Introduction: When the Market Stops Feeling Like Yours

There was a time when crypto markets felt raw, chaotic, and personal. Prices moved on weekends. Liquidity dried up during regional holidays. A single whale transaction could shake the entire market. Retail traders weren’t just participants—they were the market.

That feeling is gone.

Today’s crypto market feels smoother, more predictable, and—paradoxically—more distant. Price action aligns with U.S. market hours. Volatility compresses around macroeconomic announcements. Flows matter more than narratives. And increasingly, the largest moves are driven not by individuals clicking “buy,” but by capital rotating through regulated financial products.

This isn’t a conspiracy or a hostile takeover. It’s something more mundane and more powerful: institutional absorption. Crypto proved it was valuable, liquid, and scalable. Once that happened, it became inevitable that large financial institutions would reshape how access works.

The institutional takeover of crypto is not coming. It’s already complete.

From Permissionless Access to Institutional Gateways

In crypto’s early years, access was radically simple. If you had an internet connection, a wallet, and a willingness to navigate imperfect tools, you could participate directly. There were no suitability requirements, no accredited investor rules, and no compliance overlays. Markets were global, continuous, and largely indifferent to who you were.

That openness was crypto’s defining feature—and its greatest vulnerability.

As the market grew, capital concentration increased. Infrastructure matured. Risk moved from technical failure to systemic exposure. At that point, institutions didn’t just arrive as participants; they arrived as architects of access.

Today, the primary entry points into crypto for meaningful capital are no longer native crypto rails. They are institutional gateways: ETFs, custodians, prime brokers, and regulated trading venues designed to integrate crypto into existing financial systems.

The market didn’t close to retail explicitly. Instead, it restructured itself so that the most efficient, liquid, and capital-advantaged paths favor institutions by default.

