For years, cryptocurrencies have been associated with price volatility, speculation, and hype cycles. Bitcoin goes up, Bitcoin crashes, headlines follow. Meanwhile, something far less flashy—but far more impactful—is happening behind the scenes.

Stablecoins are becoming one of the most practical financial tools ever created.

While memes and market drama dominate social media, stablecoins are being used every day to send money across borders, pay contractors, settle transactions, and move value faster than traditional banking systems allow.

This shift isn’t loud. It isn’t viral. But it may be one of the most important financial changes of the decade.

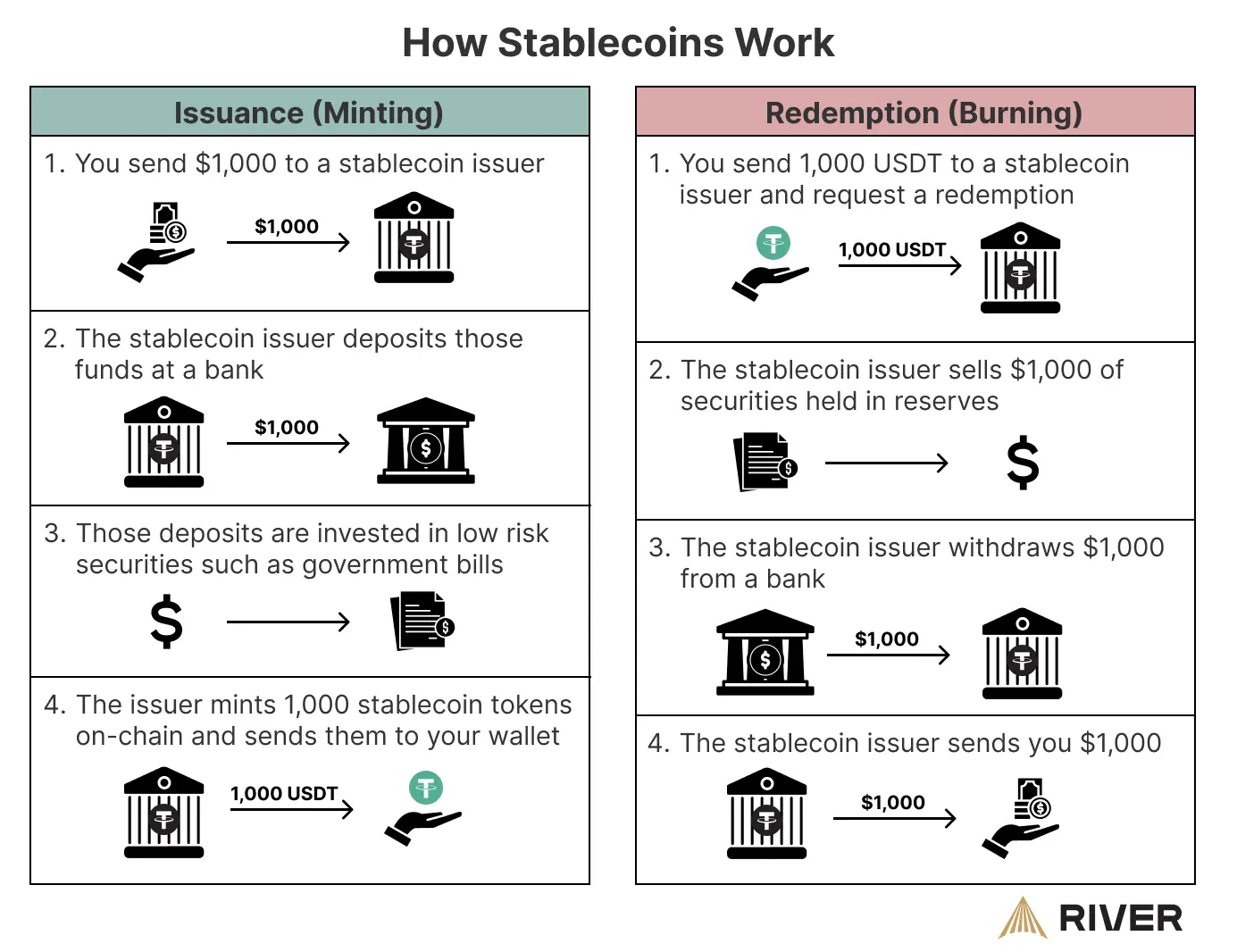

What Are Stablecoins? (In Plain English)

A stablecoin is a type of cryptocurrency designed to maintain a stable value, usually pegged to a fiat currency like the US dollar.

