The crypto market delivered a week packed with volatility, macro crosscurrents, institutional headlines, and renewed debate about whether this cycle still has structural strength underneath it. Between February 7 and February 14, 2026, traders experienced sharp drawdowns, aggressive short-term rebounds, and a broader sense of uncertainty that continues to define Q1.

This weekly breakdown will walk through Bitcoin price action, Ethereum momentum, altcoin rotation, institutional developments, and the evolving crypto market outlook as we head deeper into 2026.

Bitcoin: Testing Structure Around $60K–$70K

The dominant story of the week was Bitcoin volatility.

Bitcoin opened the week under pressure, with aggressive selling pushing price toward the $60,000 region — a level many traders had been watching as critical structural support. This move triggered liquidations across leveraged positions and intensified debate around whether the market is entering a broader crypto correction phase.

By midweek, BTC staged a partial recovery, climbing back into the $68,000–$70,000 range. However, price action remained choppy. Instead of a clean breakout, the market entered a consolidation pattern beneath psychological resistance at $70K.

From a technical perspective, this week reinforced several key realities:

- $60K–$62K remains a major Bitcoin support level

- $70K continues acting as strong overhead resistance

- Momentum indicators remain neutral-to-weakened on higher timeframes

- Volatility compression suggests a larger move may be brewing

On-chain metrics added another layer. While long-term holders have not shown broad capitulation, short-term holders appear increasingly sensitive to macro signals. This dynamic creates a fragile balance — strong long-term conviction underneath, but reactive short-term positioning on top.

For traders, this week highlighted the importance of risk management in crypto trading. Whipsaw conditions punished overleveraged positions on both sides.

The broader question remains: is this a healthy reset within a larger bull structure — or the early phase of a deeper retracement?

