Crypto headlines in 2026 feel quieter than previous cycles. There are fewer memes, fewer celebrity endorsements, and far less retail frenzy. To many casual observers, that silence looks like stagnation.

In reality, it’s the opposite.

Crypto in 2026 has moved from spectacle to strategy.

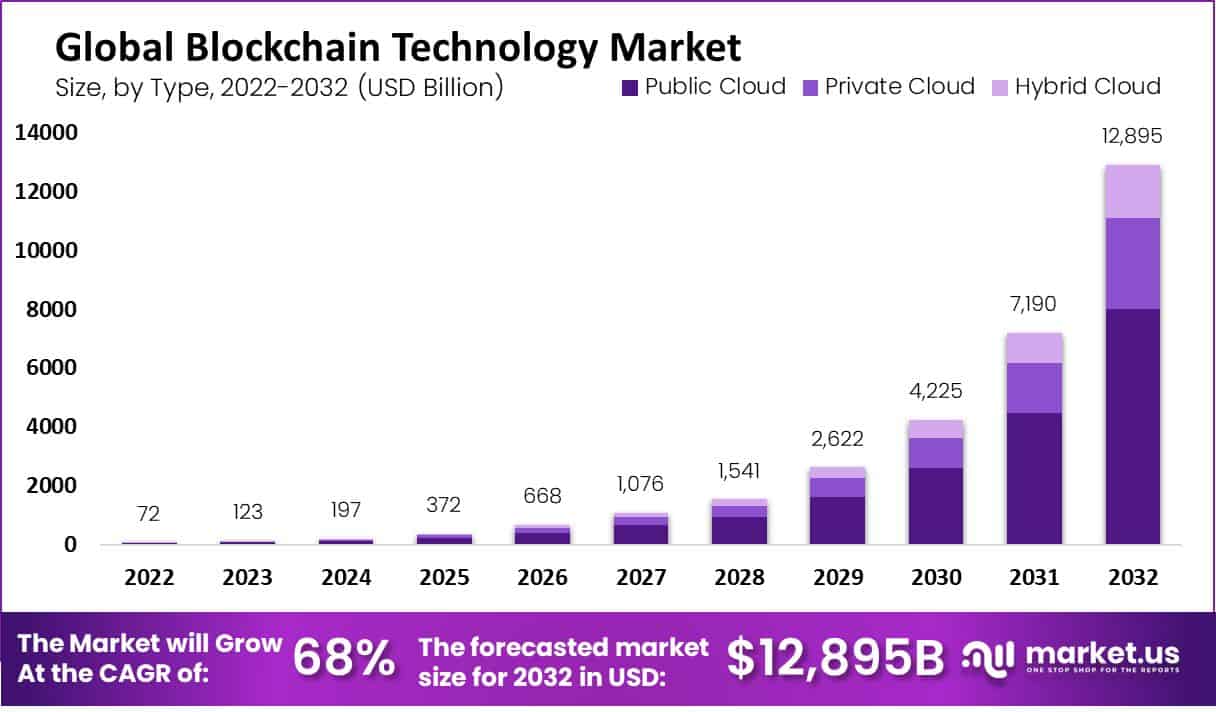

While public attention remains fixated on price predictions, Wall Street is quietly integrating blockchain technology into the core of the global financial system.

This isn’t about hype anymore.

It’s about infrastructure, control, efficiency, and power.

Here’s what Wall Street isn’t saying out loud — and why it matters.

The Shift From “Crypto as an Asset” to “Crypto as Infrastructure”

In earlier cycles, crypto was framed as a speculative asset class — something to trade, pump, or dismiss.

In 2026, the framing has changed.

Crypto Is No Longer Just an Asset

Behind closed doors, institutions increasingly view blockchain as:

- Financial infrastructure

- Settlement technology

- Market plumbing

- Data and ownership rails

Instead of asking “Should we buy crypto?”, the real question has become:

“How do we use crypto technology to modernize markets?”

That shift explains why so much of the most important crypto news barely makes headlines.

