Introduction: The Exchange That Once Ruled Crypto Is Losing Its Grip

For years, Binance was synonymous with crypto trading itself. If you were a retail trader anywhere outside the U.S., chances are Binance was your first exchange, your most-used exchange, or your only exchange.

But that era is ending.

Binance’s global market share has been steadily shrinking, competitors are catching up, and regulators have forced structural changes that permanently altered how the exchange operates. While many headlines blame “regulatory pressure” in abstract terms, that explanation dodges a harder truth:

Binance’s decline is inseparable from the decisions made by its founder, CZ.

This article breaks down what Binance’s shrinking market share really means, why it’s happening, and how CZ’s leadership style created the conditions for today’s fallout—with real consequences for everyday retail traders.

Binance’s Market Share: From Dominance to Decline

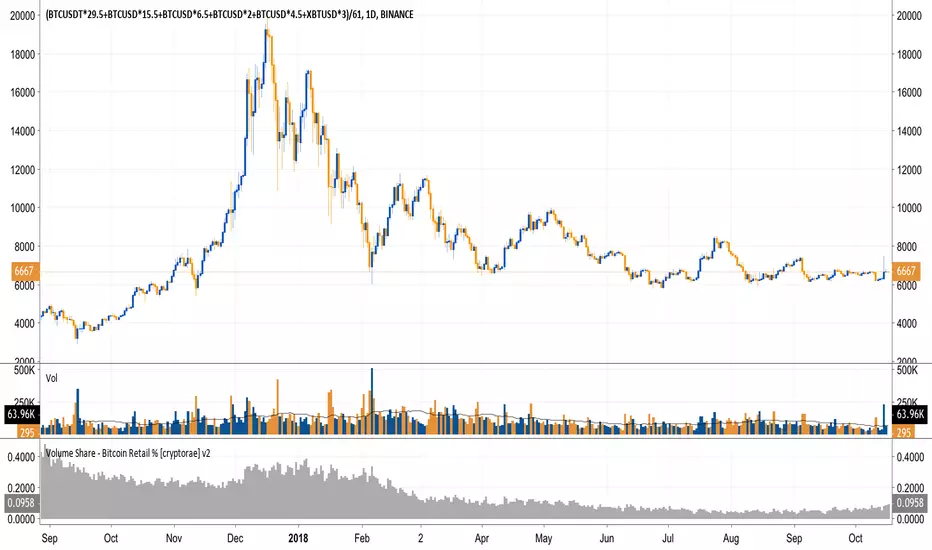

At its peak, Binance controlled over 50% of global spot crypto trading volume, with even higher dominance in derivatives. No exchange in crypto history came close.

Today:

- Binance’s spot market share is materially lower

- Its derivatives dominance is narrowing

- Regional competitors are siphoning users

- Institutional traders are diversifying away

This isn’t a sudden collapse—it’s a slow bleed.

Why Market Share Matters (Especially for Retail)

For retail traders, exchange dominance affects:

- Liquidity (tighter spreads, less slippage)

- Fee competition

- Product availability

- Execution quality during volatility

As Binance shrinks, retail traders face:

- Fragmented liquidity

- Higher effective trading costs

- Less protection during market stress

This decline isn’t theoretical—it hits wallets directly.

The Cult of CZ: When a Founder Becomes the Brand

From the beginning, Changpeng Zhao positioned himself as:

- Anti-establishment

- Anti-regulation

- Pro-user

- Faster than bureaucrats

Retail loved it.

CZ tweeted directly to users, mocked regulators, dismissed critics, and framed Binance as an unstoppable force. But that persona came with a cost.

The Problem With Founder-Centric Power

CZ didn’t just run Binance—he was Binance:

- Centralized decision-making

- Minimal transparency

- Jurisdictional ambiguity by design

- “Ask forgiveness, not permission” compliance

That approach works until it doesn’t.

And when it fails, everyone below pays the price.

Regulation Was Inevitable — CZ Made It Worse

Let’s be clear: regulation was always coming. Crypto touching trillions in volume was never going to stay ignored.

But Binance didn’t just encounter regulators—it provoked them.

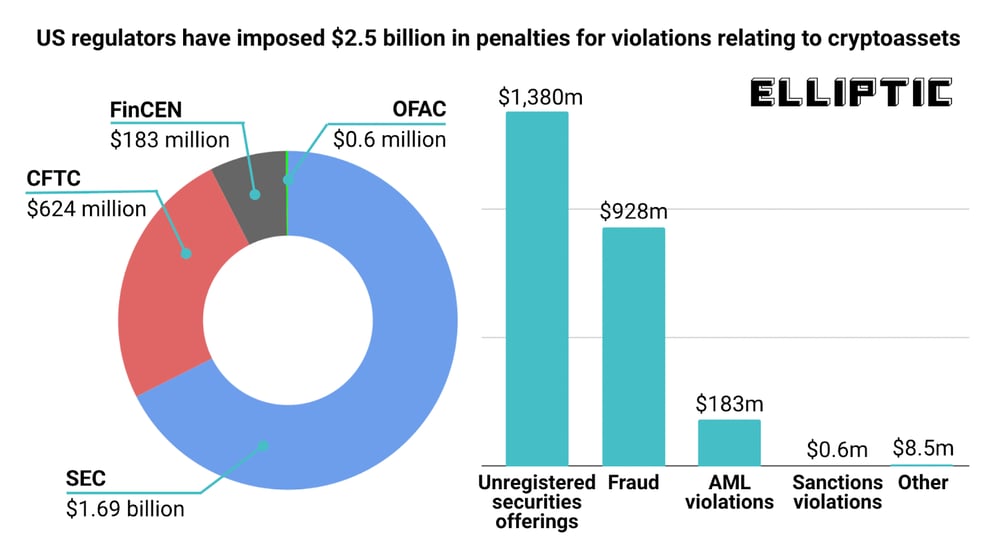

Key issues tied to CZ-era leadership:

- Operating without a clear headquarters

- Weak AML/KYC enforcement

- Allowing restricted users to access products

- Publicly antagonizing regulators

These weren’t accidents. They were strategic choices.

