The cryptocurrency industry has no shortage of controversy, but few episodes have resonated as deeply as the ongoing Gemini situation. Once positioned as one of the most compliant and institutionally friendly crypto exchanges in the world, Gemini has found itself at the center of regulatory scrutiny, investor losses, and a broader industry reckoning.

The fallout from Gemini extends well beyond a single platform. It has exposed structural weaknesses in centralized crypto businesses, highlighted regulatory blind spots, and forced investors to reconsider long-held assumptions about risk, trust, and transparency in digital asset markets.

This article examines what happened, why it matters, and what the Gemini fallout means for investors, crypto exchanges, and the future of the crypto ecosystem.

Understanding the Gemini Situation

Gemini built its reputation on compliance, security, and credibility. Founded by Cameron and Tyler Winklevoss, the exchange positioned itself as a “regulated bridge” between traditional finance and crypto. That positioning made Gemini a preferred on-ramp for institutional investors and cautious retail users alike.

The trouble began with Gemini Earn, a yield-generating product that allowed users to lend crypto assets in exchange for interest. Gemini partnered with Genesis Global Capital to facilitate these loans. When Genesis froze withdrawals amid broader market turmoil following the collapse of FTX, Gemini Earn users were suddenly unable to access billions of dollars in funds.

Regulators alleged that the Earn program constituted the sale of unregistered securities, while users accused Gemini of misrepresenting risk and failing to adequately disclose exposure. What followed was a cascade of lawsuits, enforcement actions, and reputational damage.

Why the Gemini Fallout Matters

At first glance, the Gemini situation may appear to be just another exchange-specific controversy. In reality, it represents a systemic inflection point for crypto.

Unlike earlier collapses driven by outright fraud or extreme leverage, Gemini’s challenges stem from product design, disclosure, and regulatory classification. That distinction is critical. It suggests that even exchanges operating in “good faith” and under regulatory supervision can expose users to significant, poorly understood risks.

For policymakers, Gemini has become a test case. For investors, it is a wake-up call. For exchanges, it is a warning that compliance alone is not enough.

