The Most Misunderstood Sector in Crypto

The phrase “AI tokens” might be the most overloaded term in crypto today. Some are decentralized model marketplaces. Others are GPU compute brokers. A few are autonomous agent frameworks. And several are simply general-purpose blockchains that can host AI apps but are not AI-native.

Lumping them together creates valuation distortions, narrative bubbles, and misplaced expectations.

This report evaluates the current top 10 AI-category tokens by market cap (per CoinGecko’s Artificial Intelligence category) using a structured scorecard framework to separate narrative from fundamentals.

The goal: determine which projects have credible token value capture, which are early but promising, and which are primarily riding the AI reflexivity cycle.

The Evaluation Framework

How We Score AI Tokens

Each project is evaluated across six criteria (0–5 scale where applicable):

1. Token Necessity

Is the token required for:

- Paying for inference?

- Purchasing compute?

- Staking for model access?

Or is it mostly governance veneer?

2. Demand Flywheel

Does real usage drive:

- Fees?

- Staking demand?

- Reduced float?

Are there measurable demand proxies?

3. Supply Incentives & Security

- Are GPU providers / model operators economically aligned?

- Is the network sybil-resistant?

- Is cheating costly?

4. Value Capture

Does usage:

- Burn tokens?

- Generate staking yield?

- Increase locked supply?

Or does value leak off-chain?

5. Moat

- Network effects?

- Data liquidity?

- Model marketplace depth?

- Developer ecosystem stickiness?

6. Structural Risks

Qualitative:

- Regulatory exposure

- Emissions overhang

- Centralization vectors

- Narrative fragility

The Top 10 AI Tokens by Market Cap

(As categorized under “Artificial Intelligence” on CoinGecko.)

1. Bittensor (TAO)

What It Is

A decentralized machine intelligence marketplace where miners contribute models and validators rank them. Subnets specialize in different tasks.

Token Role

TAO is used for staking, emissions, and incentive alignment across subnets.

Strengths

- Strong token necessity

- Competitive subnet architecture

- Clear intelligence-marketplace thesis

Risks

- Emissions-driven security

- Complex economics

- Reputation-based validation challenges

Score Snapshot

Token Necessity: 5

Demand Flywheel: 4

Value Capture: 4

Moat: 4

Verdict: One of the few truly AI-native crypto experiments.

2. NEAR Protocol (NEAR)

What It Is

A general-purpose Layer 1 blockchain positioning itself as AI-friendly infrastructure.

Token Role

Gas fees, staking, governance.

Strengths

- Developer tooling

- Scalability architecture

Risks

- AI is narrative overlay, not core mechanism

- Token not required for AI-specific usage

Score Snapshot

Token Necessity: 2

Demand Flywheel: 3

Value Capture: 3

Moat: 3

Verdict: AI-adjacent infra, not an AI-native protocol.

3. Internet Computer (ICP)

What It Is

On-chain compute and hosting for decentralized apps.

Token Role

Cycles for compute, staking for governance.

Strengths

- On-chain execution

- Technical ambition

Risks

- Limited AI-specific moat

- Heavy competition from centralized cloud

Score Snapshot

Token Necessity: 3

Demand Flywheel: 3

Value Capture: 3

Moat: 2

Verdict: Infrastructure bet, not AI differentiation.

4. Render (RENDER)

What It Is

A decentralized GPU marketplace for rendering and increasingly AI workloads.

Token Role

Used for paying GPU providers and staking participation.

Strengths

- Clear compute-marketplace thesis

- AI inference adjacency

- Measurable demand proxies

Risks

- GPU supply concentration

- Competition with hyperscalers

Score Snapshot

Token Necessity: 4

Demand Flywheel: 4

Value Capture: 4

Moat: 3

Verdict: Strong compute narrative with real utility.

