Cryptocurrency has fundamentally changed how value moves across the internet. But for most people, the first interaction with crypto is not with a blockchain—it’s with an exchange. Exchanges act as marketplaces where users buy, sell, and trade digital assets.

There are two dominant models in the crypto ecosystem today: centralized exchanges (CEXs) and decentralized exchanges (DEXs). While both allow users to trade cryptocurrencies, they differ radically in how they operate, how much control users retain, and what risks they introduce.

Understanding these differences is essential—not just for investors, but for anyone interested in the future of finance.

This article explains how centralized and decentralized exchanges work, compares them across key dimensions, and explains why decentralized exchanges represent a more resilient and user-empowering financial model.

What Is a Centralized Exchange (CEX)?

A centralized exchange (CEX) is a platform operated by a company that acts as an intermediary between buyers and sellers of cryptocurrencies. These exchanges function similarly to traditional stock brokerages.

When users deposit funds on a centralized exchange, they give up custody of their assets. The exchange holds user funds, manages private keys, maintains order books, and processes trades internally.

Well-known examples of centralized exchanges include Coinbase, Binance, and Kraken.

How Centralized Exchanges Work

Centralized exchanges operate using:

- Custodial wallets controlled by the exchange

- Internal databases instead of on-chain settlement

- Traditional order books matching buyers and sellers

- Compliance frameworks such as KYC (Know Your Customer) and AML (Anti-Money Laundering)

From a user’s perspective, CEXs are often easy to use. They provide polished interfaces, customer support, fiat on-ramps, and high liquidity. However, this convenience comes with significant trade-offs.

What Is a Decentralized Exchange (DEX)?

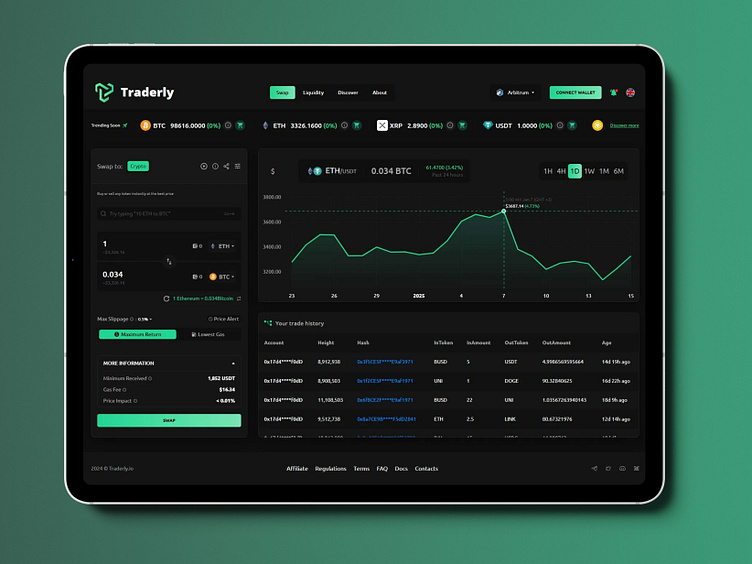

A decentralized exchange (DEX) is a peer-to-peer marketplace that allows users to trade cryptocurrencies directly from their wallets, without relying on a central authority.

