Introduction: A Structural Shift, Not a Narrative Trade

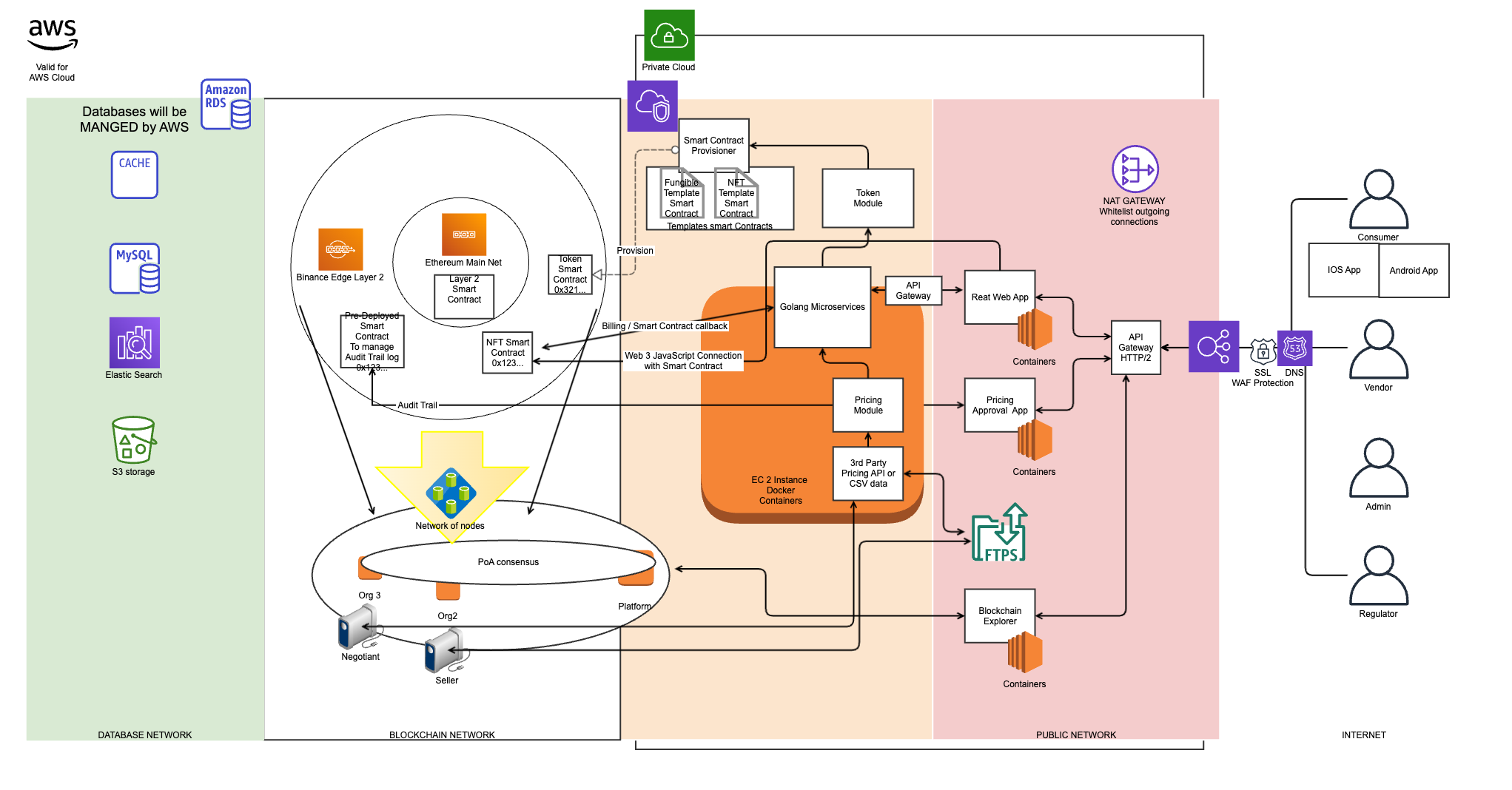

For years, institutional participation in crypto markets was discussed in hypotheticals. Futures products, trusts, and over-the-counter desks offered partial exposure, but friction remained high. That changed when tokenized exchange-traded products began to intersect directly with spot crypto markets.

