For over a decade, cryptocurrency represented financial rebellion.

It stood for decentralization, censorship resistance, and independence from banks and governments. Early adopters believed they were participating in a monetary revolution.

But in 2026, the landscape looks very different.

Crypto is no longer knocking at the doors of traditional finance.

It has a seat at the table.

The real question now is not whether crypto will disrupt the establishment — it’s whether it has already become part of it.

From Cypherpunk Roots to Institutional Capital

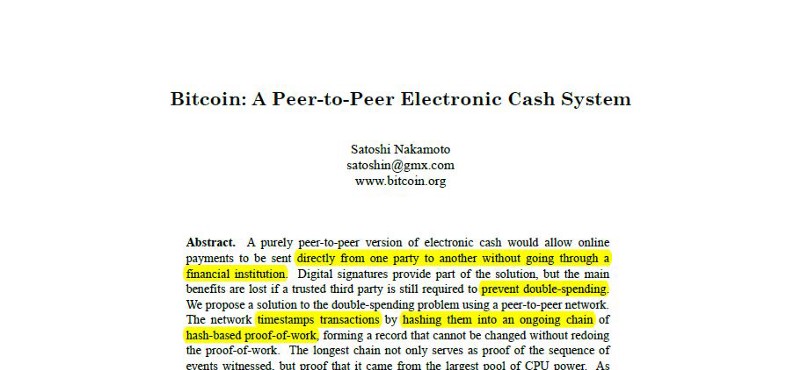

Bitcoin’s origins were deeply ideological.

The whitepaper introduced a peer-to-peer system designed to eliminate reliance on trusted intermediaries. The early community was driven by privacy advocates, programmers, and libertarian thinkers who viewed traditional finance as fragile and centralized.

Crypto was not just an asset — it was a statement.

Fast forward to today.

Major asset managers allocate capital to digital assets. Pension funds evaluate exposure. Public companies hold Bitcoin as treasury reserves.

What began as a technological protest has matured into an institutional allocation strategy.

Capital didn’t just enter crypto.

It reshaped it.

The ETF Era Changed Everything

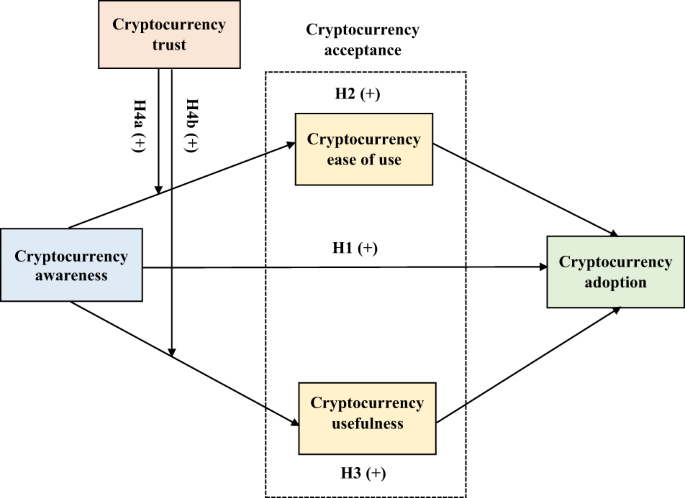

The introduction of regulated exchange-traded products marked a structural shift.

Bitcoin became accessible through brokerage accounts. Advisors could recommend exposure without requiring clients to manage private keys or wallets.

This move normalized crypto within traditional portfolios.

Instead of being an outsider asset traded primarily on offshore exchanges, Bitcoin now trades alongside equities and bonds in conventional investment vehicles.

Institutional flows altered market structure.

Liquidity deepened.

Volatility patterns shifted.

Macro sensitivity increased.

Crypto began behaving less like an isolated experiment and more like a global risk asset.

That’s not rebellion.

That’s integration.

Corporate Balance Sheets and the Treasury Strategy

There was a time when corporate Bitcoin holdings sounded reckless.

Now it’s a treasury strategy.

Public companies have integrated digital assets into balance sheets as long-term reserves or strategic holdings. This move blurred the line between crypto-native ideology and corporate capital management.

When boardrooms discuss Bitcoin alongside cash equivalents and debt issuance, something fundamental has changed.

The asset no longer lives outside the system.

It operates within it.

Once crypto becomes part of quarterly earnings calls, it transitions from protest to policy.

Regulation: The Ultimate Sign of Legitimacy

Regulators do not ignore irrelevant technologies.

The increasing frequency of digital asset discussions in legislative chambers signals recognition.

Governments are no longer debating whether crypto should exist.

They are determining how it fits into existing financial frameworks.

