Bitcoin has officially lost one of its most psychologically important levels.

With $90,000 support now broken, traders, investors, and institutions are asking the same question:

Where does Bitcoin go from here?

When major support levels fail, price action doesn’t move randomly. Markets transition into defined phases driven by liquidity, sentiment, and macro forces. This article breaks down what the $90K breakdown means, which levels matter next, and the most likely scenarios for Bitcoin’s next major move.

This is not hype. This is market structure.

Why the $90K Level Mattered So Much

The $90,000 level wasn’t just another number — it was a confluence zone.

Why $90K Was Critical Support

- Psychological round number

- Prior consolidation range

- Heavy institutional positioning

- Options and derivatives open interest

- Retail confidence anchor

When price holds above a level like this, it reinforces bullish conviction.

When it breaks, behavior changes.

Support doesn’t simply fail — belief fails with it.

What a Support Breakdown Actually Signals

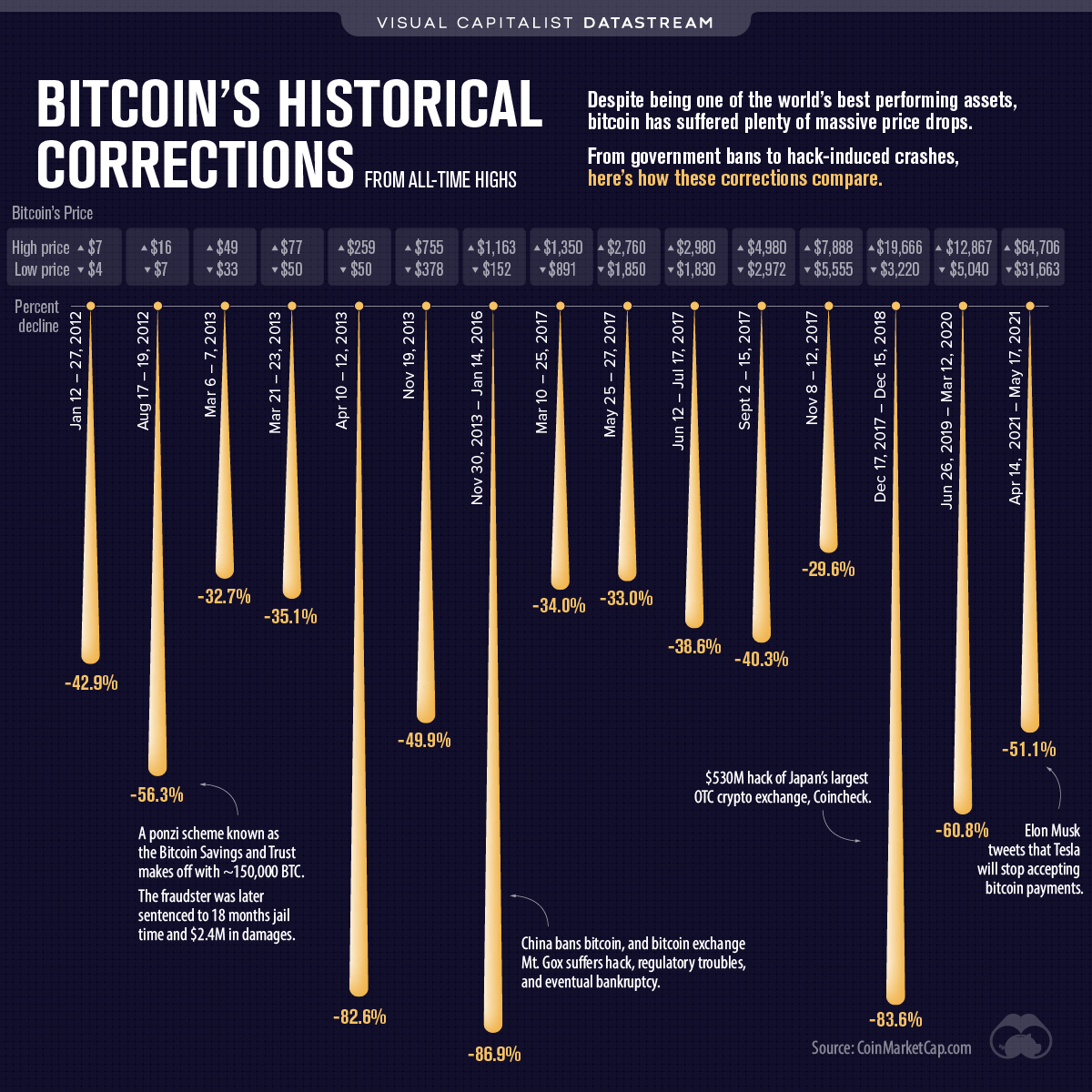

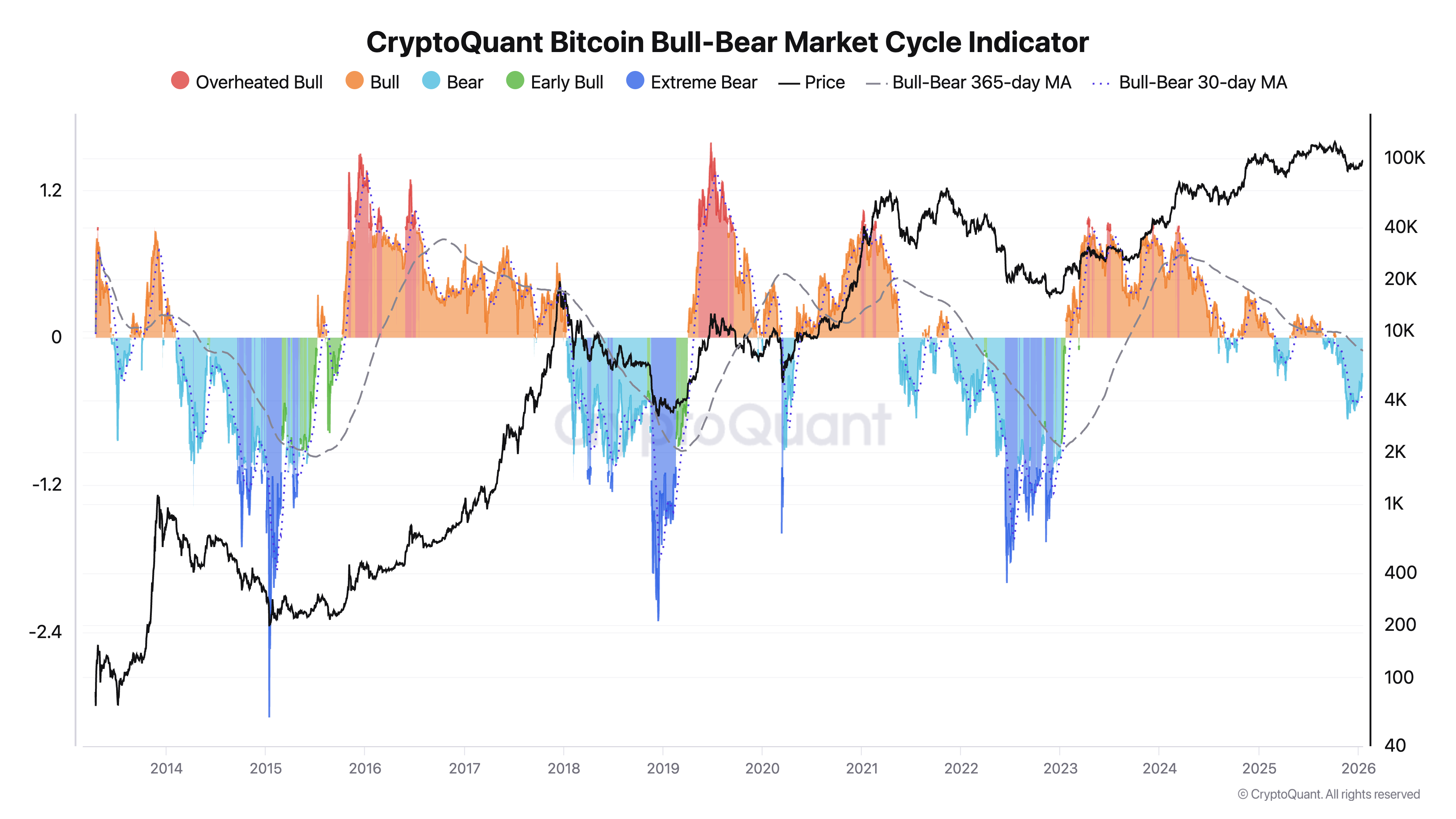

A common mistake is assuming every breakdown means the start of a bear market. In reality, support breaks can signal three very different outcomes, depending on volume, follow-through, and broader context.