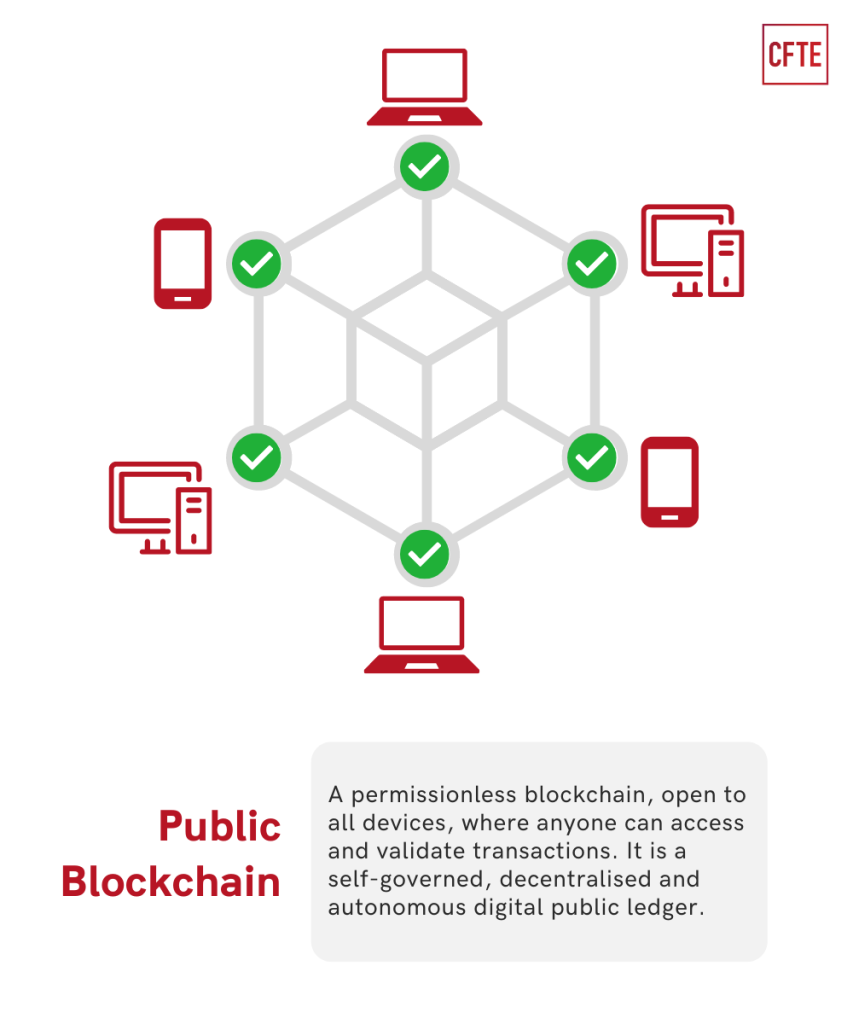

DEXs are built on blockchain networks and operate through smart contracts—self-executing code that enforces trading rules transparently and automatically.

Popular decentralized exchanges include Uniswap, SushiSwap, and PancakeSwap.

How Decentralized Exchanges Work

DEXs typically use:

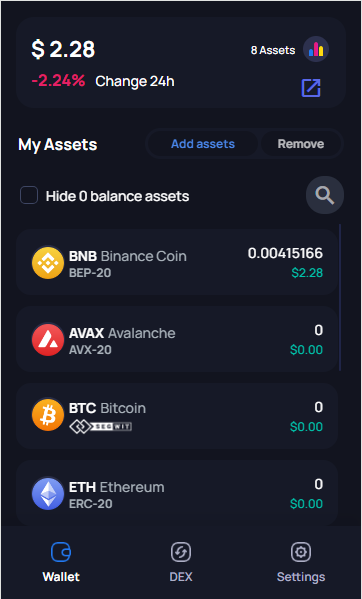

- Non-custodial wallets (users control private keys)

