Bitcoin’s sharp sell-off has reignited one of the most emotionally charged concepts in crypto markets: capitulation.

As prices fall through key psychological levels and sentiment turns decisively negative, traders and long-term investors alike are asking the same question: Is this just another correction — or are we witnessing full market capitulation?

This article breaks down what capitulation actually means, how it shows up in Bitcoin markets, why the current drawdown fits many of the criteria, and what history suggests typically comes next.

What Is Market Capitulation?

Market capitulation occurs when participants collectively give up. It’s not just selling — it’s exhausted selling. Holders who once believed in recovery abandon positions at a loss simply to exit risk.

In Bitcoin markets, capitulation is usually characterized by:

- Rapid, vertical price declines

- Spikes in sell volume

- Widespread liquidation of leveraged positions

- A sharp shift in sentiment from uncertainty to despair

Capitulation marks the point where selling pressure peaks, not because fundamentals suddenly worsened, but because psychology finally breaks.

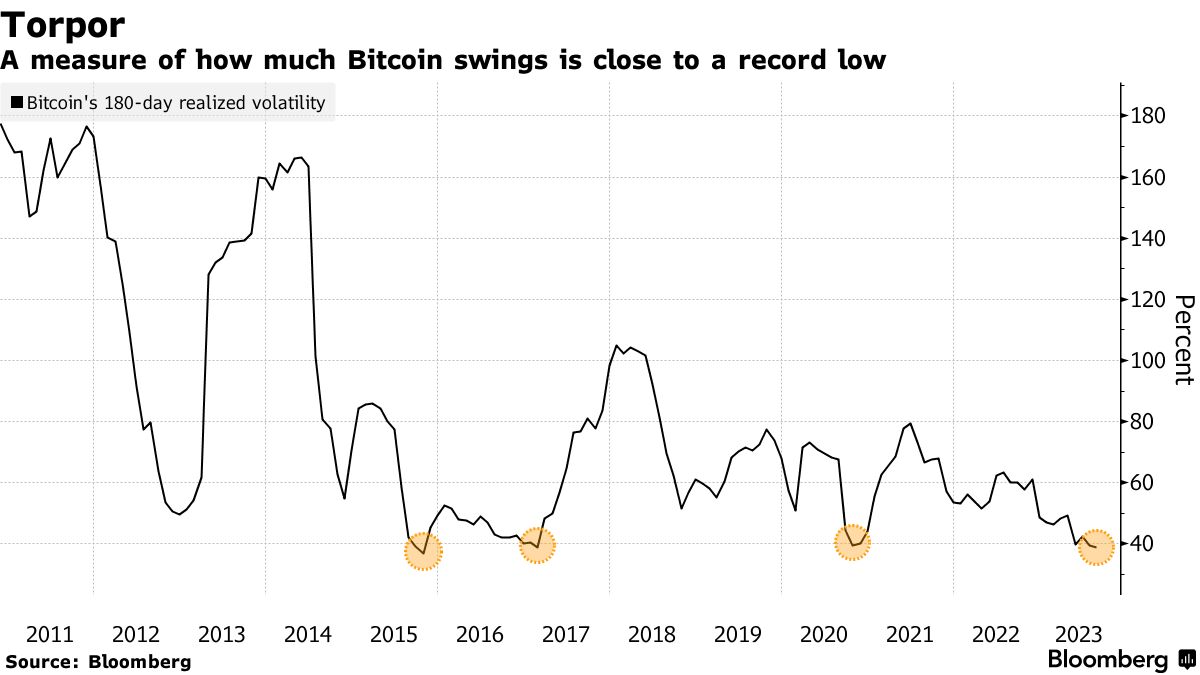

Why the Current Bitcoin Price Drop Feels Different

Bitcoin corrections are nothing new — but not all pullbacks are equal.

What makes the current drawdown stand out is structure and speed. Instead of a slow retracement, price action has:

- Broken multiple prior support zones

- Failed to hold relief rallies

- Accelerated downward on high participation

This type of movement suggests distribution and forced selling, not healthy consolidation. When bids disappear and sellers rush exits simultaneously, markets enter capitulation dynamics.

Capitulation vs Correction: The Critical Difference

A correction is orderly. Capitulation is chaotic.

| Correction | Capitulation |

|---|---|

| Gradual pullback | Sudden sharp declines |

| Low emotional stress | Panic and despair |

| Buyers step in quickly | Buyers disappear |

| Volume contracts | Volume explodes |

The current market behavior aligns far more closely with the right column than the left.