Implications for Crypto Investors

1. Yield Is Not Risk-Free

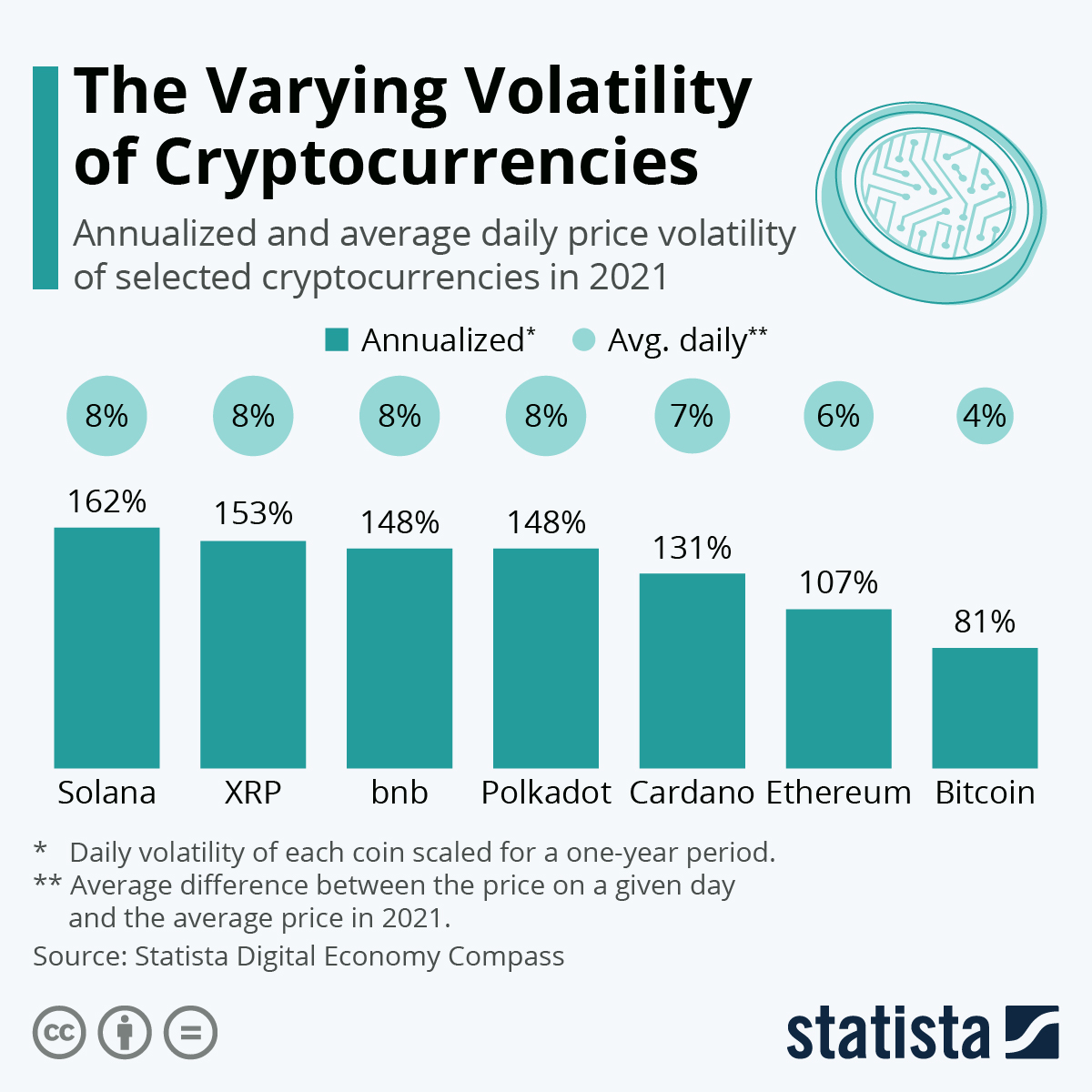

One of the clearest lessons from the Gemini fallout is that crypto yield products carry substantial counterparty risk. Many investors assumed that interest-bearing crypto accounts functioned similarly to bank savings accounts. They do not.

In Gemini’s case, users were effectively unsecured creditors of a third-party lender. When that lender failed, investor funds were trapped. This has permanently altered how many market participants view “passive income” opportunities in crypto.

2. Disclosure Matters More Than Branding

Gemini’s reputation for trust and regulatory alignment led many users to assume heightened protections. The fallout demonstrates that brand credibility does not replace transparent risk disclosure.

Going forward, investors are likely to scrutinize:

- Where their assets are actually held

- Who controls lending and rehypothecation

- Whether assets are segregated or pooled

Sophisticated investors now demand the same level of disclosure they expect from traditional financial products.

3. Self-Custody Is Gaining Momentum

The Gemini situation has reinforced a long-standing crypto mantra: “Not your keys, not your coins.” While centralized exchanges remain convenient, the fallout has accelerated interest in self-custody solutions such as hardware wallets and decentralized finance protocols.

Implications for Crypto Exchanges

1. Product Design Will Be Re-Evaluated

Yield products, staking programs, and lending services are now under intense regulatory scrutiny. Exchanges can no longer rely on vague terms of service or offshore partnerships to justify complex financial products.

Future exchange offerings will likely:

- Limit yield products to accredited or institutional investors

- Provide clearer risk segmentation

- Reduce reliance on opaque third-party counterparties

2. Compliance Is Necessary but Insufficient

Gemini’s experience underscores a hard truth: compliance does not eliminate risk. Regulators are now examining not just whether exchanges follow rules, but whether those rules adequately protect consumers.

Exchanges will need to invest heavily in:

- Legal and regulatory interpretation

- Internal risk committees

- Stress-testing of lending and yield programs

3. Reputation Has Become Fragile

Trust, once lost, is difficult to regain. Even exchanges that avoided direct exposure to Gemini’s Earn product felt secondary reputational effects across the market. Users are now quicker to withdraw funds at the first sign of uncertainty.

This dynamic increases the likelihood of liquidity stress events and accelerates the move toward proof-of-reserves and real-time transparency tools.