The Outcome

Eventually, regulators forced accountability:

- Massive fines

- Compliance monitors

- Structural constraints

- CZ stepping down from leadership

Retail traders didn’t choose this risk profile. It was chosen for them.

The Real Cost of Binance’s Decline for Retail Traders

When Binance loses market share, retail traders lose invisible advantages they once took for granted.

1. Worse Execution

Lower liquidity means:

- Larger spreads

- More slippage

- Poorer fills during volatility

Retail traders are always last in line.

2. Higher Risk Concentration

As users migrate:

- Liquidity fragments

- Smaller exchanges take on systemic risk

- Failures become more likely

Binance once absorbed shocks. Now shocks propagate.

3. Fewer “Freebies”

Ultra-low fees, aggressive promotions, and fast listings were subsidized by dominance. Shrinking share means:

- Higher fees over time

- Stricter limits

- Less generosity

Competitors Aren’t Just Winning — They’re Learning From Binance’s Mistakes

Other exchanges watched Binance closely—and learned what not to do:

- Clear headquarters

- Regulator-first strategy

- Public audits

- Separation between founder and operations

They’re slower, less flashy, but more durable.

Binance’s shrinkage isn’t just loss—it’s redistribution.

CZ as the Villain: Not Evil, But Reckless

This isn’t a cartoon villain story. CZ didn’t set out to destroy Binance.

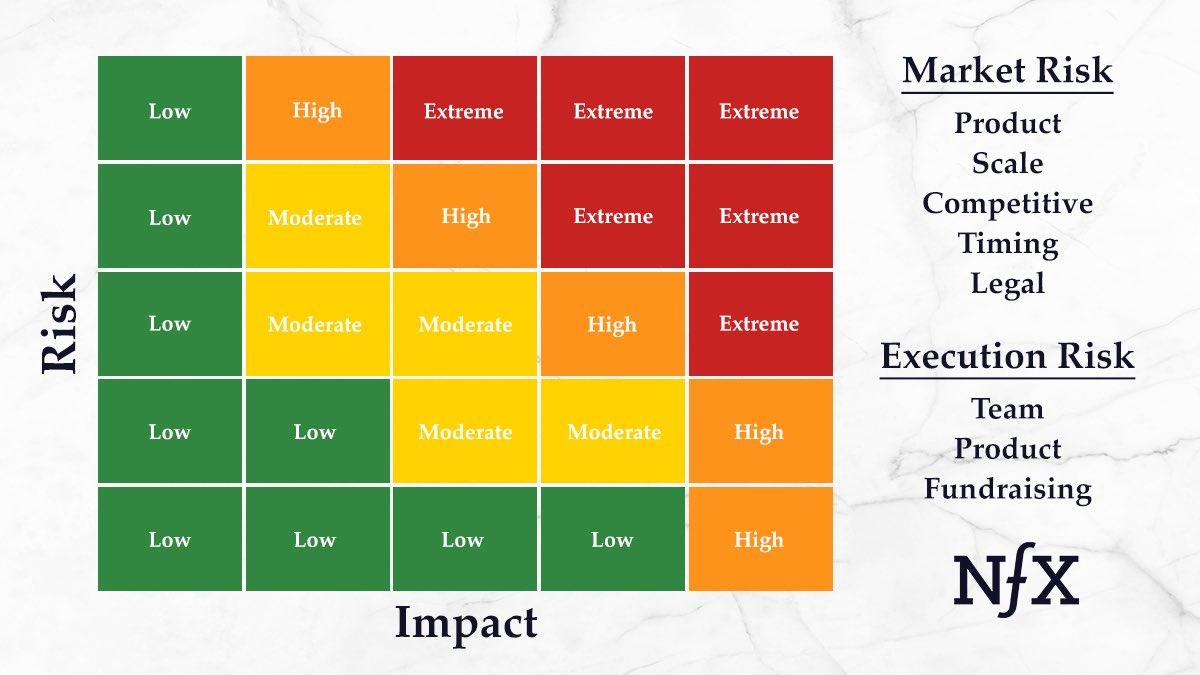

But from a retail perspective, the pattern is hard to ignore:

- Power centralized in one individual

- Rules treated as obstacles

- Risk externalized to users

- Accountability delayed until forced

That is villain behavior in markets, even if intentions were mixed.

Retail traders trusted Binance because they trusted CZ. That trust was leveraged, then broken.

What Binance’s Shrinking Market Share Signals About Crypto’s Future

Binance shrinking doesn’t mean crypto is dying. It means crypto is maturing.

Key takeaways:

- Founder-led empires don’t scale indefinitely

- Regulation favors boring over bold

- Retail traders bear hidden risks first

- Market share is a form of power—and liability

The next phase of crypto will look less exciting and more institutional.

Final Thoughts: Retail Traders Deserve Better Than Founder Ego

Binance didn’t shrink because crypto failed.

It shrank because unchecked leadership met reality.

CZ built one of the most powerful financial platforms in history—but he also built it on assumptions that couldn’t survive global scrutiny. Retail traders, once again, were left to deal with the consequences.

The lesson isn’t “don’t trust exchanges.”

It’s this:

Never confuse a charismatic founder with a sustainable system.