Margin trading and leverage trading are two of the most misunderstood concepts in crypto, forex, and derivatives markets. Traders often use the terms interchangeably, yet misunderstanding the difference is one of the most common reasons accounts get liquidated.

In this guide, you’ll learn:

- The real difference between margin trading vs leverage

- How leverage amplifies profits and losses

- What isolated margin and cross margin mean in practice

- A real liquidation example with numbers

- Why high leverage is dangerous for most traders

- How professionals actually use leverage

This article is written for beginners but detailed enough for experienced traders looking to tighten risk management.

What Is Margin Trading?

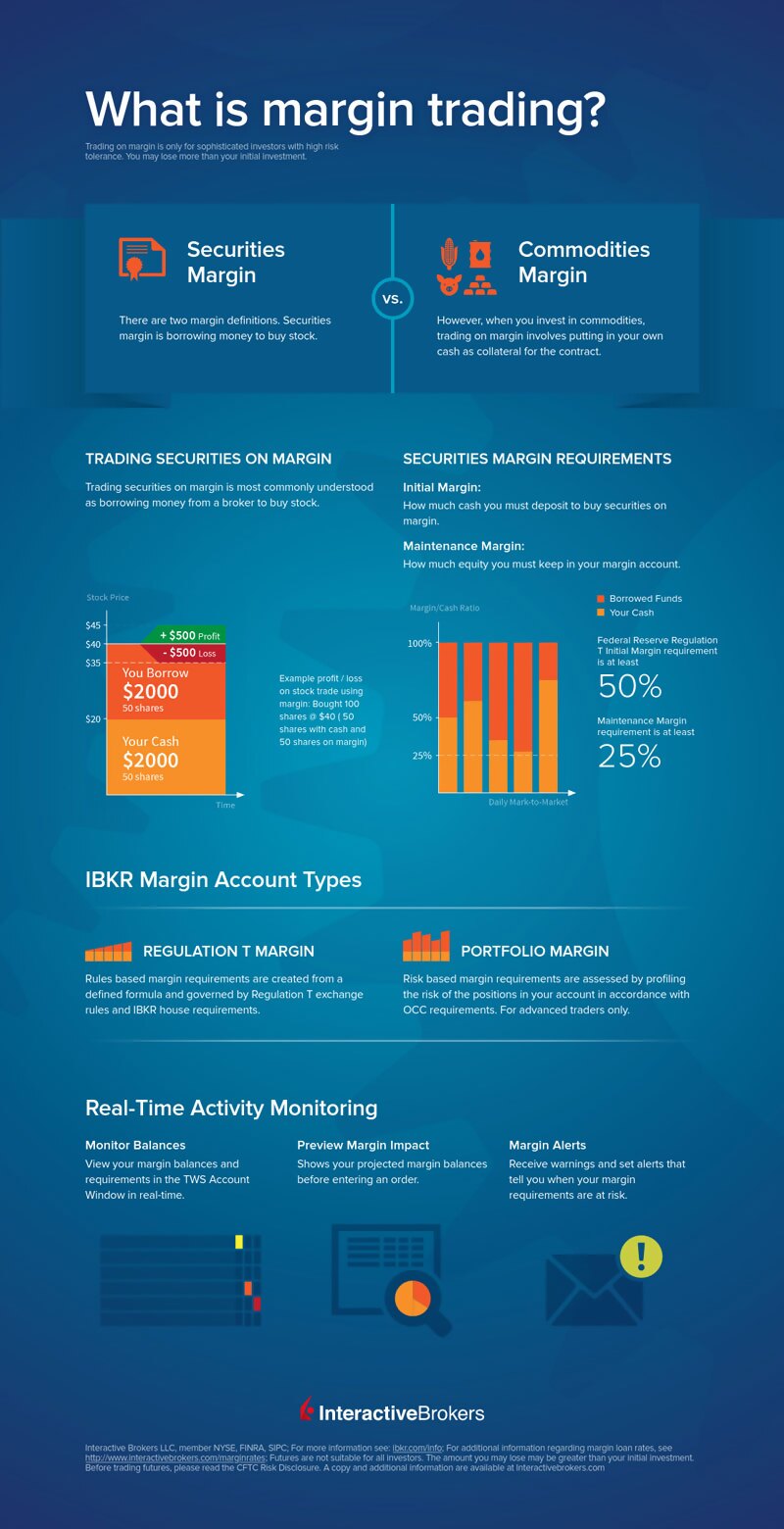

Margin trading is a trading method that allows you to borrow money from a broker or exchange to open a larger position than your cash balance would normally allow.

