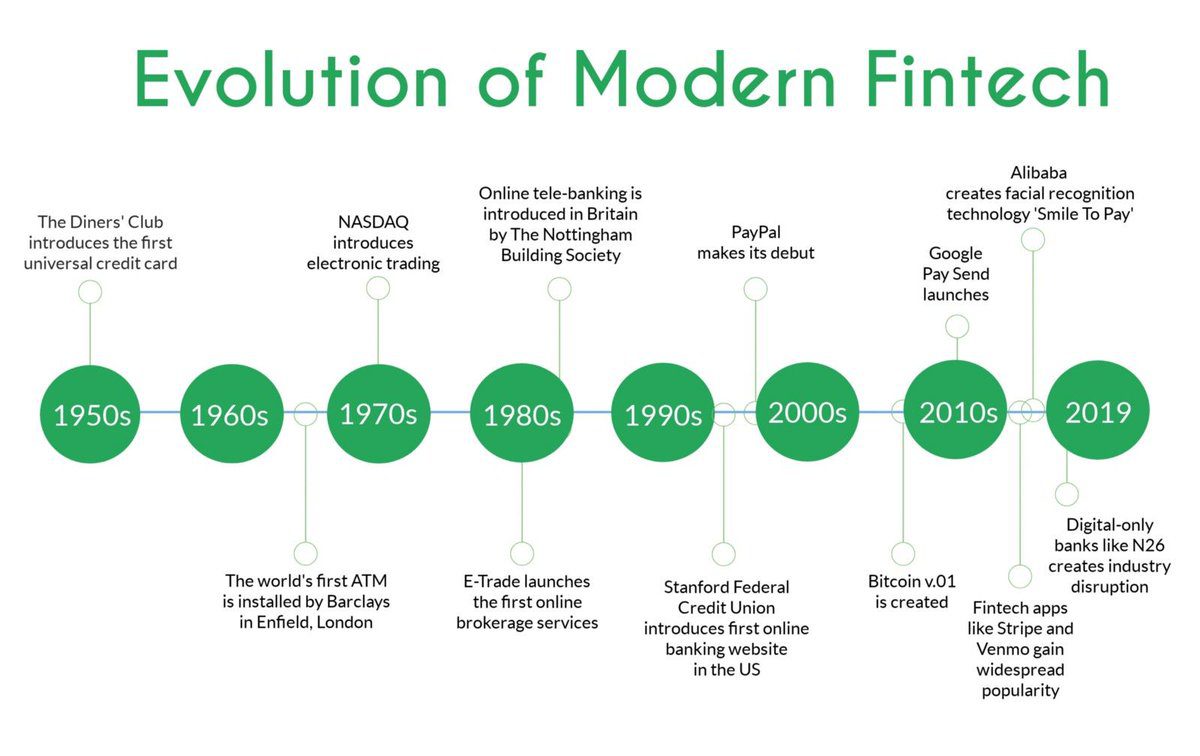

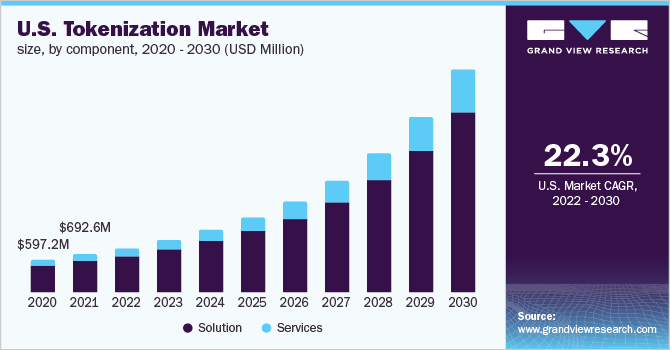

Financial markets have undergone major transformations over the last century — from paper-based trading floors to electronic exchanges and online brokerages. But a new technological shift may soon eclipse them all.

Tokenized securities — stocks, ETFs, bonds, and real-world assets issued as blockchain-based tokens — could represent the biggest financial evolution since online trading.

This change isn’t just about crypto hype. It’s about rewiring how global markets settle trades, manage ownership, enable access, and operate around the clock.

