For two full cycles, the playbook was simple: find the next Layer 1, buy the token, wait for the narrative to expand, and let reflexivity do the rest.

It worked with Ethereum.

It worked with Solana.

It worked with Avalanche.

But markets evolve. Capital rotates. Narratives saturate.

The uncomfortable thesis:

The next bull market likely won’t be led by L1 infrastructure.

It will be led by something closer to cash flow, applications, and economic gravity.

Let’s break down why.

1. The Infrastructure Trade Is Saturated

In prior cycles, the pitch was seductive:

- Faster throughput

- Cheaper gas

- Better consensus

- More scalable architecture

Each new L1 promised to fix the “limitations” of the previous one.

But today, most retail participants don’t care about marginal improvements in TPS or slight changes in consensus design. The market is no longer pricing novelty — it’s pricing utility.

There are already dozens of general-purpose smart contract chains. Most are:

- Technically competent

- Decently decentralized

- Adequately scalable

Adding one more does not create new demand. It fragments liquidity.

And fragmentation kills reflexivity.

In 2021, you could justify premium valuations because infrastructure scarcity existed. Today, blockspace is abundant. In fact, it’s over-supplied.

When supply explodes, margins compress.

That’s not bullish for L1 tokens whose valuation thesis depends on perpetual base-layer dominance.