- 1 stablecoin ≈ $1

- No wild price swings

- No guessing what it’ll be worth tomorrow

The most common stablecoins are fiat-backed, meaning they’re supported by real-world reserves such as cash or short-term government bonds.

Think of stablecoins as digital dollars that live on blockchains.

Unlike traditional money:

- They can be sent 24/7

- They don’t require a bank account

- They settle in minutes (or seconds), not days

This combination makes them uniquely suited for payments, not speculation.

Why Stablecoins Matter for Payments

Traditional payment systems weren’t built for a global, internet-native economy.

Sending money internationally often involves:

- Multiple banks

- Currency conversions

- Business-day delays

- High fees

Stablecoins remove most of this friction.

Key Advantages of Stablecoin Payments

1. Speed

Stablecoin transactions typically settle in minutes, sometimes seconds.

2. Cost

Fees are often a fraction of traditional wire transfers or remittance services.

3. Accessibility

Anyone with a smartphone and internet access can receive stablecoins.

4. Reliability

No banking hours. No holidays. No regional restrictions.

For people and businesses that move money frequently, these benefits add up fast.

The Rise of Stablecoins in Cross-Border Payments

Cross-border payments are one of the clearest real-world use cases for stablecoins.

Today, sending money from one country to another often means:

- Waiting 2–5 business days

- Paying 5–10% in fees

- Dealing with opaque exchange rates

Stablecoins simplify this process.

How It Works

- Sender converts local currency to a stablecoin

- Stablecoin is sent instantly across the blockchain

- Receiver converts stablecoin to local currency—or spends it directly

This is especially impactful in regions where:

- Banking infrastructure is weak

- Local currencies are volatile

- Remittance costs are high

In many cases, stablecoins are faster and cheaper than legacy systems like SWIFT.

