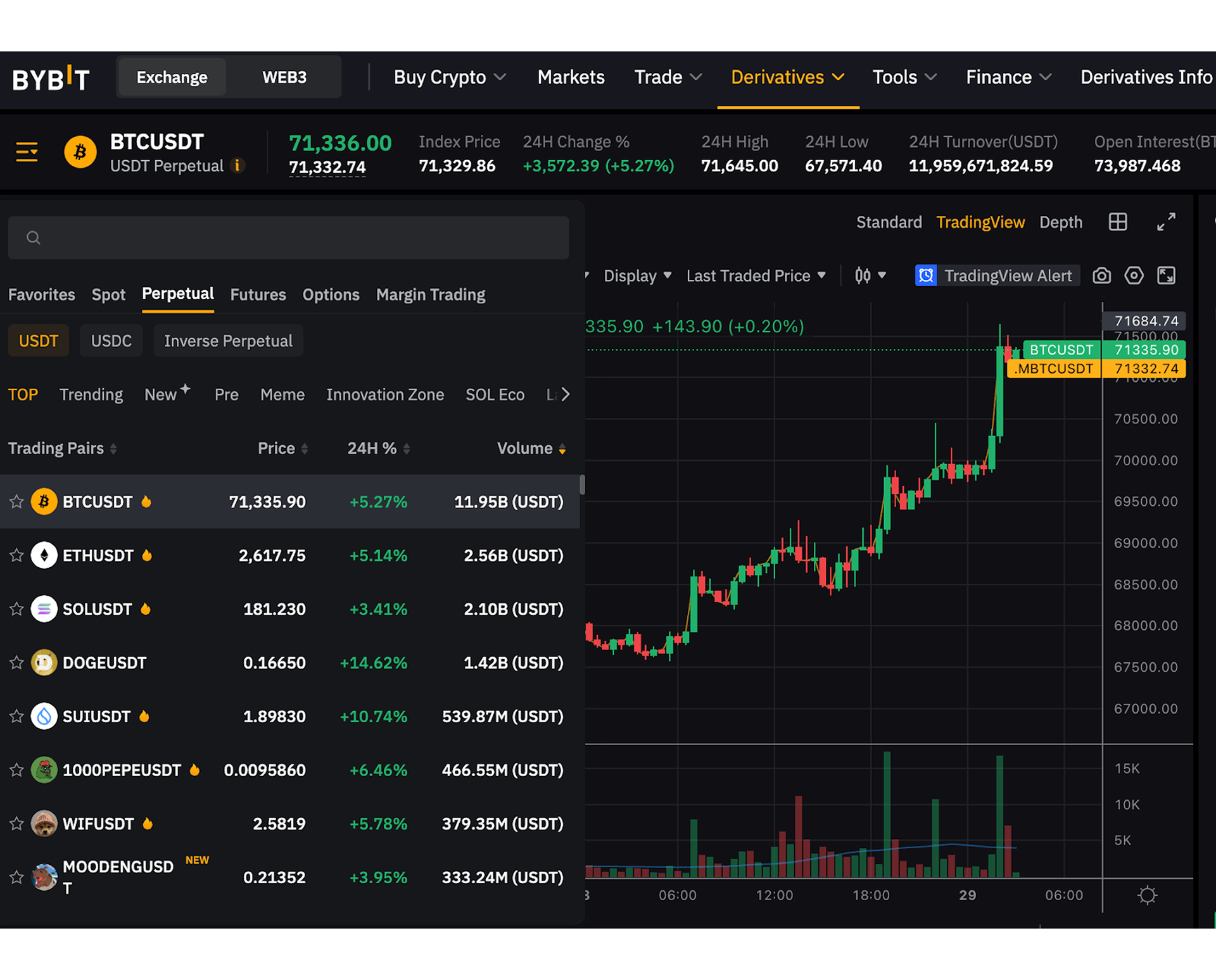

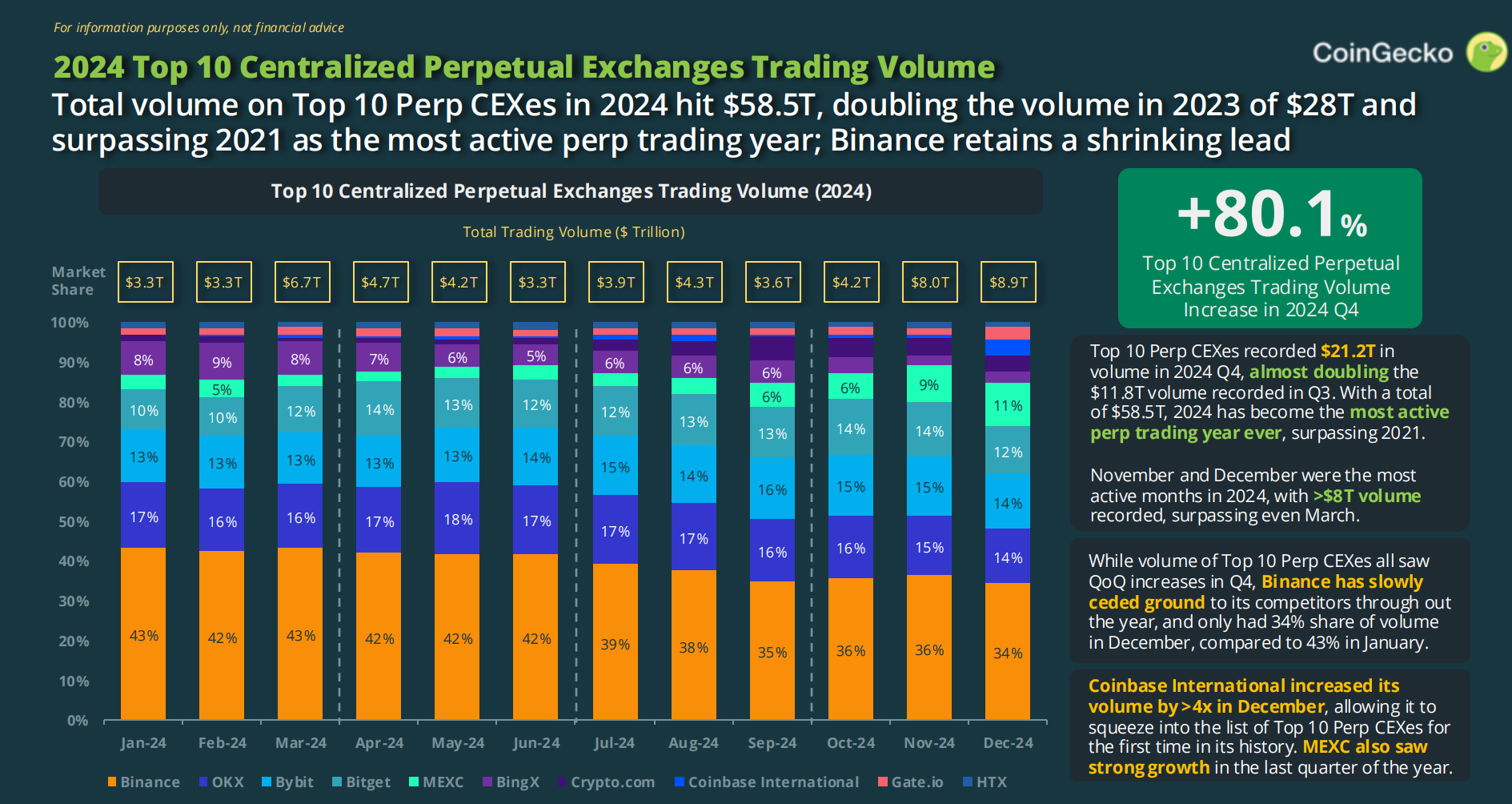

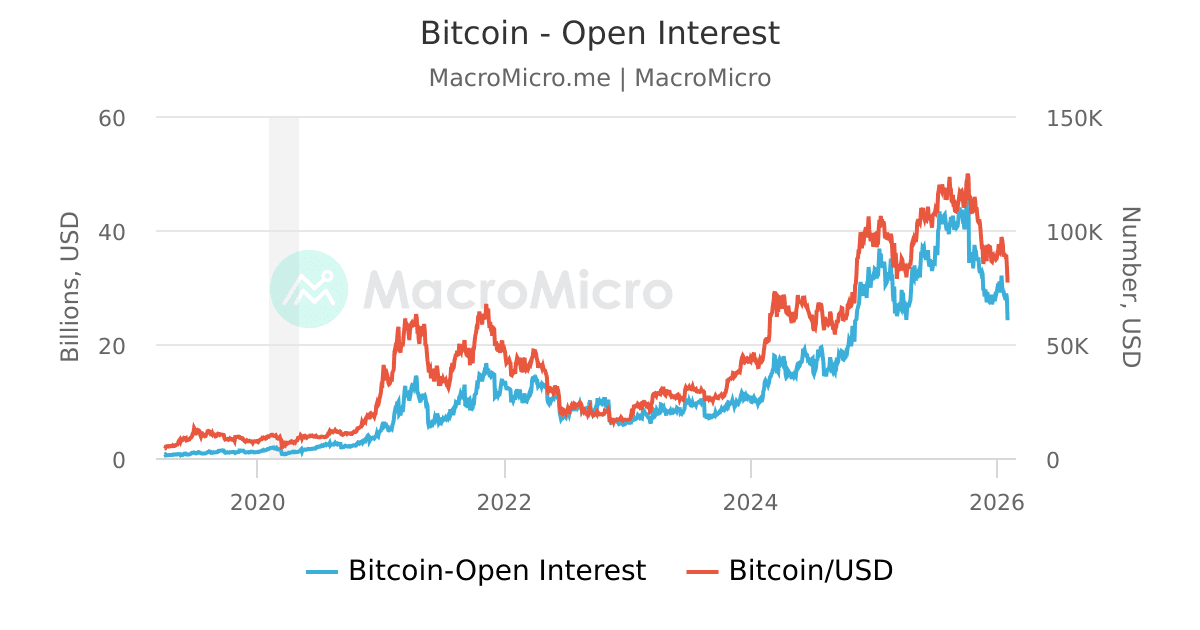

Over the past several years, perpetual futures trading has dominated crypto derivatives volume. On most days, perps account for significantly more activity than spot markets. Historically, this volume has been concentrated on centralized exchanges (CEXs).

But that structure is shifting.

Hyperliquid has emerged as one of the most disruptive forces in the on-chain derivatives space. While retail attention remains focused on legacy exchanges, Hyperliquid has quietly captured meaningful perps volume, particularly from advanced traders who value transparency, execution quality, and self-custody.

This isn’t a hype cycle narrative.

It’s a structural market evolution.

Let’s break down exactly why.

The Structural Weakness of Centralized Exchanges

Centralized exchanges still dominate global derivatives volume. However, their model has inherent vulnerabilities:

- Custodial counterparty risk

- Opaque liquidation engines

- Outage risk during volatility

- Hidden internalization of order flow

- Regulatory exposure

Major exchange failures in previous cycles permanently altered trader psychology. Even when an exchange remains solvent, trust friction increases whenever withdrawals are paused or liquidation cascades appear unusually aggressive.

Professional traders care deeply about:

- Execution transparency

- Order book integrity

- Liquidation fairness

- Fee structure

As volume scales, small inefficiencies compound into large profit differentials.

This is where decentralized derivatives platforms begin gaining traction.

What Makes Hyperliquid Different?

Hyperliquid operates as a high-performance decentralized exchange (DEX) optimized for perpetual futures. Unlike automated market maker (AMM) models used by early DEXs, Hyperliquid offers:

- Fully on-chain order book execution

- Low latency matching

- Transparent liquidation logic

- Competitive fee structure

- Self-custody asset control

The key distinction is architectural.

Where centralized exchanges control custody and execution internally, Hyperliquid leverages blockchain infrastructure while preserving performance standards expected by serious derivatives traders.

For many, this removes the largest historical objection to DEX trading: execution quality.

Transparency: The Hidden Edge

In centralized environments, traders must trust:

- Internal matching engines

- Risk models

- Insurance funds

- Liquidation priority logic

These systems are opaque.

On Hyperliquid, execution and liquidation logic operate transparently on-chain. Traders can verify mechanics rather than speculate.

In high-volatility environments, transparency reduces paranoia.

This matters more than most realize.

The more capital at stake, the more traders prefer observable systems over black boxes.