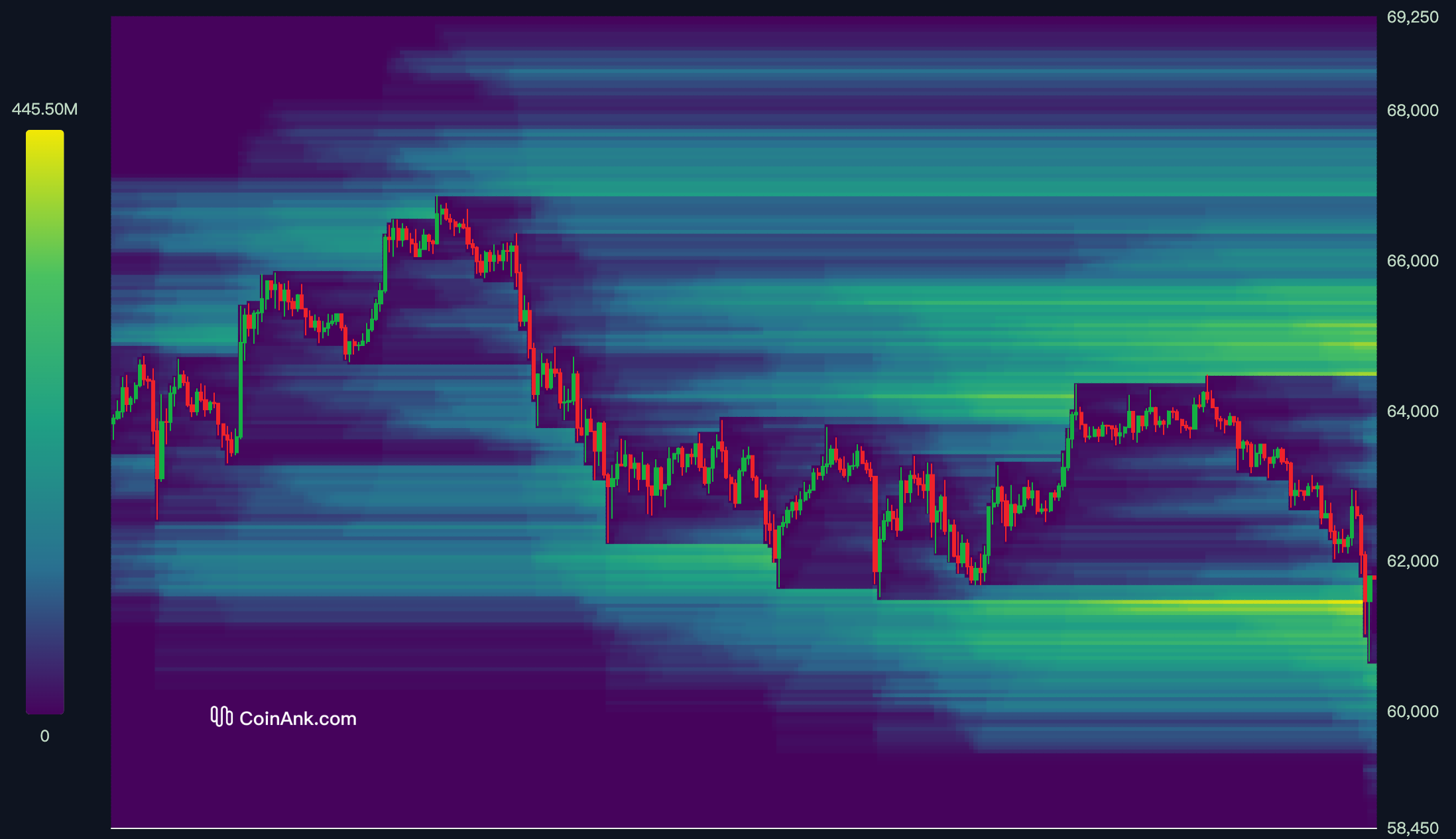

On-Chain Signals Pointing Toward Capitulation

Capitulation doesn’t just appear on price charts — it shows up on-chain.

Common Bitcoin capitulation signals include:

- Coins moving from cold storage to exchanges, indicating intent to sell

- Short-term holders realizing losses, often tracked via SOPR falling below 1

- Reduced on-chain activity, reflecting disengagement

These signals suggest that weaker hands are exiting positions, often transferring supply to stronger, longer-term holders.