Your own funds are posted as margin collateral, which protects the lender if the trade moves against you.

How Margin Trading Works

- You deposit money into your account (initial margin)

- The platform lends you additional funds

- You trade with more capital than you own

- Losses reduce your margin

- If margin falls too low, liquidation occurs

Margin Trading Example

You deposit $1,000.

The exchange allows 2× leverage.

- Your capital: $1,000

- Borrowed funds: $1,000

- Total position size: $2,000

If the position loses too much value, the exchange will close it automatically to recover the loan.

Key SEO takeaway:

Margin trading refers to the borrowing mechanism, not the size of the position.

What Is Leverage Trading?

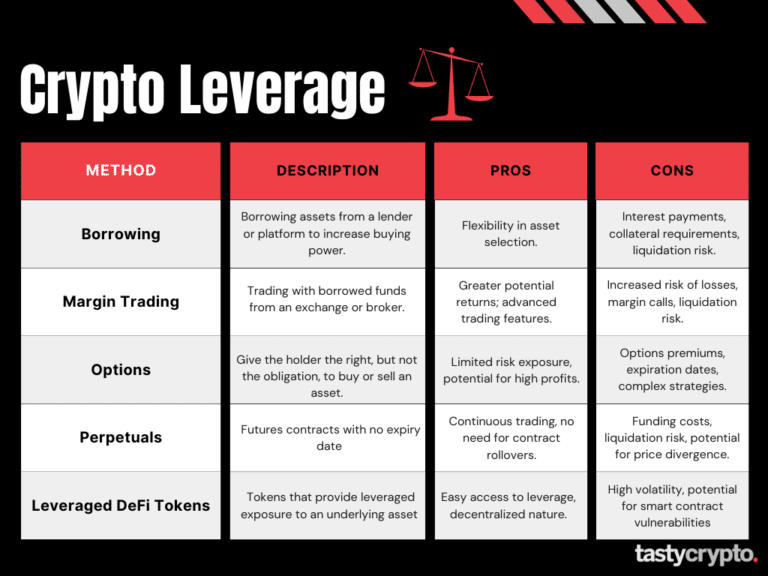

Leverage trading describes how much market exposure you control relative to your own capital. It is expressed as a ratio, such as 5×, 10×, or 50×.

Leverage does not describe borrowing directly — it describes amplification.

Leverage Trading Example

You trade with 10× leverage using $1,000.

- Your capital: $1,000

- Position size: $10,000

A 1% price move equals a 10% gain or loss on your account.

This is why leverage can dramatically increase profits — and wipe out accounts just as fast.

Margin vs Leverage: The Key Difference

The simplest way to understand the difference:

Margin is the system. Leverage is the result.

- Margin = borrowed funds + collateral

- Leverage = exposure multiplier

You use margin to obtain leverage, but they are not the same thing.

Why Traders Confuse Margin and Leverage

- Exchanges advertise leverage, not margin

- Crypto derivatives hide the borrowing mechanics

- Both increase risk in similar ways

Understanding the difference is essential before trading derivatives, futures, or perpetual contracts.

