Government shutdowns are recurring political events, particularly in the United States, that tend to generate fear, uncertainty, and speculation across financial markets. Each time headlines announce stalled budgets or furloughed federal workers, investors ask the same question:

What impact does a government shutdown have on the crypto market?

Some claim shutdowns are bullish for Bitcoin and cryptocurrencies because they expose government dysfunction. Others argue they trigger risk-off behavior that hurts speculative assets like crypto. The truth is more nuanced.

This in-depth guide explores how government shutdowns affect cryptocurrency markets, what historical data shows, and how crypto investors should interpret these events strategically—not emotionally.

What Is a Government Shutdown?

A government shutdown occurs when a legislature fails to pass funding legislation, forcing parts of the government to halt non-essential operations.

In the case of the United States federal government, shutdowns result in:

- Federal employee furloughs

- Suspension of some public services

- Delays in economic data releases

- Political uncertainty and media amplification

Importantly, essential services continue. Debt payments are made, the military remains active, and monetary policy functions remain intact.

Despite the dramatic optics, shutdowns are political events, not financial system failures.

Why Crypto Investors Care About Government Shutdowns

Cryptocurrency markets are highly sensitive to:

- Macroeconomic narratives

- Liquidity conditions

- Investor psychology

A government shutdown touches all three.

For crypto investors, shutdowns raise questions such as:

- Does Bitcoin benefit as an alternative to government systems?

- Does market uncertainty drive capital into or out of crypto?

- How does a shutdown affect regulation, interest rates, and liquidity?

To answer these, we need to separate narrative appeal from market reality.

The “Anti-Government” Bitcoin Narrative

Bitcoin was born in response to the 2008 financial crisis, embedding a long-standing narrative: crypto as protection from government failure.

During shutdowns, this narrative resurfaces:

- “If governments can’t function, decentralized money wins.”

- “Bitcoin is a hedge against political dysfunction.”

- “Crypto thrives when trust in institutions declines.”

While philosophically compelling, markets don’t trade philosophy—they trade liquidity and risk.

Historically, shutdowns have not produced sustained Bitcoin rallies on narrative alone.

Risk-On vs. Risk-Off: How Markets Actually React

In real trading conditions, cryptocurrencies behave less like gold and more like high-beta risk assets.

During shutdowns:

- Equities often weaken

- Volatility rises

- Investors reduce exposure to speculative assets

Bitcoin, Ethereum, and altcoins frequently track equities, not safe havens.

Key insight:

When markets turn “risk-off,” crypto usually falls, regardless of ideological narratives.

Liquidity Matters More Than Politics

Liquidity—not politics—is the dominant driver of crypto prices.

A government shutdown:

- Does not stop central bank operations

- Does not eliminate dollar liquidity

- Does not directly tighten financial conditions

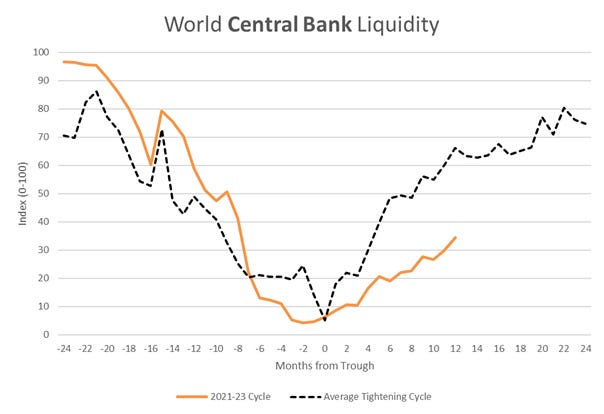

The Federal Reserve continues to:

- Set interest rates

- Conduct repo operations

- Provide banking system liquidity

As long as liquidity conditions remain stable, shutdowns alone rarely trigger major crypto market moves.