In this deep dive, we’ll explore what tokenized securities are, why Wall Street is embracing them, how they will impact investors and institutions, and why this could be the most important financial transformation of the digital era.

What Are Tokenized Securities?

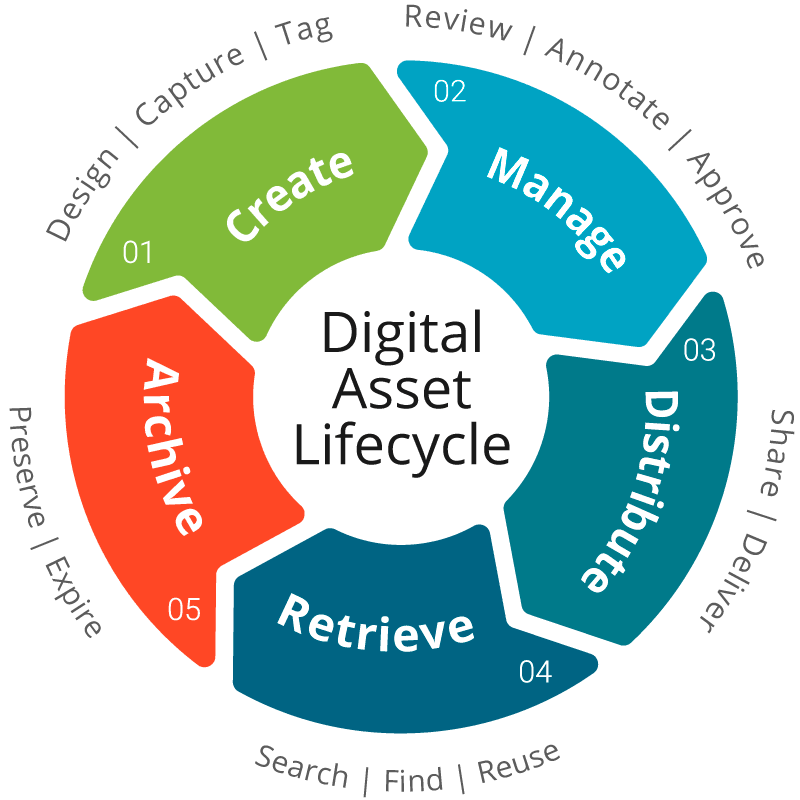

Tokenized securities are traditional financial assets — such as stocks, ETFs, bonds, or real estate — represented as digital tokens on a blockchain or distributed ledger.

Each token represents legal ownership or rights to the underlying asset, similar to a traditional share — but with enhanced programmability, faster settlement, and global accessibility.

Examples of Tokenized Assets

- Tokenized stocks (Apple, Tesla, ETFs)

- Tokenized government and corporate bonds

- Tokenized commodities (gold, oil)

- Tokenized real estate shares

- Tokenized private equity and funds

Instead of relying on legacy clearinghouses and paper-based systems, ownership is tracked digitally, often in real time.

Why This Is Bigger Than Online Trading

Online trading revolutionized who could trade.

Tokenized securities revolutionize how markets function.

Online Trading Did This:

- Gave retail investors direct market access

- Lowered trading costs

- Increased trading speed

Tokenization Does This:

- Eliminates settlement delays

- Reduces counterparty risk

- Enables fractional ownership

- Unlocks 24/7 global trading

- Makes assets programmable

In other words:

Online trading democratized access. Tokenization modernizes market infrastructure itself.