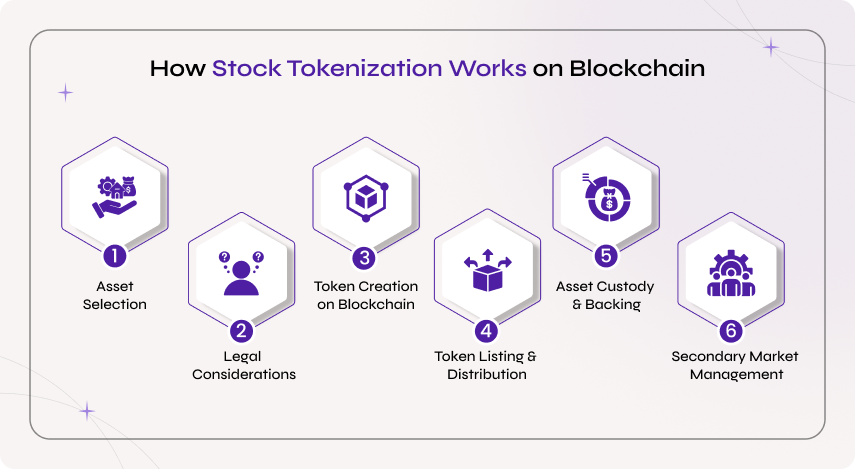

Tokenization Is the Real Story of 2026

If there is one crypto trend that defines 2026, it’s tokenization.

Tokenization refers to representing real-world assets — stocks, ETFs, bonds, real estate, commodities — as digital tokens on blockchain-based systems.

Why Wall Street Cares About Tokenization

Tokenized assets offer:

- Faster settlement

- Lower counterparty risk

- Reduced operational costs

- Fractional ownership

- Global accessibility

These benefits solve real problems Wall Street has struggled with for decades.

This isn’t ideological.

It’s operational.

Why This Is Happening Quietly

Wall Street doesn’t announce revolutions — it implements them.

There are three reasons this shift is happening quietly:

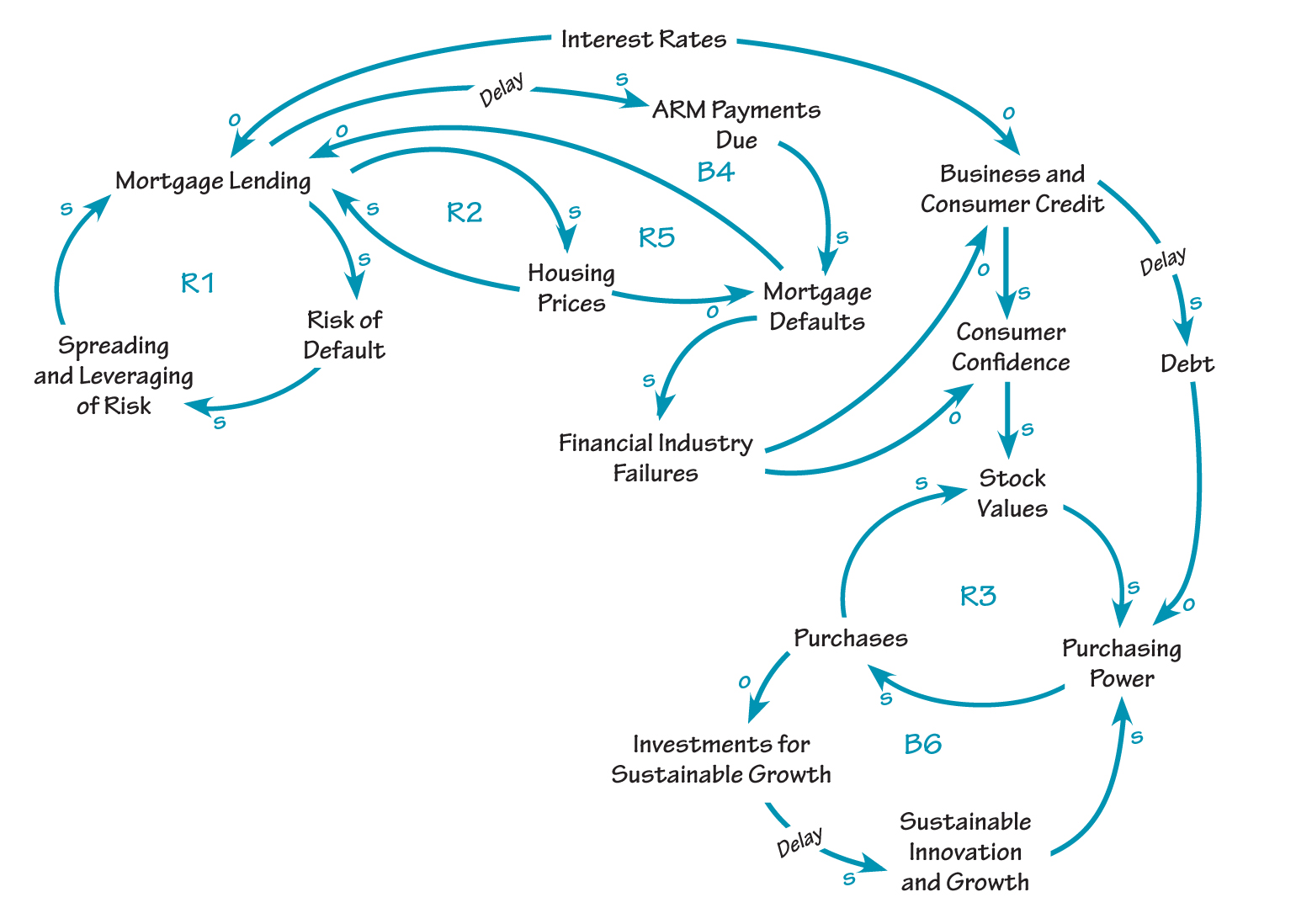

1. Regulatory Sensitivity

Public hype invites political scrutiny. Quiet infrastructure upgrades do not.

2. Competitive Advantage

Institutions don’t broadcast edge. They build it silently.

3. Cultural Memory

After multiple crypto boom-and-bust cycles, institutions have learned that noise attracts risk.

The silence is intentional.

The Rise of 24/7 Markets Without the Hype

One of the most underreported crypto-related developments in 2026 is the push toward 24/7 trading for traditional assets.

Crypto markets already operate nonstop.

Traditional markets do not.

Tokenization changes that.

Why 24/7 Trading Matters

- Global investors aren’t limited by time zones

- News doesn’t wait for market open

- Price discovery becomes continuous

- Overnight gaps become less severe

Wall Street understands this — even if it hasn’t marketed it loudly.

AI Is the Silent Partner in Crypto’s 2026 Evolution

A 24/7 market cannot be run by humans alone.

This is where AI and automation enter the picture.