Clear regulatory guidelines invite institutional capital. Compliance reduces uncertainty. Oversight stabilizes infrastructure.

Ironically, the same regulatory presence once feared by early adopters now strengthens crypto’s permanence.

When policy forms around an asset class, it becomes embedded in national financial architecture.

That is establishment status.

Stablecoins and the Banking Parallel

Stablecoins began as tools for crypto traders — digital dollars moving across blockchains.

Today, they resemble parallel banking systems.

They hold reserves.

They manage liquidity.

They operate under increasing oversight.

The distinction between a regulated bank deposit and a fully collateralized stablecoin continues to narrow.

Rather than replacing banks, stablecoins may become digital extensions of traditional finance.

That’s evolution — not revolution.

Market Structure: Who Really Moves Price Now?

Earlier cycles were heavily driven by retail leverage and speculative enthusiasm.

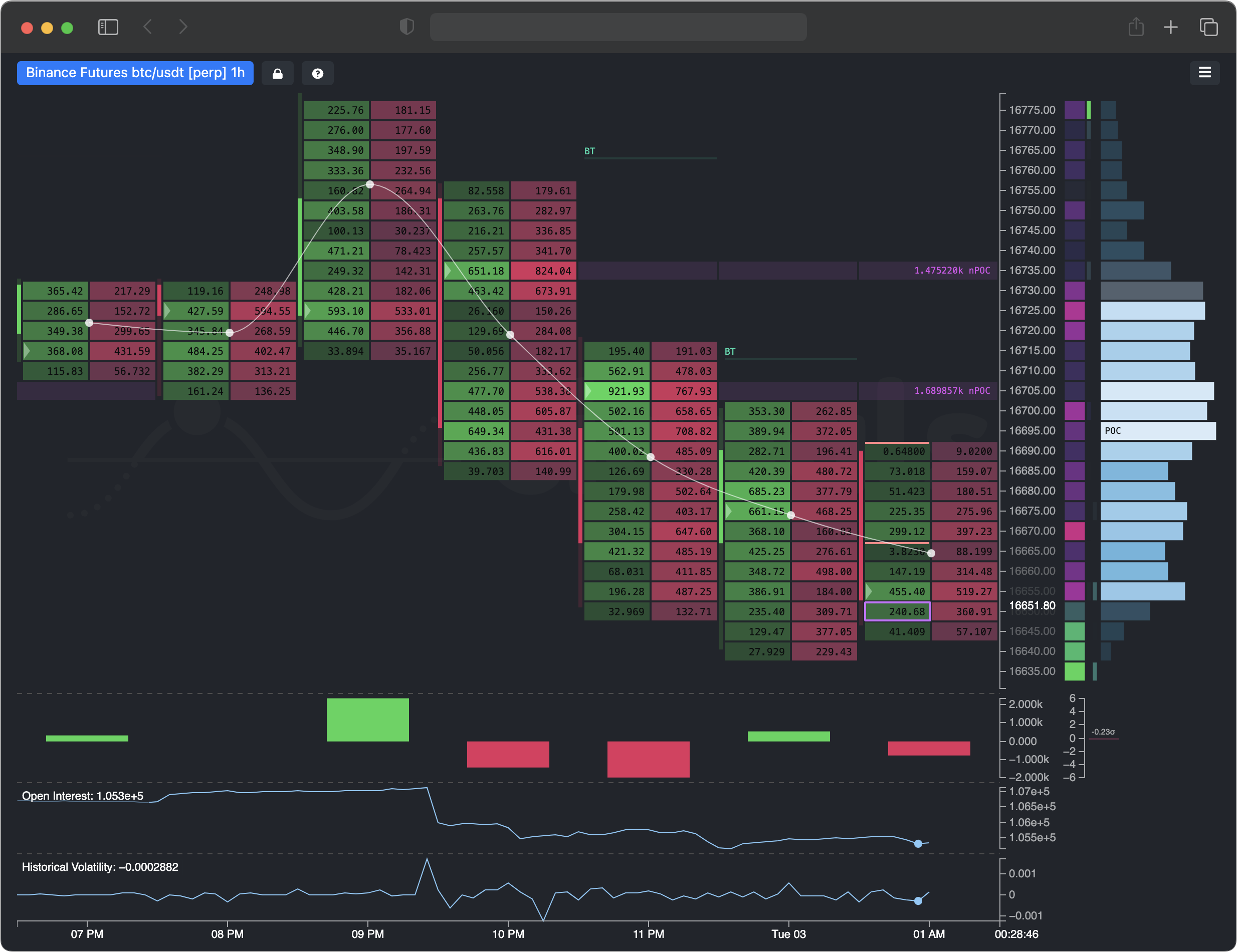

Today’s structure is different.