How Tokenized Securities Work

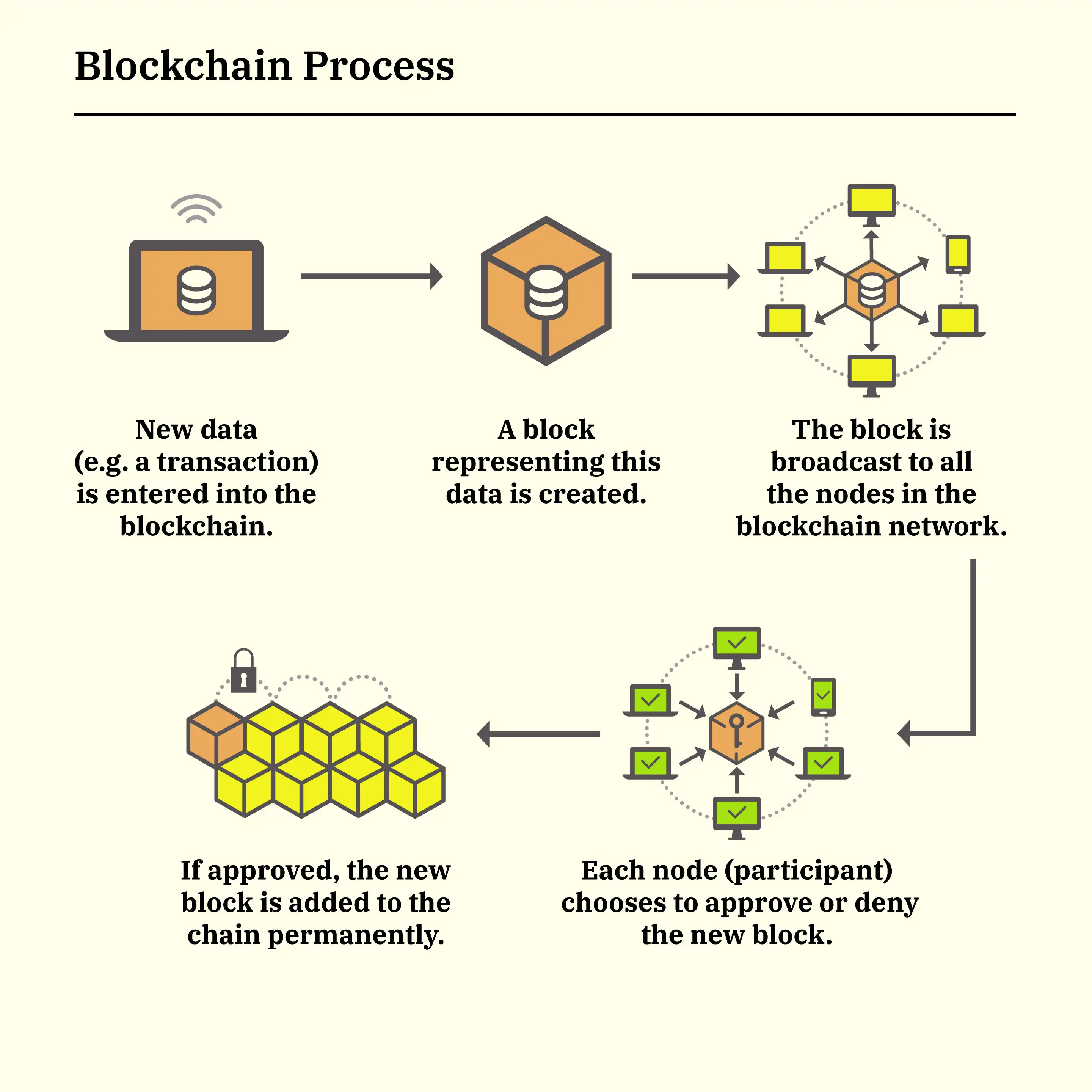

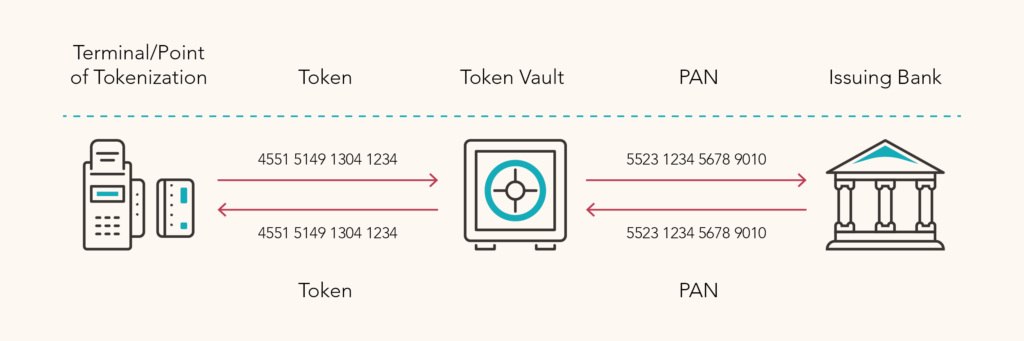

Tokenized securities are issued and tracked using blockchain or distributed ledger technology (DLT).