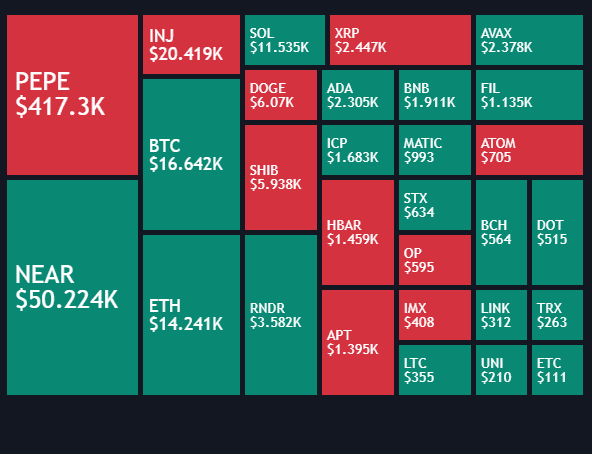

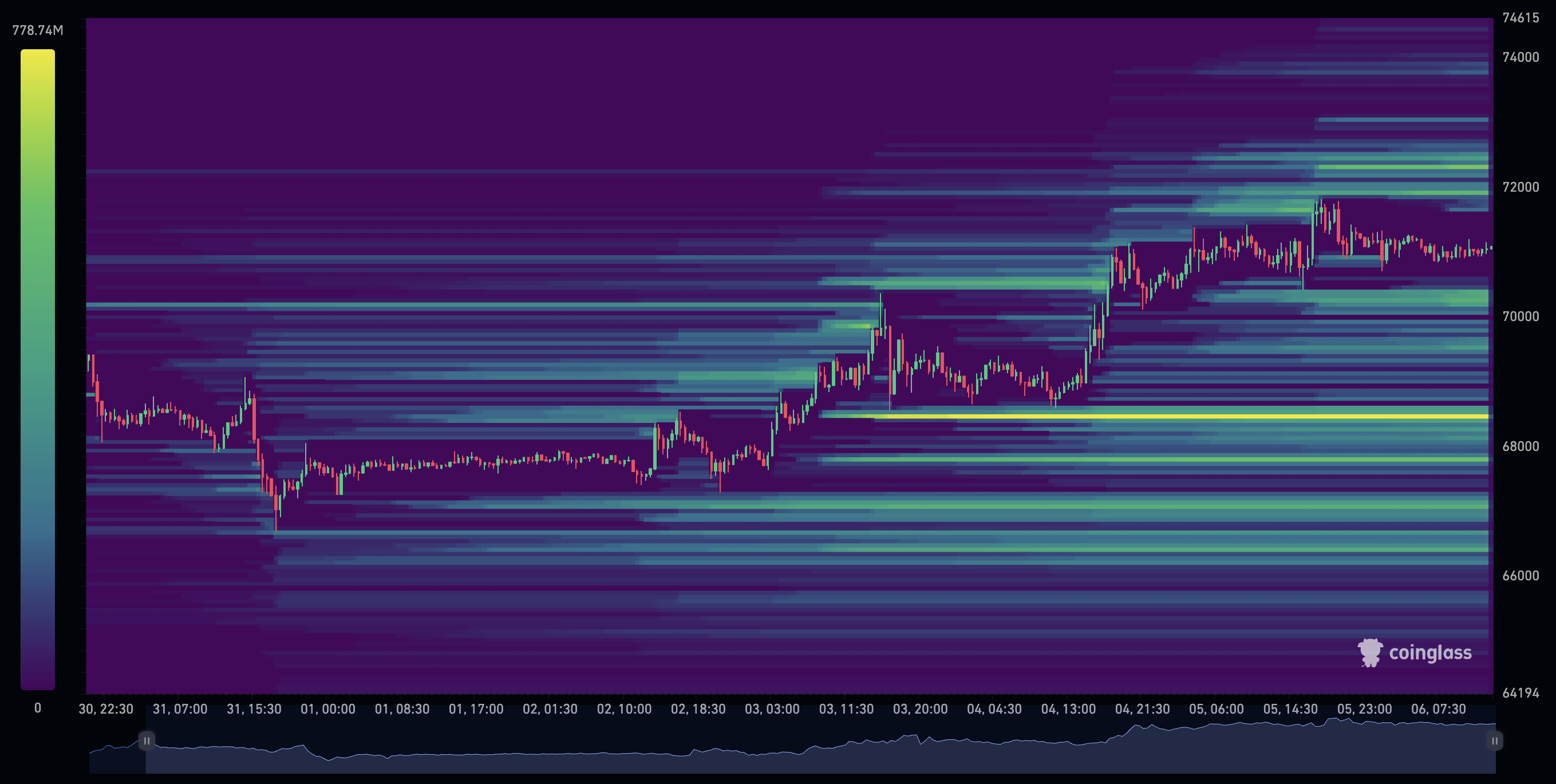

Liquidity Migration Is Gradual — But Real

Liquidity doesn’t move overnight.

It migrates incrementally.

We are witnessing early signs of:

- Advanced traders testing on-chain perps

- Capital rotation during exchange FUD cycles

- Increasing DEX derivatives market share

- Reduced psychological reliance on CEX custody

The narrative is not that centralized exchanges disappear.

It is that derivatives liquidity is fragmenting.

As even 5–10% of perps volume migrates, structural impact compounds quickly.