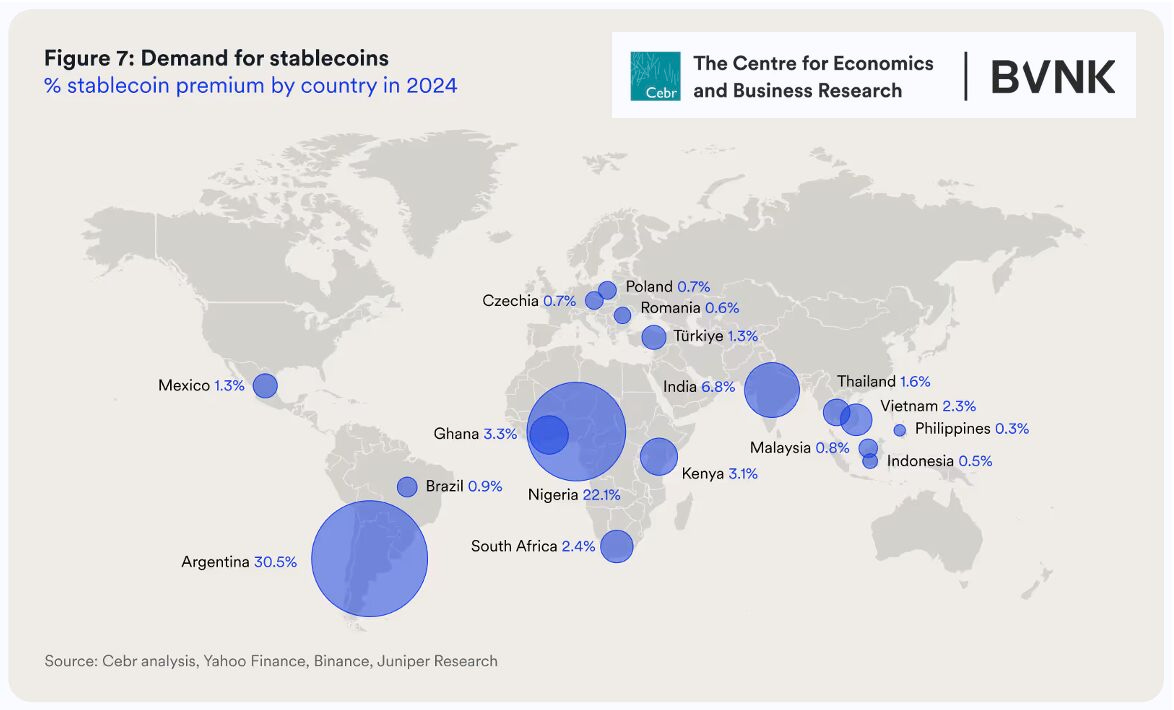

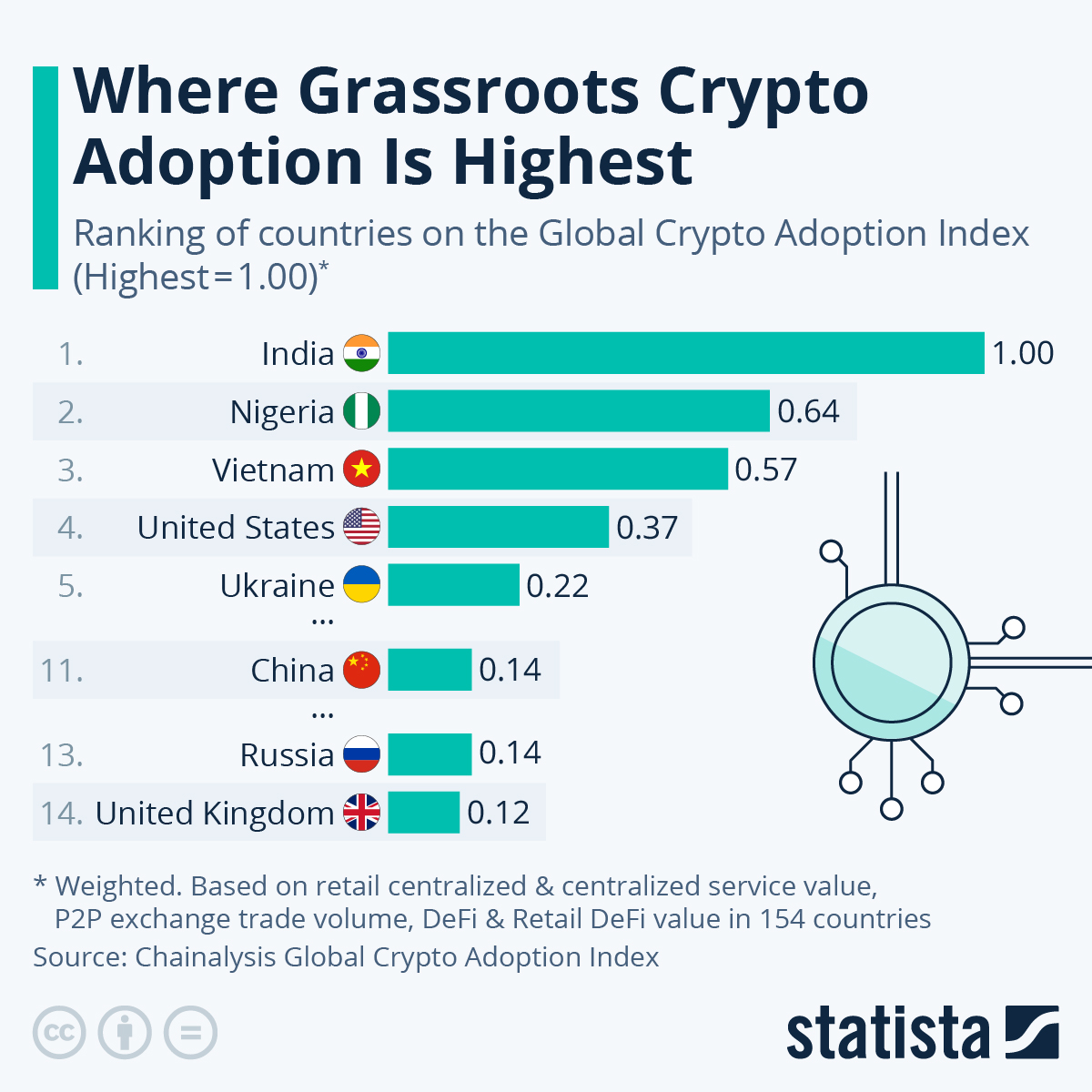

Stablecoins in Emerging Markets: A Quiet Revolution

In countries experiencing high inflation or capital controls, stablecoins are more than a convenience—they’re a lifeline.