The Basic Flow

- A real-world asset is legally structured

- Digital tokens representing ownership are created

- Tokens are stored in digital wallets or custodial platforms

- Trades settle on-chain, often in seconds

- Ownership updates instantly

This eliminates many of the slow, expensive intermediaries embedded in traditional financial systems.

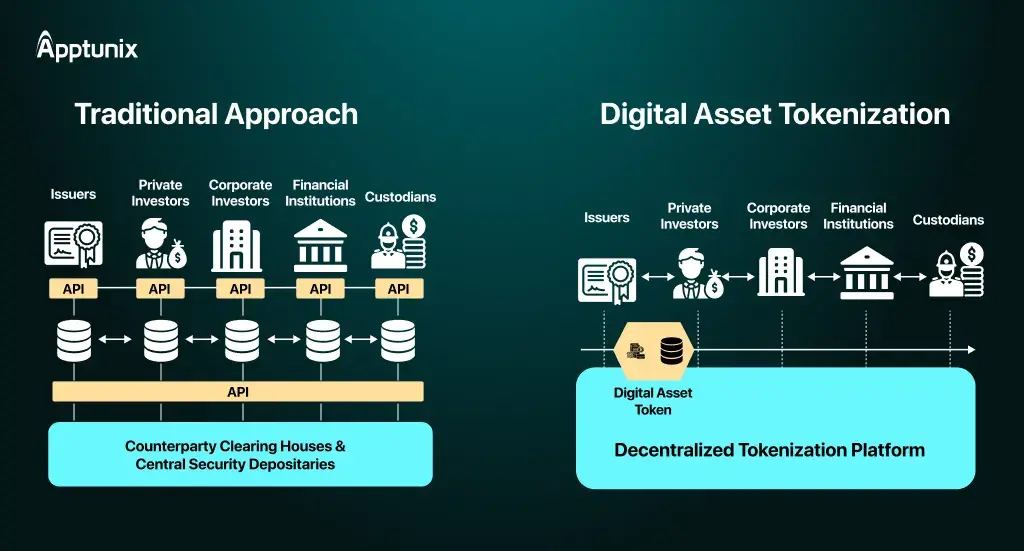

The Problem With Traditional Market Infrastructure

Despite modern trading interfaces, market plumbing remains outdated.

Current System Limitations

- Trades settle in T+2 (two business days)

- Complex clearinghouse dependencies

- High operational and reconciliation costs

- Limited trading hours

- Fragmented global systems

These inefficiencies cost the financial industry billions per year.

Tokenization solves many of these bottlenecks.

Key Benefits of Tokenized Securities

1. Near-Instant Settlement (T+0)

Instead of waiting days, trades can settle in seconds or minutes, reducing:

- Counterparty risk

- Capital lockups

- Systemic exposure

2. 24/7 Trading Markets

Tokenized assets can trade around the clock, similar to crypto markets.

This allows:

- Real-time response to news

- Global investor participation

- Reduced overnight price gaps

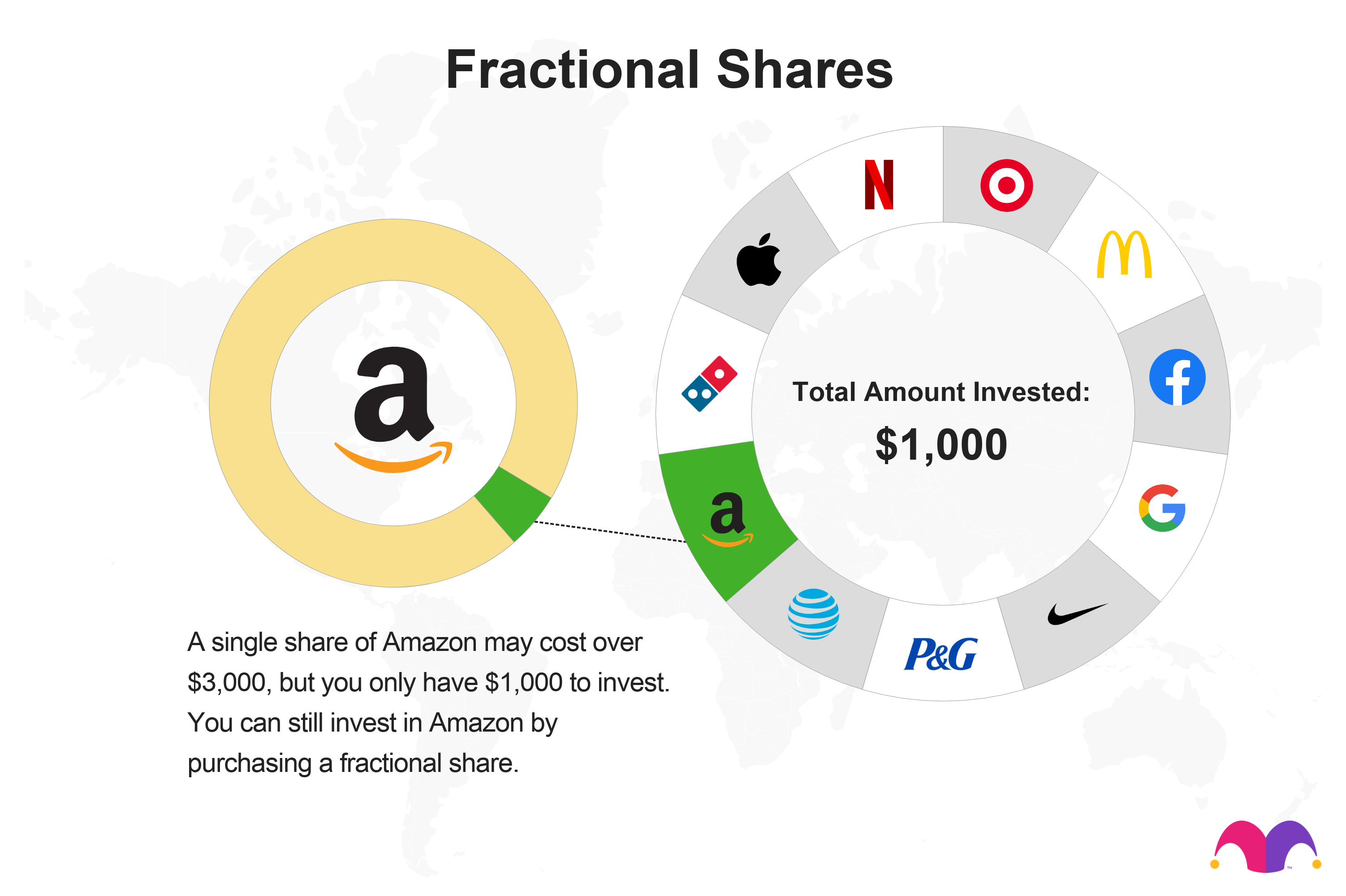

3. Fractional Ownership

Investors can own fractions of expensive assets, improving access to:

- High-priced stocks

- Real estate

- Alternative investments

4. Lower Costs and Faster Processing

By reducing intermediaries, tokenization lowers:

- Transaction fees

- Custody costs

- Administrative overhead

5. Global Access to Capital

Tokenized securities can reach investors worldwide, unlocking liquidity beyond traditional geographic boundaries.

Why Wall Street Is Embracing Tokenization

Large financial institutions are already moving in this direction.

Institutions Exploring Tokenization

- Major stock exchanges

- Global banks

- Asset managers

- Clearing firms

- FinTech infrastructure providers

Why They Care

- Reduced settlement risk

- Faster capital efficiency

- Lower operating costs

- Competitive advantage

- New revenue models

Wall Street didn’t “lose to crypto.”

It’s integrating crypto’s infrastructure into traditional finance.

Tokenized Securities vs Crypto: What’s the Difference?

| Crypto Assets | Tokenized Securities |

|---|---|

| Native digital assets | Represent real-world assets |

| Often decentralized | Usually regulated |

| Volatility-driven | Value tied to real assets |

| Less regulated | Securities law applies |

Tokenized securities bring blockchain efficiency into regulated financial markets.

