For more than a century, the closing bell of the New York Stock Exchange symbolized order, rhythm, and structure in global finance. Markets opened, markets closed, and traders went home. That era may now be ending.

With reports that the NYSE is developing infrastructure to support 24/7 trading, including tokenized stocks and ETFs, Wall Street is confronting a radical transformation: a market that never sleeps.

This shift represents more than longer trading hours. It signals a fundamental rethinking of how markets operate, who participates, and which technologies will dominate the future of finance.

Welcome to the possible death of the closing bell.

Why the NYSE Is Moving Toward 24/7 Trading

Traditional stock markets were designed around human limitations. Floor traders needed daylight, settlement systems required manual reconciliation, and information moved slowly.

None of those constraints exist anymore.

Key Forces Driving 24/7 Trading

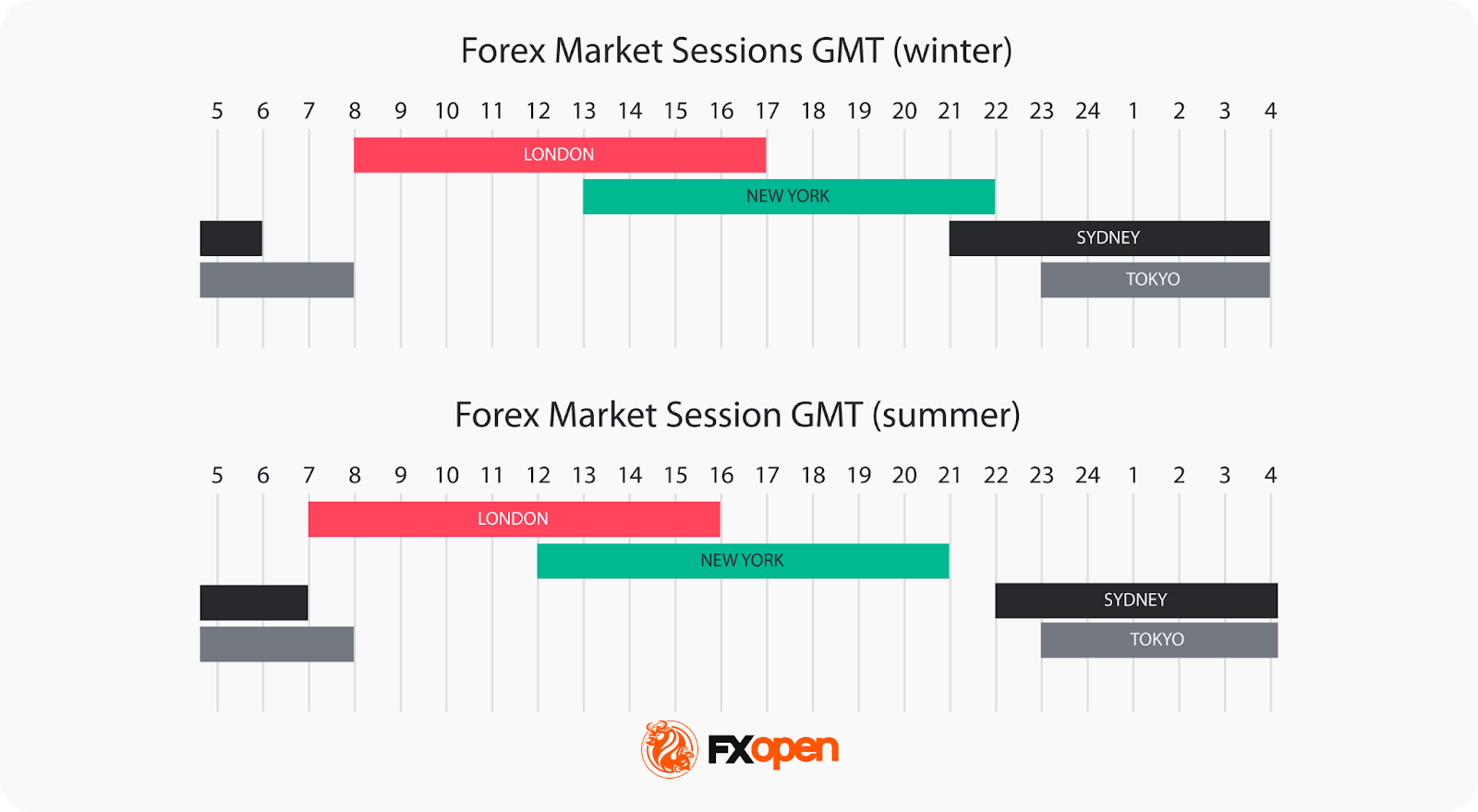

- Global participation: Investors now span every time zone

- Crypto market precedent: Digital assets trade nonstop

- Tokenization technology: Enables near-instant settlement

- AI and automation: Markets no longer require human presence

The NYSE is responding to a world where capital flows continuously and investors expect access at all times — not just between 9:30 a.m. and 4:00 p.m. Eastern Time.

4

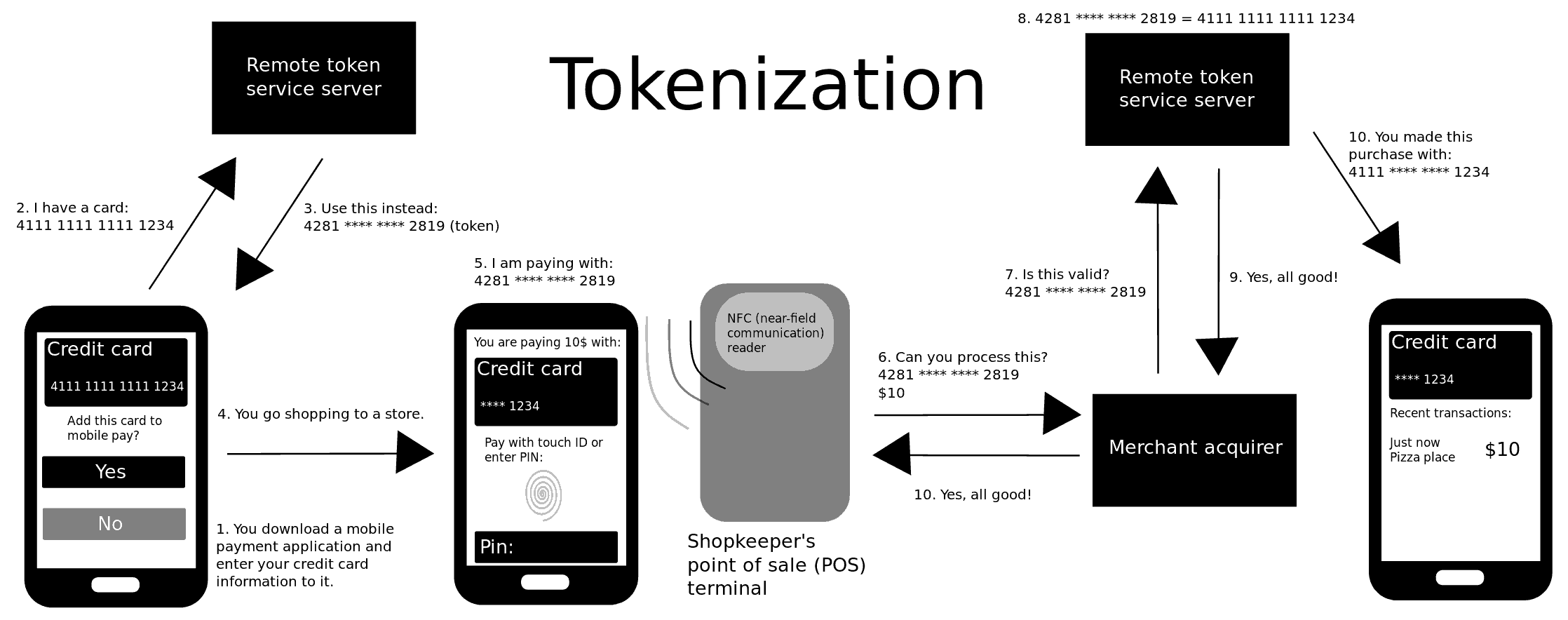

What Does “Tokenized Stocks and ETFs” Mean?

