If you own crypto—or plan to—you need a wallet. But not all crypto wallets are created equal. One of the first and most important decisions you’ll face is choosing between a custodial wallet and a non-custodial wallet.

This choice directly affects your security, control, convenience, privacy, and risk exposure. Many users don’t fully understand the difference until something goes wrong—an exchange freezes withdrawals, a hack occurs, or access is lost.

This guide explains custodial vs. non-custodial wallets in plain English, without hype or fear-mongering. By the end, you’ll know exactly which option fits your needs—and why.

What Is a Crypto Wallet, Really?

Despite the name, a crypto wallet doesn’t actually store your coins.

Your cryptocurrency always lives on the blockchain. A wallet stores the private keys that prove you own and control those assets. Whoever controls the private keys controls the funds.

This single fact explains the entire custodial vs. non-custodial debate.

What Is a Custodial Wallet?

A custodial wallet is a wallet where a third party holds your private keys on your behalf.

Most centralized exchanges provide custodial wallets automatically when you create an account.

Common Examples of Custodial Wallets

- Exchange wallets on platforms like Coinbase, Binance, and Kraken

- Some crypto apps and payment platforms

- Broker-style investment services offering crypto exposure

You log in with a username and password, and the platform manages everything else.

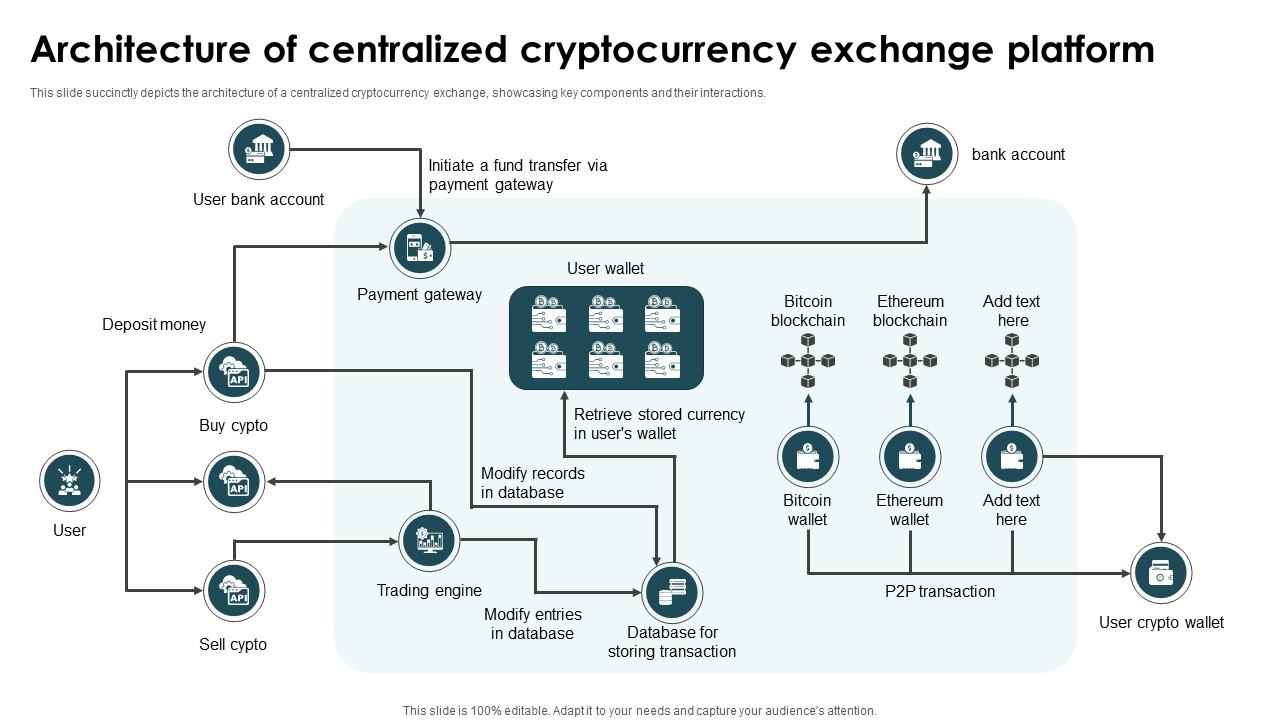

How Custodial Wallets Work

- The platform creates and controls the private keys

- Your balance is recorded internally

- Transactions are authorized through the platform

- You rely on the custodian’s security and policies

In short: they control the keys, you control the account access—at best.

