What Are Real World Asset (RWA) Tokens?

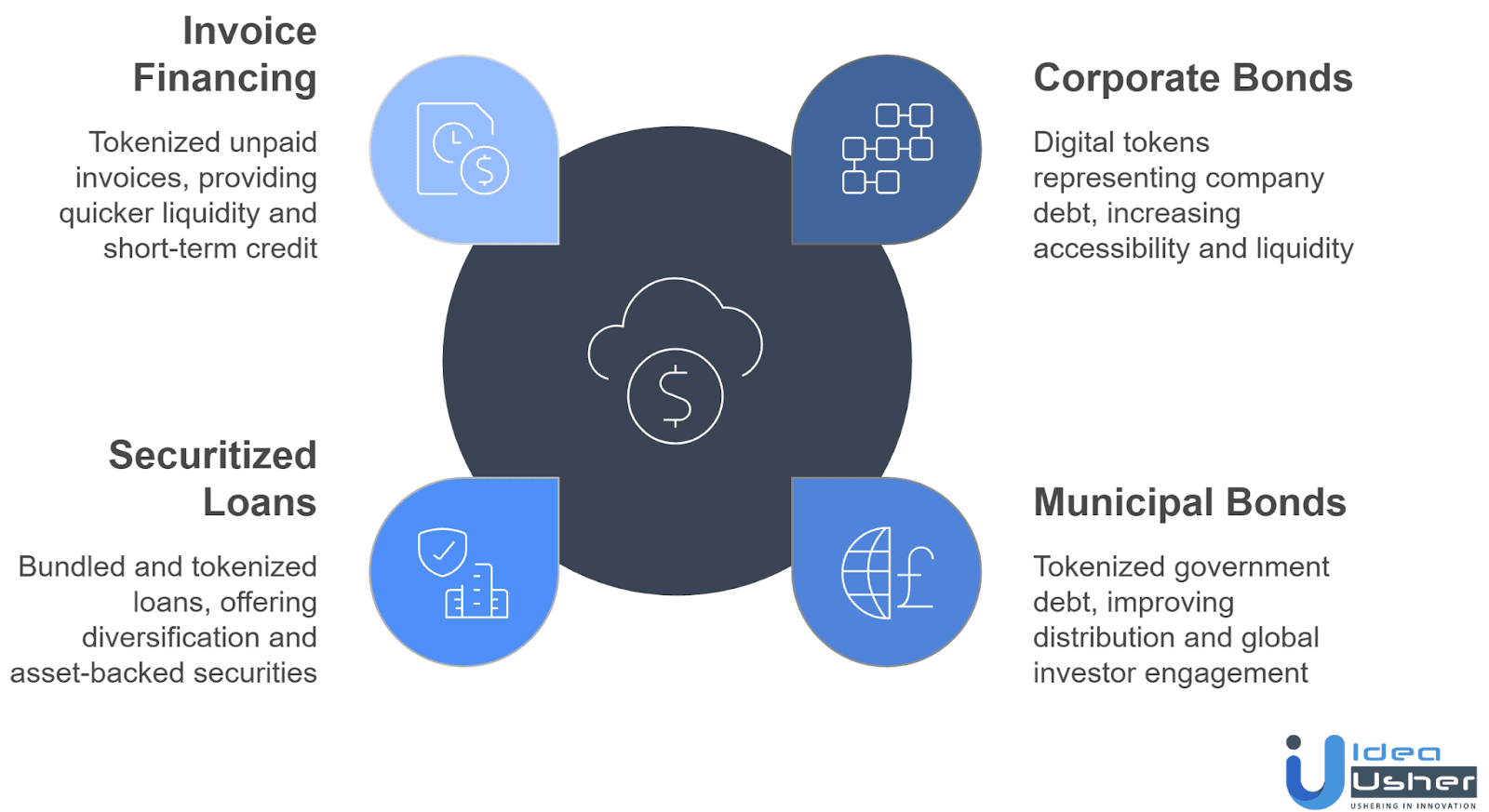

Real World Asset (RWA) tokens refer to blockchain-based tokens that represent ownership claims on tangible or traditional financial assets. These assets can include real estate, U.S. Treasuries, corporate bonds, commodities, private credit, invoices, and even fine art.

In simple terms, tokenization converts the rights to an off-chain asset into an on-chain digital representation. That representation can then be traded, transferred, collateralized, or fractionalized on a blockchain network.