Tokenization converts traditional financial assets — like stocks and ETFs — into digital tokens recorded on a blockchain or distributed ledger.

Each token represents ownership in a real-world asset, but with key advantages:

Benefits of Tokenized Assets

- 24/7 tradability

- Fractional ownership

- Near-instant settlement (T+0)

- Lower operational costs

- Improved transparency

Instead of waiting days for trades to settle, tokenized assets can clear in seconds. This makes round-the-clock trading not only possible, but efficient.

The Closing Bell: Why It Existed in the First Place

The closing bell wasn’t just ceremonial — it was practical.

Markets needed:

- Time to reconcile trades

- Human oversight and compliance checks

- Overnight risk buffers

In a world of paper certificates, phone calls, and physical trading floors, downtime was necessary.

But today’s markets are:

- Digitized

- Automated

- Algorithmically managed

The original reasons for closing markets are rapidly disappearing.

What Happens When Markets Never Close?

A 24/7 NYSE fundamentally changes how markets behave.

1. Continuous Price Discovery

News no longer waits for the opening bell.

Earnings leaks, geopolitical events, economic data, and global crises already move prices after hours. A nonstop market allows prices to adjust instantly — not gap violently at open.

2. Reduced Opening and Closing Volatility

Currently, some of the most volatile moments occur:

- At market open

- At market close

Continuous trading could smooth these spikes by spreading volume across time rather than compressing it into narrow windows.

3. Global Market Synchronization

A 24/7 NYSE aligns U.S. equities with:

- Asian markets

- European markets

- Crypto markets

This creates a truly global financial system where capital never pauses.

The Rise of AI in a 24/7 Market

Humans cannot trade around the clock.

Machines can.

In a nonstop market environment, AI-driven trading systems become essential, not optional.

Why AI Will Dominate 24/7 Trading

- Humans need sleep; AI does not

- AI reacts faster to breaking information

- Algorithms manage risk continuously

- AI scales across thousands of assets

In many ways, 24/7 trading accelerates the transition from human-led markets to machine-managed ecosystems.

What This Means for Human Traders

The death of the closing bell doesn’t eliminate humans — but it redefines their role.

Roles Likely to Shrink

- Manual day traders

- Execution-focused traders

- Short-term arbitrage specialists

Roles Likely to Grow

- Strategy designers

- Risk supervisors

- AI system monitors

- Long-term portfolio managers

Humans move from execution to oversight and judgment.

Retail Investors: Opportunity or Disadvantage?

Retail investors face both new opportunities and new risks.

Potential Benefits

- Trade outside work hours

- React to news in real time

- Access fractionalized assets

Potential Risks

- Emotional overtrading

- Burnout from nonstop markets

- Competing against AI at all hours

For retail participants, discipline becomes more important than ever.