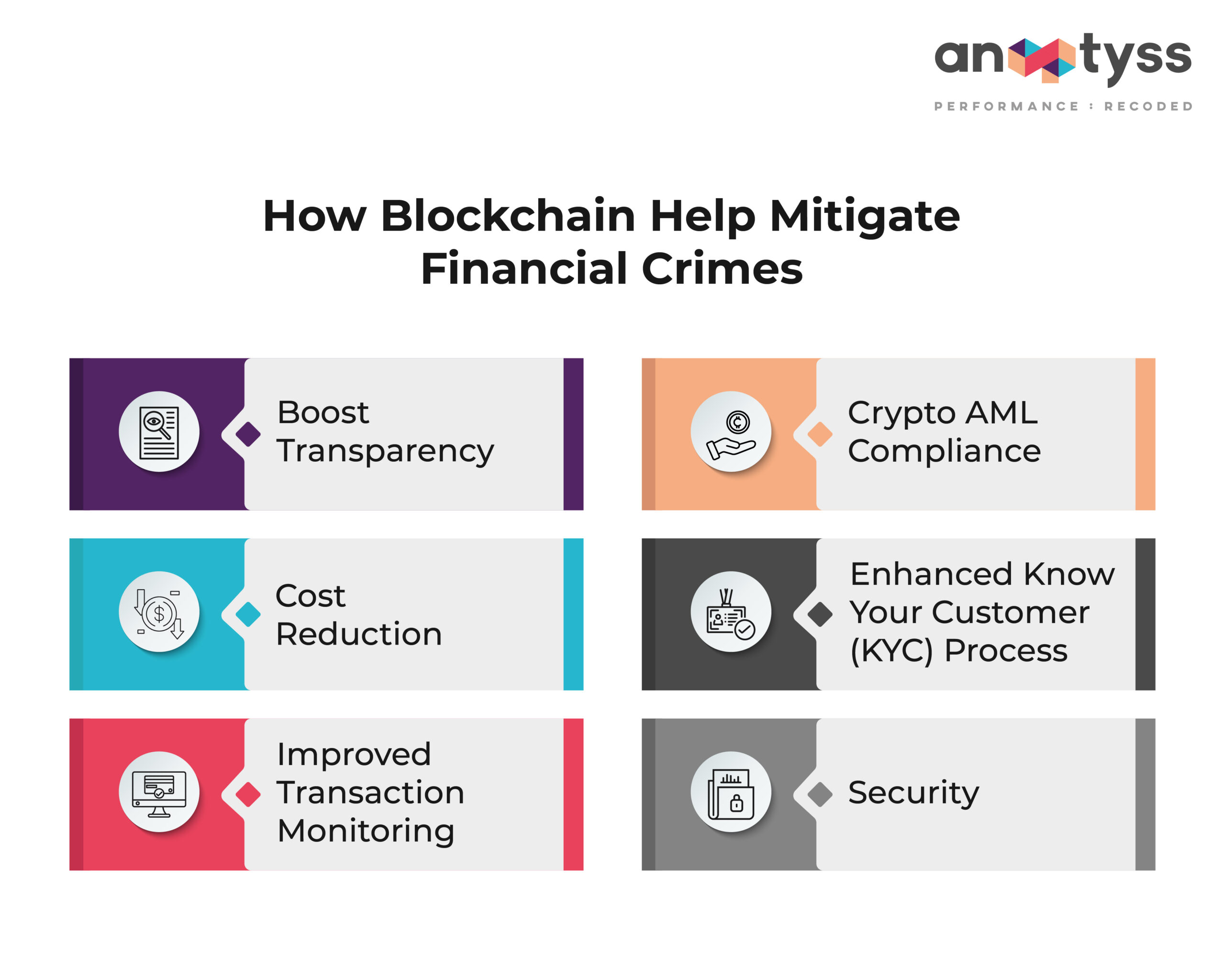

AI’s Role in Modern Crypto-Driven Markets

- Automated trading execution

- Real-time risk management

- Market surveillance and compliance

- Liquidity optimization

- Fraud and anomaly detection

Crypto infrastructure enables nonstop markets.

AI makes them manageable.

Together, they form the backbone of the next financial era.

Why Retail Investors Feel Left Out in 2026

Many retail participants feel crypto has “gone quiet” or “lost its edge.”

That perception comes from where the innovation is happening.

The New Innovation Isn’t Retail-Facing

In 2026:

- Fewer flashy apps

- Less speculative marketing

- More backend infrastructure work

Retail hype has been replaced by institutional build-out.

This doesn’t mean retail is irrelevant — it means the game has changed.

Control, Not Chaos: The Real Motivation

Crypto was once marketed as chaotic, disruptive, and uncontrollable.

Wall Street’s version of crypto is different.

What Institutions Actually Want

- Predictability

- Programmability

- Compliance

- Auditability

- Control

Tokenized systems allow assets to be:

- Programmed with rules

- Restricted by jurisdiction

- Audited in real time

This isn’t decentralization maximalism.

It’s controlled modernization.