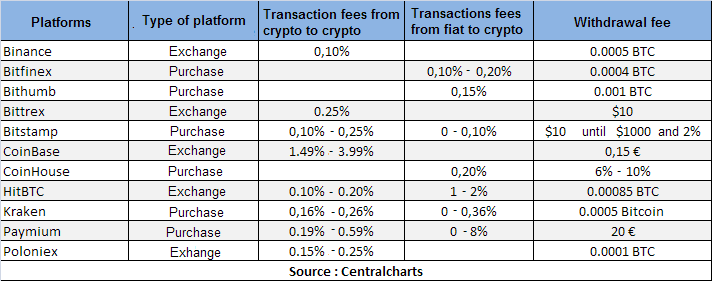

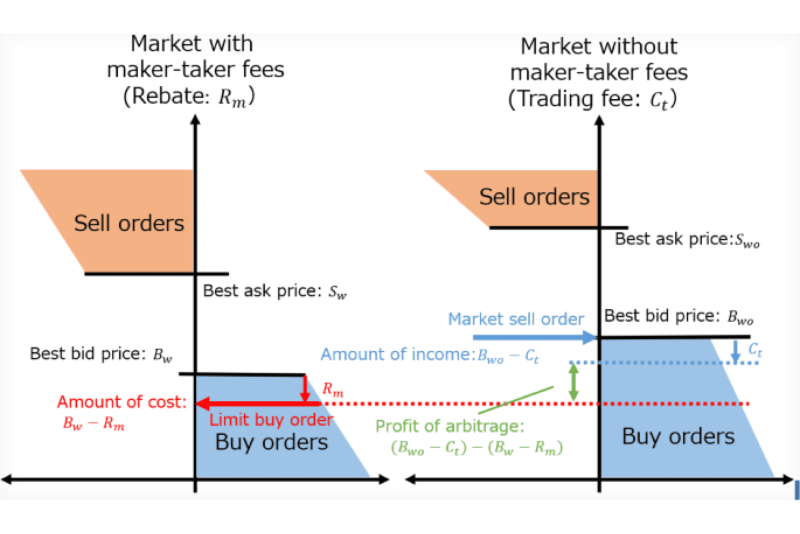

Fee Structure and Incentive Design

Fee structure drives behavior.

Centralized exchanges monetize:

- Maker/taker spreads

- Liquidations

- Funding rate imbalances

- Listing fees

Hyperliquid’s model aligns more directly with active traders by offering competitive fees and on-chain transparency.

For high-frequency participants, a few basis points difference in execution cost materially impacts long-term profitability.

Sophisticated traders calculate these differences.

Retail often does not.

The Trust Factor After Exchange Failures

Every major exchange disruption leaves residue.

Even if platforms recover, traders internalize risk differently.

Self-custody has evolved from ideology to risk management practice.

Hyperliquid’s structure allows traders to maintain greater control over assets compared to fully custodial platforms.

This psychological shift — from convenience-first to control-first — fuels gradual adoption.

Performance: The Barrier That Used to Exist

Early decentralized derivatives platforms struggled with:

- Slippage

- Front-running

- Latency

- Fragmented liquidity

Hyperliquid addressed many of these through performance optimization and architectural improvements.

As performance parity approaches centralized platforms, switching costs decline.

When switching costs fall, migration accelerates.

Regulatory Pressure and Jurisdictional Arbitrage

Centralized exchanges operate within evolving regulatory frameworks. Increased scrutiny affects:

- Leverage limits

- KYC requirements

- Derivatives accessibility

- Jurisdictional constraints

Decentralized platforms operate differently.

While regulatory clarity remains evolving globally, on-chain derivatives platforms inherently reduce single-point regulatory chokepoints.

This creates structural resilience.

Professional traders notice these trends early.

What This Means for Centralized Exchanges

The takeaway is not extinction.

It is competitive pressure.

Centralized exchanges must now compete on:

- Transparency

- Fee compression

- Execution quality

- Trust restoration

When a credible on-chain alternative exists, complacency declines.

Hyperliquid’s growth forces innovation.

Is This the Beginning of a Perps Market Shift?