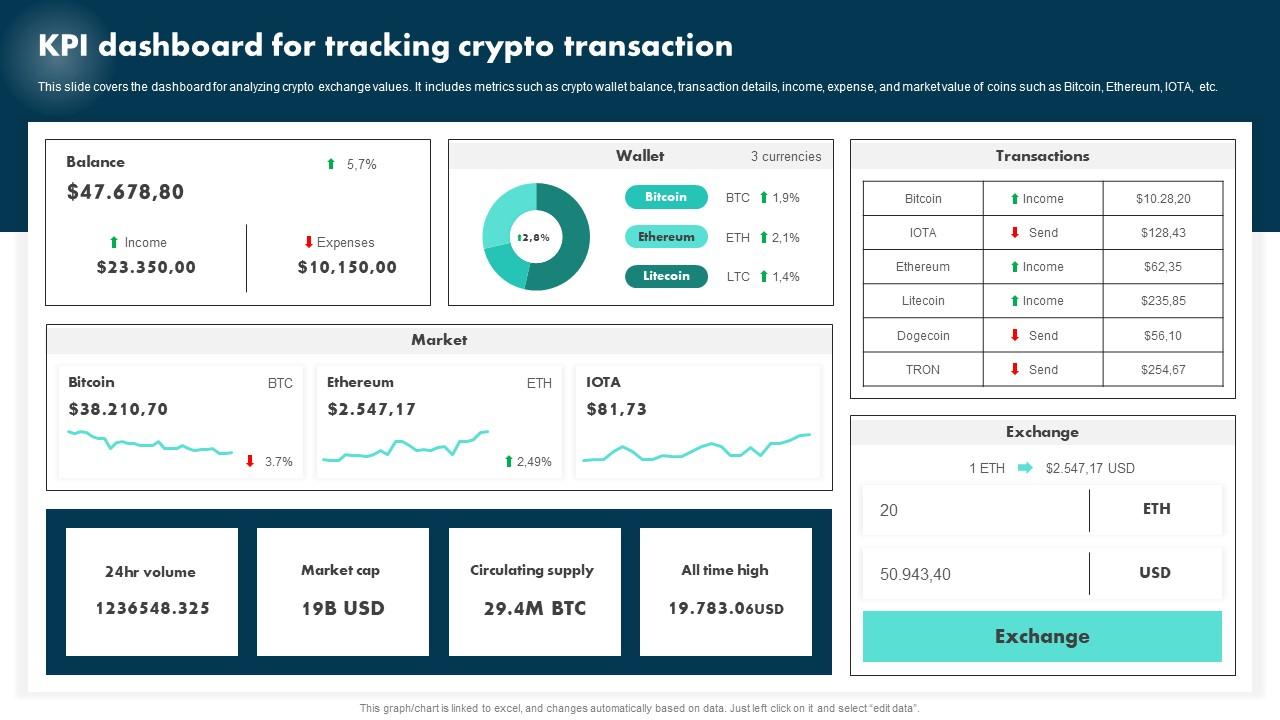

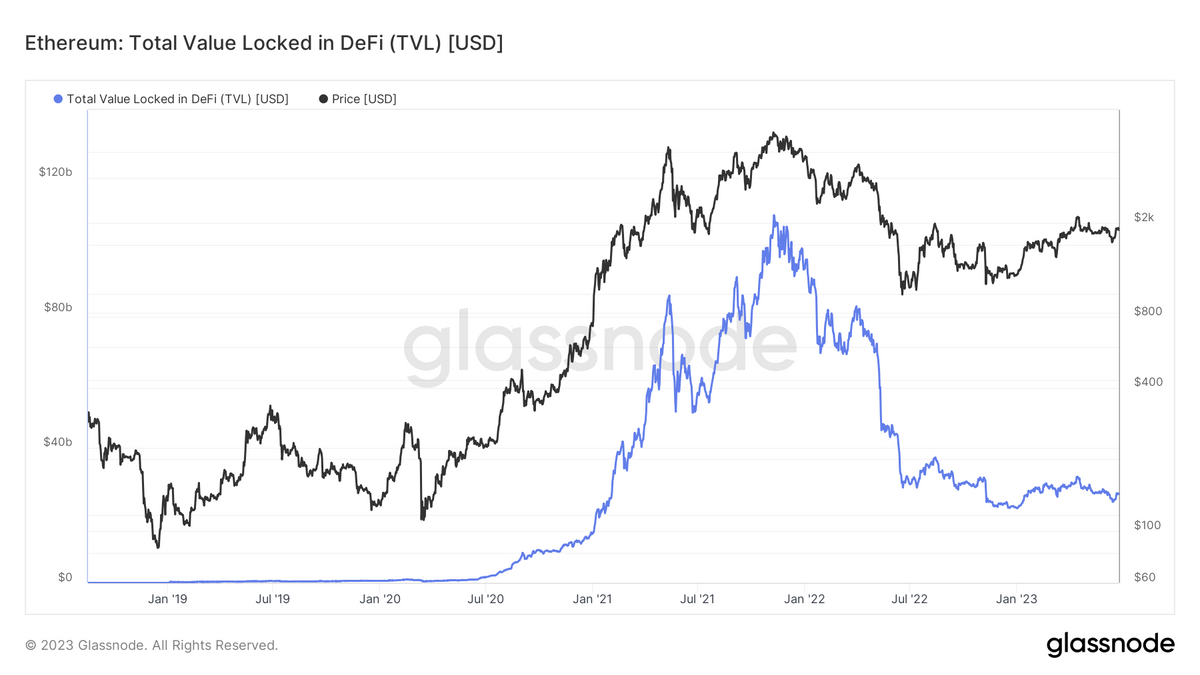

2. The Market Is Maturing Toward Revenue

Early crypto valued possibility.

The next phase will value performance.