The core idea behind RWA tokenization is efficiency. Traditional financial markets are fragmented, slow to settle, and geographically siloed. By contrast, blockchain infrastructure offers:

- Near-instant settlement

- Global access

- Programmable compliance

- Fractional ownership

- Transparent auditability

This convergence of blockchain finance and traditional assets is increasingly seen as one of the most credible pathways for crypto’s long-term integration into global capital markets.

Why Real World Asset Tokens Are Gaining Momentum

The RWA crypto narrative has gained significant traction for several structural reasons.

1. Yield in a Post-DeFi Boom World

During the DeFi summer era, yields were often driven by token emissions and speculative liquidity mining. As those incentives declined, investors began seeking sustainable, real yield. Tokenized U.S. Treasuries and private credit instruments began offering stable returns derived from real economic activity rather than inflationary tokenomics.

2. Institutional Participation

Major asset managers such as BlackRock and Franklin Templeton have publicly explored or launched blockchain-based fund structures. This institutional validation has significantly strengthened the credibility of tokenized securities and digital asset infrastructure.

When traditional finance (TradFi) allocates capital on-chain, it signals a shift from experimentation to structural integration.

3. Capital Efficiency and Liquidity

Traditional private markets are notoriously illiquid. By issuing tokenized assets, issuers can fractionalize exposure, broaden investor access, and reduce settlement friction. Investors benefit from improved transferability and potential secondary market liquidity.

How RWA Tokenization Actually Works

Understanding the mechanics behind real world asset tokenization is essential.

Step 1: Asset Origination

An underlying asset (e.g., a Treasury bill or real estate property) is identified.

Step 2: Legal Structuring

Often, the asset is placed into a Special Purpose Vehicle (SPV). Investors purchase tokens that represent equity or debt claims on that SPV.

Step 3: Smart Contract Issuance

A security token is minted on a blockchain (often Ethereum or a compatible network). The smart contract embeds compliance logic such as KYC restrictions or transfer limitations.

Step 4: On-Chain Trading & Settlement

Investors hold the token in a wallet. Dividends, coupon payments, or yields can be distributed automatically via smart contracts.

The result is a hybrid architecture combining traditional legal enforceability with blockchain settlement infrastructure.

Tokenized U.S. Treasuries: The Breakout Use Case

Among all RWA crypto sectors, tokenized Treasuries have emerged as a dominant vertical.

Why?

- Clear legal framework

- Highly liquid underlying market

- Low credit risk

- Attractive yield environment

Tokenized Treasury funds allow crypto-native investors to earn U.S. government bond yields without exiting blockchain ecosystems. This creates a bridge between DeFi protocols and sovereign debt markets.

For stablecoin issuers and DeFi platforms, tokenized Treasuries also serve as collateral, improving systemic stability.

Real Estate Tokenization: Fractional Ownership at Scale

Real estate tokenization has long been proposed as a transformative application of blockchain technology.

Traditional real estate investing suffers from:

- High minimum capital requirements

- Illiquidity

- Long settlement timelines

- Geographic restrictions

With property tokenization, investors can purchase fractional shares of buildings, rental portfolios, or development projects.

The thesis is straightforward: if equity markets can be digitized, so can property rights.

However, challenges remain in regulatory clarity, property law integration, and secondary market liquidity.