Pros and Cons of Custodial Wallets

✅ Advantages of Custodial Wallets

Ease of use

Custodial wallets are beginner-friendly. No seed phrases, no manual backups, no technical setup.

Account recovery

Forgot your password? You can usually recover access via email or identity verification.

Integrated features

Trading, staking, fiat on-ramps, customer support, and tax reporting are often built in.

Lower personal responsibility

You’re not solely responsible for securing private keys.

❌ Disadvantages of Custodial Wallets

No true ownership

If you don’t control the private keys, the crypto isn’t truly yours.

Counterparty risk

Exchanges can freeze accounts, halt withdrawals, go bankrupt, or be hacked.

Regulatory exposure

Custodial platforms comply with regulations, KYC, sanctions, and government orders.

Single point of failure

If the platform fails, users may lose access—sometimes permanently.

The crypto mantra exists for a reason: “Not your keys, not your coins.”

What Is a Non-Custodial Wallet?

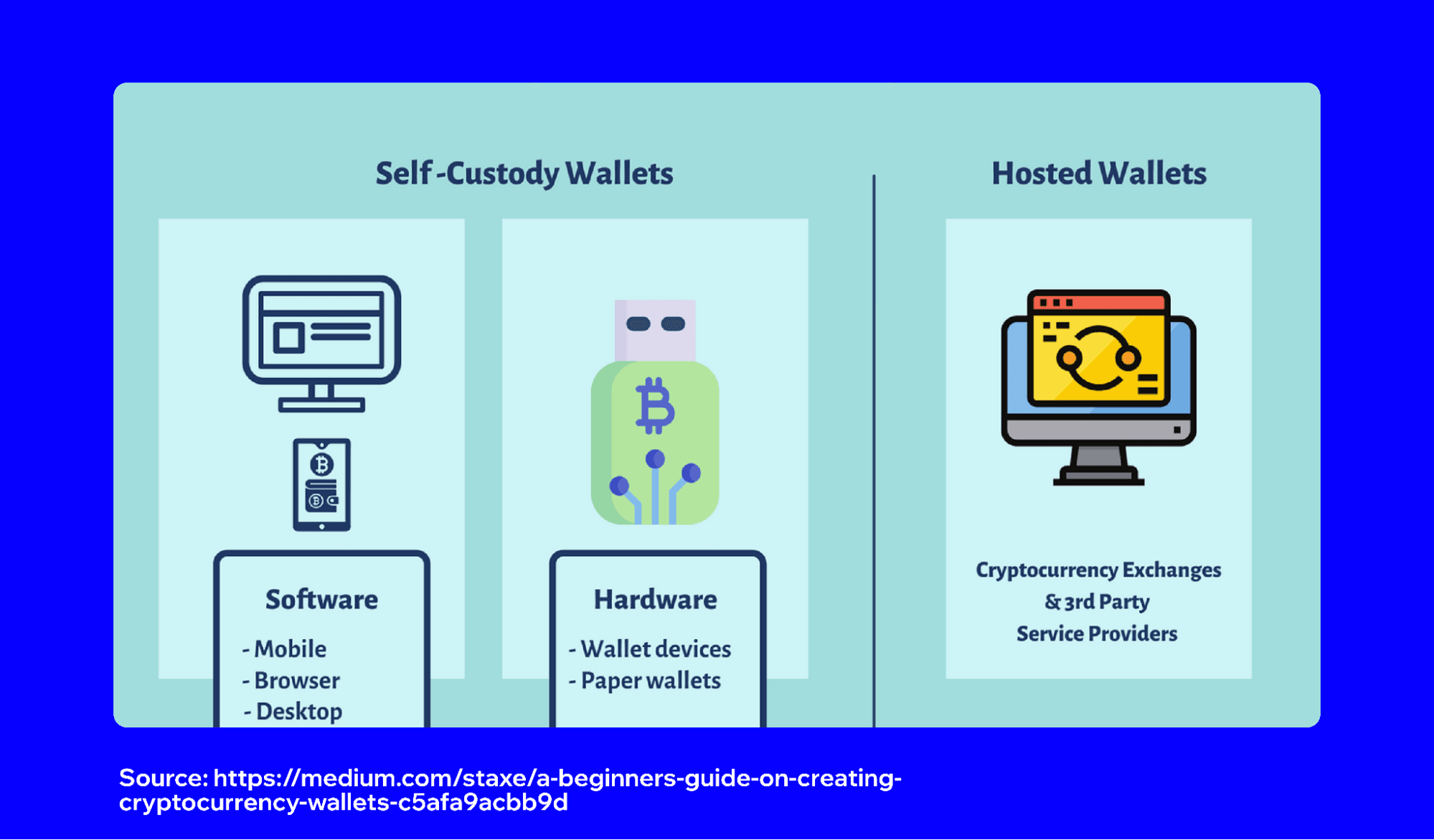

A non-custodial wallet (also called a self-custody wallet) is a wallet where you control the private keys—and therefore the funds.

No third party can move, freeze, or access your crypto without your permission.

Common Examples of Non-Custodial Wallets

- Software wallets like MetaMask and Trust Wallet

- Hardware wallets like Ledger and Trezor

- Open-source desktop and mobile wallets

When you set one up, you receive a seed phrase (usually 12 or 24 words). That phrase is the key to your crypto.

Pros and Cons of Non-Custodial Wallets

✅ Advantages of Non-Custodial Wallets

True ownership and control

You are the sole owner. No intermediary can interfere.

Censorship resistance

No account freezes, withdrawal limits, or arbitrary restrictions.

Better privacy

No mandatory KYC tied directly to wallet usage.

DeFi and Web3 access

Required for decentralized applications, NFTs, and smart contracts.

❌ Disadvantages of Non-Custodial Wallets

Full responsibility

Lose your seed phrase and your funds are gone—permanently.

Higher learning curve

Users must understand backups, phishing risks, and transaction mechanics.

No customer support safety net

