The narrative that cryptocurrency is purely speculative is fading. While traders debate resistance levels and macro liquidity, a quieter shift is happening underneath the charts: real-world crypto adoption is accelerating among younger generations.

One of the most unexpected signals? A growing number of Gen Z users report paying for everyday expenses — including dates — with digital assets.

This isn’t just a cultural curiosity. It reflects a broader structural transition in how younger consumers view Bitcoin, stablecoins, and crypto payments in general. For investors, traders, and builders, this shift matters more than short-term volatility.

Let’s break down what’s happening — and what it means for the crypto market in 2026.

The Survey That Sparked the Conversation

Recent industry surveys show that a noticeable percentage of Gen Z respondents have used cryptocurrency for real-world payments — including paying for meals, entertainment, and even dates.

While headlines focus on the novelty, the deeper takeaway is behavioral:

- Younger users are comfortable holding digital assets.

- They view crypto wallets as spending tools, not just trading accounts.

- They are integrating digital currency into social life.

That matters.

For over a decade, crypto adoption was largely driven by speculation. But consumer usage is what transitions an asset class from fringe to infrastructure. When people spend crypto casually — not just during bull markets — it signals normalization.

From a search perspective, this trend aligns with rising interest in:

- crypto payments

- how to pay with Bitcoin

- Gen Z crypto adoption

- using stablecoins for everyday purchases

The cultural shift is measurable — and growing.

Why Gen Z Is More Comfortable Using Crypto

To understand why this trend is emerging, you have to understand the generation driving it.

Gen Z grew up in:

- A mobile-first financial world.

- An era of online gaming currencies.

- A social environment where digital identity equals real identity.

Digital value is not abstract to them.

Unlike older generations who transitioned from physical cash to credit cards, Gen Z skipped straight to digital wallets. Adding cryptocurrency to that ecosystem isn’t a leap — it’s an extension.

Three major drivers stand out:

1. Distrust in Traditional Financial Systems

After witnessing inflation spikes, bank failures, and macro uncertainty, younger consumers are more open to alternatives like Bitcoin and decentralized finance.

2. Stablecoin Practicality

Not everyone is spending volatile assets. Many are using stablecoins like USDC for faster settlement and reduced price fluctuation risk.

3. Social Signaling

Using crypto is culturally expressive. It signals tech fluency, independence, and financial experimentation.

In other words, crypto has become part payment rail — part identity layer.

The Role of Stablecoins in Everyday Spending

The real engine behind this behavioral shift isn’t necessarily Bitcoin itself — it’s stablecoins.

When someone pays for dinner using crypto, they’re often not transferring BTC directly. Instead, they may be using:

- USDC

- USDT

- Crypto-linked debit cards

- Wallet-based QR payments

Stablecoins provide:

- Fast settlement

- Borderless transfers

- Dollar-pegged value

- Reduced volatility risk

From an SEO standpoint, searches for stablecoin payments, crypto debit card, and USDC adoption have climbed alongside market maturation.

This indicates that crypto is no longer just a speculative instrument — it’s becoming transactional infrastructure.

And infrastructure is what builds long-term value.

What This Means for the Current Crypto Market

The broader crypto market in 2026 is navigating a transitional phase:

- Institutional participation is high.

- Volatility cycles are compressing.

- Regulatory clarity is gradually improving.

- Retail speculation is more selective.

In that environment, real-world adoption metrics matter more than meme-driven narratives.

When younger consumers begin using crypto as money rather than a lottery ticket, it strengthens:

- Network effects

- Wallet growth

- On-chain transaction volume

- Payment integrations

And that changes valuation models.

Instead of asking only, “Is Bitcoin breaking resistance?” investors may increasingly ask:

- Are active wallets growing?

- Is merchant adoption expanding?

- Are stablecoin transaction volumes increasing?

That shift in focus is a sign of market maturation.

Social Payments and the Normalization of Crypto

Crypto payments among Gen Z often happen socially:

- Splitting bills

- Paying back friends

- Covering shared experiences

This peer-to-peer usage model mirrors how Venmo and Cash App grew — but now with blockchain rails underneath.