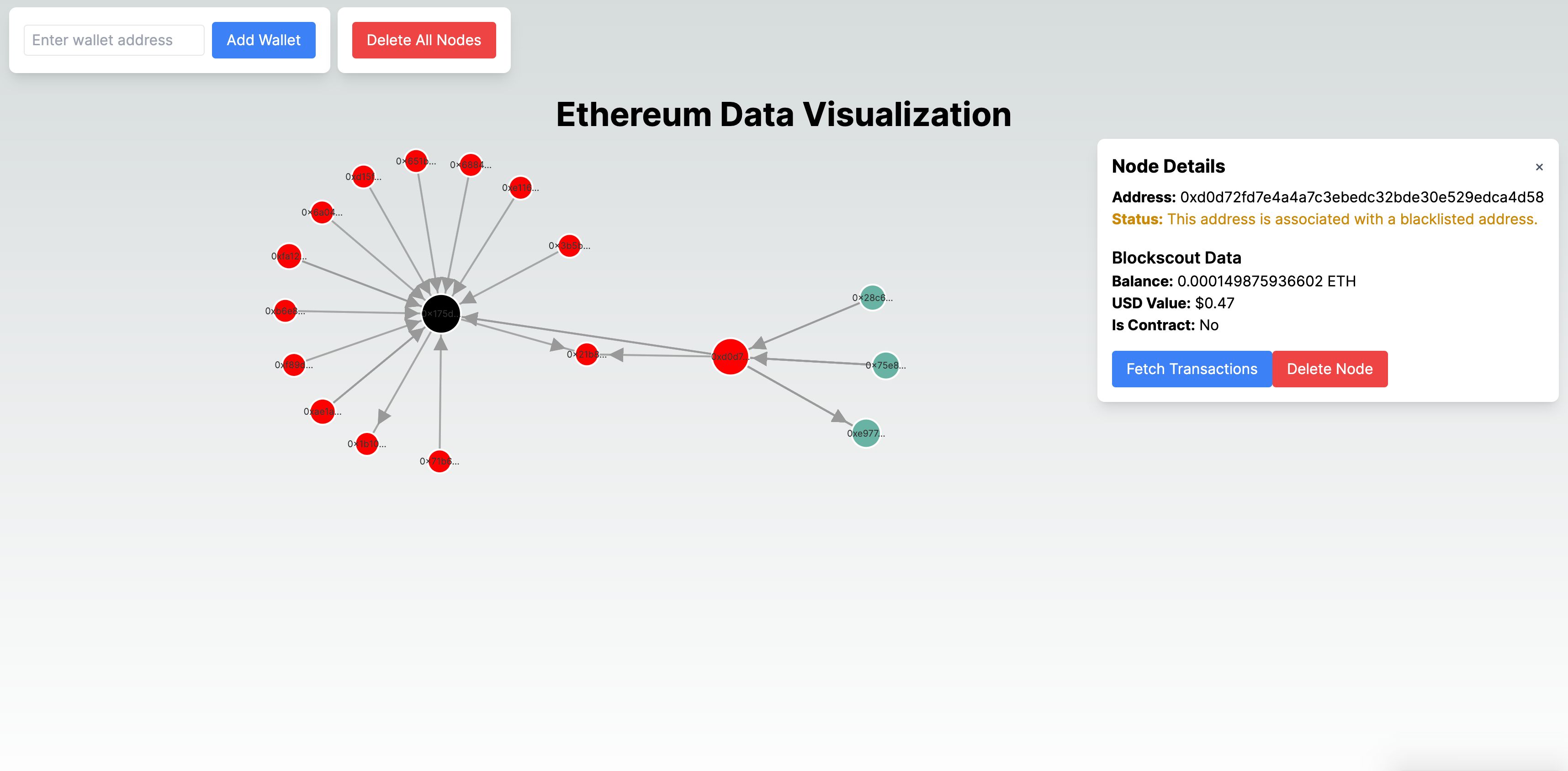

Retail is no longer naive. After multiple drawdowns, investors are asking sharper questions:

- Does this protocol generate fees?

- Who captures the value?

- Is there real demand, or just incentives?

Look at protocols like Uniswap or Maker. They produce measurable economic output.

That changes the psychology of a bull run.

Instead of “Which chain will developers choose?” the new question becomes:

“Which protocol is printing?”

This shifts capital from base-layer speculation to application-layer economics.

L1s sell blockspace. Apps sell services.

Services create defensible revenue. Blockspace is becoming a commodity.