Institutional desks deploy algorithmic strategies. Derivatives markets are deeper and more sophisticated. Macro events — interest rate changes, liquidity tightening, global risk shifts — increasingly influence crypto prices.

Correlation with traditional markets has strengthened during risk-off events.

Crypto now reacts to the same macro variables that drive equities and bonds.

When digital assets move with global liquidity cycles, they are participating in the broader financial ecosystem.

That’s not outsider behavior.

That’s systemic integration.

Decentralization vs. Operational Reality

Decentralization remains foundational.

But operationally, concentration exists.

Large custodians manage significant supply. Major exchanges aggregate liquidity. Institutional staking providers oversee meaningful validator participation.

Access points often remain centralized even if the base layer protocol is distributed.

This tension doesn’t negate decentralization — it highlights maturity.

Every transformative technology eventually intersects with centralized infrastructure for scale and compliance.

Crypto is no exception.

The Psychological Shift

Perhaps the most significant evolution is psychological.

Early adopters saw themselves as part of a movement.

New participants often see crypto as:

• A growth asset

• A diversification tool

• A trading instrument

The ideological intensity has softened.

Narrative energy now focuses on returns and risk management rather than rebellion.

When mindset shifts from protest to performance, markets mature.

And maturity is what establishments are built on.

Has the Revolution Failed — or Succeeded?

Some argue integration equals co-option.

Others argue it equals validation.

If digital assets are debated by lawmakers, allocated by institutions, integrated into corporate strategies, and embedded into payment rails, then they are no longer fringe.

They are foundational.

True disruption often ends not in destruction, but in adoption.

Crypto didn’t tear down the system.

It embedded itself within it.

That may be a greater achievement.

What This Means for Retail Traders

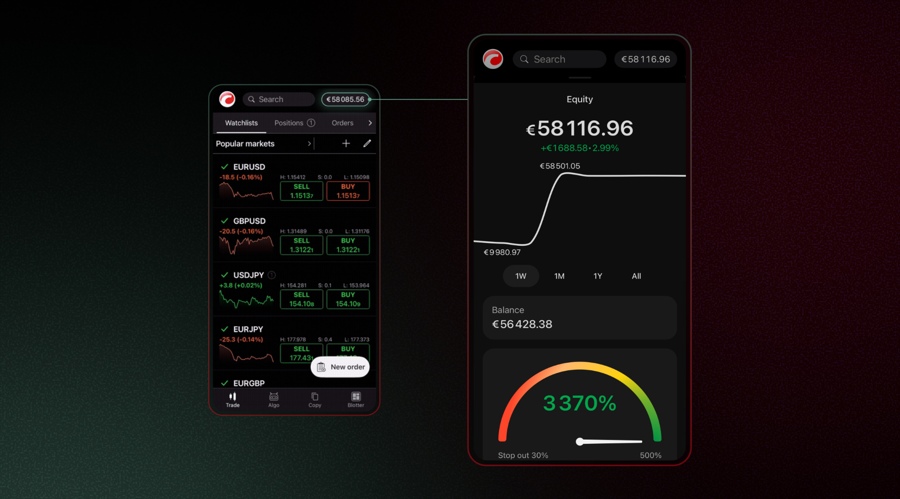

For independent traders, adaptation is key.

Volatility cycles may lengthen. Institutional capital often dampens extreme moves while still allowing structural trends.

Macro awareness becomes critical. Liquidity conditions, regulatory developments, and global risk appetite increasingly influence price direction.

Opportunity remains — but the dynamics evolve.

Understanding that crypto now operates inside the financial system rather than outside it changes strategic positioning.

Awareness creates edge.

The New Establishment

Crypto is no longer invisible to power structures.

It is integrated into payment systems.

Modeled in financial institutions.

Debated in policy frameworks.

Held on corporate balance sheets.

The rebellious phase built awareness.

The institutional phase builds permanence.

Digital assets have crossed the threshold from outsider innovation to embedded infrastructure.

Crypto doesn’t stand outside the walls anymore.

It helps shape the architecture within them.

Final Thoughts

Financial history follows a pattern:

- Innovation emerges at the edge.

- Capital recognizes opportunity.

- Institutions adapt.

- Integration follows.

Crypto has entered stage four.

Whether viewed as compromise or confirmation, the transition is undeniable.

The anti-establishment era sparked the fire.

The establishment era sustains it.

And for traders and investors who recognize the shift early, understanding this evolution may be more valuable than any single trade.