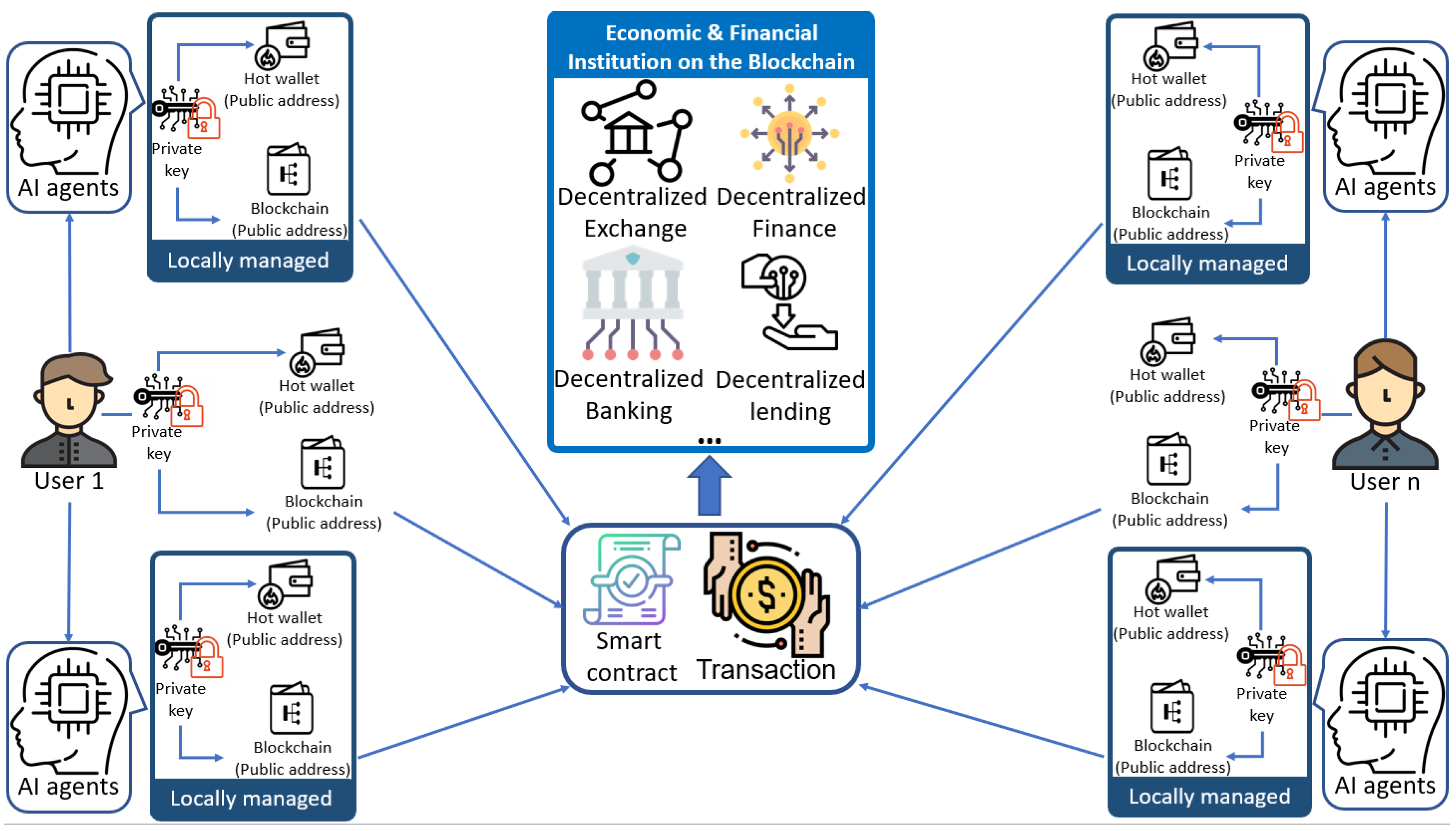

5. Virtuals Protocol (VIRTUAL)

What It Is

An AI agent protocol enabling autonomous digital agents.

Token Role

Fueling agent creation, interactions, and ecosystem incentives.

Strengths

- High narrative momentum

- Agent-economy thesis

Risks

- Agent monetization unclear

- Speculative reflexivity

Score Snapshot

Token Necessity: 3

Demand Flywheel: 3

Value Capture: 2

Moat: 2

Verdict: Early, high-risk agent play.