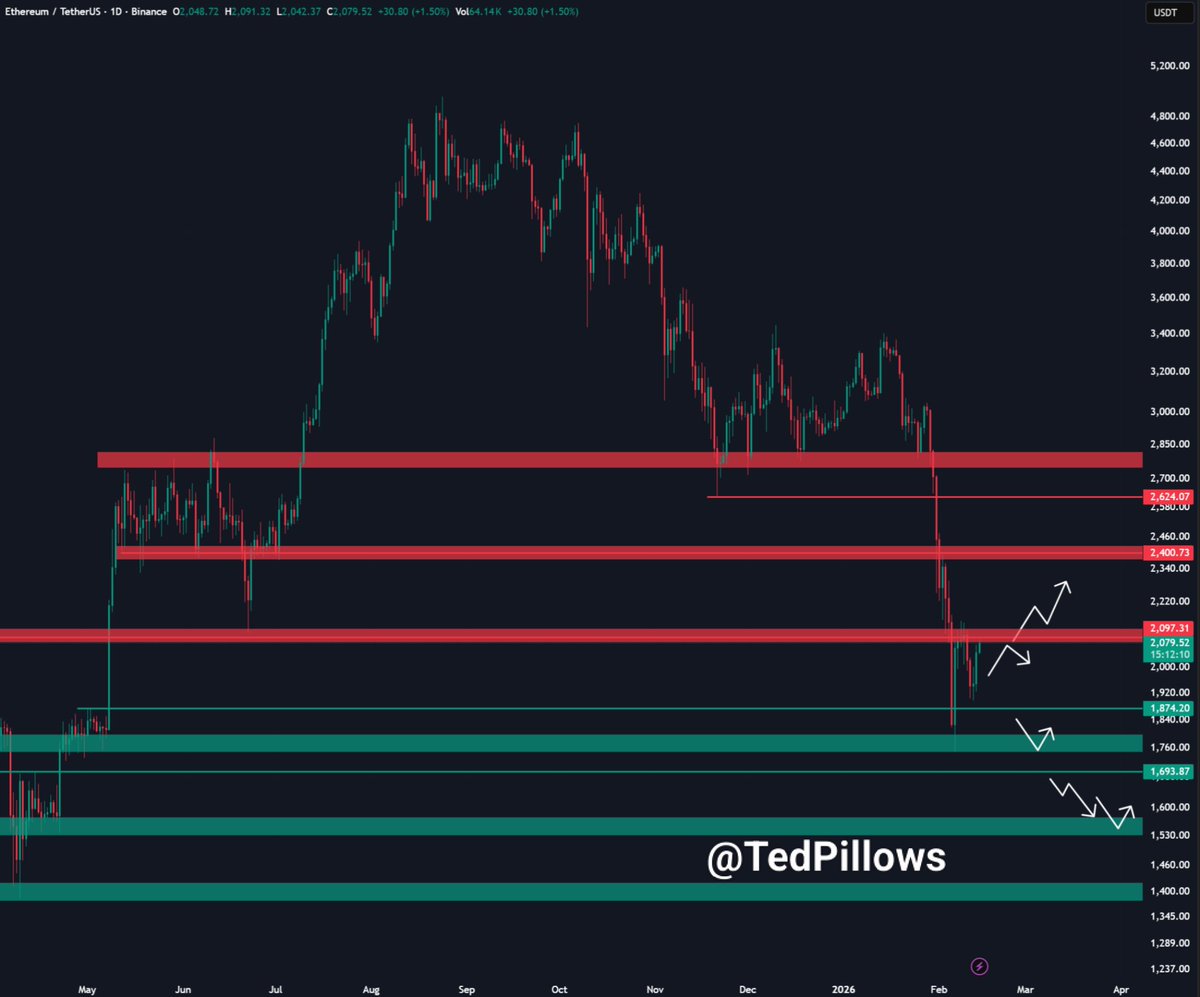

Ethereum: Mirroring Bitcoin but Lagging Momentum

Ethereum largely mirrored Bitcoin’s movement but showed slightly weaker momentum relative to BTC.

After dipping earlier in the week, ETH stabilized in the low-to-mid $2,000 range. Traders are closely watching the $2,000 level as a key structural pivot. A sustained break below that zone could accelerate downside pressure, while reclaiming $2,200–$2,300 would restore bullish momentum.

From a broader lens, Ethereum price prediction 2026 conversations have shifted toward caution. While long-term narratives around staking, scaling, and institutional adoption remain intact, short-term liquidity conditions are dominating price action.

Key developments this week:

- ETH correlation with BTC remains high

- Spot demand appears stable but not aggressive

- Volatility spikes align closely with macro headlines

- Altcoin capital rotation remains selective

Ethereum’s relative performance compared to Bitcoin will likely determine whether we see renewed altcoin season momentum — or further capital concentration back into BTC dominance.