The important distinction:

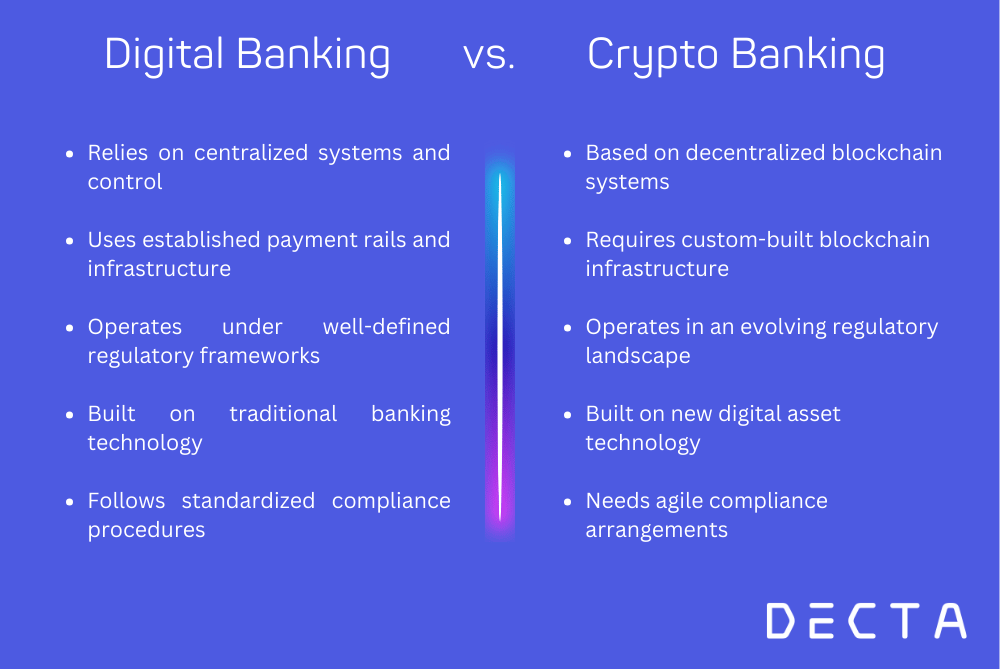

Traditional fintech apps rely on banking infrastructure.

Crypto-native payments operate on blockchain networks.

As blockchain usability improves, friction declines.

And once friction drops low enough, adoption accelerates.

This is exactly how technological inflection points occur.

Cultural Adoption Often Precedes Market Cycles

Historically, technological revolutions follow a pattern:

- Early technical experimentation

- Speculative frenzy

- Crash and consolidation

- Infrastructure build-out

- Cultural integration

- Sustainable expansion

Crypto has already experienced phases one through three multiple times.

Now, phase five — cultural integration — is quietly unfolding.

When a technology becomes socially embedded, it gains durability.

The fact that younger users casually integrate crypto into dating and daily life may seem trivial — but culturally embedded technologies rarely disappear.

They evolve.

Challenges to Widespread Everyday Crypto Use

Despite growth, hurdles remain:

Volatility

Spending highly volatile assets introduces timing risk.

User Experience

Wallet management and key custody can intimidate newcomers.

Tax Complexity

In many jurisdictions, crypto spending triggers taxable events.

Regulatory Fragmentation

Different countries apply inconsistent rules.

These factors slow full adoption — but they do not eliminate momentum.

Each bull and bear cycle has improved:

- Wallet interfaces

- Custody options

- Payment integrations

- Compliance clarity

The infrastructure is gradually catching up to cultural demand.

The Bigger Signal: Crypto Is Becoming Normal

The real takeaway isn’t about who paid for dinner.

It’s about normalization.

When cryptocurrency shifts from:

“Did you hear about that crazy coin?”

to

“Can you send me that in USDC?”

— the narrative changes.

Markets are ultimately driven by adoption curves.

And adoption curves often move slowly — until they don’t.

Gen Z’s casual use of crypto suggests:

- Digital wallets are becoming lifestyle tools.

- Stablecoins are functioning as real payment rails.

- Blockchain-based money is integrating into everyday culture.

For long-term investors, this is arguably more meaningful than short-term price swings.

Final Thoughts: Watch Behavior, Not Just Charts

The current crypto market remains volatile. Price cycles will continue. Headlines will fluctuate between optimism and panic.

But beneath that noise, a deeper structural evolution is underway.

Younger generations are not debating whether crypto is legitimate.

They’re deciding how to use it.

And that distinction changes everything.

If adoption continues to spread socially and transactionally, the future valuation of digital assets may depend less on hype and more on utility.

Crypto’s next phase may not be defined by speculative mania.

It may be defined by normalization.

And sometimes, the most powerful signals are the quietest ones — like someone paying for a date with digital dollars.