Crypto traders obsess over charts.

They track RSI, funding rates, open interest, and liquidation heatmaps. They debate macro cycles, ETF flows, and regulatory headlines.

But what if one of the most powerful leading indicators isn’t a traditional market metric at all?

What if it’s a prediction market?

Polymarket may be one of the most underappreciated tools in crypto — not because it predicts the future perfectly, but because it quantifies belief in motion.

And in crypto, belief moves price.

Let’s unpack why Polymarket might be the most actionable leading indicator in the ecosystem.

1. Prediction Markets Price Probability Before Confirmation

Traditional markets react to news.

Prediction markets trade on the probability of news.

That distinction matters.

When traders on Polymarket buy “Yes” shares in a contract — say, a major regulatory approval — they’re not waiting for confirmation. They’re pricing in likelihood.

Meanwhile, spot crypto markets often wait for:

- Official announcements

- Media coverage

- Influencer amplification

- Narrative momentum

This creates a structural timing gap.

Polymarket reflects forward-looking conviction.

Crypto price often reflects reactive momentum.

During major crypto catalyst events — regulatory decisions, ETF approvals, policy shifts — Polymarket odds have frequently adjusted before large price expansions in Bitcoin.

Is it perfect? No.

But it captures something charts don’t: evolving probability.

And probability shifts are often the earliest signal of a coming volatility event.

2. Crypto Trades Narratives — Polymarket Trades Belief

Crypto is not a fundamentals-first asset class.

It is a narrative-driven market.

In equities, earnings anchor valuation.

In crypto, expectation anchors valuation.

When traders believe something is coming — an ETF, a rate cut, regulatory clarity — they position early.

Polymarket becomes the purest expression of that positioning.

Unlike Twitter sentiment or Telegram hype, Polymarket requires capital. You cannot like a probability. You must buy it.

That converts belief into skin-in-the-game sentiment.

For crypto retail traders, that matters.

It filters noise.

It reveals where money-backed conviction is flowing before headlines hit.

In essence:

Crypto markets trade stories.

Polymarket prices the odds those stories come true.

3. Political Probability and Crypto Volatility

Regulation is one of the largest macro overhangs in crypto.

When political probabilities shift, so does perceived regulatory risk.

If odds rise for a candidate viewed as crypto-friendly, traders anticipate:

- Lighter regulatory pressure

- Clearer ETF pathways

- Broader institutional participation

Crypto prices often respond.

But Polymarket reflects these shifts earlier because it aggregates expectations in real time.

This is not magic.

Both markets respond to the same information inputs. But prediction markets compress reaction time.

Instead of waiting for polling narratives to dominate mainstream media, traders can watch probability flow.

Polymarket becomes a live dashboard for policy risk pricing.

For retail traders, that’s powerful.

It turns politics — normally abstract and slow — into quantifiable signals.