ETFs Changed Who Crypto Is For

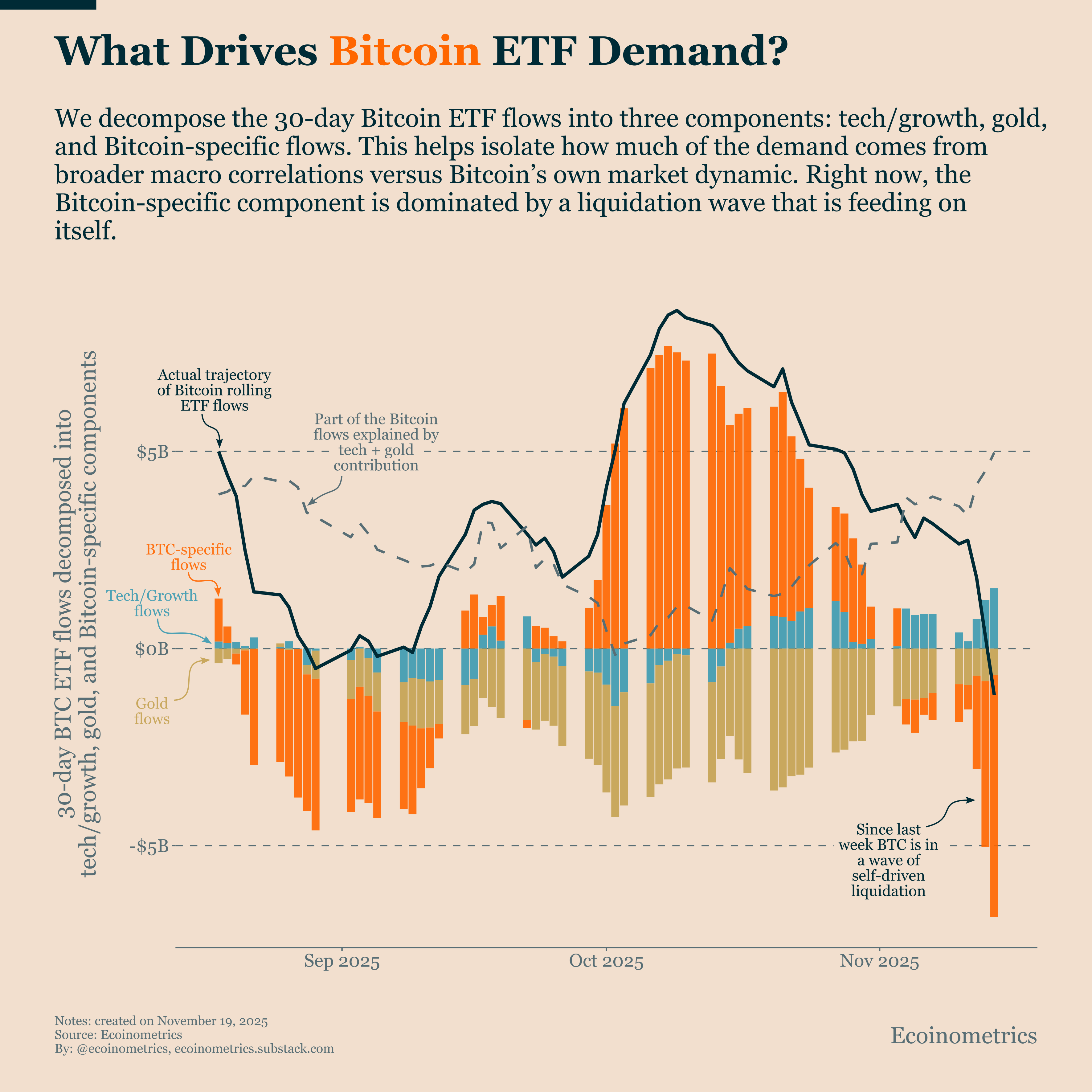

Nothing illustrates the institutional takeover more clearly than the rise of spot crypto ETFs.

For years, crypto advocates debated whether exchange-traded funds would be bullish or bearish. The answer turned out to be both—and neither. ETFs didn’t simply add demand. They redefined participation.

When exposure to crypto is packaged into a familiar financial instrument, several things happen simultaneously:

- Capital that could not touch native crypto now enters at scale

- Price discovery shifts from on-chain venues to regulated markets

- Flows become more important than fundamentals

- Market hours synchronize with traditional finance

The most important effect, however, is subtle: ownership becomes abstracted. ETF buyers do not custody assets. They do not interact with protocols. They do not vote, stake, bridge, or transact. They hold exposure, not assets.

This is not inherently negative. In fact, it is precisely what institutions require. But it marks a decisive break from crypto’s original participation model.

When firms like BlackRock and Fidelity offer crypto exposure through regulated vehicles, they are not merely validating the asset class. They are re-routing demand away from native crypto infrastructure and into institutional pipes.

Crypto still exists—but increasingly as a backend system supporting front-end financial products.

Custody: The Quiet Center of Power

In traditional finance, custody is boring. In crypto, custody is everything.

Whoever controls custody controls:

- Settlement

- Access

- Compliance

- Recovery

- And ultimately, risk allocation

As institutions entered crypto, self-custody did not scale with them. Instead, custody professionalized. Regulated custodians, insurance frameworks, segregation of duties, and audit requirements became prerequisites for serious capital.

This had two major consequences.

First, it centralized operational gravity. Assets moved from millions of individual wallets into a smaller number of professionally managed vaults. Even when underlying blockchains remain decentralized, practical control consolidates.

Second, it shifted trust. Early crypto replaced institutional trust with cryptographic guarantees. Institutional crypto reintroduces trust—just with different actors and better reporting.

Retail users are still free to self-custody. But liquidity, derivatives, lending, and structured products increasingly revolve around institutional custodians. The market follows where capital is safest, insured, and legally protected.

That is not ideology. That is capital efficiency.

Prime Brokerage and the End of Equal Access

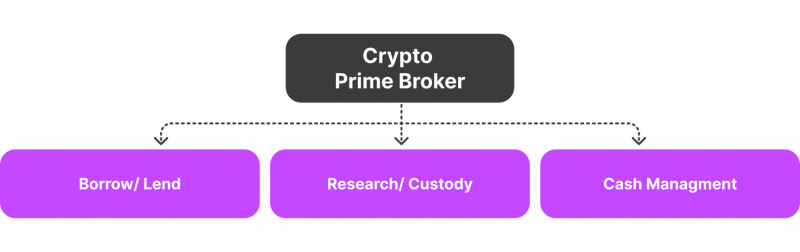

Another underappreciated shift is the rise of crypto prime brokerage.

Prime brokerage changes markets by creating tiers of access. Institutions receive:

- Better execution

- Lower fees

- Deeper liquidity

- Leverage

- Direct market access

- OTC block trades

Retail traders, by contrast, interact with surfaced liquidity after it has already been intermediated.

This is not unique to crypto—it mirrors traditional markets—but it represents a philosophical reversal. Early crypto minimized information asymmetry. Prime brokerage formalizes it.