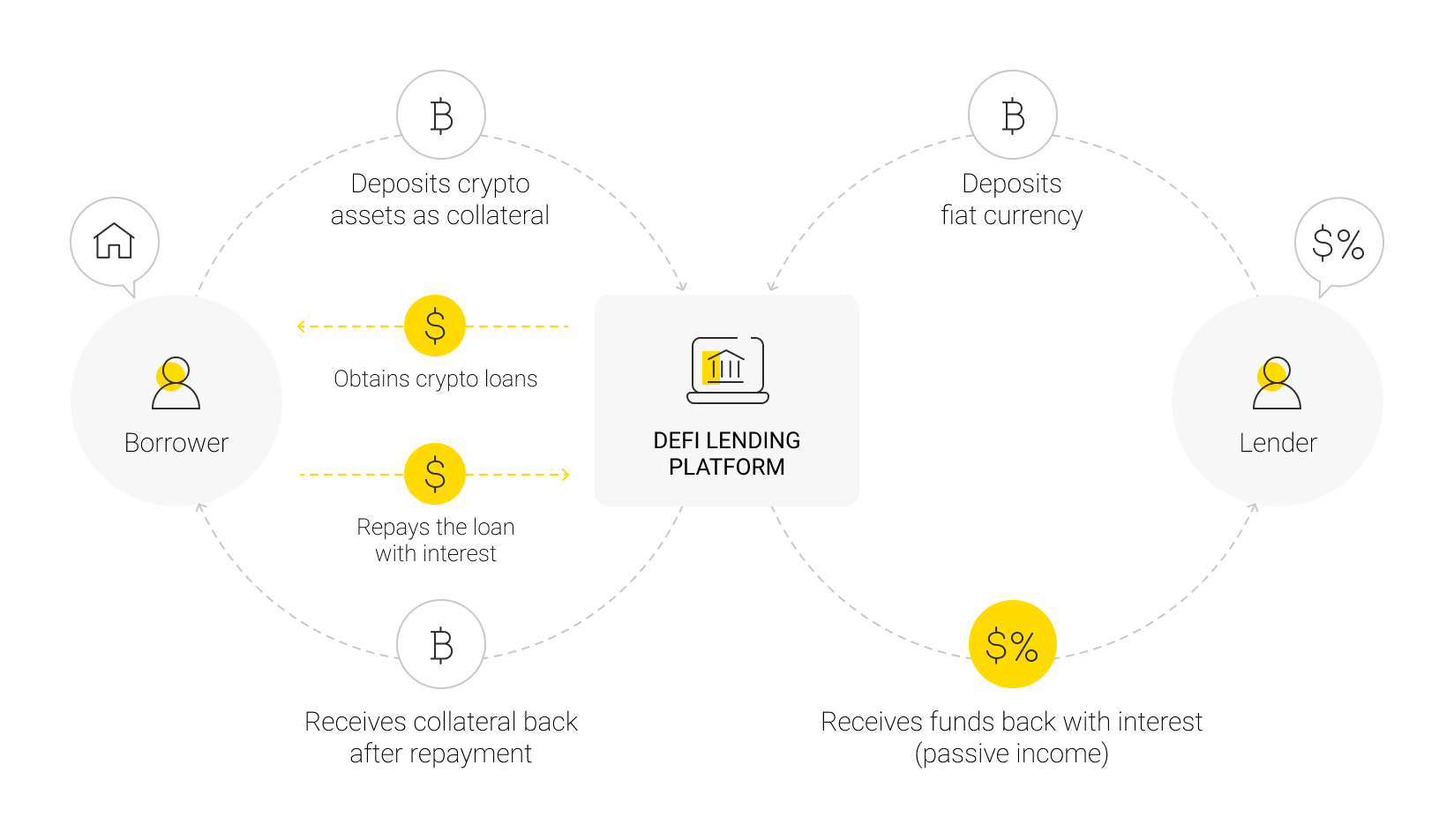

Private Credit and On-Chain Lending

One of the fastest-growing segments in real world asset crypto is private credit.

DeFi lending protocols are increasingly integrating off-chain borrowers. Instead of overcollateralized crypto loans, capital is deployed to real businesses generating real revenue.

Benefits include:

- Diversified yield sources

- Lower correlation with crypto market volatility

- Structured credit models

This evolution shifts DeFi from speculative leverage toward institutional-grade credit markets.