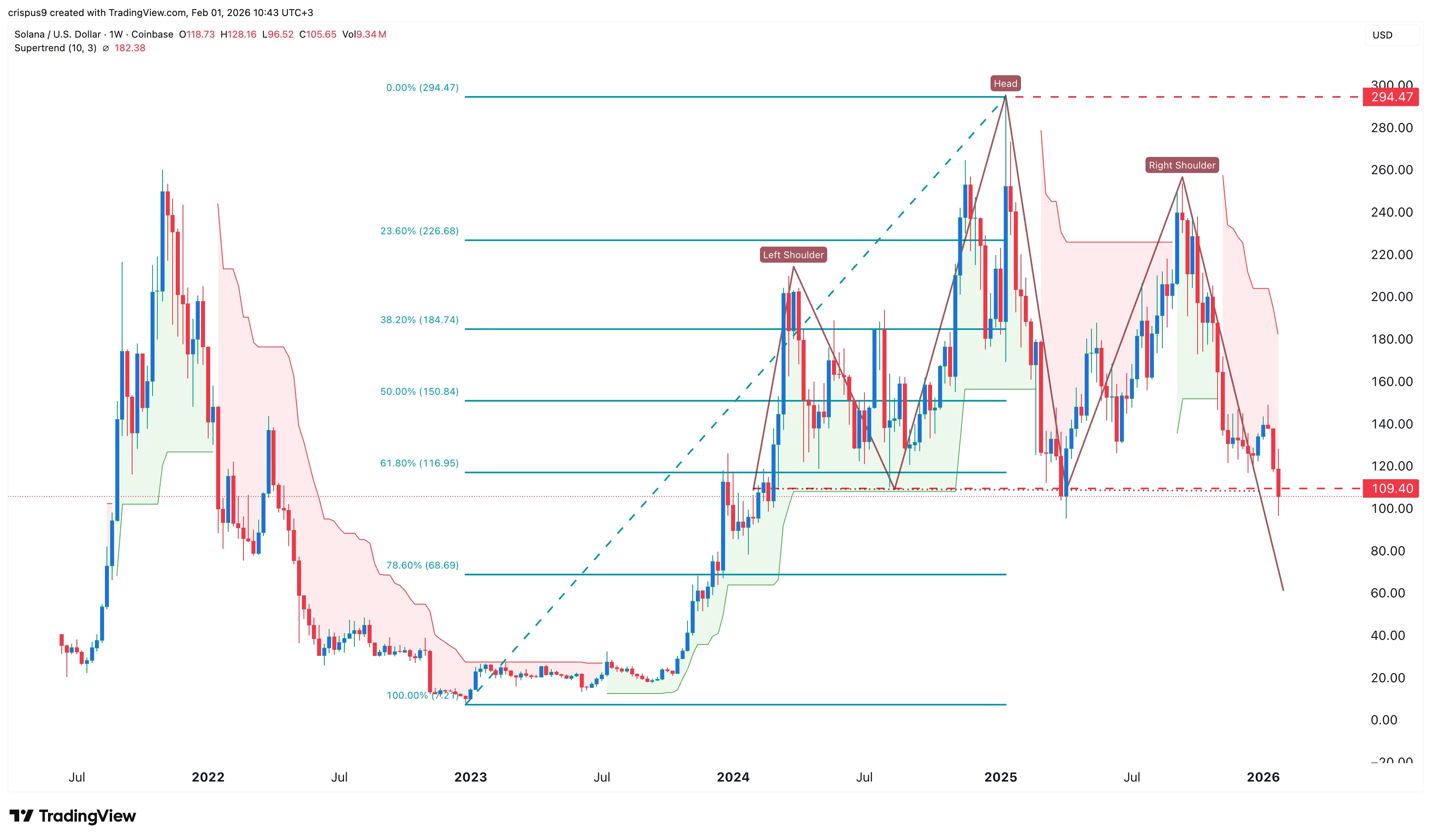

Altcoins: Selective Strength, No Full Rotation Yet

While the broader market felt unstable, certain altcoins showed resilience.

Solana posted double-digit percentage swings during the week, bouncing aggressively off local support zones. Meanwhile, XRP held structural levels better than many mid-cap assets.

However, this was not a broad-based altcoin breakout.

The altcoin landscape showed:

- High intraday volatility

- Rapid rotation between sectors

- Selective inflows rather than market-wide expansion

- Traders favoring liquid large-cap alternatives

Smaller cap tokens continued to underperform during risk-off sessions. This reinforces an ongoing 2026 theme: institutional and professional capital tends to concentrate in high-liquidity names during uncertainty.

For those tracking crypto market dominance, Bitcoin’s share of total market cap remains elevated compared to historical altcoin-heavy phases. Until BTC either breaks decisively higher or confirms a clear bottom, widespread altcoin momentum may remain muted.

Institutional Developments: Pressure and Participation

Institutional headlines added complexity to this week’s narrative.

Coinbase reported a significant quarterly loss, highlighting the sensitivity of exchange revenues to declining trading volume and compressed volatility conditions earlier in the quarter. While not unexpected, the headline reinforced that even major players are navigating margin pressure during consolidation phases.

Meanwhile, reports indicated that Binance continued adding to Bitcoin holdings. Whether interpreted as strategic accumulation or balance sheet management, it reinforces that major exchanges and institutional participants remain structurally engaged.