6. Artificial Superintelligence Alliance (FET)

What It Is

Agent-based AI economy (formerly Fetch.ai, now ASI Alliance).

Token Role

Staking, governance, agent execution incentives.

Strengths

- Long-standing project

- AI-agent-first architecture

Risks

- Ecosystem fragmentation

- Competitive overlap with newer agent protocols

Score Snapshot

Token Necessity: 4

Demand Flywheel: 3

Value Capture: 3

Moat: 3

Verdict: Legacy agent infrastructure with optional upside.

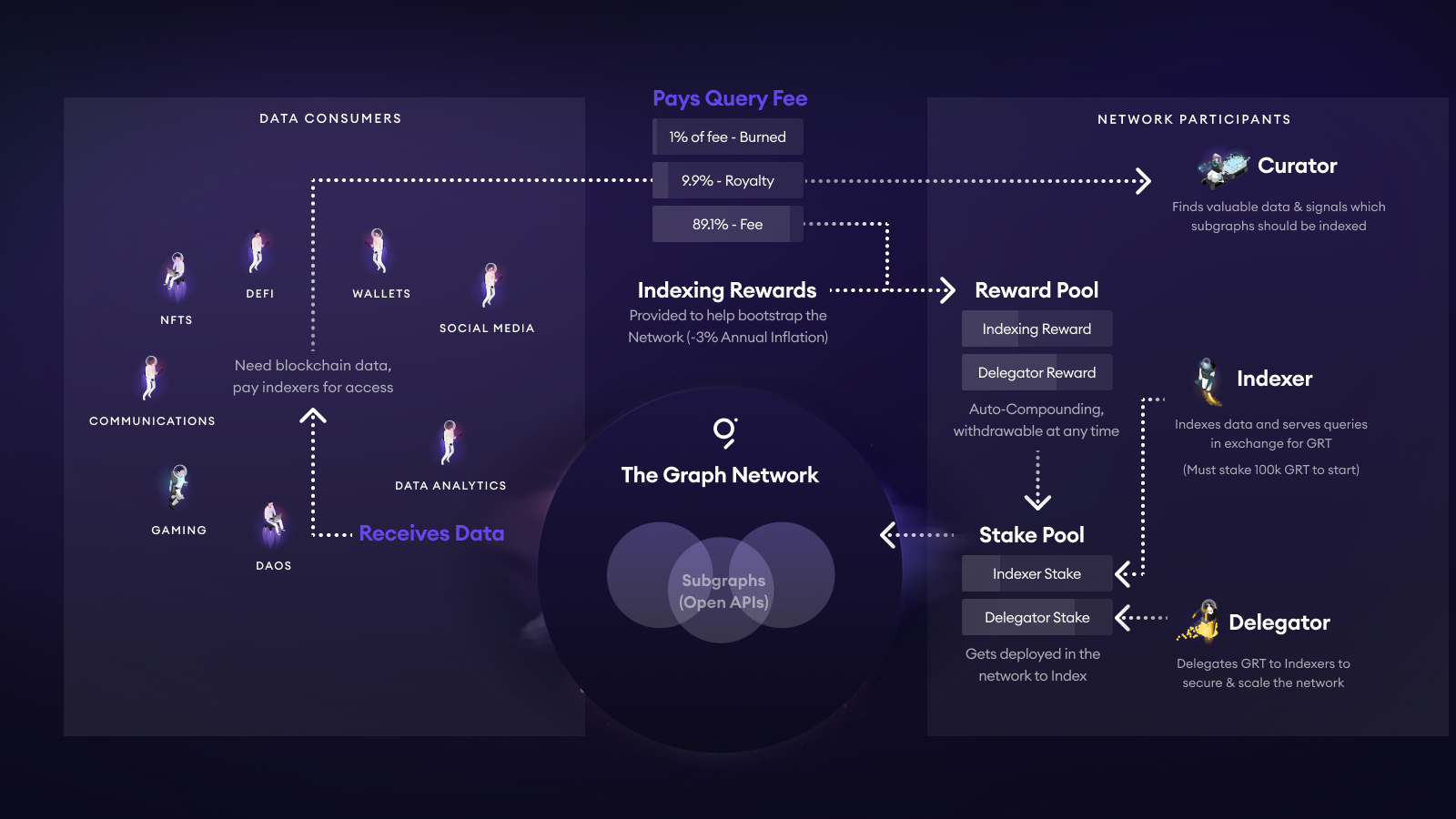

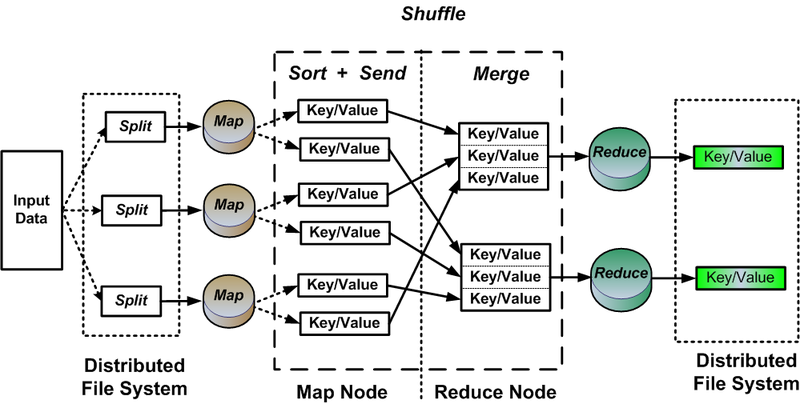

7. The Graph (GRT)

What It Is

Decentralized data indexing protocol.

Token Role

Indexers stake GRT; consumers pay query fees.

Strengths

- Real usage

- Cross-chain demand

- Clear value loop

Risks

- Not AI-exclusive

- Margins sensitive to competition

Score Snapshot

Token Necessity: 4

Demand Flywheel: 4

Value Capture: 4

Moat: 4

Verdict: Infrastructure backbone, AI-adjacent but durable.

8–10: Smaller Cap AI-Category Tokens

Projects such as Story (IP), Kite (KITE), and Pippin (PIPPIN) are earlier-stage and narrative-driven relative to the above names.

Common characteristics:

- Higher FDV vs circulating supply

- Limited measurable demand

- Narrative-dependent price action

These require asymmetric belief in future ecosystem growth.

Sector Segmentation: Stop Lumping Them Together

AI tokens fall into five structural buckets:

- Decentralized Model Networks – Bittensor

- Compute Marketplaces – Render

- Agent Protocols – ASI, Virtuals

- Data / Indexing Rails – The Graph

- General Infra (AI-Adjacent) – NEAR, ICP

Different buckets imply different valuation frameworks.