This isn’t just another inflow story. Tokenized ETFs represent a new liquidity pathway, one that alters volatility profiles, correlation regimes, and market structure in ways active traders cannot ignore. Unlike retail-driven cycles, these instruments introduce rule-based capital, constrained flows, and predictable rebalance behavior.

This article breaks down how tokenized ETFs work, who is issuing them, how capital actually moves, and what edge traders can extract from this transition.

What Are Tokenized ETFs (And Why They Matter to Traders)?

Tokenized ETFs are blockchain-based representations of traditional exchange-traded funds or fund-like vehicles that track crypto assets or baskets. Unlike legacy ETFs, these products can:

- Settle faster (sometimes near-instant)

- Trade across extended hours

- Interact with on-chain liquidity

- Be integrated into DeFi infrastructure

From a trader’s perspective, the key distinction isn’t branding — it’s flow mechanics.

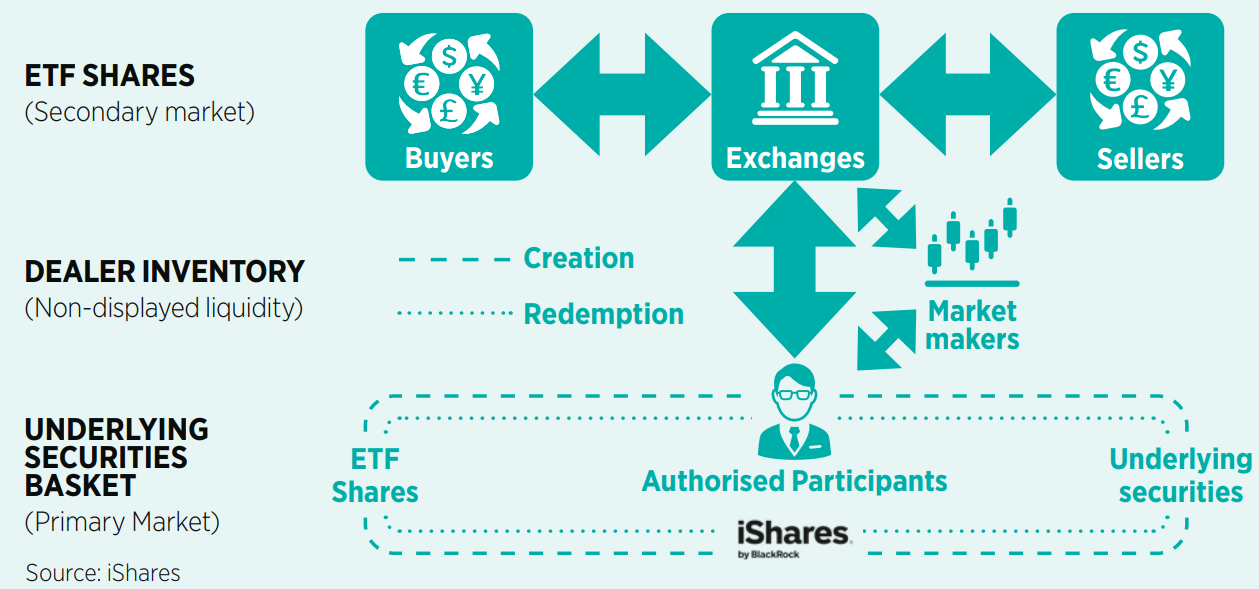

ETF capital does not behave like discretionary trading capital. It moves through:

- Scheduled creations/redemptions

- Rebalance windows

- Mandated allocation constraints

That predictability introduces tradable signals, especially around volatility compression, basis shifts, and correlation changes.