Institutional crypto adoption in 2026 has matured compared to earlier cycles. Instead of speculative hype cycles, we are witnessing:

- More measured capital allocation

- Increased regulatory oversight discussions

- Sophisticated derivative hedging strategies

- Greater emphasis on liquidity management

However, institutional involvement does not eliminate volatility — it simply changes its structure. Moves can become sharper and more mechanically driven due to derivative positioning and algorithmic strategies.

Macro Backdrop: Inflation, Risk Assets, and Liquidity

This week’s macro data offered temporary relief.

Inflation readings came in cooler than expected, briefly supporting risk assets, including crypto. Yet the reaction was muted. The market’s inability to sustain a breakout despite favorable macro news signals underlying fragility.

Key macro themes affecting the crypto market outlook 2026:

- Persistent liquidity concerns

- Correlation with equity volatility

- Cautious Federal Reserve posture

- Reduced speculative leverage compared to peak cycle highs

Crypto remains highly sensitive to broader risk sentiment. When equities wobble, digital assets tend to amplify the move. When macro improves, crypto rallies — but often struggles to hold gains without sustained capital inflows.

This dynamic suggests that crypto is behaving less like an isolated alternative asset and more like a high-beta macro instrument.

Market Psychology: Capitulation or Controlled Correction?

One of the most important undercurrents this week was sentiment.

Social metrics, funding rates, and derivatives positioning indicate growing caution — but not full capitulation.

True crypto market capitulation typically involves:

- Sharp multi-day liquidations

- Extreme negative funding

- Panic-driven spot selling

- High-volume flushes through major support

While this week contained elements of stress, the structure resembles more of a controlled correction within a larger trend.

That said, analysts have floated bearish scenarios projecting potential revisits of deeper support levels if macro conditions deteriorate. These forecasts range widely — from moderate pullbacks to more aggressive downside targets.

The market currently sits in a zone of indecision. Bulls argue structural adoption and institutional involvement provide a floor. Bears counter that liquidity remains thin and macro risk persists.

Both arguments hold merit.

Key Technical Levels to Watch

As we close the week, traders are focused on several pivotal levels:

Bitcoin

- Support: $60K–$62K

- Resistance: $70K–$72K

- Break above $72K could trigger momentum expansion

- Break below $60K could accelerate downside

Ethereum

- Support: $2,000

- Resistance: $2,250–$2,300

- Failure to hold $2K could shift sentiment sharply

Market structure often hinges on these psychological thresholds. Consolidation beneath resistance typically leads to either explosive breakouts or equally sharp breakdowns.

Total Market Capitalization and Liquidity Conditions

The total crypto market capitalization remains below previous euphoric highs, hovering in a stabilization phase. Liquidity remains present but not abundant.

During this week:

- Market cap contracted early

- Partial recovery followed

- Net weekly performance remains mixed

- Stablecoin dominance rose modestly during volatility spikes

When stablecoin balances increase on exchanges, it often signals traders preparing for either buying opportunities or defensive positioning.

This week’s pattern suggests caution rather than panic.

What This Means for Traders and Investors

For active traders, this week reinforced three core principles:

- Volatility is structural, not temporary

- Position sizing matters more than prediction

- Liquidity pockets drive short-term price swings

For longer-term investors, the broader thesis around digital asset adoption, institutional participation, and macro hedging remains intact — but patience is required.

Crypto in 2026 is more mature, more integrated with traditional finance, and more reactive to macro liquidity cycles than previous eras.

That maturity reduces pure speculation — but increases correlation with broader markets.

Final Thoughts: The Calm Before the Next Move?

The week of February 7–14, 2026, can best be described as transitional.

We saw:

- A sharp early-week drawdown

- Partial recovery into consolidation

- Institutional headlines reinforcing participation

- Macro data offering mixed relief

- Sentiment leaning cautious but not broken

Markets rarely stay compressed for long. Consolidation near major levels often precedes expansion.

The next decisive move in Bitcoin price action will likely set the tone not just for the remainder of February — but potentially for the entire quarter.

For now, discipline outweighs prediction.

Crypto remains volatile. Structure remains intact — but fragile. Institutional involvement remains steady — but not euphoric.

And as always in this market, patience rewards those who understand that volatility is not a flaw — it is the feature.