The Role of AI in Tokenized Markets

When markets run 24/7, humans can’t monitor them constantly.

AI Will Power:

- Automated trading strategies

- Real-time risk management

- Liquidity optimization

- Fraud detection and compliance

- Market surveillance

Tokenization + AI = always-on, machine-driven financial markets.

Impact on Retail Investors

Opportunities

- Access to premium assets

- Trade outside work hours

- Lower capital requirements

- Global diversification

Risks

- Increased volatility

- Competing against algorithms

- Emotional overtrading

- Security and custody challenges

Retail investors must adapt by focusing on long-term strategy over short-term speculation.

Impact on Institutions and Banks

Banks Will Need To:

- Upgrade technology stacks

- Implement blockchain settlement

- Automate compliance

- Build digital custody systems

- Integrate AI-driven risk models

Institutions that fail to modernize risk becoming obsolete.

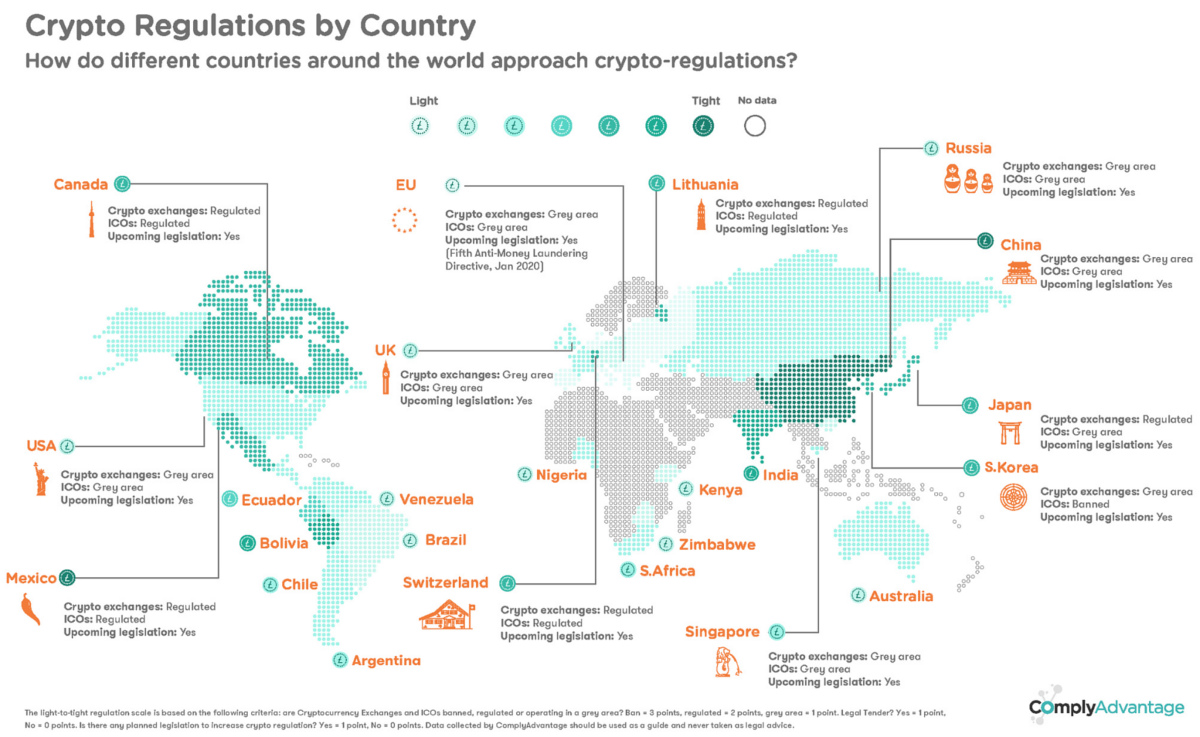

Regulatory Challenges and Legal Evolution

Tokenized securities still require clear legal frameworks.

Key Regulatory Questions

- Who issues and custodies tokens?

- How are investor protections enforced?

- How do global jurisdictions align?

- What happens in disputes or hacks?