There’s no “reset password” button in self-custody.

User error risk

Sending funds to the wrong address or chain is often irreversible.

Custodial vs. Non-Custodial Wallets: Side-by-Side Comparison

| Feature | Custodial Wallet | Non-Custodial Wallet |

|---|---|---|

| Private key control | Third party | You |

| Ease of use | Very high | Moderate |

| Security model | Platform-dependent | User-dependent |

| Recovery options | Yes | No |

| Censorship resistance | Low | High |

| DeFi/Web3 access | Limited | Full |

| Ownership | Indirect | Direct |

Which Type of Wallet Should You Use?

The correct choice depends on how you use crypto, not ideology.

Custodial Wallets Are Better If You:

- Are brand new to crypto

- Trade frequently

- Hold small amounts

- Value convenience over control

- Want easy fiat integration

Non-Custodial Wallets Are Better If You:

- Hold long-term investments

- Care about sovereignty and censorship resistance

- Use DeFi, NFTs, or Web3 apps

- Want maximum control and privacy

- Understand (or are willing to learn) security basics

The Hybrid Approach (Most Common)

Many experienced users do both:

- Custodial wallets for trading and liquidity

- Non-custodial wallets for long-term storage

This balances usability and security.

Security Best Practices (Regardless of Wallet Type)

- Use strong, unique passwords and a password manager

- Enable two-factor authentication on custodial accounts

- Never share your seed phrase—ever

- Store backups offline (preferably in multiple locations)

- Beware of phishing links, fake apps, and social engineering

- Test small transactions before sending large amounts

Final Thoughts: Control vs. Convenience

Custodial and non-custodial wallets aren’t enemies—they’re tools for different jobs.

Custodial wallets prioritize ease and accessibility.

Non-custodial wallets prioritize ownership and resilience.

Understanding the difference is not optional in crypto—it’s foundational.

If crypto represents a shift toward financial sovereignty, non-custodial wallets are where that promise actually lives. But sovereignty comes with responsibility, and not everyone needs or wants that from day one.

Choose deliberately. Your future self will thank you.