When large players can trade off-exchange, hedge exposure across venues, and internalize flow, price discovery becomes smoother but less transparent. Volatility compresses. Retail sees fewer extremes—but also fewer asymmetric opportunities.

Crypto didn’t become unfair. It became financially normal.

Regulated Wrappers Are Now the Default

Perhaps the clearest signal that the takeover is complete is this: regulated wrappers are now the default path for new participants.

New entrants are more likely to:

- Buy exposure through brokerage accounts

- Hold crypto via custodians

- Use compliant on-ramps

- Trade during market hours

- Think in terms of allocations, not ideology

Meanwhile, native crypto rails increasingly serve two groups:

- Power users who accept complexity and risk

- Speculative retail chasing higher volatility

The middle—the mass market—has migrated to institutional rails.

This wasn’t forced. It was chosen. Complexity, security risk, tax uncertainty, and operational friction pushed users toward safer abstractions. Institutions were ready to provide them.

Crypto didn’t lose users. It changed interfaces.

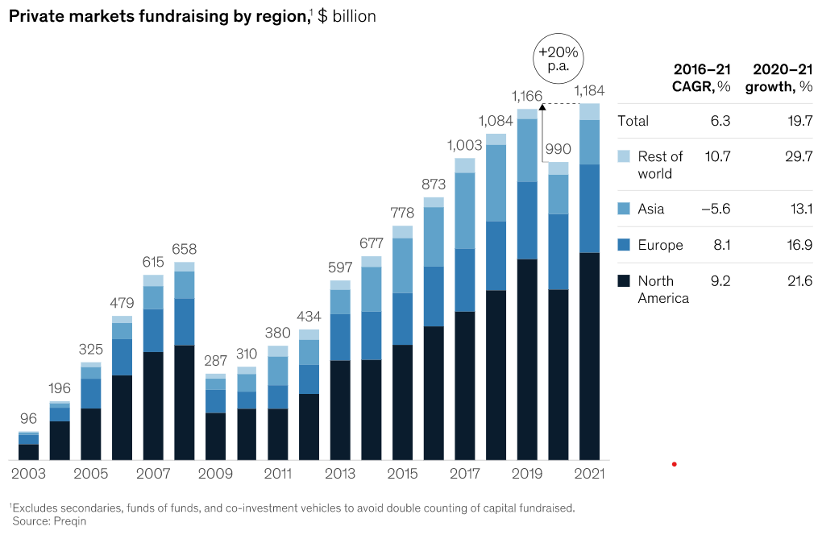

Why This Was Always Going to Happen

Every successful financial innovation follows the same arc:

- Early adopters take outsized risk

- Infrastructure matures

- Capital concentrates

- Institutions standardize access

- Volatility decreases

- Returns normalize

Crypto is not exempt from economic gravity.

Once crypto reached sufficient liquidity, market depth, and legal recognition, it became impossible for institutions to ignore—and impossible for them not to reshape. Large pools of capital require predictability, compliance, and scale. Systems that provide those characteristics win.

The mistake was assuming that decentralization alone could prevent institutionalization. In reality, decentralization describes network design, not market behavior.

Markets optimize for efficiency. Institutions specialize in efficiency.

What Retail Didn’t Lose—and What It Did

It’s tempting to frame this shift as retail losing control. That’s only partially true.

Retail lost:

- Structural advantage

- Early access to asymmetric inefficiencies

- Narrative dominance

Retail gained:

- Safer exposure

- Lower volatility

- Easier access

- Reduced operational risk

What disappeared was not opportunity—but edge.

Crypto no longer rewards mere participation. It rewards sophistication, scale, or risk tolerance. Retail can still win, but the playing field now resembles every other mature financial market.

The Market We Have Now

Crypto today is best understood as financial infrastructure, not a counter-financial movement.

It is:

- Integrated into capital markets

- Influenced by macro conditions

- Traded by institutions

- Governed indirectly through regulation and custody

The revolution didn’t fail. It stabilized.

Whether that is disappointing or reassuring depends on what you wanted crypto to become.

Conclusion: Absorption, Not Defeat

The institutional takeover of crypto was not a hostile act. It was a consequence of success.

Crypto proved it could hold value, move capital, and support global markets. Once it did, institutions did what they always do: they built frameworks to control risk, standardize access, and scale participation.

Retail wasn’t pushed out. It was outgrown.

The next phase of crypto won’t look like the last one. It will be quieter, more regulated, and more intertwined with traditional finance. The frontier hasn’t vanished—it has simply moved to the edges.

And as always in markets, the edges are where risk—and opportunity—still live.