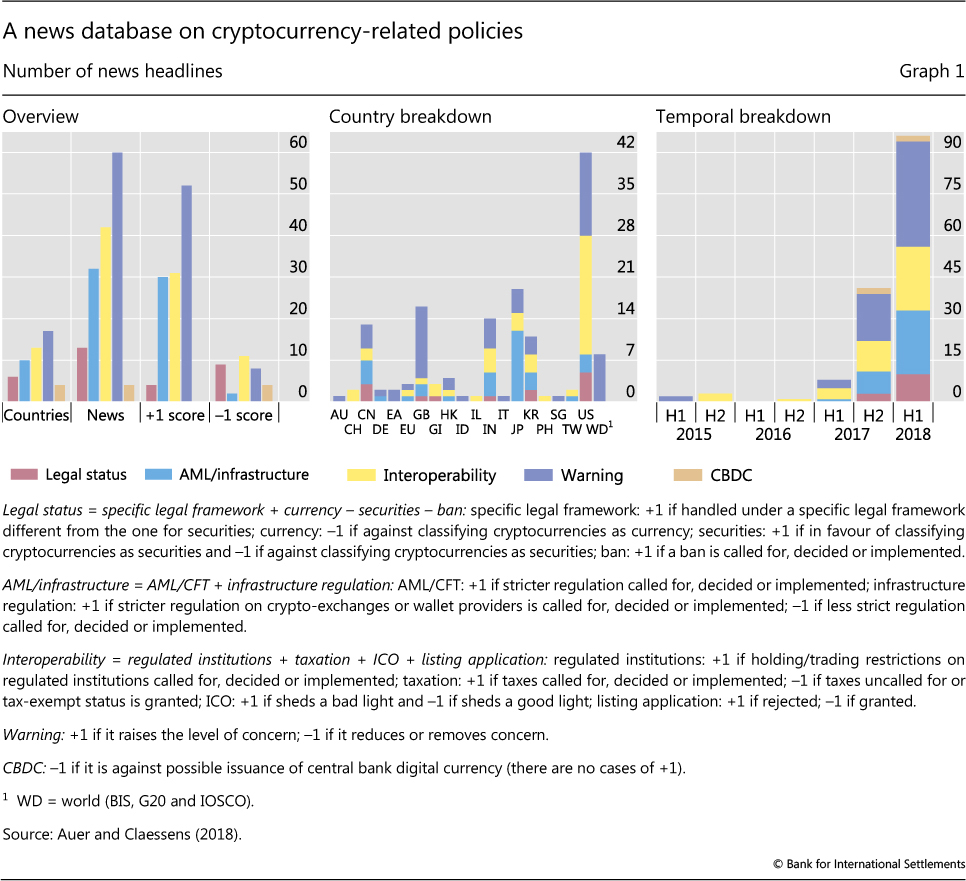

Regulatory Implications and Industry Oversight

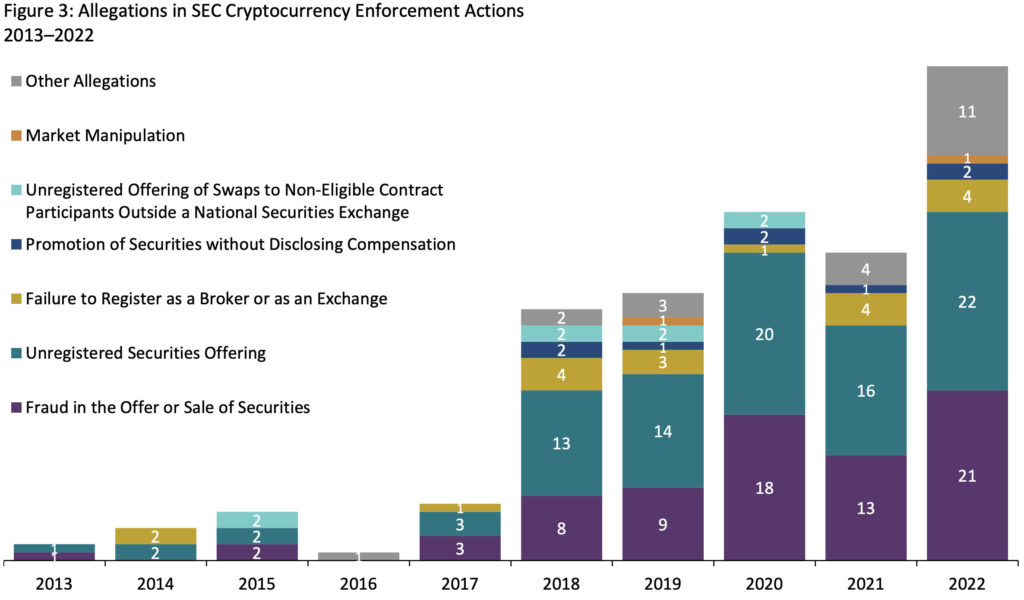

The Gemini fallout has emboldened regulators, particularly in the United States. Enforcement agencies argue that the situation illustrates why crypto lending and yield products should fall under existing securities laws.

For the industry, this means:

- More enforcement-led regulation

- Fewer regulatory gray areas

- Increased compliance costs

Whether this results in clearer rules or continued regulatory uncertainty remains an open question. What is certain is that exchanges can no longer assume regulatory ambiguity will persist indefinitely.

Market-Wide Effects of the Gemini Fallout

The Gemini situation contributed to a broader erosion of confidence during an already fragile market period. While not as dramatic as FTX, its impact has been more subtle and arguably more enduring.

Key market effects include:

- Reduced participation in centralized yield products

- Slower onboarding of institutional capital

- Increased demand for transparent custodial models

Investors now price counterparty risk more aggressively, which has reshaped liquidity dynamics across exchanges.

What the Gemini Fallout Signals for the Future of Crypto

1. A Shift Toward Simpler Models

The next phase of crypto growth is likely to favor simpler, more transparent business models. Exchanges that focus on spot trading, custody, and infrastructure may outperform those pursuing aggressive financial engineering.

2. DeFi as a Parallel Track, Not a Replacement

While decentralized finance offers transparency, it introduces its own risks. The Gemini fallout does not signal the end of centralized exchanges, but rather a clearer separation of roles between CeFi and DeFi.

3. Maturation Through Accountability

Ultimately, the Gemini situation may strengthen the industry. Painful episodes often precede structural improvement. Better disclosures, stronger governance, and clearer regulation could pave the way for sustainable growth.

Final Thoughts

The Gemini fallout is more than a single company’s crisis. It is a defining moment for the crypto industry’s relationship with risk, regulation, and trust.

For investors, it reinforces the need for due diligence and skepticism toward yield promises. For exchanges, it highlights the limits of compliance without transparency. For the broader ecosystem, it signals that crypto’s next era will be shaped not by rapid experimentation, but by accountability and resilience.

How the industry responds will determine whether crypto emerges stronger—or repeats the same mistakes under new branding.