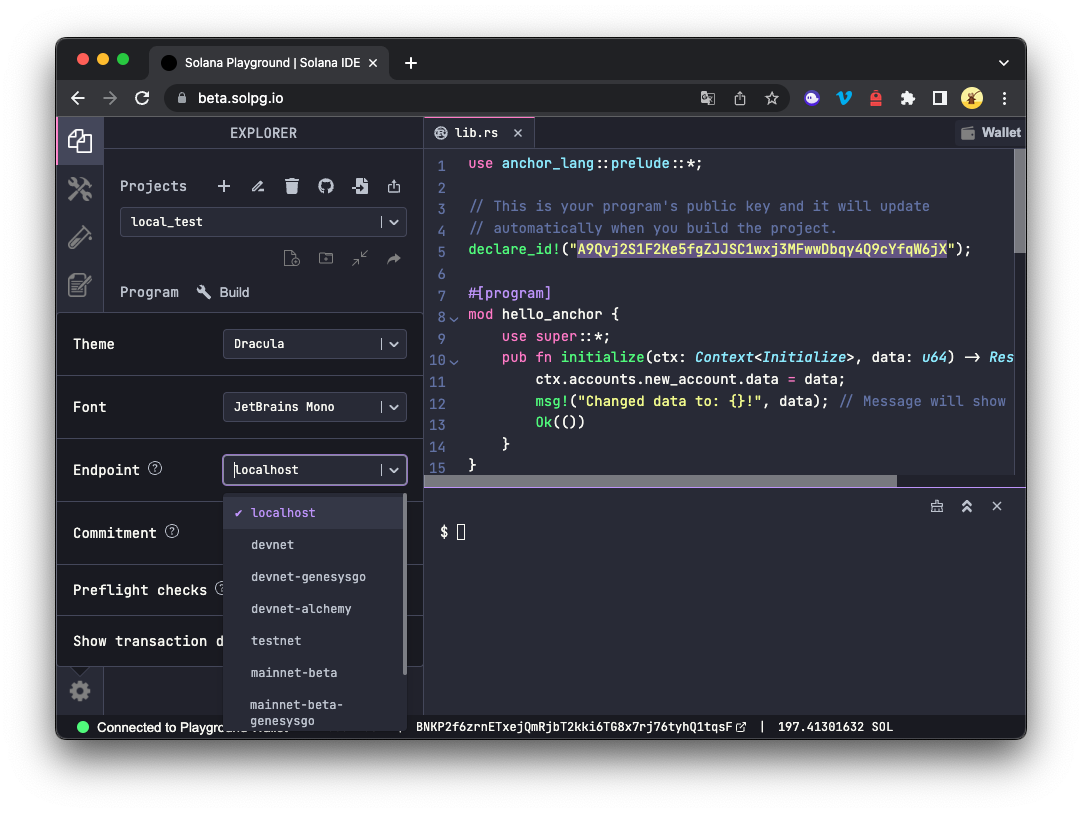

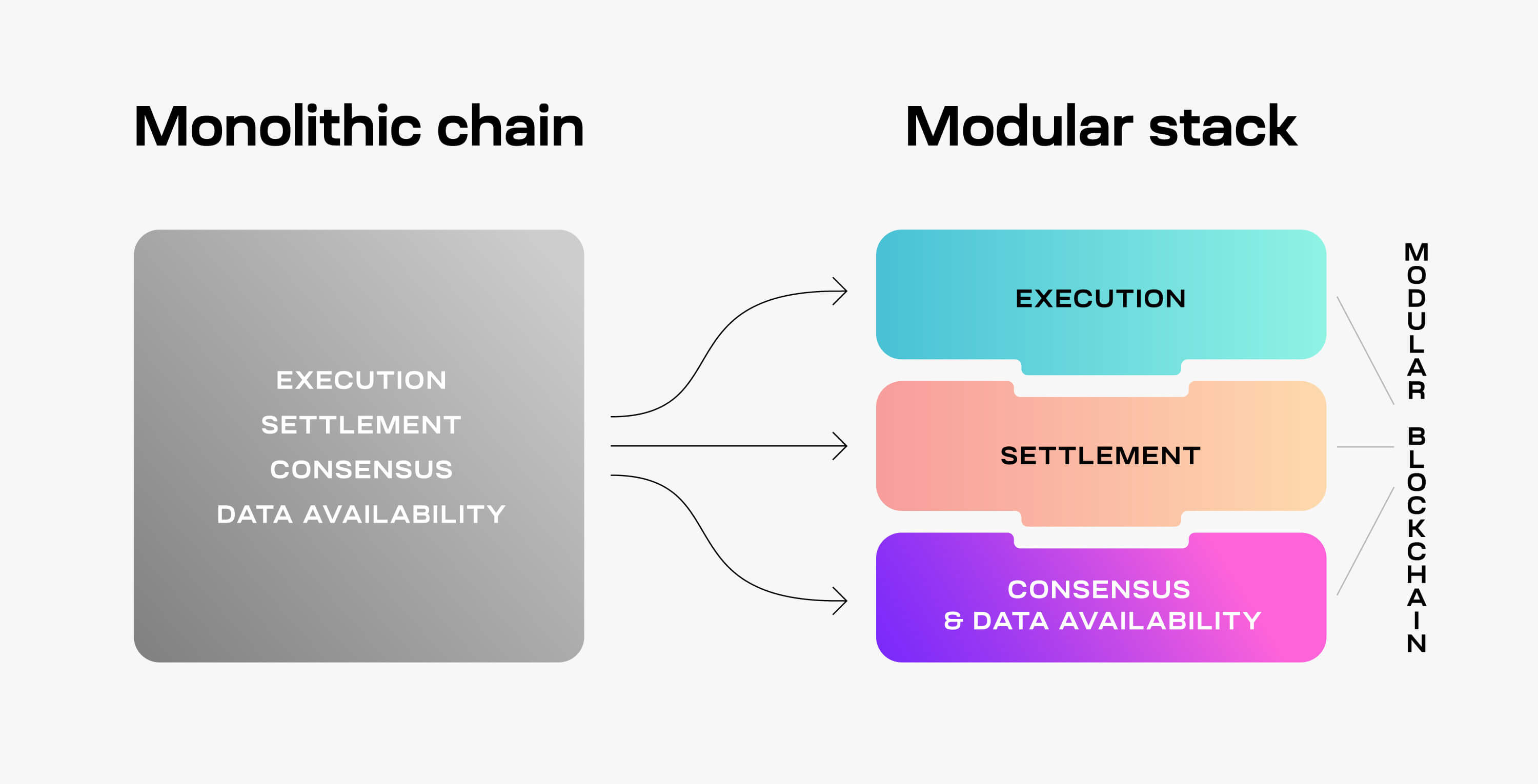

3. Modular Architecture Breaks the L1 Monopoly

The modular thesis changes everything.

With projects like Celestia, execution, settlement, and data availability can be separated.

That means applications no longer need to build an entire sovereign L1 to launch.

They can:

- Deploy a rollup

- Rent data availability

- Use shared settlement

In other words: infrastructure becomes plug-and-play.

If launching a blockchain becomes trivial, the premium attached to owning a general-purpose L1 token compresses.

Infrastructure becomes middleware.

Middleware rarely captures the majority of value in technology cycles.

Applications do.

4. Retail Attention Follows Products, Not Consensus Algorithms

Retail does not evangelize validator uptime metrics.

They share:

- Trading apps

- Gaming platforms

- Social protocols

- Yield dashboards

The 2021 mania was not about Byzantine Fault Tolerance.

It was about NFTs, memecoins, and DeFi.

Infrastructure narratives were upstream — but the dopamine lived in applications.

The next bull run will likely amplify that dynamic.

When the next viral product emerges, people won’t ask which L1 secures it.

They’ll ask how to participate.

And participation capital flows to the token closest to the action.

5. Liquidity Is Consolidating

Liquidity fragmentation was tolerated in prior cycles because capital was abundant.

But after multiple contractions, liquidity has become more disciplined.

Capital tends to concentrate around:

- Deepest order books

- Most composable ecosystems

- Strongest network effects

That often benefits dominant chains like Ethereum and high-performance ecosystems like Solana — but it doesn’t necessarily benefit new L1 entrants.

The barrier to dethroning incumbents is dramatically higher than it was in 2019.

The asymmetry that once existed for “next-gen L1” bets has compressed.

