The crypto exchange landscape is shifting again.

For years, centralized exchanges dominated everything: liquidity, leverage, onboarding, and global user growth. But in 2026, a new pattern is emerging. Traders—especially experienced ones—are migrating toward high-performance decentralized exchanges.

And one name keeps coming up in serious trading circles:

Hyperliquid.

The rise of Hyperliquid decentralized exchange isn’t loud. It’s not hype-driven. It’s not retail-fueled mania.

It’s structural.

Let’s break down why Hyperliquid trading volume is growing, how its model differs from centralized competitors, and why this could signal a deeper transformation in the crypto derivatives market.

The Centralized Exchange Model Is Showing Cracks

Centralized exchanges (CEXs) offer convenience. Fast onboarding. Fiat ramps. Customer support.

But they also come with structural risk.

Recent years have exposed several weaknesses:

- Custodial control of user funds

- Opaque market-making relationships

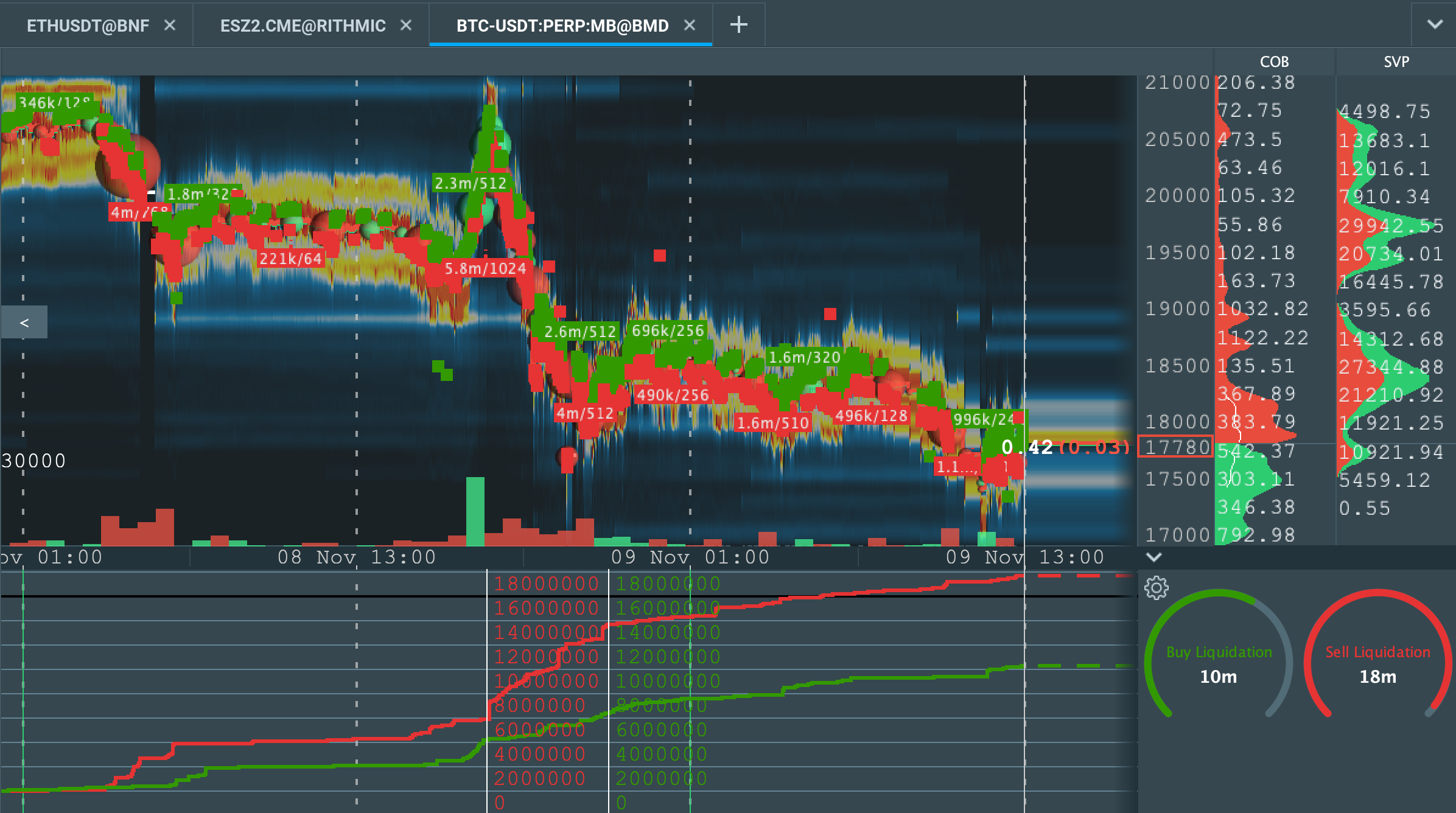

- Sudden liquidation cascades

- Regulatory intervention risk

- Trading halts during volatility

Many traders learned the hard way that “not your keys, not your coins” isn’t just a slogan.