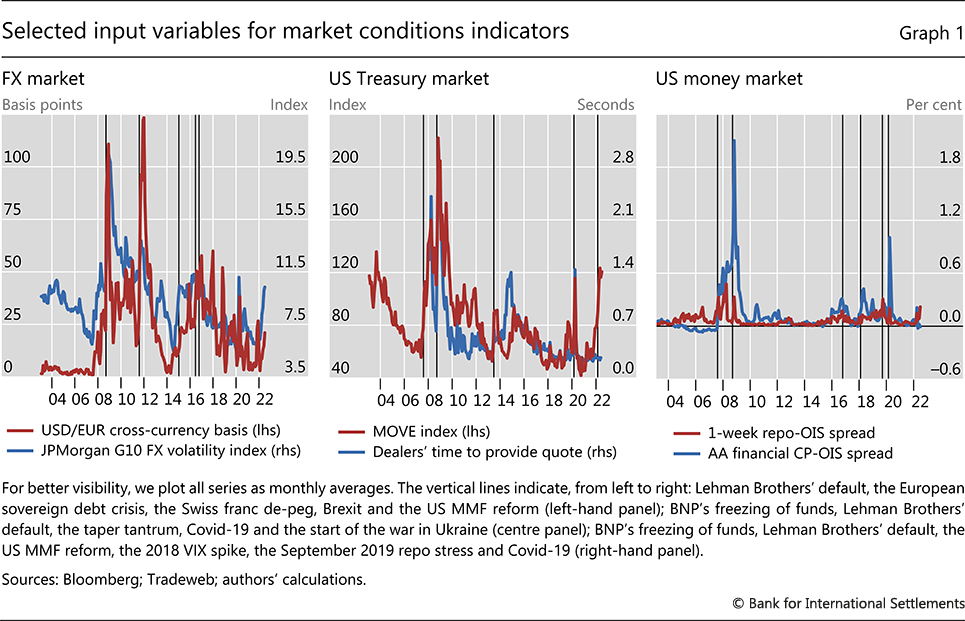

Liquidity, Volatility, and Market Stability

One of the biggest questions surrounding 24/7 trading is market stability.

Will Liquidity Fragment?

Trading volume may spread across time zones, potentially thinning liquidity during off-peak hours. This could increase volatility during certain windows.

However, as participation grows globally, liquidity may stabilize and even improve.

Will Crashes Be Worse?

24/7 markets could:

- React faster to panic

- Trigger algorithmic cascades

But they could also:

- Avoid overnight surprise gaps

- Absorb shocks gradually

The outcome depends on regulation, safeguards, and circuit breakers.

Regulatory Challenges of a 24/7 NYSE

Regulators face a massive adjustment.

Key Regulatory Questions

- Who monitors markets at 3 a.m.?

- How are halts and circuit breakers enforced?

- What jurisdiction governs global participants?

- How is market manipulation detected nonstop?

A 24/7 exchange requires 24/7 regulation — likely supported by AI surveillance systems.

How This Impacts Traditional Financial Institutions

Banks, brokers, and custodians must adapt or risk obsolescence.

Required Changes

- Always-on infrastructure

- Automated compliance systems

- Real-time settlement capabilities

- AI-driven risk management

Institutions built for batch processing and business hours will struggle in a real-time world.

