The market doesn’t reward emotion — it rewards positioning.

If I had $10,000 to deploy in crypto today, I’d structure it for asymmetric upside while maintaining core exposure to liquidity anchors and ecosystem momentum.

This is not financial advice — it’s a strategic allocation framework built for crypto-native investors navigating volatility.

1️⃣ 50% – Bitcoin (BTC) Allocation Strategy

Target Allocation: $5,000

Primary objective: Stability + liquidity + macro hedge

Why 50% in Bitcoin allocation strategy?

- Deepest liquidity in crypto markets

- Institutional ETF flows

- Recognized digital commodity narrative

- Dominance cycles still drive alt liquidity

For crypto-native investors, BTC is not about 100x returns. It’s about portfolio gravity. Every cycle, capital rotates through BTC first.

SEO Focus Terms:

- Bitcoin portfolio allocation

- BTC institutional adoption

- Bitcoin cycle strategy

2️⃣ 25% – Ethereum (ETH) Positioning

Target Allocation: $2,500

Objective: Ecosystem exposure + yield + narrative depth

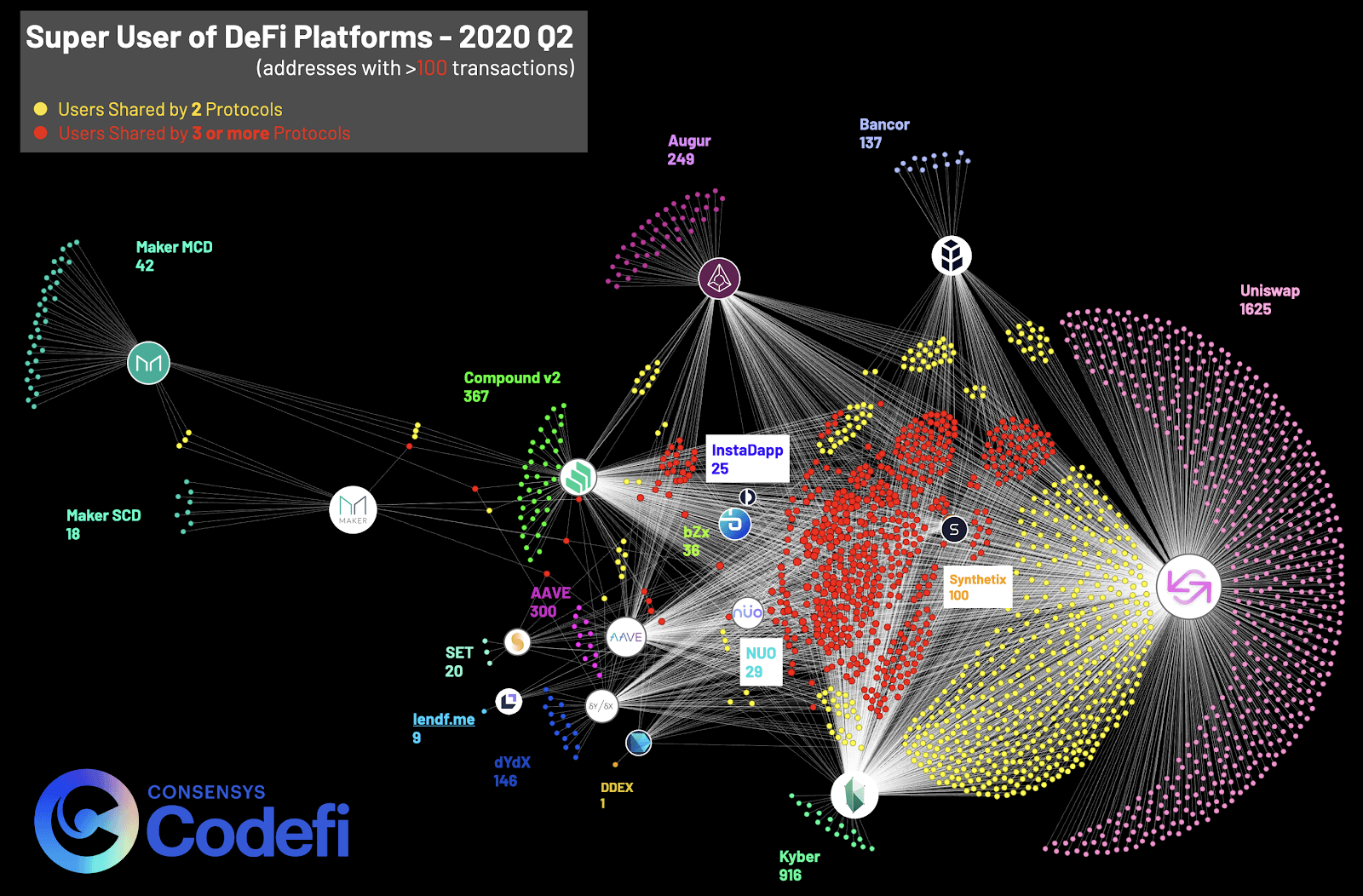

Ethereum remains the settlement layer for DeFi, NFTs, L2 scaling, and institutional tokenization.

Why this matters:

- High staking participation

- Expanding Layer 2 ecosystem

- Deflationary mechanics (post-merge burn dynamics)

- Institutional infrastructure built on ETH

SEO Focus Terms:

- Ethereum investment thesis

- ETH staking yield strategy

- Layer 2 ecosystem growth

ETH historically captures strong beta once BTC consolidates.

3️⃣ 15% – Large-Cap Alt Exposure (Layer 1 Rotation)

Target Allocation: $1,500

Objective: Beta exposure during alt rotation

Candidates include:

- Cardano

- Solana

- Avalanche