When you trade on a centralized platform, you are trusting the exchange’s risk engine, liquidity providers, and compliance decisions. If they freeze withdrawals or halt trading during extreme volatility, your position is stuck.

This has led to growing interest in non-custodial crypto trading platforms.

And that’s where Hyperliquid enters the picture.

What Is Hyperliquid and Why Traders Are Paying Attention?

Hyperliquid decentralized exchange is a high-performance derivatives DEX focused primarily on perpetual futures trading.

Unlike many early decentralized exchanges that struggled with speed and slippage, Hyperliquid is built for serious traders.

Key characteristics include:

- Fully onchain order book

- High throughput matching engine

- Deep perpetual futures liquidity

- Transparent risk engine

- Non-custodial wallet connection

The platform doesn’t feel like a typical DEX.

It feels like a centralized exchange—without centralized custody.

For traders used to Binance or Bybit interfaces, the transition feels surprisingly smooth.

And that frictionless experience matters.

The Performance Gap Between DEX and CEX Is Closing

Historically, centralized exchanges won on performance.

DEXs were:

- Slower

- More expensive

- Thinner liquidity

- Prone to MEV and slippage

That gap is narrowing fast.

Hyperliquid’s infrastructure is designed specifically for high-speed crypto derivatives trading. Instead of relying on fragmented liquidity pools, it operates more like a professional matching engine—yet remains onchain.

This hybrid approach eliminates one of the biggest psychological barriers traders had about decentralized trading:

Execution quality.

When spreads are tight and slippage is minimal, traders stop caring whether it’s technically “decentralized.” They care about fills.

Hyperliquid is delivering competitive execution.

And execution is everything in leverage trading.

Transparency: The Risk Engine Is Visible

One of the most underappreciated advantages of decentralized exchanges is transparency.

On centralized platforms, liquidation algorithms are proprietary. You don’t see how margin calculations are structured. You don’t see how insurance funds operate in real time.

With Hyperliquid, much of the onchain derivatives trading data is publicly verifiable.

This changes trader psychology.

When you can audit risk parameters and see collateral flows, you reduce counterparty uncertainty.

In volatile markets, that confidence matters more than marketing.

For advanced traders managing large leverage positions, knowing how the risk engine functions can mean the difference between trust and suspicion.

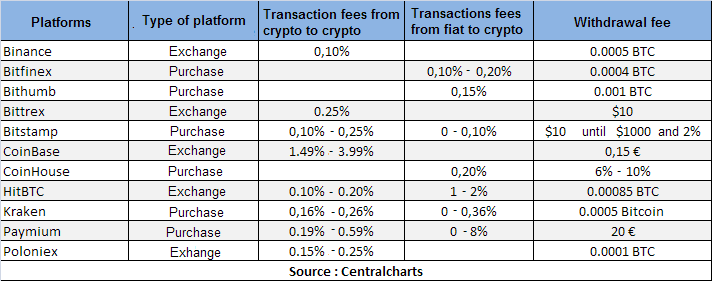

Fee Structures and Incentives Are Attracting Professionals

Professional traders calculate everything.

Fees. Funding. Rebates. Liquidity depth.

Hyperliquid’s model includes competitive fee tiers and incentive structures that reward active traders.

On centralized exchanges, fee discounts often depend on holding exchange tokens or maintaining VIP volume tiers. That works—but it centralizes power further.

Hyperliquid’s incentives are more aligned with usage and liquidity contribution.

This is particularly appealing to traders who:

- Don’t want token lockups

- Prefer transparent funding rates

- Value predictable cost structures

In derivatives markets, small fee differences compound dramatically over time.

For high-volume traders, migrating to a platform with tighter economics isn’t ideological—it’s rational.

Regulatory Pressure Is Pushing Traders Toward DEXs

The global regulatory environment is tightening.

Centralized exchanges face increasing scrutiny regarding:

- KYC enforcement

- Leverage limits

- Derivatives restrictions

- Regional trading bans

As governments attempt to formalize crypto derivatives regulation, centralized platforms must comply.

