The crypto market is entering a decisive phase. Liquidity is rotating, narratives are shifting, and volatility compression across majors suggests expansion is imminent. For active traders, understanding which assets are trending — and more importantly why — is critical for positioning ahead of crowd momentum.

This week’s trending assets reflect five dominant forces shaping the market:

- Institutional positioning around Bitcoin

- Smart-contract dominance battles between Ethereum and Solana

- High-beta narrative rotation into AI and modular ecosystems

- Renewed memecoin speculation cycles

- Early signs of layer-2 capital migration

Below is a tactical breakdown of the most discussed and traded assets this week — and what they signal for short-term and swing traders.

Bitcoin (BTC): Volatility Compression Before Expansion?

Bitcoin remains the liquidity anchor of the market. This week, it’s trending not because of explosive upside — but because of structural setup.

We’re seeing:

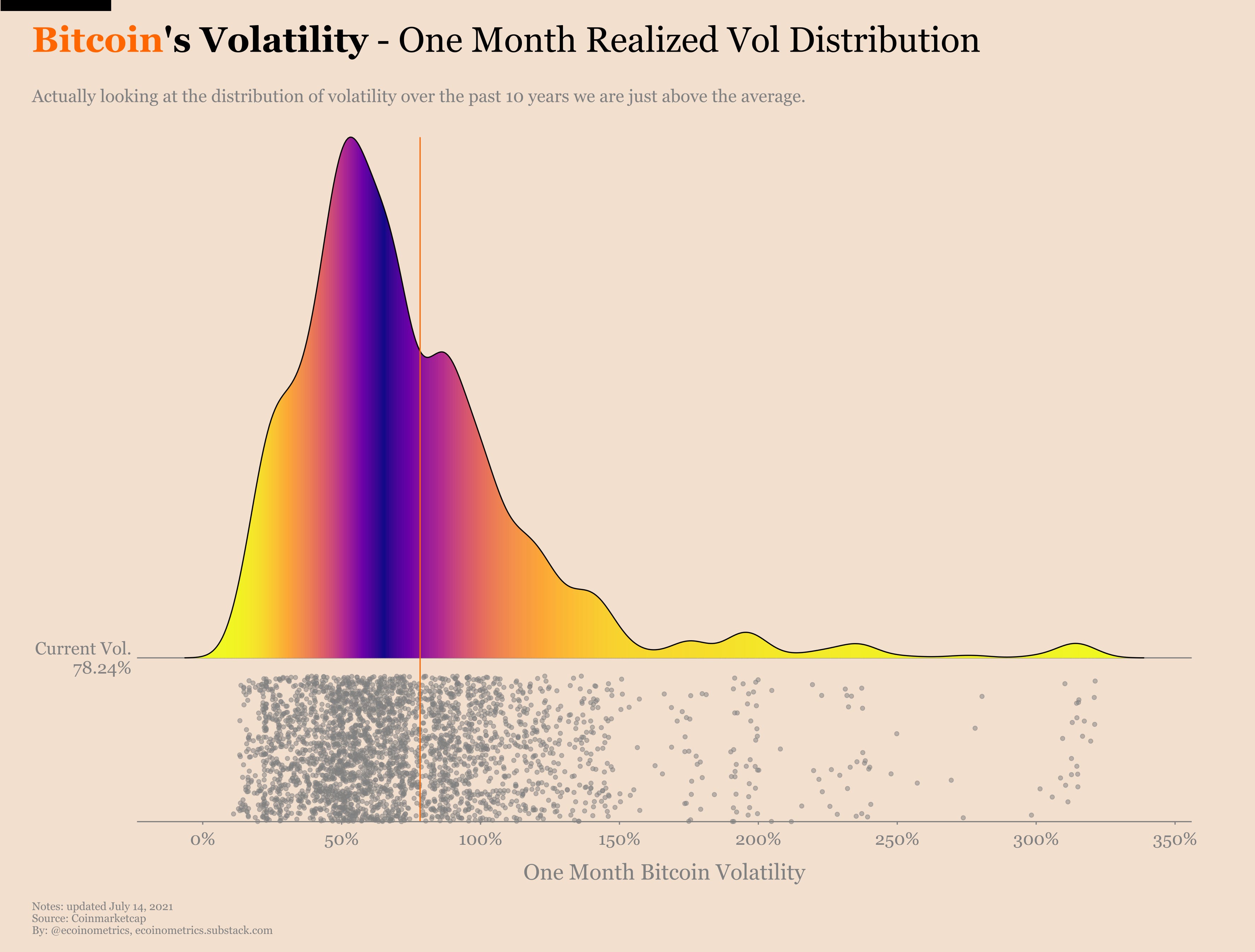

- Tightening volatility bands

- Declining realized volatility

- Increasing open interest without directional conviction

- ETF flows stabilizing after prior outflows

From a trader’s standpoint, this is classic compression before expansion.

Why It Matters

When BTC consolidates tightly while alts fluctuate, it often precedes:

- A large directional breakout

- A volatility event tied to macro or options expiry

- A liquidity sweep before continuation

Watch for:

- Liquidity resting above equal highs

- Funding rate divergence

- Sudden spikes in volume during low-liquidity hours

If Bitcoin breaks upward with volume, it typically pulls majors first. If it breaks down, expect rapid deleveraging across overextended alts.

For traders, BTC right now is less about chasing momentum and more about preparing for range resolution trades.

Ethereum (ETH): Rotation Trade or Structural Underperformance?

Ethereum is trending this week largely because of the ETH/BTC pair. The ratio is at a technical inflection point, and traders are debating whether ETH is due for rotation.