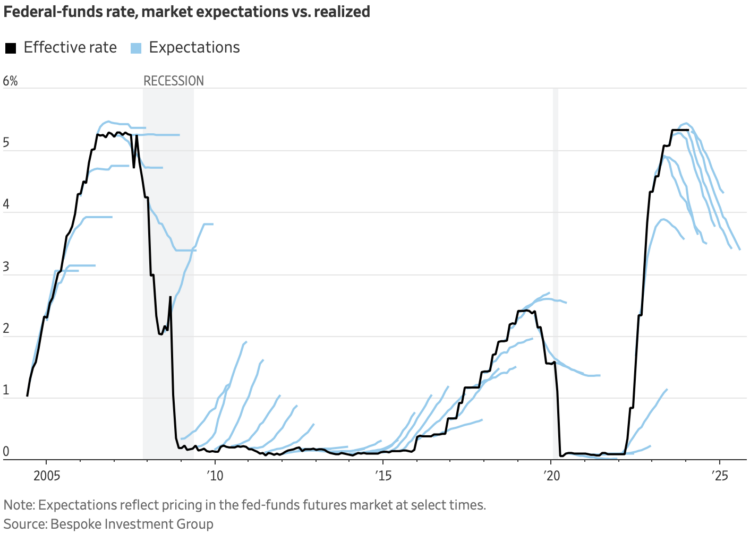

Shutdowns and Interest Rate Expectations

Shutdowns can indirectly influence crypto by affecting expectations, not actions.

When shutdowns occur:

- Economic data releases may be delayed

- Inflation and employment clarity decreases

- Rate-cut timing becomes harder to price

Crypto markets are extremely sensitive to:

- Real interest rates

- Future easing expectations

- Changes in yield curves

If shutdown-related uncertainty delays expectations of rate cuts, crypto may face temporary pressure.

Regulatory Impact: Temporary Relief, Not Structural Change

One of the most overlooked effects of government shutdowns is regulatory slowdown.

During shutdowns:

- Enforcement actions may pause

- Court deadlines can slip

- Regulatory guidance may be delayed

For crypto markets, this can create:

- Short-term relief rallies

- Reduced headline risk

- Temporary sentiment improvement

However, this effect is temporary. Once funding resumes, regulatory momentum returns.

Shutdowns do not change the regulatory trajectory of crypto policy.