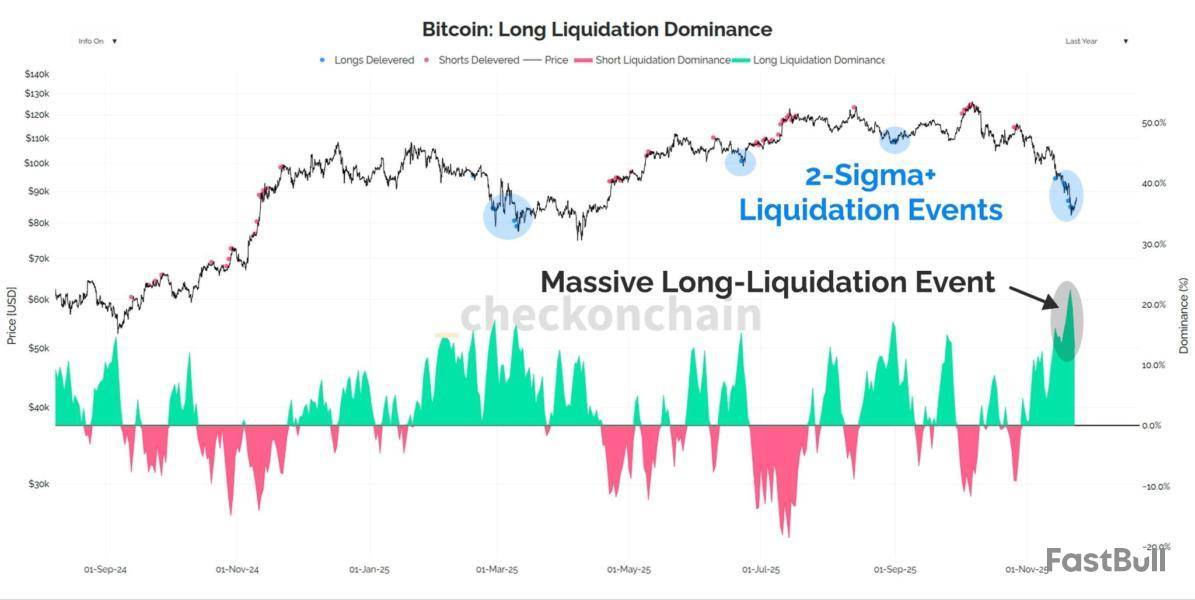

The Role of Leverage and Liquidations

Leverage accelerates capitulation.

When price drops rapidly, leveraged long positions are liquidated automatically. This forced selling:

- Pushes price lower

- Triggers more liquidations

- Creates a feedback loop

This phenomenon — known as a liquidation cascade — is a defining feature of crypto capitulation events and often explains why sell-offs feel disproportionate to news flow.

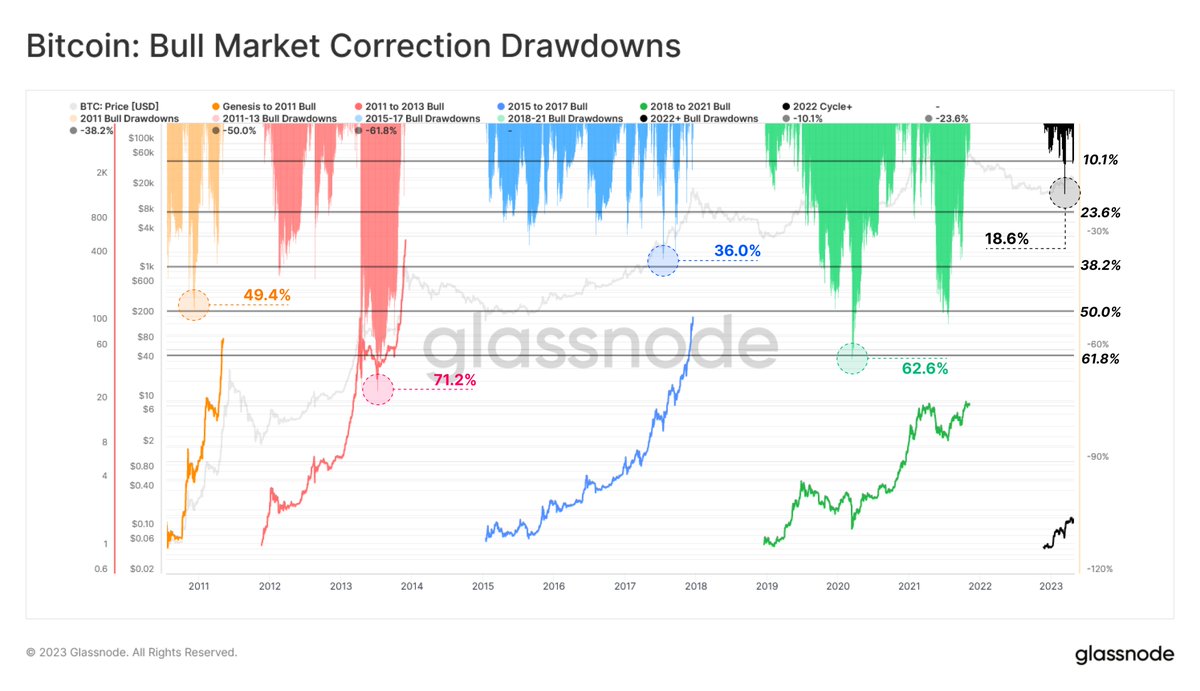

Historical Bitcoin Capitulation Cycles

Bitcoin has capitulated before — repeatedly.