- On-chain settlement

- Smart contracts instead of intermediaries

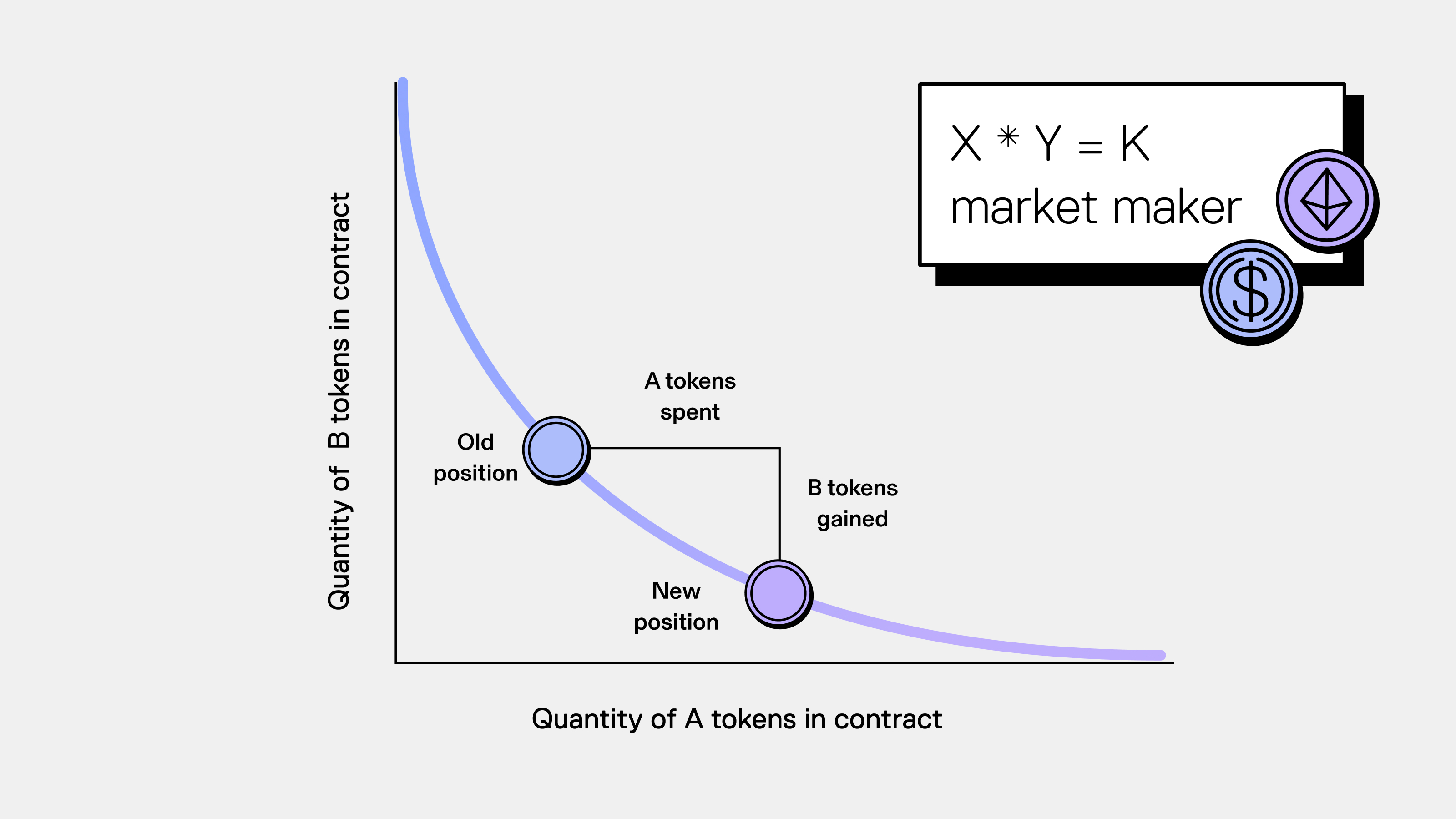

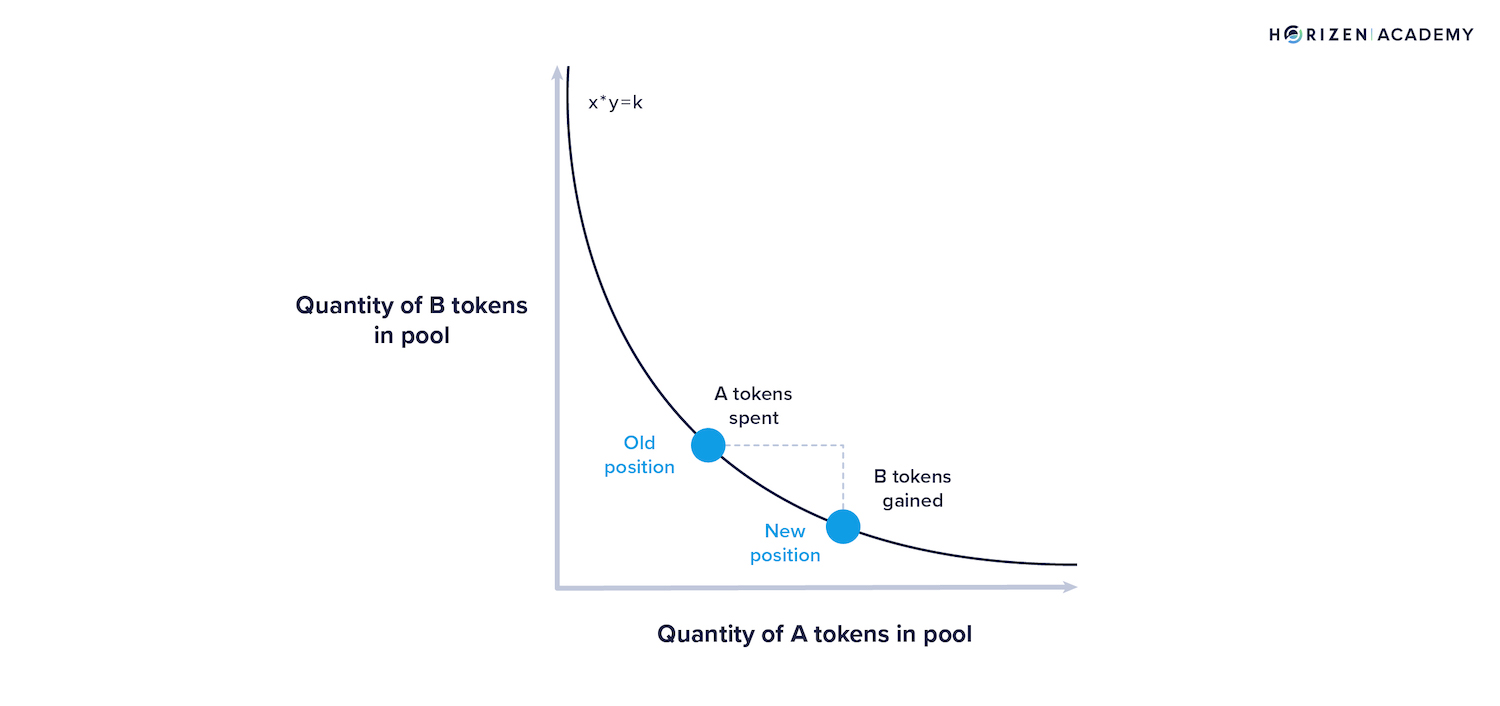

- Automated Market Makers (AMMs) instead of order books

Rather than trusting a company, users trust open-source code and the underlying blockchain network.

This model aligns closely with the original philosophy of cryptocurrency: self-sovereignty, transparency, and permissionless access.

Custody: Who Controls Your Assets?

The most important difference between centralized and decentralized exchanges is custody.

Centralized Exchanges: Custodial by Design

When using a CEX:

- The exchange controls your private keys

- Withdrawals can be delayed, frozen, or blocked

- Assets can be lost due to hacks or insolvency

History provides many cautionary tales, including exchange collapses where users discovered too late that their funds were not truly theirs.

Decentralized Exchanges: User-Owned Assets

With a DEX:

- You retain full control of your private keys

- Trades execute directly from your wallet

- No third party can freeze or confiscate funds

This principle is often summarized by a common crypto maxim: “Not your keys, not your crypto.” Decentralized exchanges are built around fixing this exact problem.

Security and Risk Models

Centralized Exchange Risks

Centralized exchanges represent single points of failure:

- Large honeypots for hackers

- Internal fraud or mismanagement risk

- Regulatory seizure or shutdown

Even well-regulated exchanges are vulnerable because trust is concentrated in one organization.