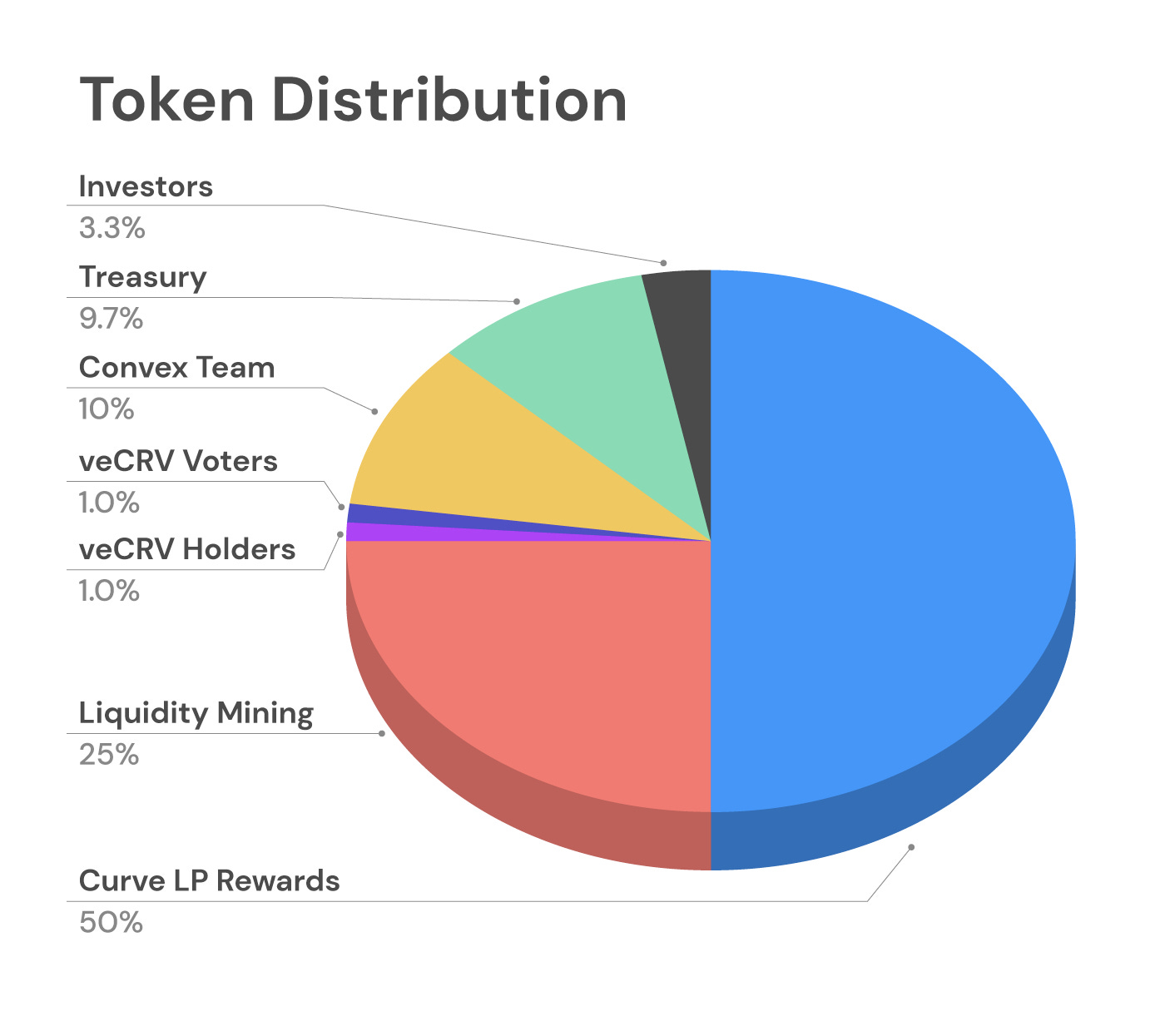

6. Token Models Are Evolving

Early L1 tokens relied heavily on inflationary emissions.

That model subsidized growth.

But inflation is a tax on holders.

Newer designs emphasize:

- Fee burns

- Buybacks

- Revenue sharing

- Real yield

Investors are recalibrating around sustainability.

Application tokens tied to measurable demand can outcompete base-layer tokens reliant on speculative growth.

The market is slowly shifting from narrative beta to economic alpha.

7. The Asymmetric Opportunity Is Moving Up the Stack

Technology cycles follow a pattern.

Early phase: infrastructure captures outsized returns.

Mid phase: platforms consolidate.

Late phase: applications dominate.

Crypto is transitioning from phase one to phase two.

The next explosive growth may come from:

- Onchain derivatives

- Decentralized physical infrastructure

- Tokenized real-world assets

- AI-native crypto networks

Not from launching L1 number 47.

When blockspace becomes abundant, differentiation shifts to product-market fit.

And product-market fit lives at the application layer.

The Contrarian Take

This is not a death sentence for L1s.

Dominant chains will still accrue value.

But the leadership premium — the 20x asymmetry that once came from betting on the next base layer — is likely diminishing.

The next bull market may be led by:

- Protocols with visible cash flow

- Apps with viral distribution

- Tokens aligned with real usage

- Networks that create economic stickiness

In short:

The next cycle could look less like a race for faster blockchains —

and more like a competition for sustainable onchain businesses.

Retail investors who adjust early will stop chasing infrastructure headlines and start studying revenue dashboards.

Because when the music starts again, capital won’t care who has the most elegant consensus algorithm.

It will care who is making money.