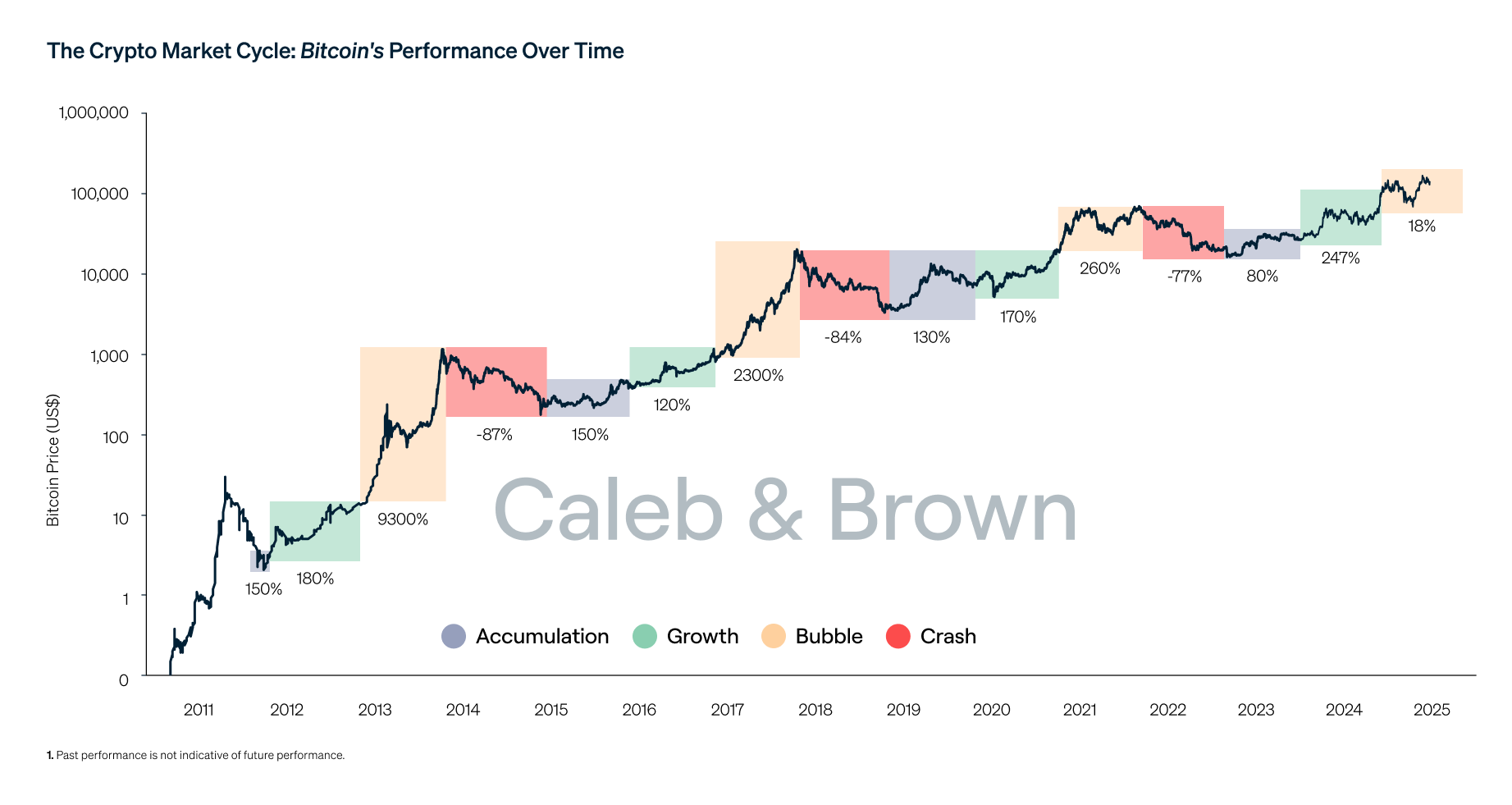

Historical Performance: What the Data Shows

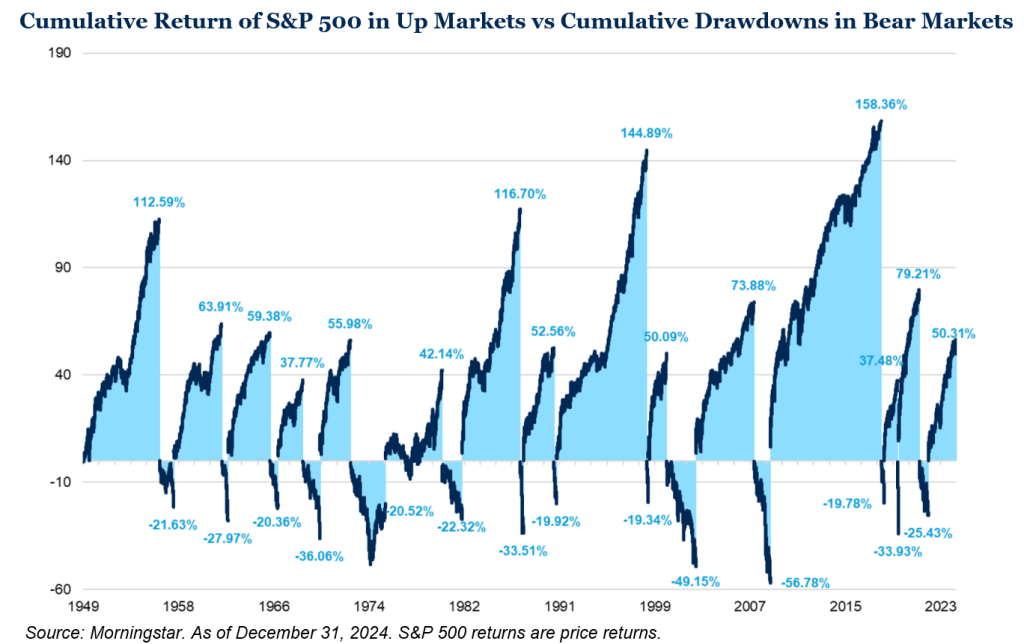

Looking at past shutdowns:

- Crypto volatility often increases slightly

- No shutdown triggered a sustained bull market

- Bitcoin correlated more with equities than with gold

Key takeaway:

Shutdowns are not bullish or bearish catalysts—they are noise events.