Decentralized Exchange Risks

DEX risks are different—not absent, but more transparent:

- Smart contract bugs

- User error (e.g., sending funds to wrong address)

- Market volatility and impermanent loss

However, these risks are:

- Publicly auditable

- Not dependent on corporate solvency

- Not amplified by pooled custody

From a systemic perspective, decentralized exchanges distribute risk instead of concentrating it.

Transparency and Trust

Centralized Exchanges Require Trust

Users must trust that a CEX:

- Actually holds the assets it claims

- Is solvent

- Is not engaging in risky behavior behind the scenes

Most exchange operations occur off-chain and are invisible to users.

Decentralized Exchanges Are Trust-Minimized

DEXs operate in the open:

- Trades settle on public blockchains

- Liquidity pools are visible in real time

- Smart contract logic can be audited

Trust shifts from institutions to verifiable systems, which is a foundational improvement in financial infrastructure.

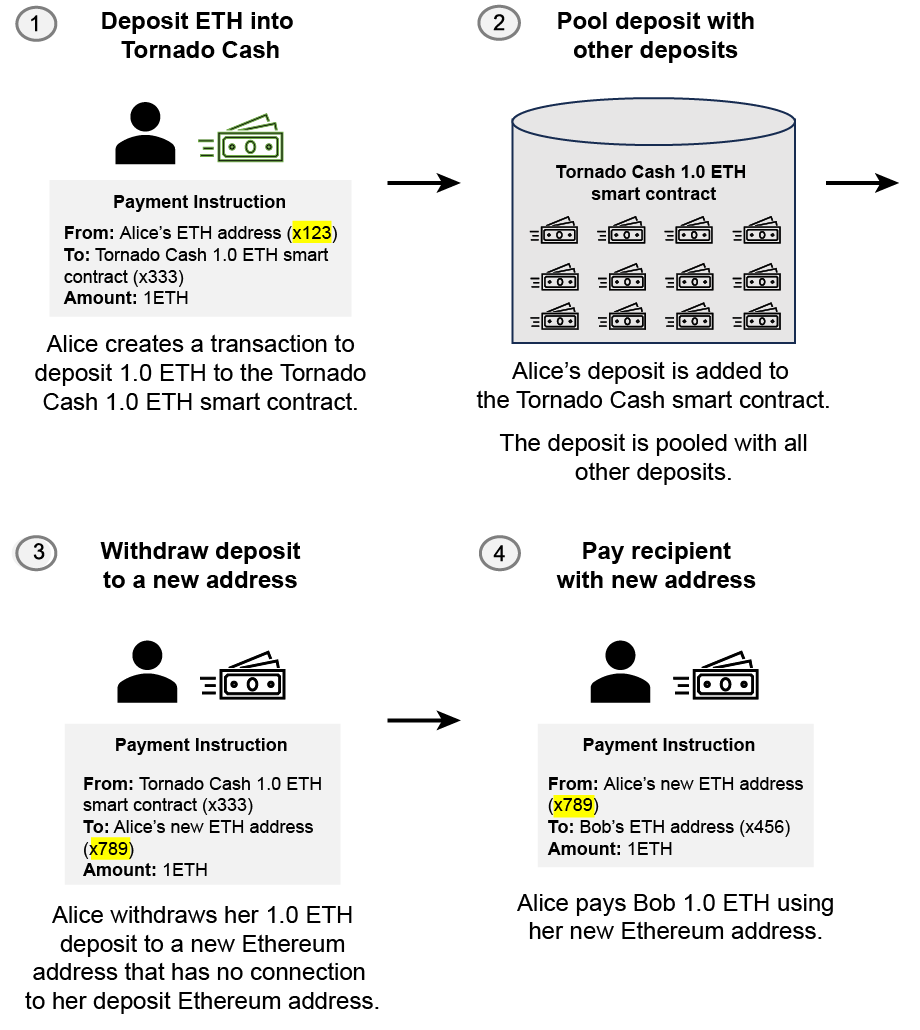

Regulation and Censorship Resistance

Centralized exchanges are tightly coupled to regulatory frameworks:

- Mandatory identity verification

- Account freezes

- Geographic restrictions

While regulation may provide consumer protections, it also introduces censorship and exclusion.