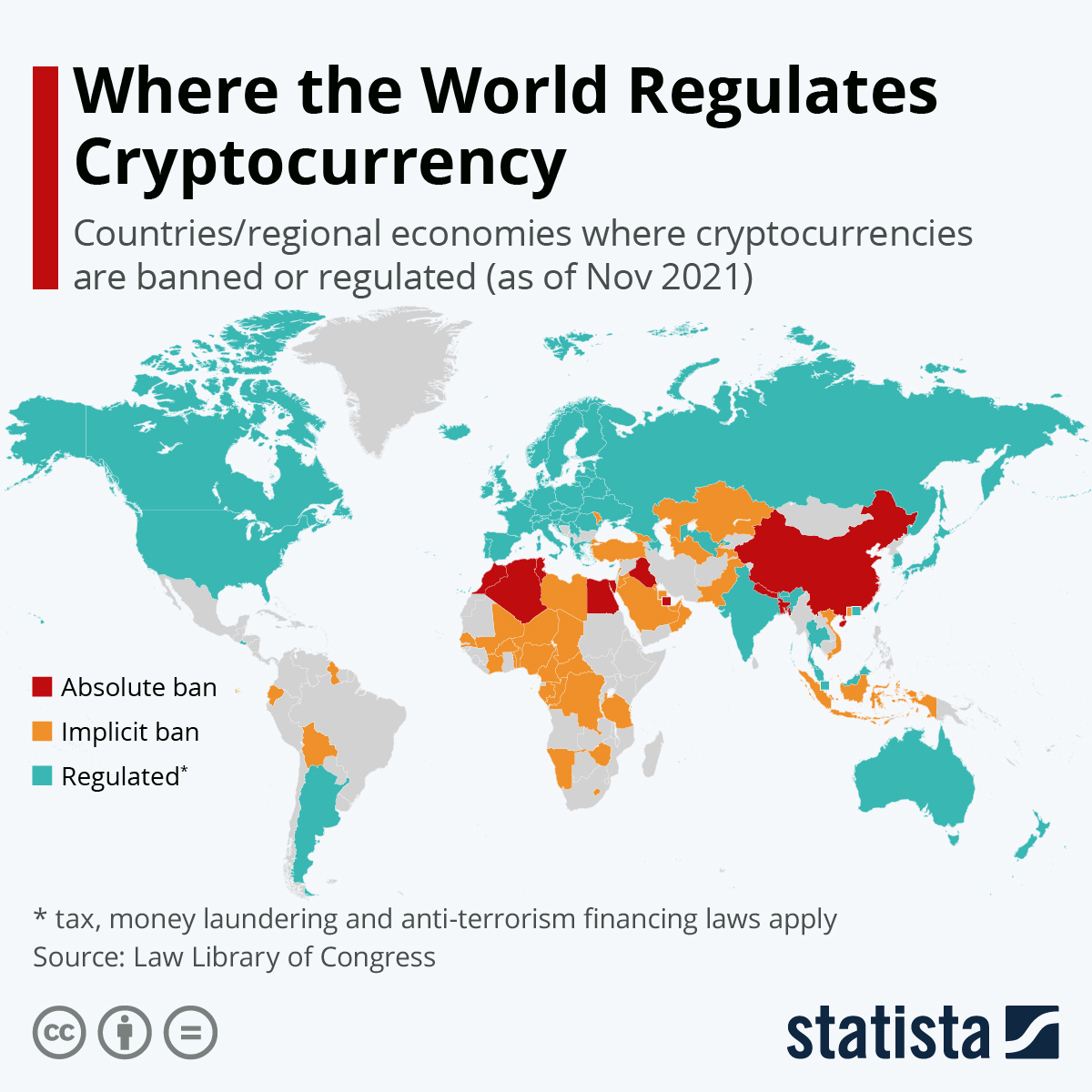

Regulatory Landscape: Opportunity and Constraint

The future of RWA tokenization is inseparable from regulatory frameworks.

In the United States, oversight from entities such as the U.S. Securities and Exchange Commission plays a critical role in defining whether tokens are treated as securities.

Key regulatory considerations:

- Investor accreditation requirements

- Transfer restrictions

- Custody standards

- Disclosure obligations

While regulation increases compliance costs, it also legitimizes digital securities markets. Institutional capital requires regulatory clarity.

Key Risks in Real World Asset Tokens

Despite optimism, RWA crypto investments carry non-trivial risks.

Counterparty Risk

Investors rely on off-chain custodians and SPV operators.

Legal Enforceability

If a dispute arises, token holders depend on traditional courts.

Liquidity Illusion

Secondary markets may be thin, leading to pricing inefficiencies.

Smart Contract Risk

Code vulnerabilities can compromise token infrastructure.

The hybrid nature of RWAs means risk exists both on-chain and off-chain.

Why RWA Tokens Could Be a Trillion-Dollar Market

The global bond market exceeds $100 trillion. Global real estate is worth hundreds of trillions. Even marginal tokenization penetration implies massive scale.

If blockchain infrastructure captures even:

- 1% of global bonds

- 0.5% of global real estate

- A portion of private credit

The total addressable market for tokenized real world assets could reach trillions.

Unlike meme tokens or speculative altcoins, RWAs align blockchain with productive economic output. This narrative is inherently more durable.

The Strategic Implications for Crypto

Real world asset tokenization represents a structural shift:

- Crypto becomes infrastructure, not just speculation

- Stablecoins become settlement layers

- DeFi becomes capital markets middleware

- Asset managers become on-chain issuers

This evolution repositions blockchain as financial plumbing rather than parallel finance.

Conclusion: From Speculation to Financial Infrastructure

The rise of Real World Asset (RWA) tokens signals crypto’s transition into mainstream finance.

By combining legal asset claims with blockchain efficiency, RWAs bridge the gap between TradFi and DeFi. Institutional adoption, sustainable yield generation, and regulatory progress all support long-term growth.

While risks remain, the underlying thesis is compelling: if capital markets are digitizing, blockchain will likely be part of that transformation.

The question is no longer whether RWA crypto will grow — but how large and how quickly the integration will occur.

If the broader crypto ecosystem evolves from speculative trading venues into global settlement infrastructure, tokenized assets may be remembered as the turning point.