The Players Driving Tokenized ETF Adoption

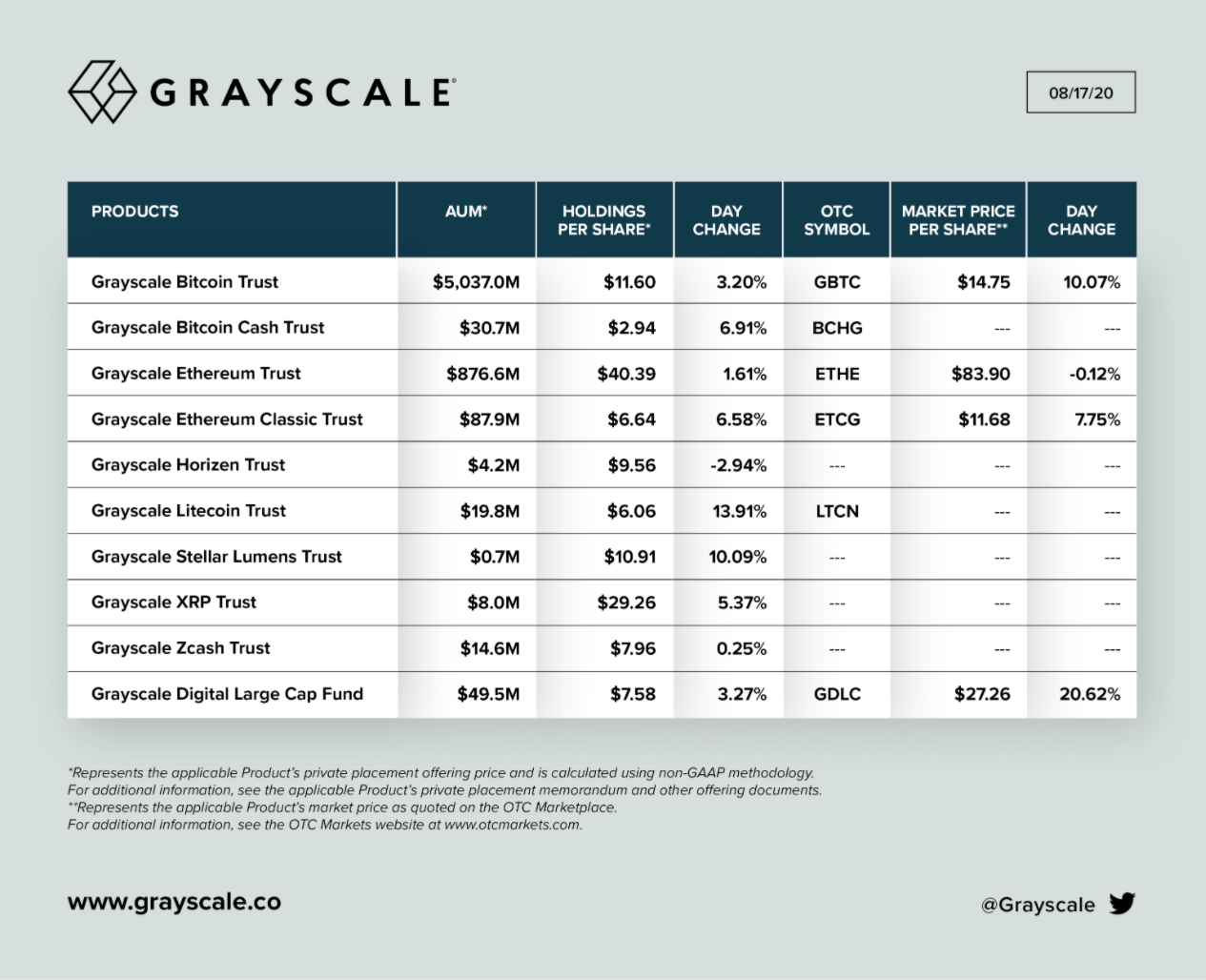

Institutional issuance is not theoretical anymore. Major asset managers are already shaping this market, including BlackRock, Grayscale, and Franklin Templeton.