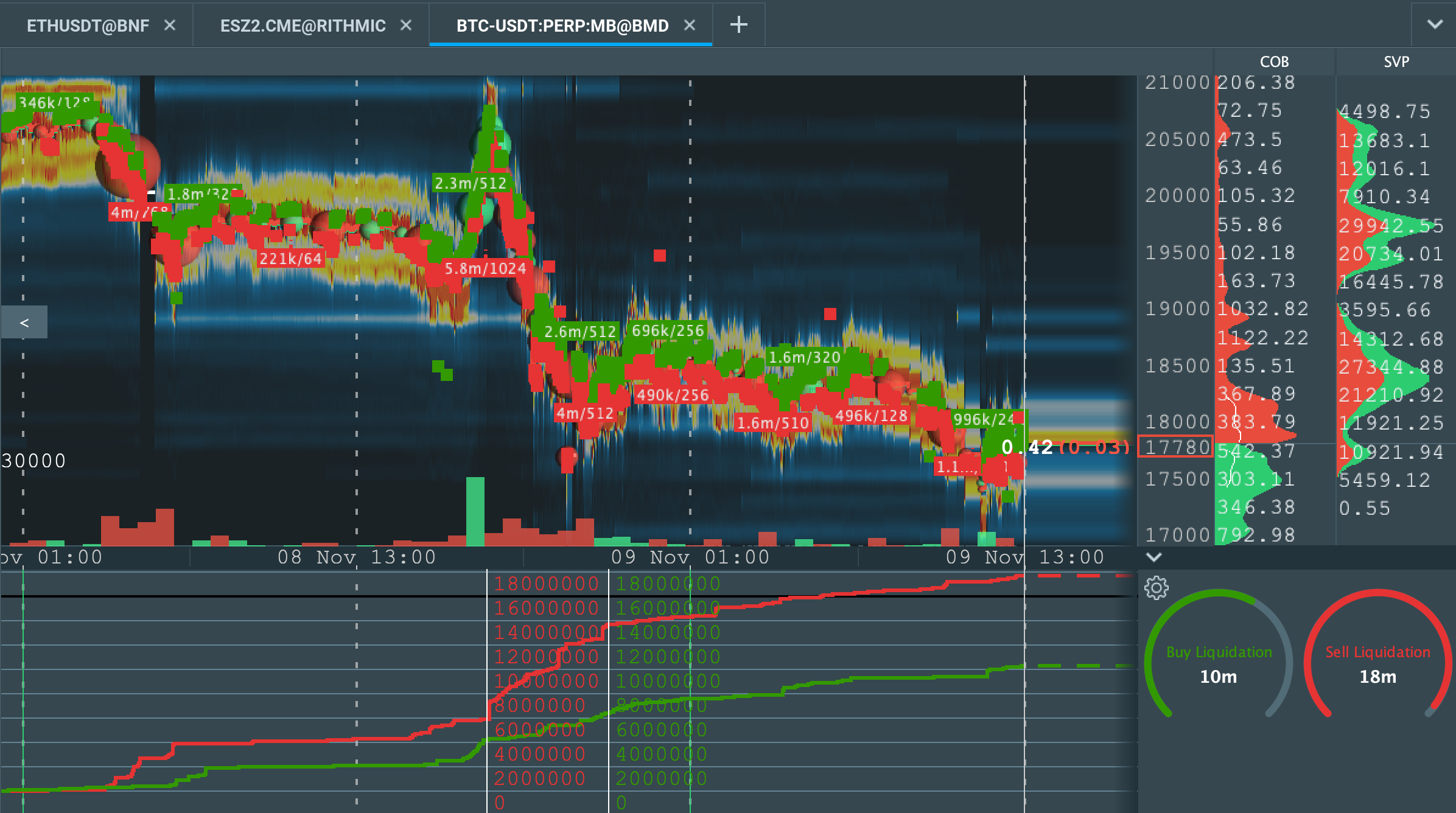

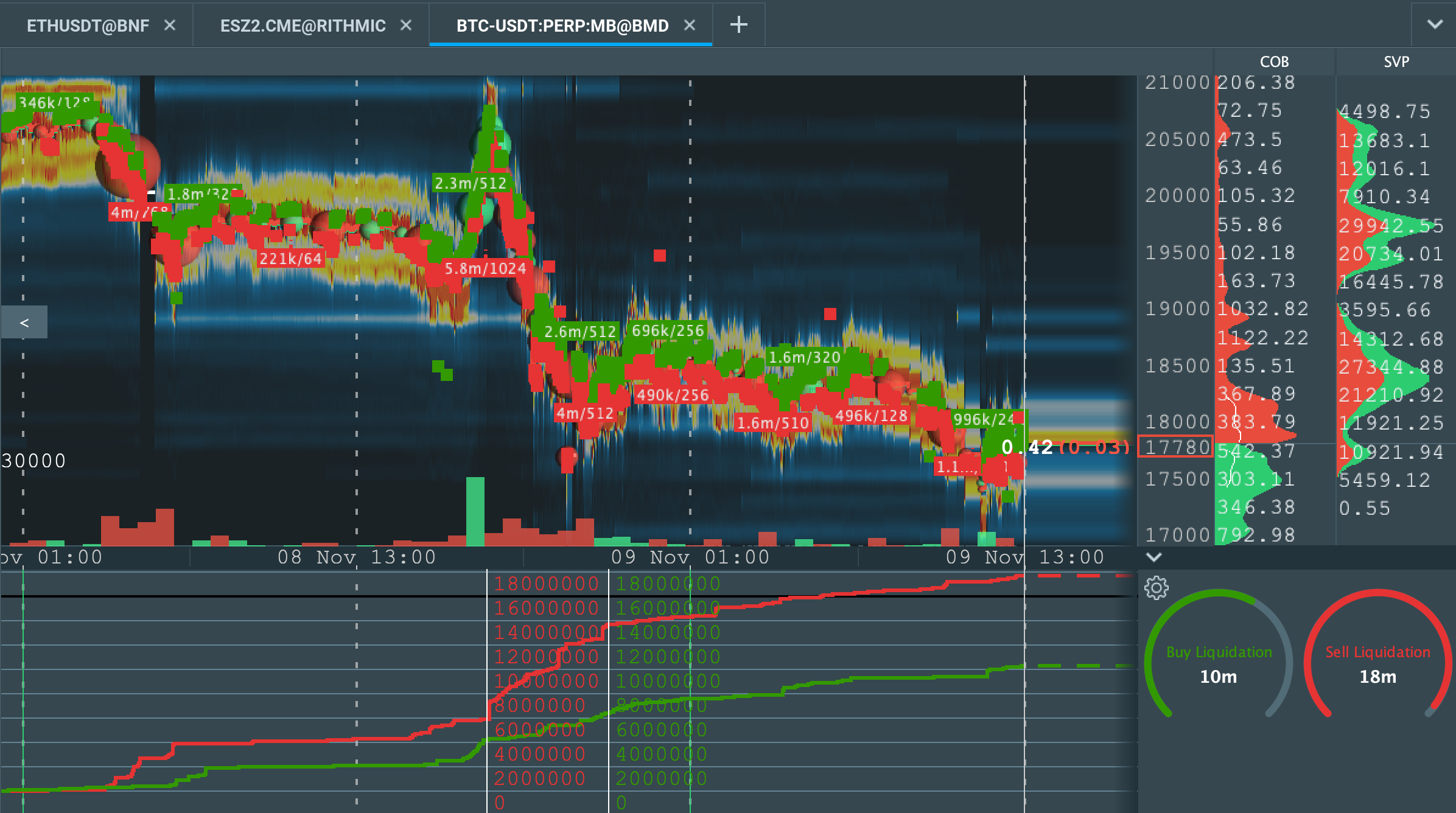

How Liquidation Works in Margin and Leverage Trading

Liquidation happens when your losses approach the value of your margin collateral.

The exchange automatically closes your position to:

- Prevent your balance from going negative

- Recover borrowed funds

- Protect system liquidity

Liquidation is not a stop-loss.

It’s a forced position closure, often at a worse price.

Isolated Margin Explained

Isolated margin limits risk to a single position.

Each trade has its own margin allocation, and losses cannot exceed the margin assigned to that trade.

Isolated Margin Example

- Account balance: $5,000

- Margin allocated to trade: $1,000

Worst case:

- You lose $1,000

- The remaining $4,000 is untouched

Pros of Isolated Margin

- Defined risk

- Ideal for beginners