That compliance often results in:

- Reduced leverage caps

- Product restrictions

- Geographic blocking

DEXs operate differently.

While they are not immune to regulation, their architecture reduces single points of enforcement.

For traders seeking flexibility, this matters.

Hyperliquid offers an alternative route to global derivatives access—without traditional custodial constraints.

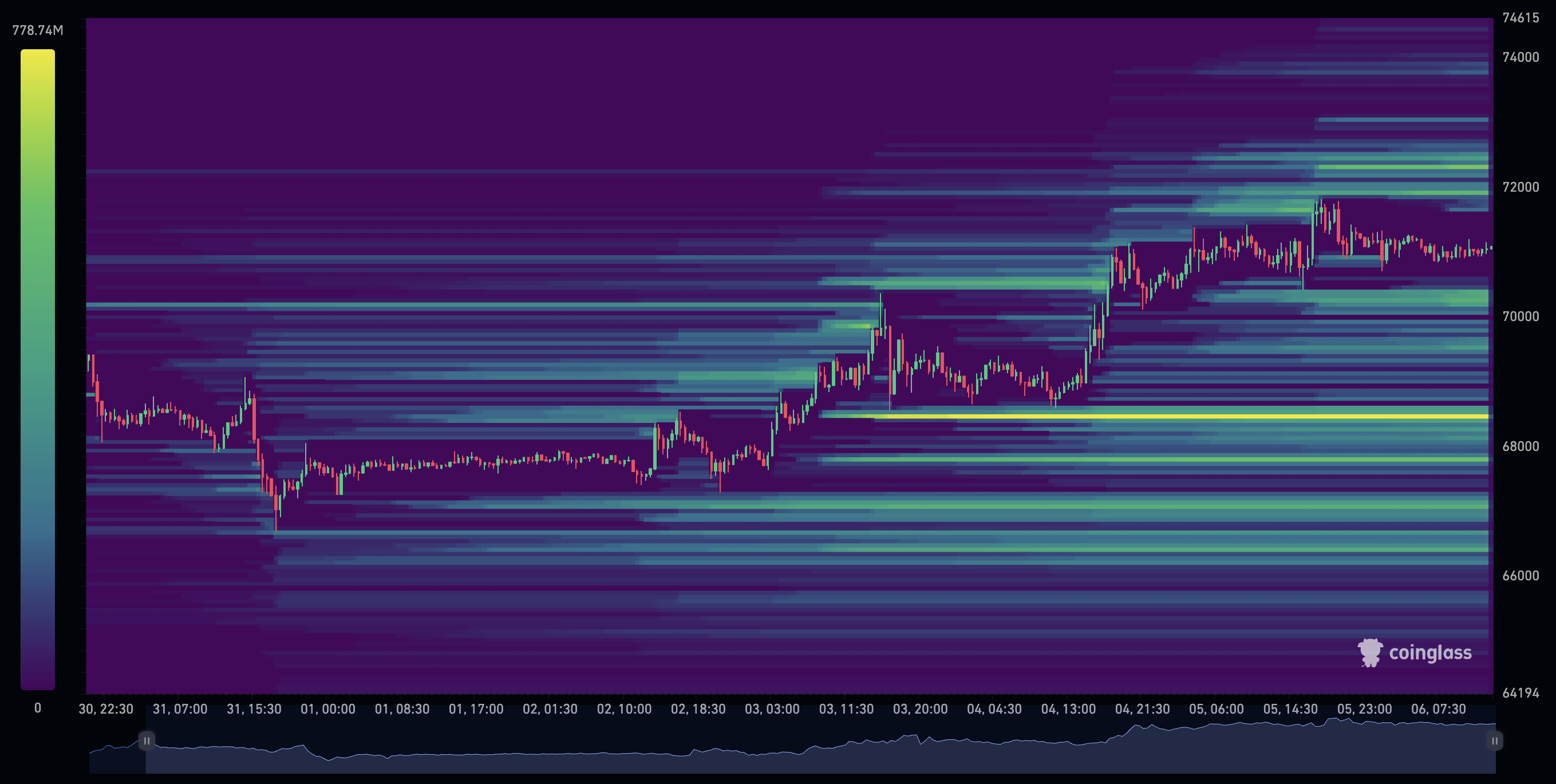

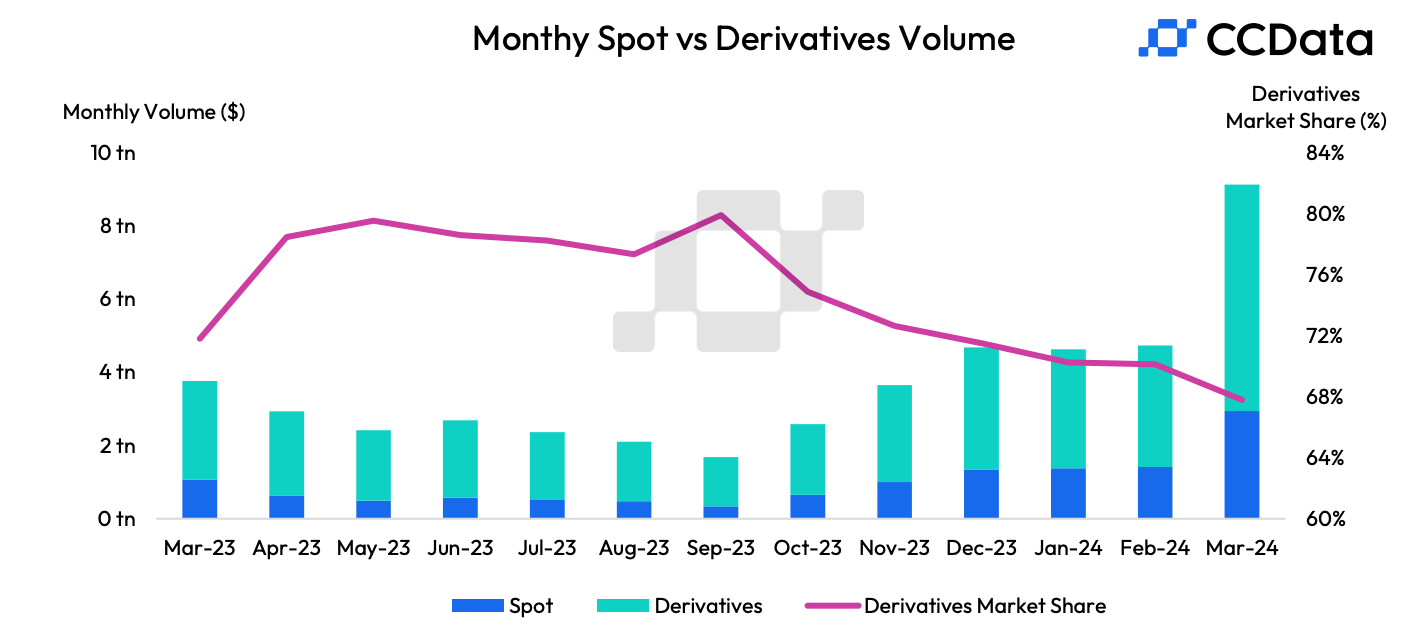

Liquidity Migration Is the Real Signal

Market share is not determined by narratives.

It’s determined by liquidity.

As Hyperliquid trading volume increases and open interest grows, a feedback loop begins:

More liquidity → tighter spreads → more traders → deeper markets → more liquidity.

This network effect is what built Binance in its early days.

Now, we’re seeing a decentralized version of that flywheel forming.

Liquidity migration rarely happens overnight.

It happens gradually—then suddenly.

When professional traders move first, retail often follows later.

Is This the Beginning of a Structural Shift?

The rise of Hyperliquid may not signal the end of centralized exchanges.

But it does signal competition at a level that didn’t exist before.

If decentralized derivatives platforms can deliver:

- Comparable execution

- Competitive fees

- Transparent risk management

- Sufficient liquidity

Then the original argument for centralized dominance weakens.

This isn’t about ideology.

It’s about efficiency.

Markets naturally gravitate toward structures that reduce counterparty risk while preserving performance.

Hyperliquid is attempting to offer both.

Final Thoughts: Why Traders Should Pay Attention

Most retail traders chase price.

Professional traders watch infrastructure.

The real shifts in crypto don’t begin with memes. They begin with liquidity and architecture.

The growth of Hyperliquid decentralized exchange suggests something deeper is happening in the derivatives market.

We are watching:

- Custodial risk being questioned

- Performance parity between DEX and CEX

- Transparent risk engines gaining appeal

- Regulatory friction pushing migration

- Liquidity redistributing

Centralized exchanges will not disappear.

But their monopoly on serious trading may be ending.

For traders serious about leverage, execution, and structural risk, ignoring this shift would be a mistake.

The quiet migration has already begun.

The only question is how long before everyone notices.