Expect regulatory modernization — not rejection.

Risks and Concerns Around Tokenization

Major Risks Include:

- Smart contract vulnerabilities

- Market manipulation risks

- Liquidity fragmentation

- Custody and hacking concerns

- Over-financialization

Technology reduces friction — but increases speed of failure if mismanaged.

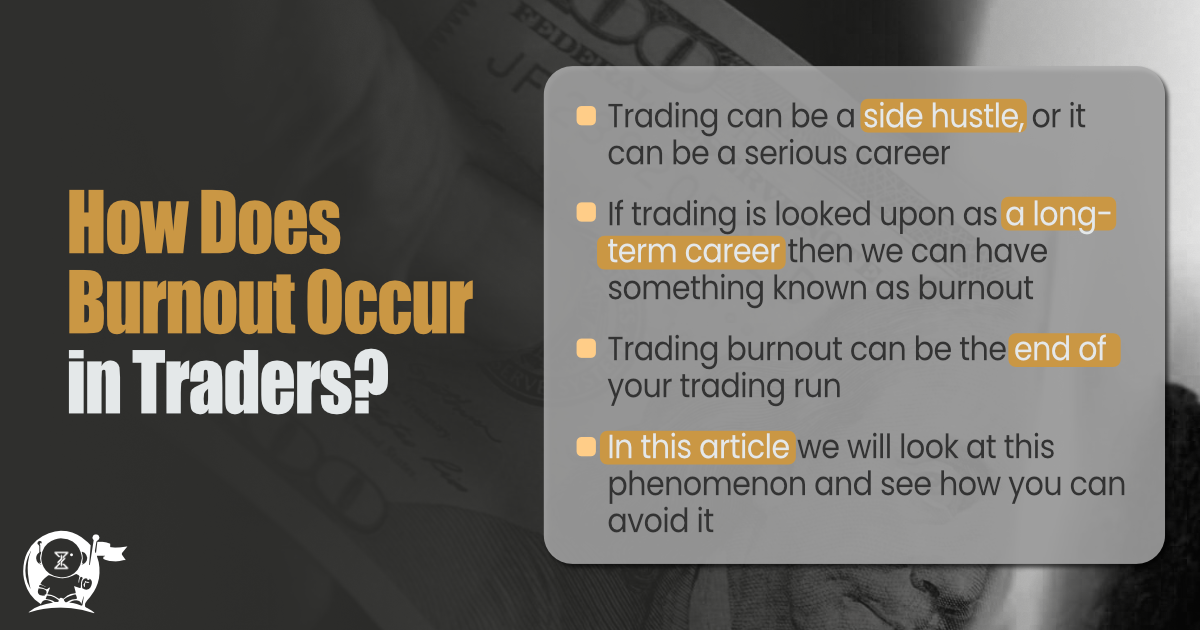

The Psychological Shift: Always-On Markets

Markets that never close change how people behave.

Effects May Include:

- Increased trader burnout

- Greater reliance on automation

- Shorter market reaction cycles

- Faster sentiment shifts

Successful participants will prioritize discipline and systems over emotion.

How Tokenization Could Reshape Global Finance

Potential Long-Term Impacts

- Global capital flows become more fluid

- Private markets become more accessible

- Settlement becomes instant worldwide

- Financial infrastructure becomes programmable

- Markets become more transparent

This could be the foundation for a new financial operating system.

Are Tokenized Securities the Future?

All major trends point in one direction:

- Exchanges exploring tokenized trading

- Banks building blockchain rails

- Regulators modernizing frameworks

- Investors demanding faster, cheaper, global access

This isn’t speculation — it’s infrastructure evolution.

Tokenized securities won’t replace traditional markets overnight.

But over time, they may become the backbone of global finance.

Final Thoughts: The Biggest Shift Since Online Trading

Online trading changed who could trade.

Tokenized securities change how markets fundamentally operate.

They promise:

- Faster settlement

- Global access

- Lower costs

- Smarter infrastructure

- Always-on markets

This shift will not happen overnight — but it will happen.

Those who understand it early will be positioned ahead of the curve.

Those who ignore it may find themselves trading in yesterday’s system.

The next era of finance is being built — token by token.