- Safer for high leverage trades

- Prevents account-wide liquidation

SEO note:

Isolated margin trading is widely recommended for new crypto traders.

Cross Margin Explained

Cross margin shares margin across all open positions in your account.

Instead of liquidating one trade early, the system pulls funds from your entire balance to keep positions open.

Cross Margin Example

- Account balance: $5,000

- One trade starts losing heavily

Instead of liquidating:

- Losses drain your full account

- Liquidation happens later — but is far more destructive

Pros and Cons of Cross Margin

Pros

- Better for hedged portfolios

- Lower liquidation frequency

Cons

- Entire account at risk

- Dangerous for beginners

- Losses compound silently

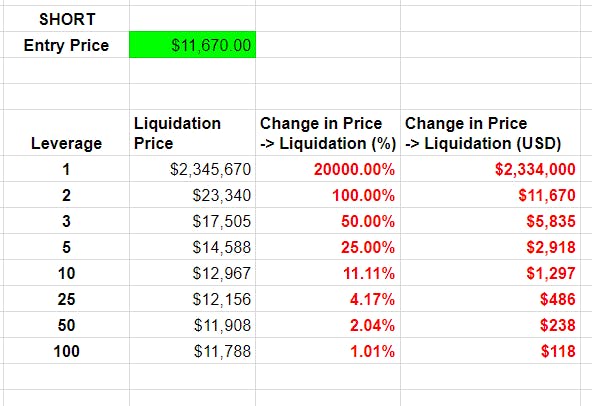

Real Liquidation Example (Step by Step)

Let’s walk through a realistic liquidation scenario.