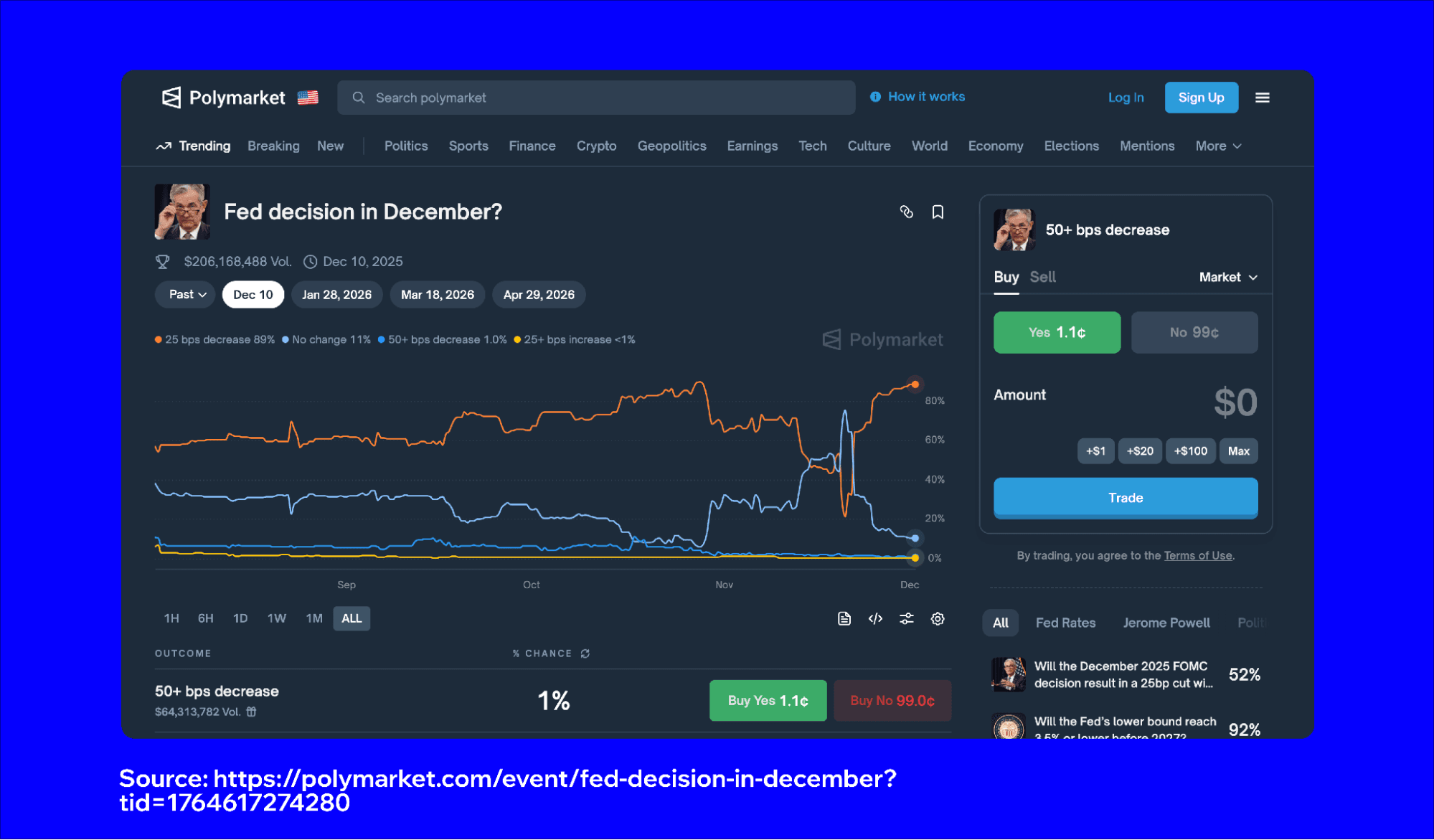

4. Liquidity Cycles and Rate Cut Odds

Crypto thrives in liquidity expansion.

When capital is cheap and risk appetite rises, speculative assets outperform.

Prediction markets often list contracts tied to macro events — rate cuts, economic data surprises, geopolitical events.

When rate cut probability spikes, that reflects shifting expectations about future liquidity.

Crypto often responds favorably to those shifts.

Again, Polymarket doesn’t cause the move.

But it aggregates the changing macro consensus faster than many retail traders can process traditional economic data.

If you see odds of easing rise sharply, that may signal a coming risk-on rotation.

Not guaranteed. But directional.

Retail traders who treat Polymarket as a macro dashboard gain an edge in understanding sentiment inflection points.

5. The Reflexivity Loop

Here’s where it gets fascinating.

Crypto traders use Polymarket.

That creates a reflexive loop:

- Traders shift odds upward.

- Social media notices rising probability.

- Narrative strengthens.

- Spot crypto markets react.

- Confidence increases.

- Odds rise further.

Belief reinforces price.

Price reinforces belief.

This is reflexivity in its purest digital form.

In traditional finance, belief is opaque.

In prediction markets, belief is tokenized and visible.

Retail traders who understand this dynamic can anticipate momentum accelerations.

When probability begins trending hard in one direction, it often precedes heightened volatility in correlated crypto assets.

Not always — but often enough to matter.