Why this bucket exists:

- Higher volatility = higher upside

- Narrative cycles (AI, RWA, DePIN) rotate capital

- Strong ecosystems attract speculative liquidity

SEO Focus Terms:

- best large-cap altcoins

- Layer 1 blockchain investment

- altcoin rotation strategy

This allocation assumes you understand volatility and are positioned before retail momentum arrives.

4️⃣ 10% – High-Risk Asymmetric Plays

Target Allocation: $1,000

Objective: Asymmetric upside

This bucket is where you look for 3–10x potential — knowing volatility is extreme.

One option:

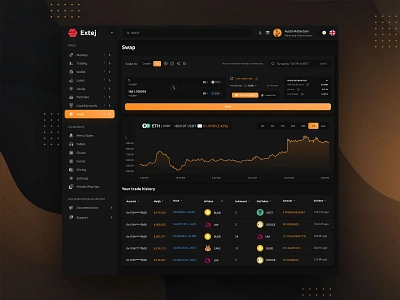

Hyperliquid Protocol Vault (on-chain perpetuals ecosystem exposure)

Hyperliquid operates in the decentralized perpetual trading space, offering vault-based participation in on-chain trading strategies.

Why consider it in the high-risk bucket?

- On-chain derivatives growth narrative

- Capital-efficient trading infrastructure

- Performance-based yield potential

Other high-risk categories:

- Emerging AI tokens

- Early-stage DePIN

- Low-cap ecosystem tokens

This portion should not exceed 10% unless you have high risk tolerance.

Portfolio Structure Summary

| Allocation | Asset Class | Objective |

|---|---|---|

| 50% | BTC | Liquidity + Macro Anchor |

| 25% | ETH | Ecosystem & Yield |

| 15% | Large-Cap Alts | Beta & Rotation |

| 10% | High-Risk Vault / Emerging Plays | Asymmetric Upside |

Strategic Considerations for Crypto-Native Investors

- Watch BTC dominance trends

- Monitor stablecoin inflows

- Track ETF flows and funding rates

- Rotate risk exposure as volatility expands

This framework balances durability and upside without overexposing the portfolio to illiquid speculation.