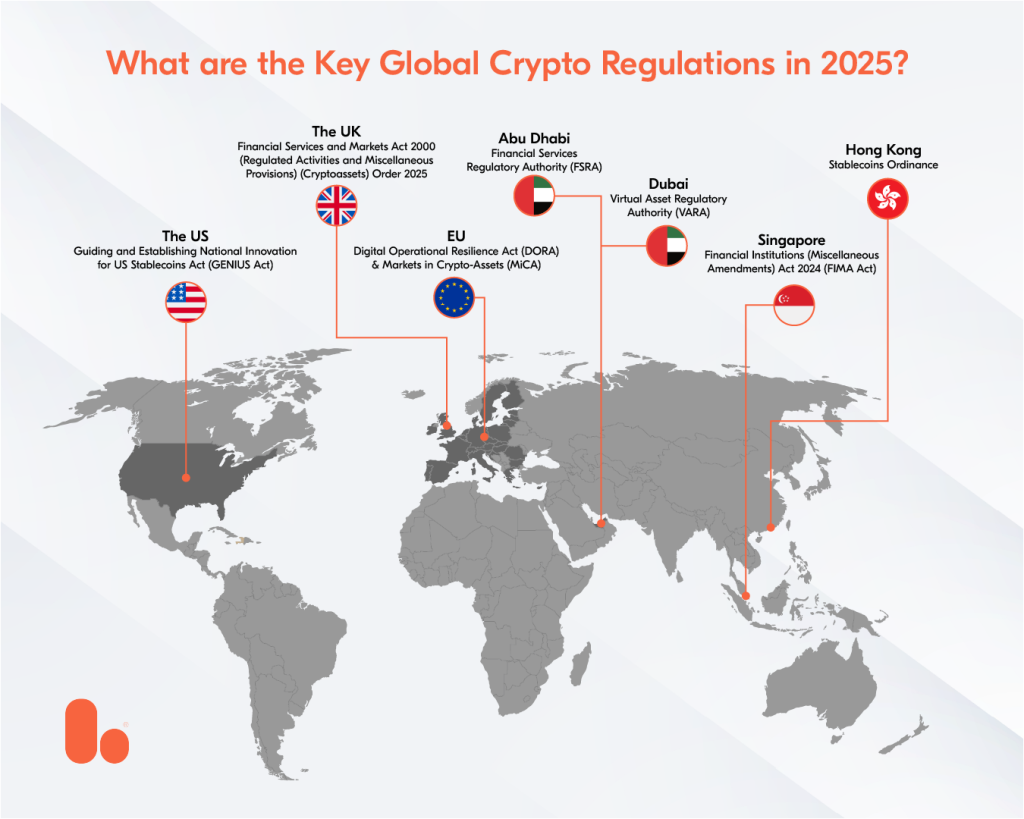

The Regulatory Shift No One Talks About

Another reason crypto feels “quiet” in 2026 is regulatory maturation.

Instead of constant threats and bans, regulators are:

- Updating frameworks

- Clarifying definitions

- Integrating blockchain into compliance

Regulation hasn’t disappeared — it has normalized.

That’s exactly what institutions wanted.