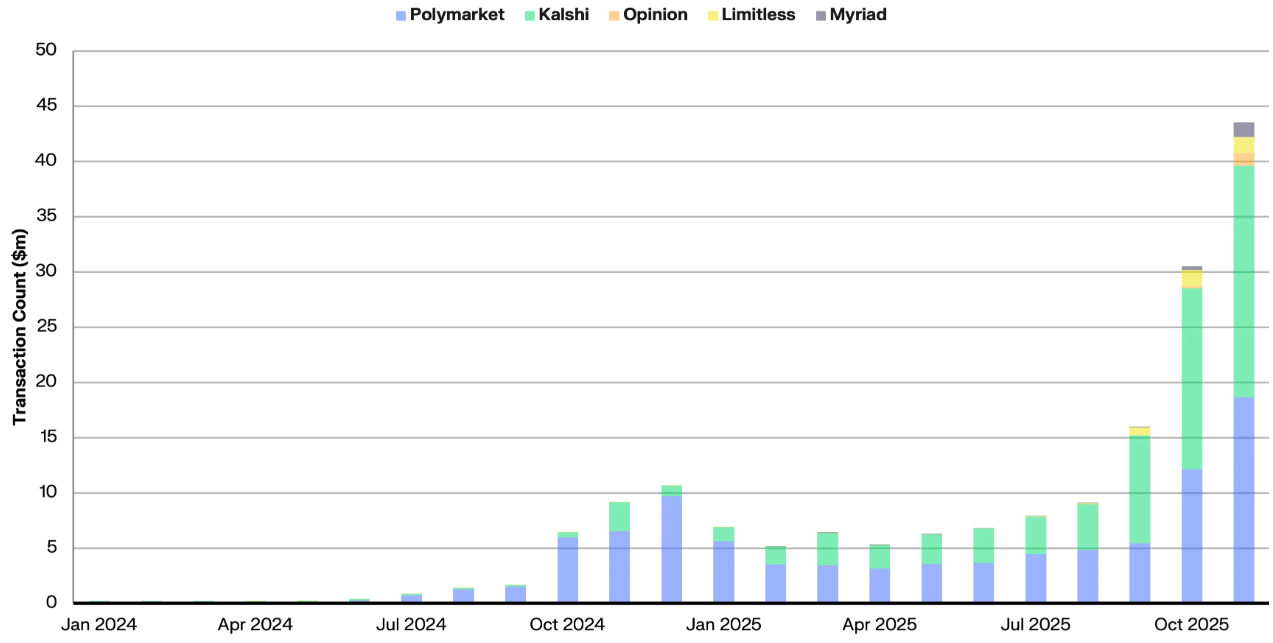

6. Measuring Speculative Temperature

Crypto is fundamentally a speculative ecosystem.

Participation surges during risk-on phases and collapses during drawdowns.

Polymarket activity can act as a barometer of speculative intensity:

- Rising volume

- Expanding market participation

- Aggressive probability swings

When traders are actively wagering on uncertain events, it reflects elevated risk tolerance.

High participation in prediction markets often correlates with broader speculative enthusiasm.

When odds markets are quiet and liquidity thin, that may signal cooling sentiment.

In this way, Polymarket becomes less about specific contracts and more about measuring the overall animal spirits of the ecosystem.

Retail traders who track that temperature can better contextualize breakouts and fakeouts.

7. Case Study Thinking: ETF Approval Dynamics

Consider a hypothetical ETF approval scenario.

As rumors circulate:

- Polymarket odds rise from 30% to 55%.

- Crypto Twitter amplifies discussion.

- Spot Bitcoin drifts upward.

If odds continue climbing — 65%, 75%, 85% — that rising probability may serve as confirmation of strengthening consensus.

Retail traders watching only price might see gradual accumulation.

Traders watching probability see the conviction building beneath it.

If odds suddenly collapse from 80% to 40%, that may signal shifting expectations before a headline confirms delay or rejection.

Probability collapses often precede volatility spikes.

Monitoring these shifts can provide a timing edge — not to predict outcomes, but to anticipate volatility expansion.