Trade Setup

- Capital: $1,000

- Leverage: 10×

- Position size: $10,000

- Asset: Bitcoin

- Entry price: $50,000

- Position: Long

$10,000 at $50,000 BTC = 0.2 BTC

Price Moves Against the Trade

Bitcoin drops from $50,000 → $45,000

That’s a 10% move.

Loss calculation:

- 10% × $10,000 = $1,000 loss

Your margin is gone.

Liquidation Occurs

The exchange liquidates around $45,500–$46,000 to account for:

- Trading fees

- Slippage

- Risk buffers

Result:

- Position closed automatically

- Nearly 100% margin loss

- Trade ends even if price later recovers

What If This Was Cross Margin?

If your account held $5,000 total:

- Losses would continue beyond $1,000

- The system drains more funds

- A deeper drop could wipe out the entire account

This is how traders lose far more than expected.

Why High Leverage Is So Risky

| Leverage | Price Move to Liquidation |

|---|---|

| 2× | ~50% |

| 5× | ~20% |

| 10× | ~10% |

| 20× | ~5% |

| 50× | ~2% |

| 100× | ~1% |

Bitcoin routinely moves 2–5% in minutes.

At high leverage:

- Normal volatility causes liquidation

- Trades fail even when the idea is correct

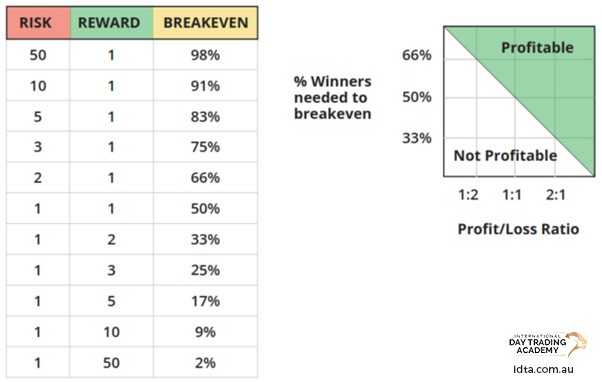

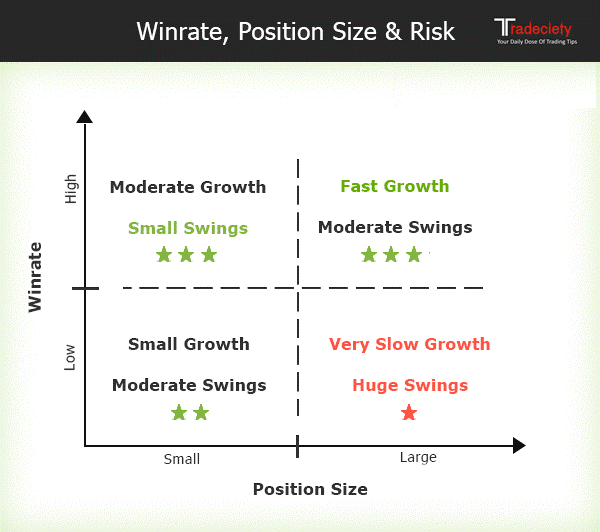

How Professional Traders Use Margin and Leverage

Professional traders:

- Use low leverage (1–3×)

- Prefer isolated margin

- Size positions conservatively

- Use stop-losses well before liquidation

Leverage is used for capital efficiency, not gambling.

Final Thoughts: Margin vs Leverage Trading

Margin and leverage are powerful tools — but unforgiving ones.

If you don’t understand:

- Your liquidation price

- The difference between isolated and cross margin

- How leverage multiplies losses

You should not be trading leveraged products.

The market doesn’t need to be wrong for you to lose money —

it only needs to move faster than your margin can survive.