Recent developments include:

- Renewed interest in staking yields

- Increased layer-2 activity

- Capital rotation discussions from BTC to ETH

- Persistent debate about fee revenue sustainability

The Trade Thesis

If BTC dominance stalls, ETH is usually first in line for capital rotation. Historically:

- BTC consolidates

- ETH outperforms

- Then high-beta alts follow

However, ETH has shown relative underperformance over extended periods, raising concerns about structural capital migration to alternative chains.

Why Traders Should Care

Ethereum still commands:

- Deep liquidity

- Institutional acceptance

- Robust derivatives markets

But if ETH fails to reclaim key ratio levels, capital may skip directly into higher beta ecosystems.

Watch:

- ETH/BTC reclaim levels

- Funding flip from negative to positive

- Layer-2 TVL acceleration

This is a decision zone. Traders positioning early for a rotation move may capture outsized relative gains.

Solana (SOL): High-Throughput Momentum Machine

Solana continues trending due to ecosystem velocity. Unlike Ethereum’s institutional weight, Solana thrives on retail momentum, memecoin velocity, and low transaction costs.

This week’s buzz centers on:

- Rising on-chain activity

- Increased DEX volume

- Speculative token launches

- Narrative dominance in social metrics

Why SOL Keeps Trending

Solana is currently optimized for:

- Speed

- Cheap execution

- Viral token cycles

In high-risk environments, traders migrate toward chains where capital turns over faster.

SOL often acts as a proxy for:

- Risk appetite

- Retail participation

- Short-term speculative flows

Tactical Implications

When SOL trends:

- Lower caps on its ecosystem often outperform dramatically

- Perp funding heats up quickly

- Liquidation cascades can amplify moves

Traders should monitor:

- Open interest spikes

- Social dominance metrics

- Network congestion events

SOL is rarely slow. It’s either consolidating quietly — or expanding violently.

AI-Linked Tokens: Narrative Reignition

The AI narrative is resurfacing. Whether justified by real development or simply cyclical hype, AI-adjacent tokens are regaining momentum.

Why now?

- Broader AI sector strength in equities

- Traders seeking fresh narrative plays

- Lower liquidity caps allowing rapid price expansion

These tokens typically exhibit:

- Explosive vertical rallies

- Sharp retracements

- High funding volatility

Why It Matters for Traders

Narrative trades are momentum trades. They rely less on fundamentals and more on:

- Social velocity

- Volume acceleration

- Breakout structure

AI tokens often front-run broader altcoin moves. When they ignite, it signals speculative appetite returning.

Risk management is essential here:

- Scale entries

- Use trailing stops

- Avoid chasing parabolic extensions

These assets reward speed — and punish hesitation.

Memecoins: The Sentiment Thermometer

Memecoins are trending again — not because of fundamentals, but because of liquidity conditions.

Historically, memecoin strength signals:

- Peak retail engagement

- High speculative leverage

- Risk-on psychology

They thrive when:

- Gas fees are low

- Traders are bored of majors

- Capital seeks fast multiples

Why They Matter Even If You Don’t Trade Them

Memecoins act as sentiment indicators.

If memecoins are:

- Exploding upward → Risk appetite is strong

- Rolling over aggressively → Liquidity is thinning

- Failing to sustain breakouts → Buyers are exhausted

Professional traders monitor them not necessarily to invest — but to gauge market temperature.

When meme volume surpasses blue-chip volume, caution increases.

Layer-2 Ecosystems: Quiet Capital Migration

Layer-2 tokens are trending subtly. Not explosively — but structurally.

Activity suggests:

- Users seeking cheaper execution

- Bridged capital increasing

- Ecosystem incentives ramping up

Layer-2 plays are typically:

- Lower volatility than memecoins

- Higher beta than majors

- Dependent on broader ETH sentiment

If Ethereum rotates upward, L2 tokens often outperform on a percentage basis.

For traders, these are rotation vehicles — not narrative rockets.

Market Structure Overview

Across trending assets, we see a few structural themes:

1. Liquidity Is Selective

Capital is not evenly distributed. It rotates aggressively into narratives showing momentum.

2. Volatility Is Compressed in Majors

BTC and ETH are coiling. This usually precedes expansion.

3. Speculation Is Returning

AI tokens and memecoins trending simultaneously suggests risk tolerance is rising.

4. Institutional vs Retail Divide

Bitcoin reflects institutional positioning.

Solana and memes reflect retail velocity.

Understanding where liquidity originates helps define trade duration.

Strategic Positioning for Traders

Given this week’s trends, consider structured approaches:

Momentum Strategy

Focus on:

- Breakout confirmation

- Volume expansion

- Funding shifts

Works best on SOL ecosystem and AI tokens.

Rotation Strategy

Track:

- BTC dominance

- ETH/BTC ratio

- Layer-2 inflows

Position early before broader market recognizes rotation.

Volatility Expansion Play

Prepare for:

- BTC range breakout

- Options expiry events

- Liquidation cascades

Keep alerts set around key liquidity pools.

Risk Considerations

Trending assets attract leverage. Leverage attracts liquidation events.

Avoid:

- Entering parabolic moves

- Ignoring funding rates

- Oversizing in low-liquidity tokens

Monitor:

- Open interest divergence

- Social dominance spikes

- Sudden narrative exhaustion

In fast markets, capital preservation is edge preservation.

Final Take: What This Week’s Trends Signal

The market is transitioning.

Bitcoin is compressing.

Ethereum is at a ratio crossroads.

Solana is absorbing speculative energy.

AI tokens are reigniting narrative momentum.

Memecoins are flashing sentiment signals.

This combination suggests we are not in a dormant phase — we are in a pre-expansion environment.

For traders, the key is not predicting direction — but positioning for movement.

Stay adaptive.

Track liquidity.

Respect volatility.

The trends are speaking. The question is whether you’re positioned before they resolve.