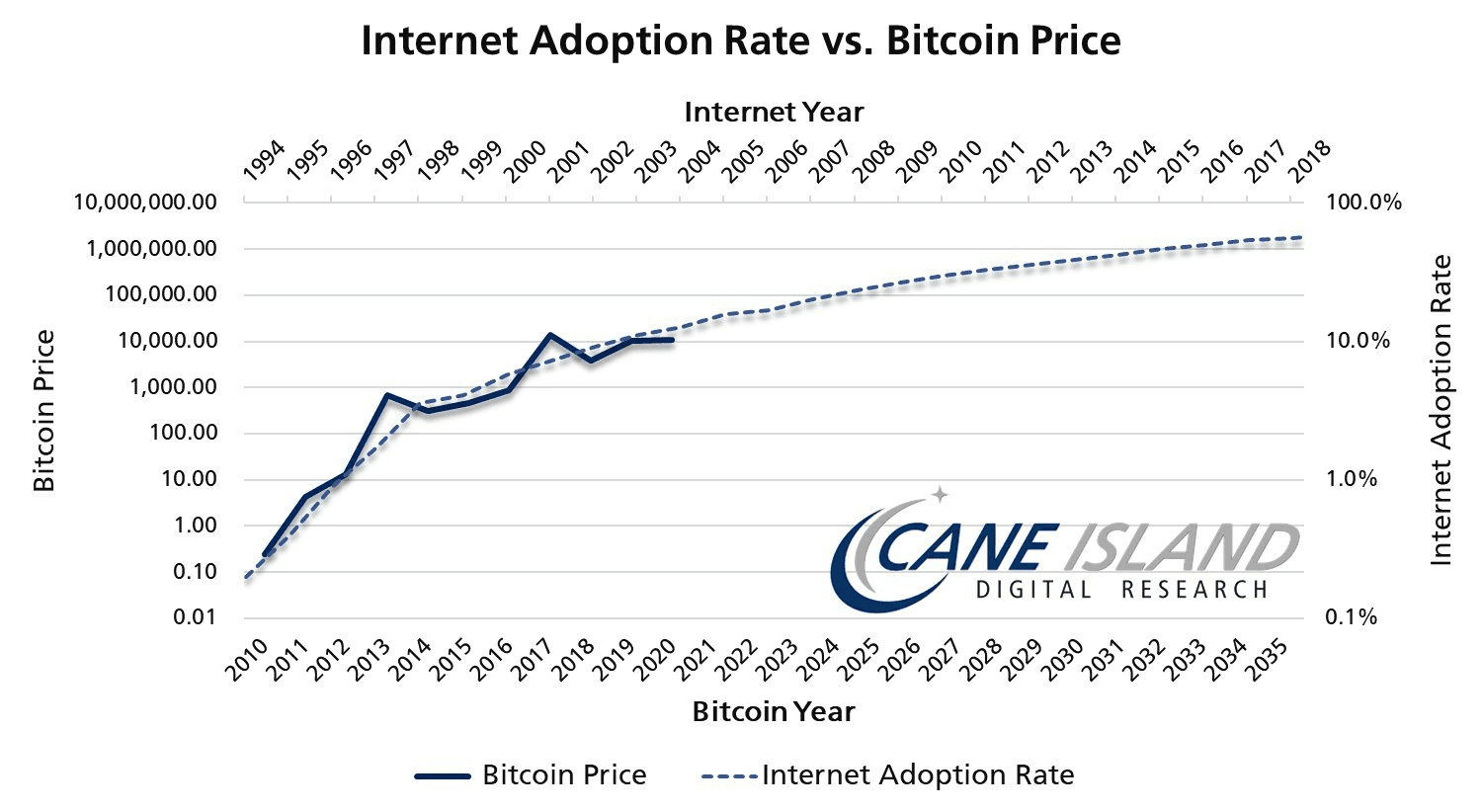

Why Price Isn’t the Leading Indicator Anymore

In earlier cycles, price led the narrative.

In 2026, infrastructure leads price.

Signals That Matter More Than Charts

- Settlement system upgrades

- Tokenization pilots

- Institutional custody expansion

- Exchange infrastructure changes

- Regulatory clarity

Price reacts after these systems are in place — not before.

The Psychological Shift: From Speculation to Systems

Crypto’s culture has changed.

The dominant mindset in 2026 is no longer:

- “How fast can this go up?”

It’s:

- “How does this fit into the system?”

This favors:

- Long-term thinkers

- Infrastructure builders

- Strategic capital

Short-term speculation hasn’t vanished — but it’s no longer the main event.

What This Means for the Future of Crypto

Crypto in 2026 isn’t trying to overthrow Wall Street.

It’s being absorbed into it.

Likely Outcomes Over the Next Few Years

- Tokenized securities become mainstream

- Settlement times approach real-time

- AI-driven markets dominate execution

- Global capital flows increase

- Market access expands — quietly

The revolution isn’t loud anymore because it doesn’t need to be.

What Smart Investors Are Doing Differently in 2026

Instead of chasing headlines, sophisticated participants focus on:

- Structural adoption

- Regulatory direction

- Infrastructure investment

- Risk management

- Patience

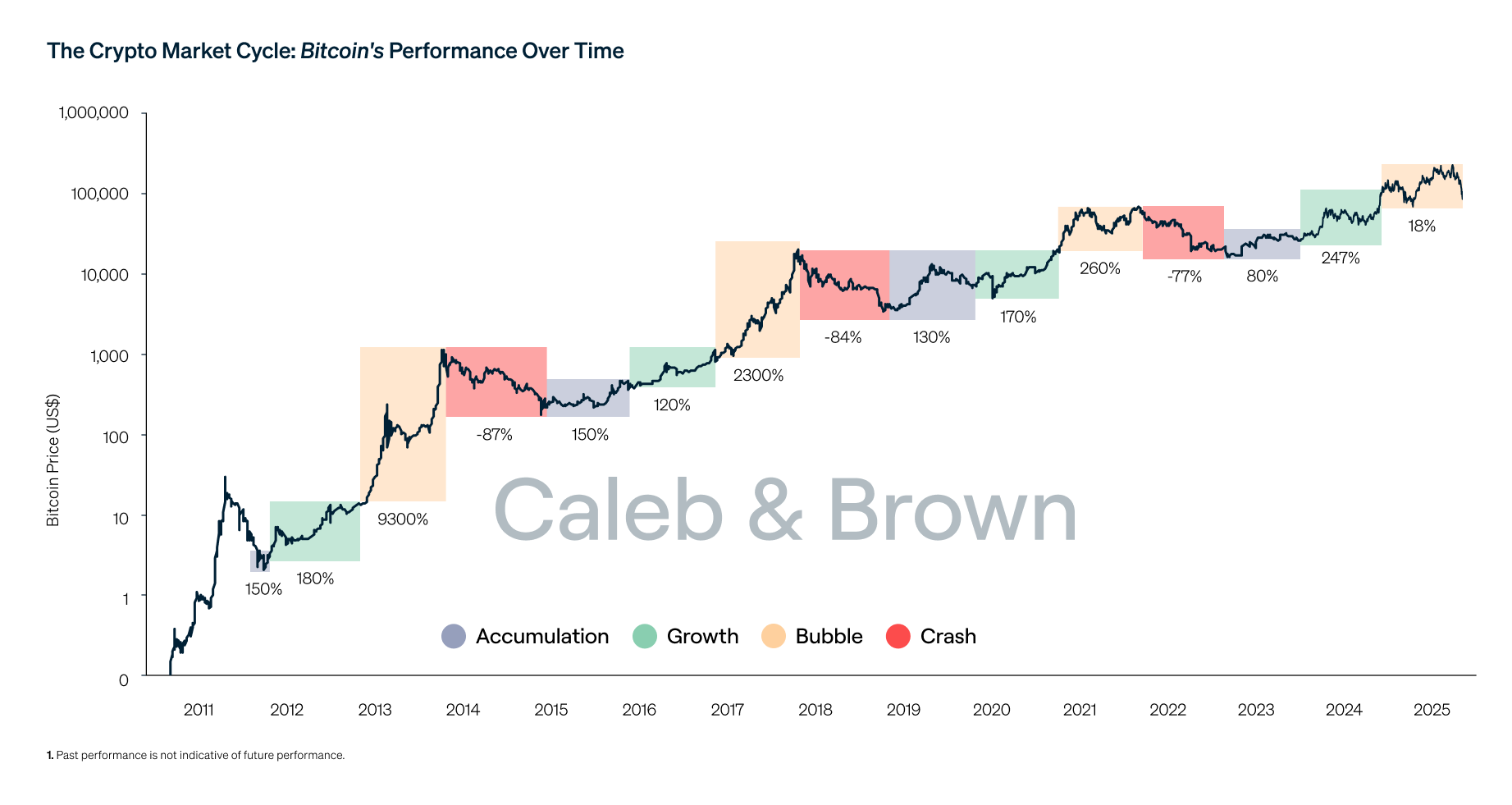

They understand that boring phases build the foundation for explosive ones.

Why Silence Is Actually a Bullish Signal

Historically, the loudest moments in crypto marked tops — not beginnings.

The quiet phases:

- Allow systems to be built

- Flush weak participants

- Reset expectations

- Attract serious capital

Crypto’s silence in 2026 is not weakness.

It’s consolidation at scale.

Final Thoughts: The Quiet Phase That Changes Everything

Crypto news in 2026 doesn’t scream for attention.

It doesn’t need to.

Behind the scenes, Wall Street is:

- Rebuilding market infrastructure

- Integrating blockchain technology

- Preparing for always-on markets

- Aligning regulation with innovation

By the time the shift becomes obvious, it will already be complete.

Crypto in 2026 isn’t about hype.

It’s about who controls the rails of global finance.

And that’s exactly what Wall Street isn’t saying out loud.