Each approaches tokenization differently:

- Some tokenize exposure while custody remains off-chain

- Others issue on-chain shares backed by traditional custodians

- A few experiment with direct blockchain settlement layers

For traders, issuer identity matters because it determines:

- Credibility and capital scale

- Redemption efficiency

- Market confidence during drawdowns

Large issuers reduce tail-risk narratives but increase systematic flow dominance, which tends to suppress explosive upside while deepening liquidity.

How Capital Actually Enters the Market

Understanding ETF flows requires separating headline inflows from market impact.

ETF inflows do not always mean spot buying:

- Authorized participants may hedge via futures

- Exposure may be netted internally

- Creations can lag underlying demand

However, when tokenized ETFs interact with on-chain markets, arbitrage loops tighten:

- Premiums close faster

- Volatility spikes dampen

- Large directional moves require more capital

For traders, this means:

- Fewer irrational wicks

- Cleaner support/resistance

- Higher reliability of volume-weighted levels

Tokenized ETFs vs Spot Exposure: A Trader’s Comparison

Tokenized ETFs introduce indirect demand, while spot markets reflect direct conviction.

| Factor | Tokenized ETFs | Spot Markets |

|---|---|---|

| Capital behavior | Rule-based | Discretionary |

| Volatility | Dampened | Reflexive |

| Liquidity | Deep but passive | Fragmented but reactive |

| Narrative impact | Slow-burn | Explosive |

For short-term traders, spot still dominates momentum trades. For swing and structural traders, ETFs increasingly define range boundaries.

Correlation Effects Traders Should Watch

As tokenized ETFs grow, crypto correlations shift:

- BTC correlates more with equity indices during risk-on/off regimes

- Altcoin beta compresses during ETF-driven inflow cycles

- Cross-asset hedging increases

This creates opportunities:

- Fade overextended beta when ETF inflows slow

- Trade volatility expansion during rebalance periods

- Position for correlation breakdowns during macro shocks

The key is timing, not just direction.

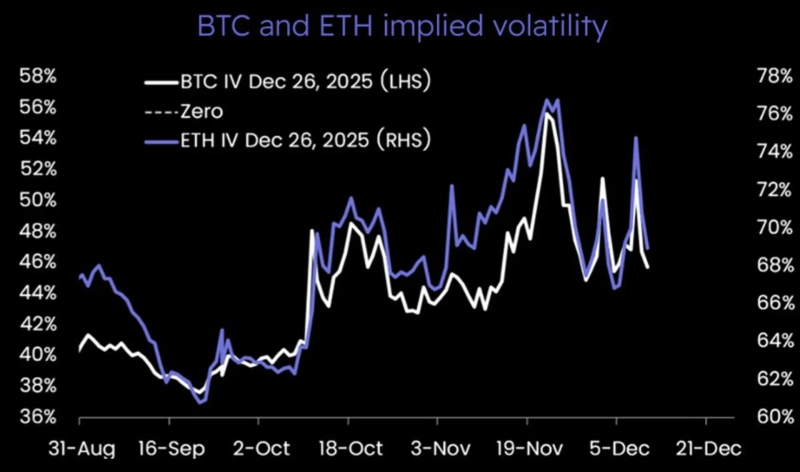

The Impact on Volatility and Options Markets

Institutional ETF exposure tends to:

- Lower implied volatility

- Reduce skew extremes

- Increase open interest consistency

For options traders, this environment favors:

- Calendar spreads

- Volatility mean reversion

- Structured yield strategies

However, when volatility does break out, moves can be more violent because positioning is crowded.

What This Means for Active Traders Going Forward

Tokenized ETFs are not killing opportunity — they are changing where opportunity lives.

Expect:

- Fewer parabolic melt-ups

- More grind trends

- Clearer macro-driven rotations

Traders who adapt to flow-based analysis — instead of pure narrative trading — will outperform in this regime.

Conclusion: Trade the Structure, Not the Headline

Tokenized ETFs represent the institutionalization of crypto markets. That doesn’t mean reduced opportunity — it means more rules, more patterns, and more exploitable behavior.

For traders, the edge is no longer guessing adoption. It’s understanding how capital is forced to behave once it arrives.