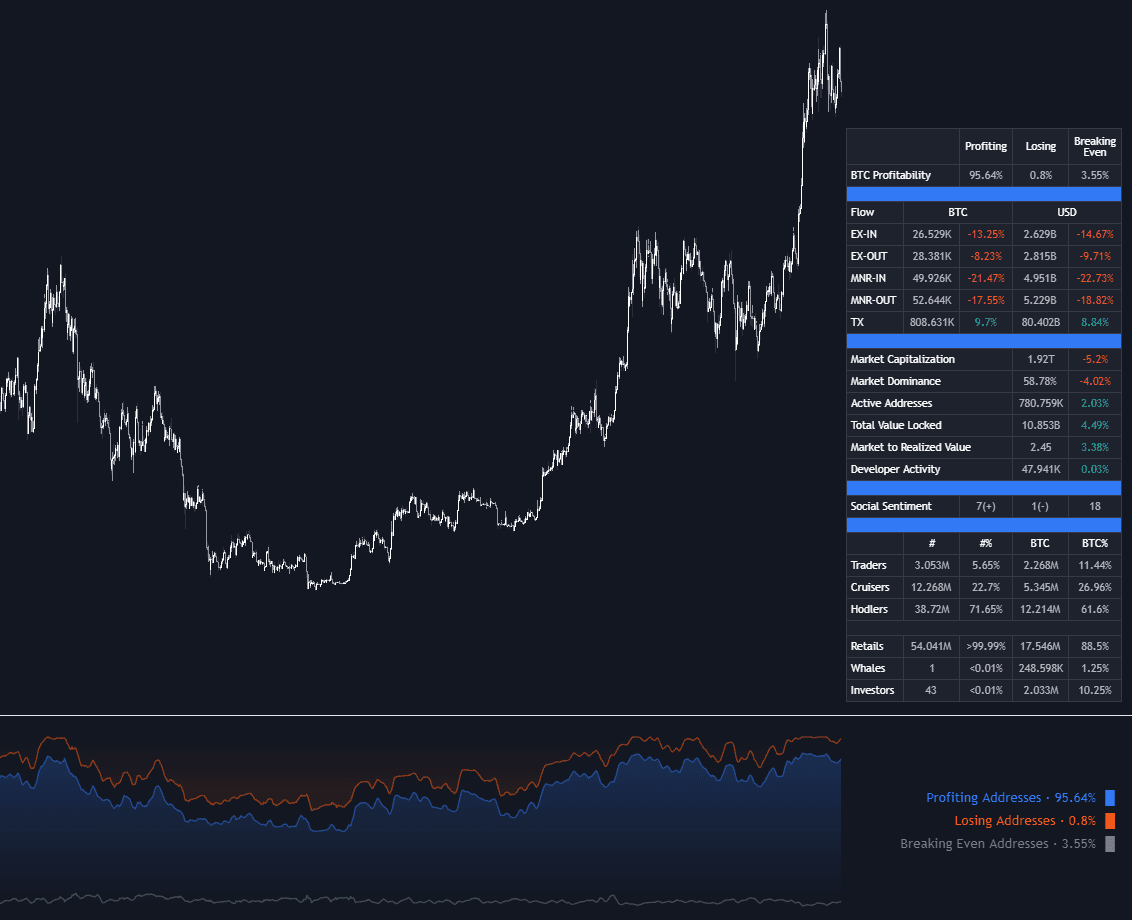

If derivatives liquidity gradually decentralizes, the broader implications include:

- Reduced systemic custodial risk

- More distributed leverage exposure

- Increased on-chain transparency

- Evolution of decentralized finance (DeFi) infrastructure

We are not yet in a fully decentralized derivatives market.

But the early signs of structural transition are visible.

Quietly.

What Traders Should Do Now

Instead of reacting emotionally to narratives, traders should:

- Monitor perps volume distribution

- Track funding rate shifts

- Compare execution metrics

- Understand platform architecture

Markets reward preparation.

Whether liquidity migrates 10% or 40% over the next cycle, those who understand structural shifts early position themselves advantageously.

Want to Learn How to Trade Perps Properly?

If you’re serious about mastering perpetual futures trading, understanding liquidation mechanics, and navigating volatility without relying on exchange narratives, access this free crypto trading bootcamp.

Inside, we cover:

- how to trade 10 minutes daily using 1 simple strategy

- Risk management frameworks

- Funding rate interpretation

- Liquidity sweep identification

- High-probability trade structures

You can access it free at:

It’s tactical, structured, and built for real market conditions.

Final Thoughts

Hyperliquid is not dominating headlines.

It is gaining market share quietly.

That is how structural shifts begin.

Centralized exchanges still hold majority volume — but the competitive landscape is changing. As execution quality converges and transparency becomes a premium feature, decentralized perps platforms stand to gain meaningful ground.

The migration will not be dramatic.

It will be incremental.

And incremental shifts often become exponential before most notice.