People use stablecoins to:

- Preserve savings in dollar-equivalent assets

- Receive payments from abroad

- Avoid unstable local currencies

Unlike opening a foreign bank account, stablecoins require no permission.

All that’s needed is:

- A smartphone

- An internet connection

- A digital wallet

For millions of people, stablecoins provide access to basic financial stability that traditional systems fail to deliver.

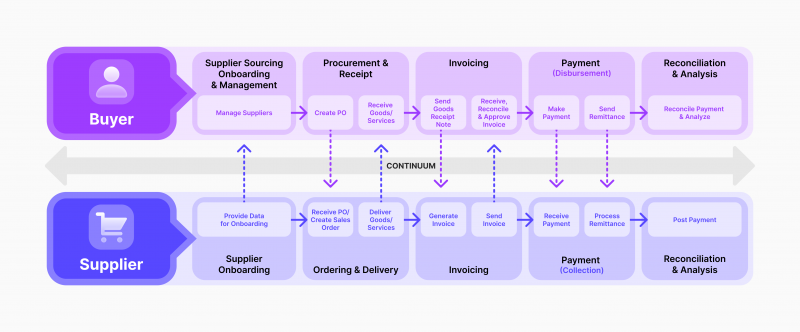

Businesses Are Adopting Stablecoins Faster Than You Think

Stablecoin adoption isn’t limited to individuals. Businesses are increasingly using them for:

- International payroll

- Vendor payments

- Treasury management

- Settlement between partners

Why Companies Use Stablecoins

- Faster settlement improves cash flow

- Lower fees reduce operational costs

- Global reach simplifies international expansion

Some companies now pay remote workers entirely in stablecoins, avoiding:

- Banking delays

- Currency conversion issues

- Regional payment restrictions

This trend is growing quietly—but consistently.

Stablecoins vs Traditional Banking: A Direct Comparison

| Feature | Traditional Banks | Stablecoins |

|---|---|---|

| Operating Hours | Business days only | 24/7 |

| Settlement Time | 1–5 days | Minutes |

| Cross-Border Fees | High | Low |

| Accessibility | Bank account required | Internet access only |

| Transparency | Limited | On-chain, verifiable |

This doesn’t mean banks are disappearing—but it does mean they’re no longer the only option.