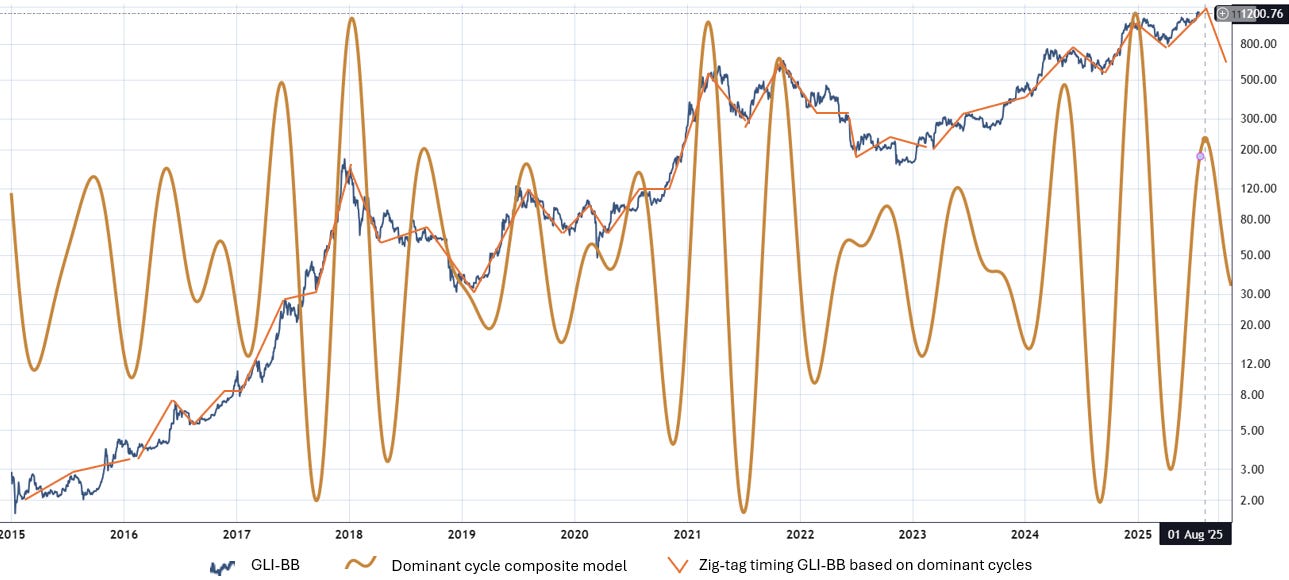

Crypto trends remain driven by:

- Monetary policy

- Liquidity cycles

- Network adoption

- Regulatory clarity

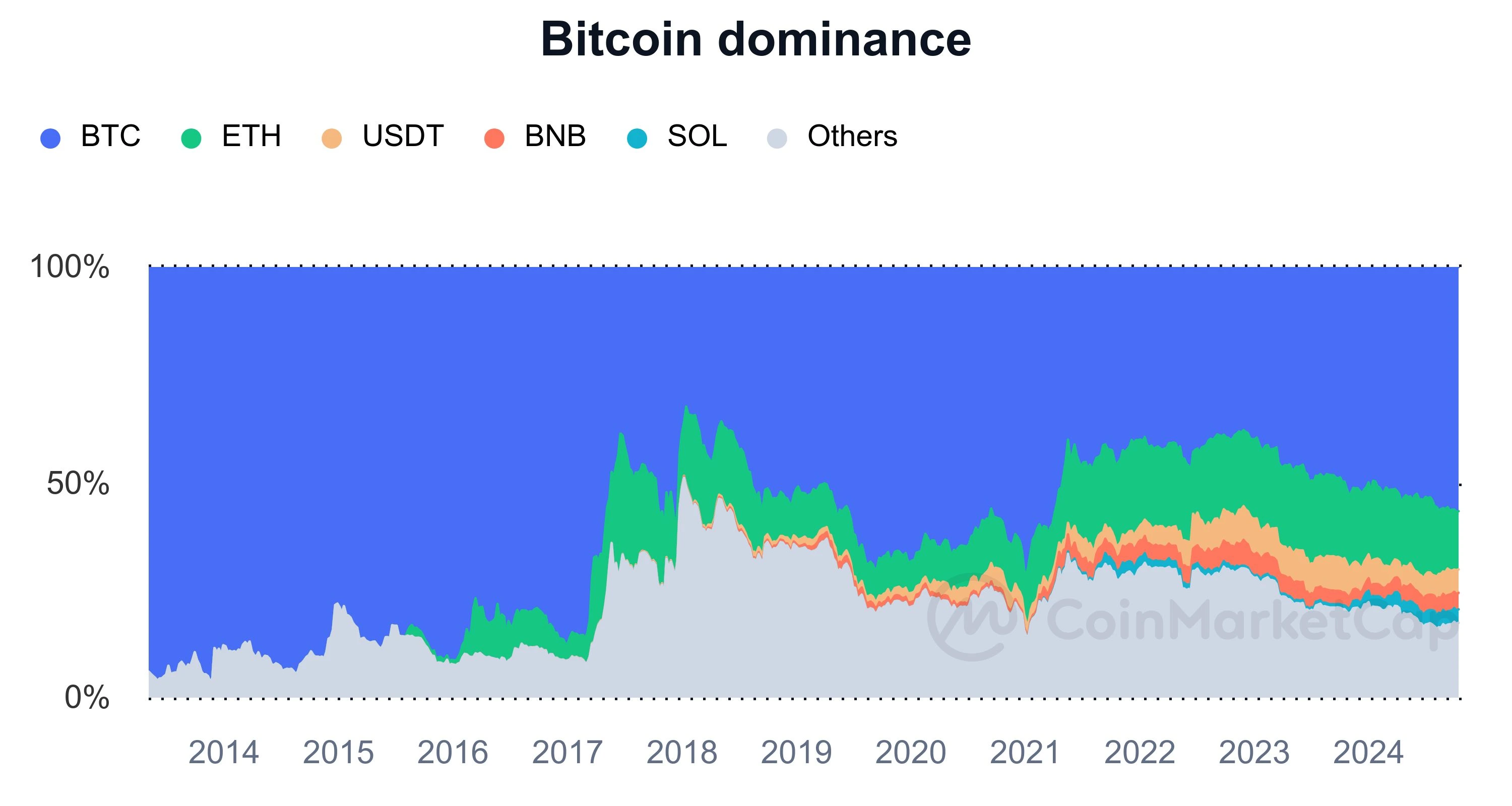

Bitcoin vs Altcoins During Shutdowns

Shutdown-related uncertainty can subtly shift capital allocation:

Bitcoin

- Often holds value better than altcoins

- Viewed as “lower risk” within crypto

- Benefits marginally from safe-haven narratives

Altcoins

- More sensitive to risk-off conditions

- Higher volatility

- More vulnerable to liquidity contractions

Shutdowns may temporarily increase Bitcoin dominance, but rarely enough to define a cycle.

Government Shutdown vs Debt Ceiling Crisis

It’s critical to distinguish shutdowns from debt ceiling crises.

| Event | Crypto Impact |

|---|---|

| Government shutdown | Low |

| Debt ceiling default risk | High |

| Monetary tightening | Very high |

| Liquidity expansion | Extremely bullish |

Debt ceiling risks threaten:

- Treasury market stability

- Dollar credibility

- Global liquidity

Shutdowns do not.

Strategic Takeaways for Crypto Investors

If you’re investing in crypto during a government shutdown:

- Ignore headlines—watch liquidity

- Track interest rate expectations

- Expect noise, not trend reversals

- Bitcoin generally outperforms altcoins

- Shutdowns are not buy or sell signals

Professional crypto investors treat shutdowns as background volatility, not catalysts.

Final Verdict: Do Government Shutdowns Matter for Crypto?

A government shutdown:

- Does not damage crypto fundamentals

- Does not create sustained upside

- Does not threaten the financial system

Crypto markets care far more about central bank policy, liquidity, and risk appetite than political standoffs.

Bottom line:

Government shutdowns are media events, not crypto market events.