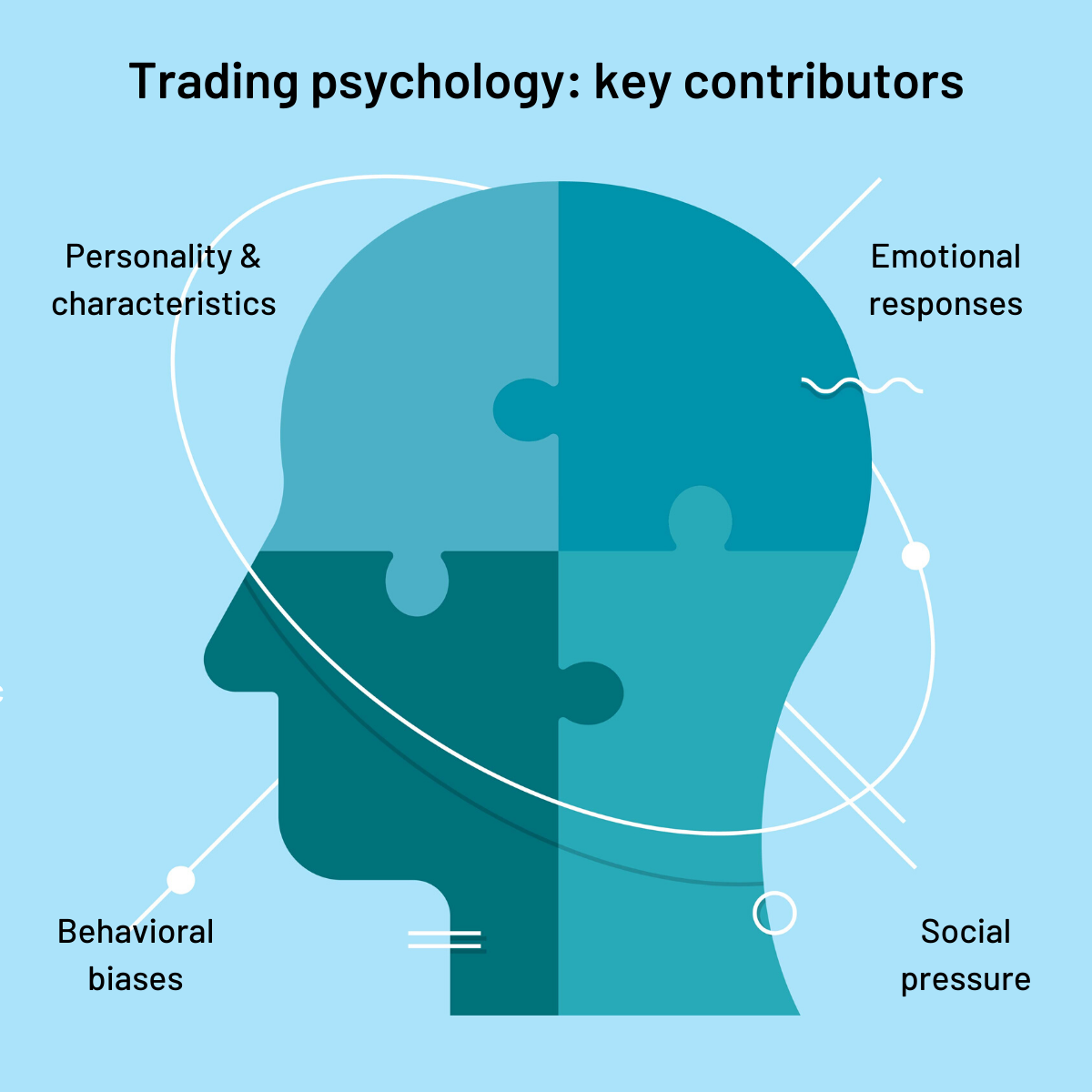

The Psychological Shift: Markets Without Pauses

One overlooked consequence of 24/7 trading is psychological.

Markets used to offer:

- Natural breaks

- Time for reflection

- Cooling-off periods

Without pauses, participants must self-regulate more than ever.

This may lead to:

- Increased burnout

- Greater reliance on automation

- A cultural shift away from constant monitoring

Is the Closing Bell Really Dead?

Not immediately — but its meaning is changing.

The bell may remain ceremonial, but functionally:

- Trading may continue elsewhere

- Tokenized markets may operate nonstop

- Liquidity may migrate over time

Much like how physical trading floors became symbolic, the closing bell may soon represent tradition rather than necessity.

A Glimpse Into the Future of Markets

If the NYSE successfully implements 24/7 trading with tokenized stocks and ETFs, the implications are enormous:

- Stocks trade like crypto

- Settlement becomes instant

- AI becomes central to market function

- Finance becomes truly global

This is not just a technical upgrade — it’s a structural evolution.

Final Thoughts: The End of an Era, the Beginning of Another

The development of 24/7 trading by the NYSE marks a historic turning point.

The closing bell once defined when markets lived and died each day. In a tokenized, automated, always-on financial system, that boundary dissolves.

The future of markets will not be measured in trading hours — but in responsiveness, resilience, and intelligence.

The bell may still ring.

But the market will never stop listening.