A Support Break Means One of Three Things:

- A temporary liquidity sweep

- A deeper corrective phase

- A full trend transition

Understanding which scenario we’re in requires analyzing what happens next, not just what already happened.

Scenario 1: The Liquidity Sweep and Fast Reclaim (Bullish)

In the most optimistic scenario, the break below $90K is a liquidity grab, not a structural failure.

What This Looks Like

- Sharp move below $90K

- Stops get triggered

- Weak longs are flushed

- Strong buying steps in

- Price quickly reclaims $90K

This pattern is common in Bitcoin, especially near major psychological levels.

What Confirms This Scenario

- High volume on the breakdown and the recovery

- Strong daily or weekly close back above $90K

- Funding rates reset from overheated levels

If Bitcoin reclaims $90K quickly, the level flips back to support — and the breakdown becomes fuel for continuation higher.

Probability: Moderate, but time-sensitive

Key invalidation: Sustained closes below $90K

Scenario 2: The Healthy Correction (Neutral–Bullish)

The most common outcome after a major support break is a deeper but controlled correction.

Bitcoin does not move in straight lines — even in strong bull markets.

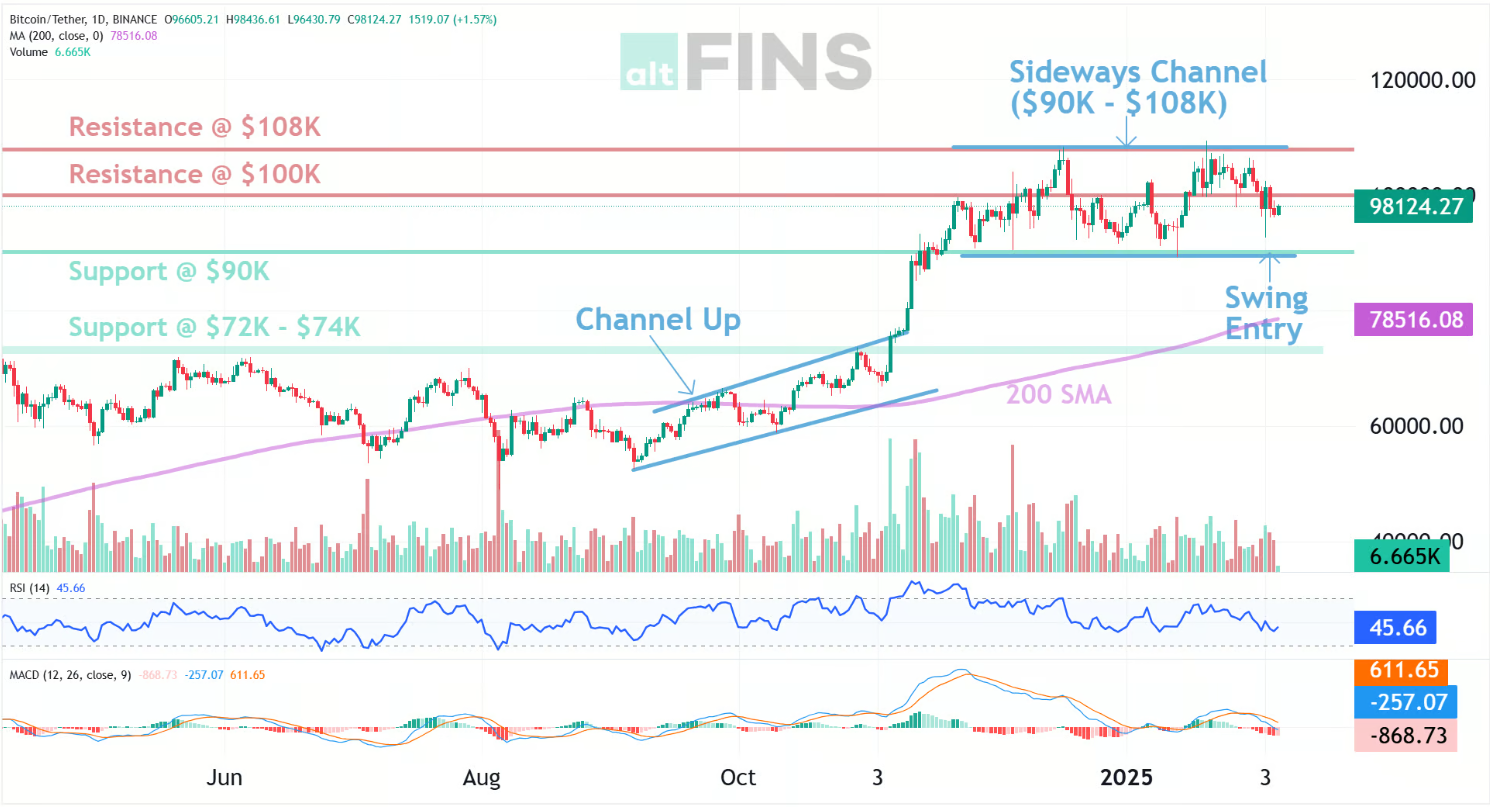

Typical Targets in This Scenario

- $85K (short-term structural support)

- $80K (previous demand zone)

- $72K–$75K (major high-timeframe support)

These levels represent areas where:

- Long-term buyers previously stepped in

- Institutions accumulated

- Volume nodes are concentrated

Why This Can Be Bullish Long-Term

Corrections:

- Reset leverage

- Shake out weak hands

- Build stronger bases