Past cycles show a consistent pattern:

- Price peaks and enthusiasm is extreme

- Extended decline erodes confidence

- Capitulation flushes remaining sellers

- Long consolidation follows

- New trend eventually emerges

Importantly, capitulation has never marked the exact bottom. Instead, it signals the end of aggressive selling, not the start of immediate upside.

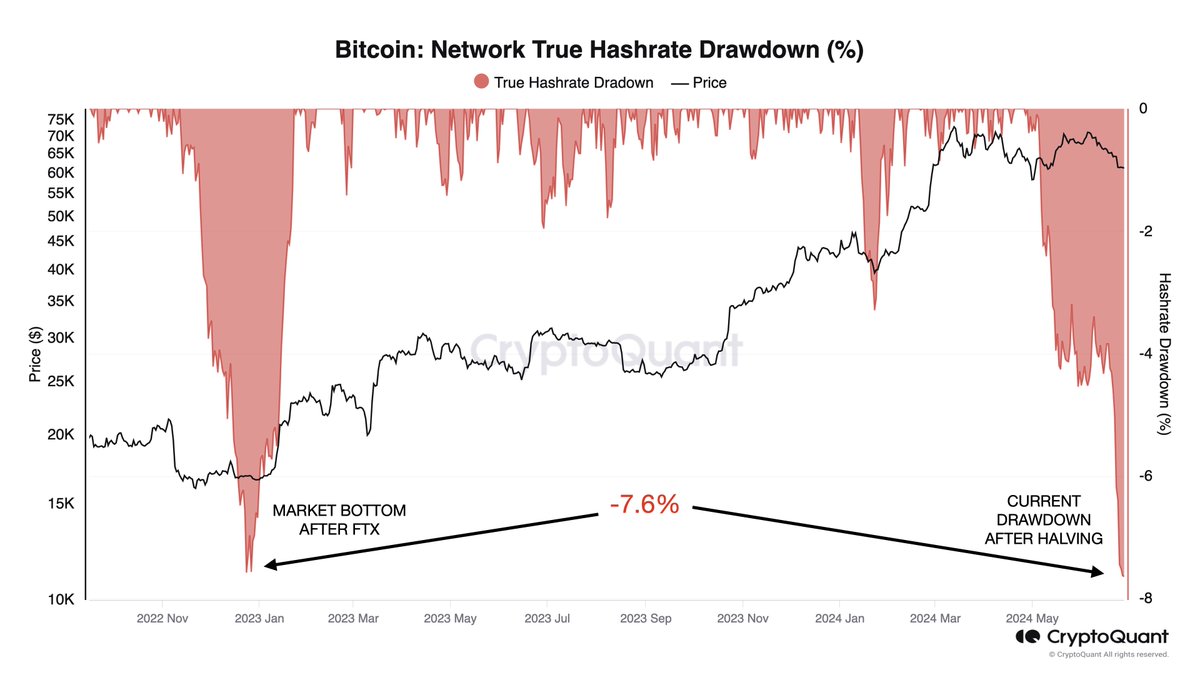

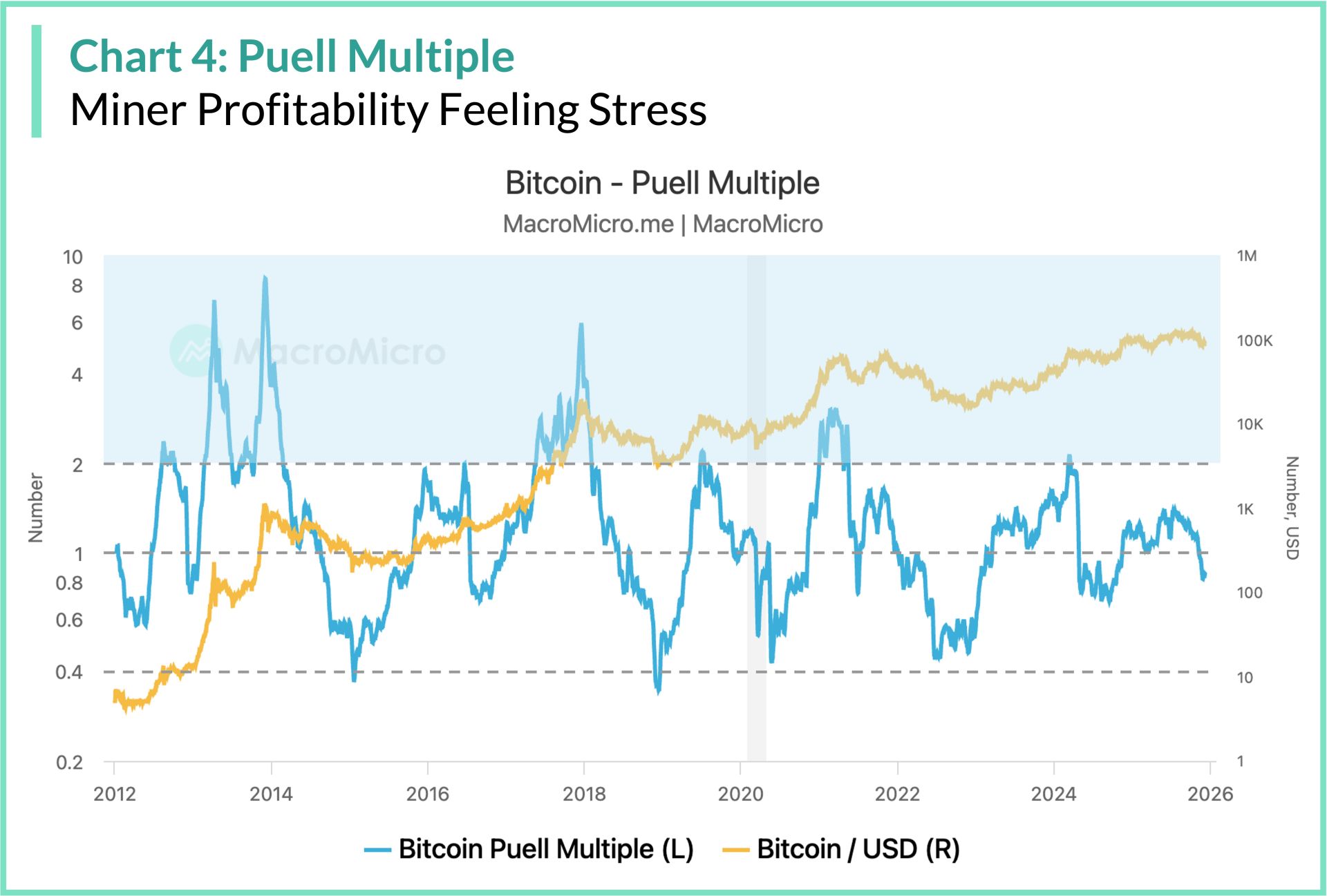

Miner Capitulation: A Secondary Pressure Point

Miners are natural forced sellers. When profitability drops:

- Operational costs exceed rewards

- Reserves are sold to cover expenses

- Additional supply hits the market

Miner capitulation can deepen drawdowns — but historically, it has also coincided with late-stage bear market conditions, not early ones.

Why Capitulation Feels Worse Than It Is

Capitulation is emotionally brutal because it attacks conviction:

- Long-term holders doubt their thesis

- New investors question the entire asset class

- Media narratives turn uniformly negative

Ironically, this emotional exhaustion is precisely what markets require to reset supply and rebuild demand.

What Capitulation Does — and Does Not — Mean

Capitulation does not guarantee:

- An immediate rebound

- A V-shaped recovery

- That price cannot go lower

What it does indicate is that most motivated sellers are gone. Markets often transition from panic → boredom → accumulation after capitulation, not straight into a bull run.

How Investors Should Approach Capitulation Periods

Smart approaches during capitulation include:

- Avoiding leverage entirely

- Scaling in gradually, not all at once

- Focusing on time horizon, not timing

- Preserving capital for volatility

Capitulation rewards patience far more than bravery.

Final Thoughts: Capitulation Is a Process, Not an Event

Bitcoin market capitulation is not a single candle or headline — it’s a psychological and structural reset.

The current price drop shows many hallmarks of capitulation: panic selling, leverage unwinds, broken support, and collapsing sentiment. While this does not ensure an immediate bottom, it strongly suggests the market is transitioning away from speculative excess and toward a healthier long-term structure.

For investors who understand cycles, capitulation is not something to fear — it’s something to respect.