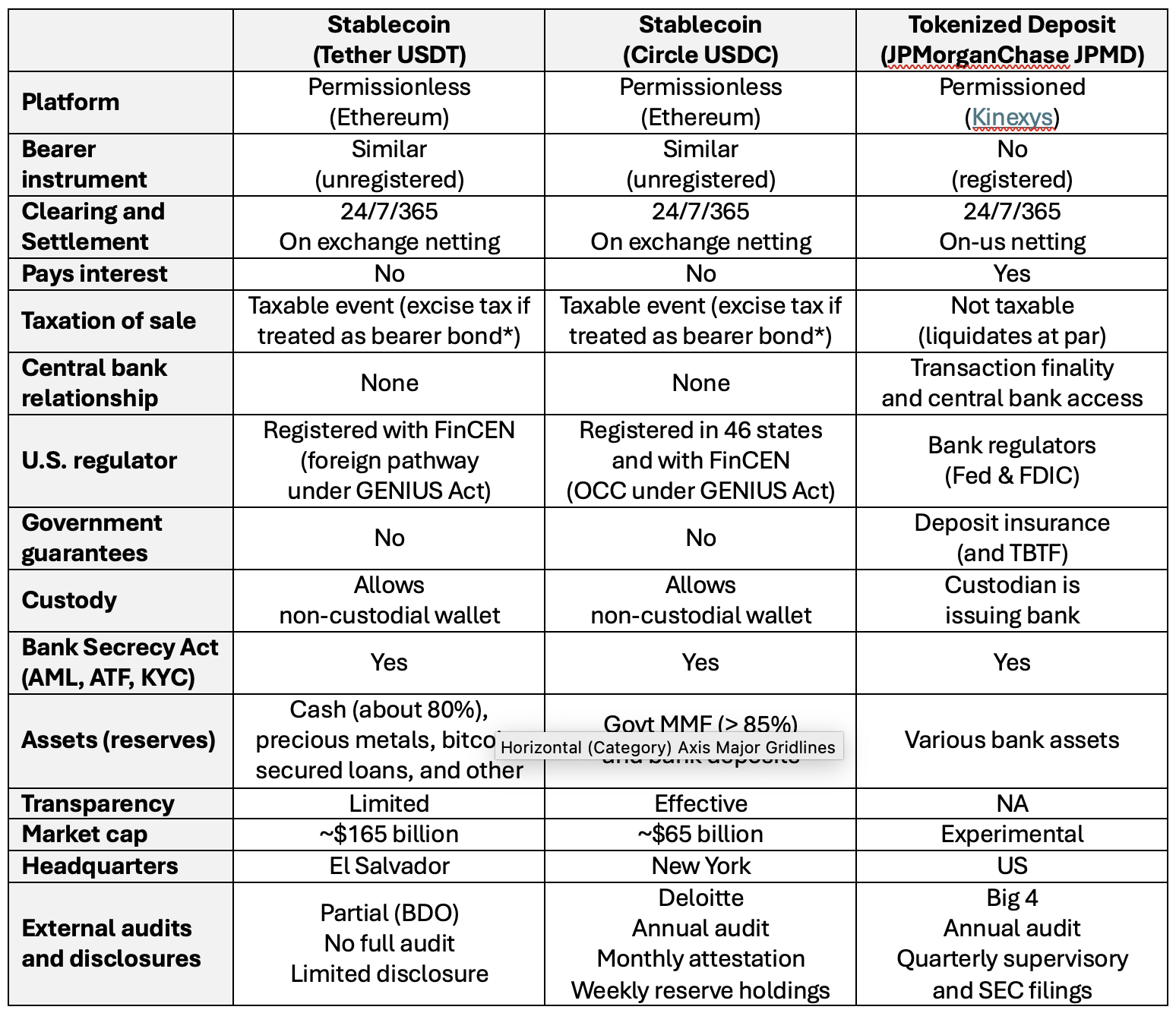

Regulation: The Turning Point for Stablecoins

For years, regulation was seen as a threat to crypto. For stablecoins, it may be the opposite.

Clear rules:

- Increase trust

- Encourage institutional adoption

- Protect users

Regulators worldwide are increasingly focused on stablecoin oversight, particularly around reserves and transparency.

This is pushing issuers to operate more like regulated financial institutions—without losing the efficiency of blockchain rails.

Are Stablecoins Safe?

Like any financial tool, stablecoins carry risks—but they are very different from volatile cryptocurrencies.

Key considerations:

- Who issues the stablecoin?

- Are reserves audited?

- Is the stablecoin fully backed?

Many users now treat reputable stablecoins as digital cash equivalents, especially for short-term storage and payments.

Education and transparency are essential—but the technology itself is maturing rapidly.

Why This Shift Is Happening Quietly

Stablecoins aren’t exciting in the way speculative assets are.

They:

- Don’t promise 100x returns

- Don’t trend on social media

- Don’t rely on hype

Instead, they solve real problems.

That’s why adoption is happening under the radar, driven by:

- Businesses

- Migrant workers

- Freelancers

- International traders

Real utility doesn’t need marketing—it spreads naturally.

The Future of Payments Is Already Here

Stablecoins are unlikely to replace traditional money overnight. But they are steadily becoming the preferred settlement layer for digital payments.

Over time, we may see:

- Banks integrating stablecoin rails

- Governments issuing regulated digital currencies

- Stablecoins embedded into everyday apps

The biggest change won’t be dramatic—it will be invisible.

Payments will simply become:

- Faster

- Cheaper

- More global

And most people won’t even realize that stablecoins are doing the work.

Final Thoughts

Stablecoins represent a rare moment in technology where:

- The innovation is real

- The benefits are immediate

- The disruption is already underway

While headlines focus on price swings and speculation, stablecoins are quietly reshaping how money moves around the world.

Not loudly.

Not dramatically.

But effectively.