If price stabilizes at one of these zones and forms higher-timeframe structure, the bull trend remains intact — just delayed.

Probability: High

Key signal: Sideways consolidation after the drop

Scenario 3: $90K Becomes Resistance (Bearish Shift)

This is the scenario bulls don’t want — but must respect.

When former support flips into resistance, it signals a change in market control.

Warning Signs

- Failed attempts to reclaim $90K

- Lower highs forming below resistance

- Weak bounce volume

- Increasing sell pressure on rallies

In this case, $90K acts as a ceiling rather than a floor.

Downside Risk Expands To

- $75K

- $68K

- $60K psychological support

This does not automatically mean a multi-year bear market — but it does suggest a longer consolidation or macro-driven downtrend.

Probability: Depends on macro conditions

Confirmation: Multiple rejections at $90K

The Role of Market Sentiment After the Breakdown

Price moves are fueled by emotion as much as liquidity.

Typical Sentiment Shift After Major Support Breaks

- Optimism → uncertainty

- Dip-buying → hesitation

- Confidence → risk management

Retail traders often panic after support breaks — while smart money waits for confirmation and discounts.

If sentiment flips to fear while on-chain data shows accumulation, that divergence often marks opportunity.

How Institutions Are Likely Positioning

Institutions don’t react emotionally — they react strategically.

After a support break, large players typically:

- Reduce exposure temporarily

- Hedge downside risk

- Wait for structural confirmation

- Re-accumulate at predefined levels

This creates range-bound price action, not immediate collapse.

Institutions thrive on volatility — but only when it’s controlled.