You wouldn’t value AWS, Nvidia, and OpenAI the same way. The same applies here.

Winners, Watchlist, Avoid

🟢 Winners (Structural Alignment + Token Value Capture)

- Bittensor (TAO)

- Render (RENDER)

- The Graph (GRT)

Common traits:

- Clear token necessity

- Demand-linked staking or fee loops

- Measurable usage proxies

🟡 Watchlist (Narrative + Execution Risk)

- Artificial Superintelligence Alliance (FET)

- Virtuals Protocol (VIRTUAL)

- Select small-cap agent plays

These depend on:

- Agent monetization

- Developer ecosystem growth

- Non-speculative demand emergence

🔴 Avoid (For Now)

- General-purpose chains branded as “AI plays”

- High-FDV, low-circulating tokens without revenue signals

- Projects where AI is marketing, not mechanism

The Core Insight

The investable question isn’t:

“Is AI big?”

It’s:

“Where does AI demand settle — compute, models, agents, or data — and does the token capture that demand?”

Most tokens fail on value capture mechanics.

The winners will be:

- The protocols that own scarce coordination layers.

- The networks where usage directly tightens float.

- The marketplaces where liquidity compounds.

Everything else is reflexive beta.

Final Thought

AI will reshape software. But in crypto, the real competition isn’t about building the smartest model.

It’s about designing the strongest economic network around intelligence.

And only a handful of AI tokens are structurally positioned to survive once the narrative cools.

If this cycle matures, expect capital to rotate from “AI narrative tokens” to “AI revenue tokens.”

The distinction will matter.