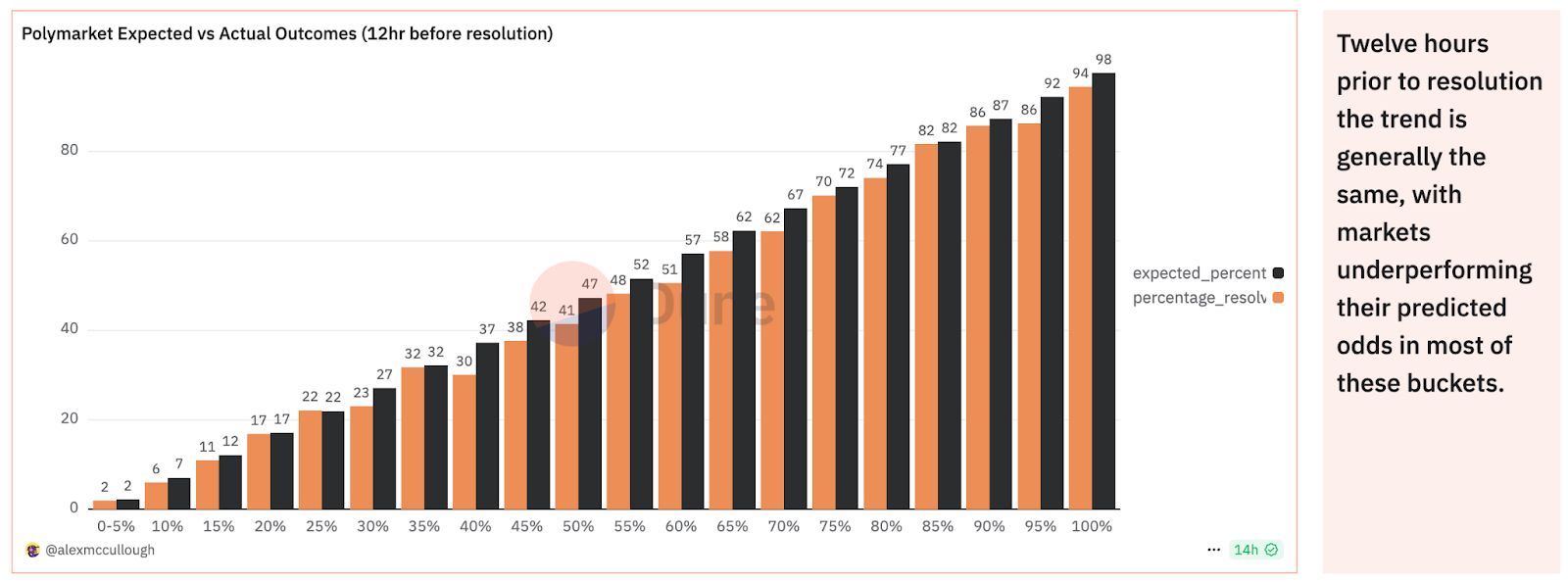

8. The Limits of the Thesis

No indicator is infallible.

Prediction markets can be:

- Thinly traded

- Influenced by whales

- Subject to emotional swings

- Wrong

Correlation does not equal causation.

Sometimes both Polymarket and crypto are reacting to the same macro headline simultaneously.

Sometimes probability swings are noise.

Retail traders must avoid overfitting narratives.

Polymarket is not an oracle.

It is a probability mirror.

Used responsibly, it complements price analysis.

Used blindly, it becomes another source of bias.

9. The Bigger Picture: Information Markets as Crypto’s Nervous System

Prediction markets aspire to build decentralized information pricing.

Crypto aspires to build decentralized finance.

When combined, they create something powerful:

A real-time, onchain consensus engine for future events.

In that framework, Polymarket isn’t just adjacent to crypto.

It becomes part of crypto’s informational infrastructure.

Imagine a future where:

- Major funds monitor prediction markets for positioning signals.

- Onchain derivatives auto-adjust exposure based on probability shifts.

- Smart contracts integrate prediction market data into treasury management.

At that point, crypto and prediction markets stop being correlated.

They become integrated.

Polymarket becomes a live volatility feed for digital capital.

Conclusion: Watch Probability, Not Just Price

Retail traders are trained to watch charts.

But crypto moves on expectation before confirmation.

Polymarket quantifies expectation.

It reveals where capital-backed belief is shifting before many price moves accelerate.

It is not perfect.

It is not predictive in isolation.

But as a complement to price analysis, it may be one of the most underutilized tools available.

If crypto trades narratives —

and narratives are about what might happen —

Then tracking the market that prices “what might happen” could be the closest thing to a leading indicator we have.

In the next volatility event, don’t just ask:

“What is price doing?”

Ask:

“What is probability doing?”

Because in crypto, belief moves first.

And Polymarket measures belief in real time.