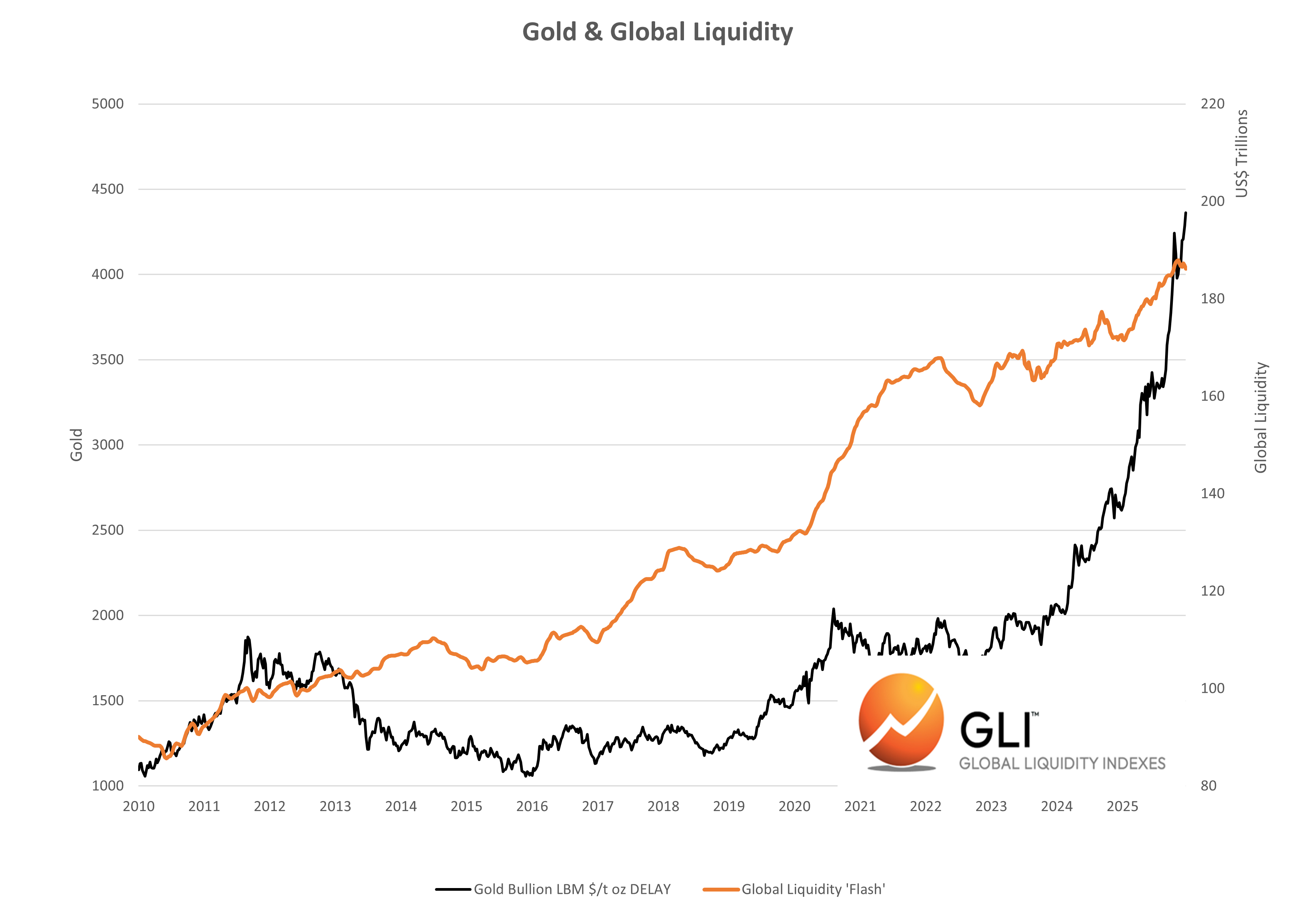

The Impact of Macro Conditions

Bitcoin does not trade in isolation.

Key macro drivers now matter more than ever:

- Interest rates

- Liquidity conditions

- Dollar strength

- Equity market trends

If macro conditions remain supportive, Bitcoin corrections tend to be contained.

If liquidity tightens, support breaks carry more weight.

What Retail Traders Should Not Do Here

After losing $90K, emotions spike — and mistakes follow.

Avoid These Common Errors

❌ Panic selling into support zones

❌ Overleveraging short positions

❌ Assuming “this time is different”

❌ Ignoring higher-timeframe structure

Markets punish emotional extremes.

Smarter Strategies After the $90K Breakdown

Instead of predicting, focus on preparing.

Smarter Approaches

- Scale entries, don’t lump sum

- Respect invalidation levels

- Use spot over leverage

- Track volume and structure, not headlines

Patience outperforms prediction in transitional markets.

Key Levels to Watch Going Forward

Here’s a simplified roadmap:

| Level | Meaning |

|---|---|

| $90K | Major resistance |

| $85K | Short-term structural zone |

| $80K | Psychological + technical |

| $72–75K | High-confidence demand |

| $60K | Long-term cycle support |

Price reaction matters more than the level itself.

So… Where Is Bitcoin Headed Next?

There is no single answer — only probability ranges.

- A fast reclaim favors continuation

- Consolidation favors patience

- Rejection favors deeper downside

What happens after the break matters more than the break itself.

Bitcoin has survived far worse than a lost support level — but it has never ignored market structure.

Final Thoughts: Breakdown or Opportunity?

Breaking $90K feels dramatic — but markets are built on cycles, not emotions.

This moment will define:

- Who trades emotionally

- Who waits for confirmation

- Who positions strategically

Bitcoin doesn’t reward certainty.

It rewards discipline.

The next major move won’t be decided by panic — but by what price does after the dust settles.