Decentralized exchanges, by contrast:

- Are permissionless

- Do not require identity verification

- Are accessible globally

This makes DEXs especially important for individuals in restrictive or underbanked regions.

Liquidity, Fees, and Market Access

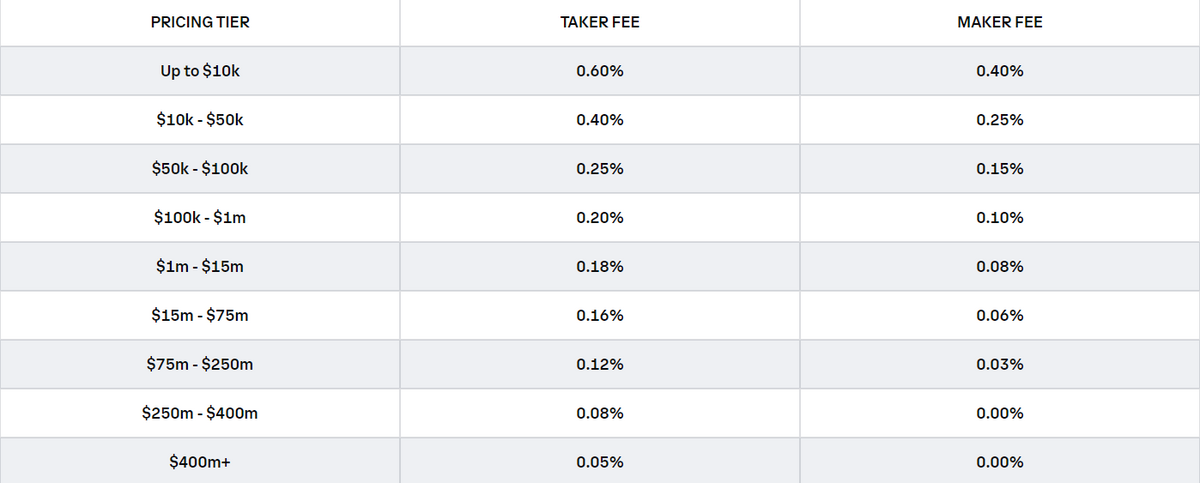

Centralized Exchanges

Pros:

- Deep liquidity for major trading pairs

- Tight spreads

Cons:

- Withdrawal fees

- Trading fees

- Listing gatekeepers

Decentralized Exchanges

Pros:

- Open market access

- Anyone can provide liquidity

- Competitive fee structures

Cons:

- Slippage on low-liquidity pairs

Importantly, DEXs democratize market making—allowing users to earn fees instead of paying them to centralized intermediaries.

User Experience and Accessibility

Centralized exchanges currently dominate in ease of use. However, DEX UX has improved dramatically with modern wallets and interfaces.

Today, using a decentralized exchange often requires:

- A wallet such as MetaMask

- Basic understanding of gas fees

- Responsibility for one’s own security

While this learning curve is real, it is also the cost of true ownership—and the gap continues to narrow.

Why Decentralized Exchanges Represent the Future

Decentralized exchanges are not merely an alternative—they are an evolution.

They offer:

- Self-custody by default

- Reduced systemic risk

- Global accessibility

- Transparent and auditable infrastructure

Centralized exchanges may continue to serve as onboarding ramps, but long-term value accrues to systems that minimize trust and maximize user control.

From a philosophical and practical standpoint, decentralized exchanges better align with the original promise of cryptocurrency: financial freedom without intermediaries.

Final Thoughts

Centralized exchanges prioritize convenience. Decentralized exchanges prioritize sovereignty.

For casual users, CEXs may feel easier today—but ease should never come at the cost of ownership, transparency, and resilience.

As decentralized technology matures, the question is no longer if decentralized exchanges will dominate—but when.

For anyone serious about understanding crypto, participating in DeFi, or protecting their financial autonomy, learning how to use decentralized exchanges is no longer optional. It is essential.