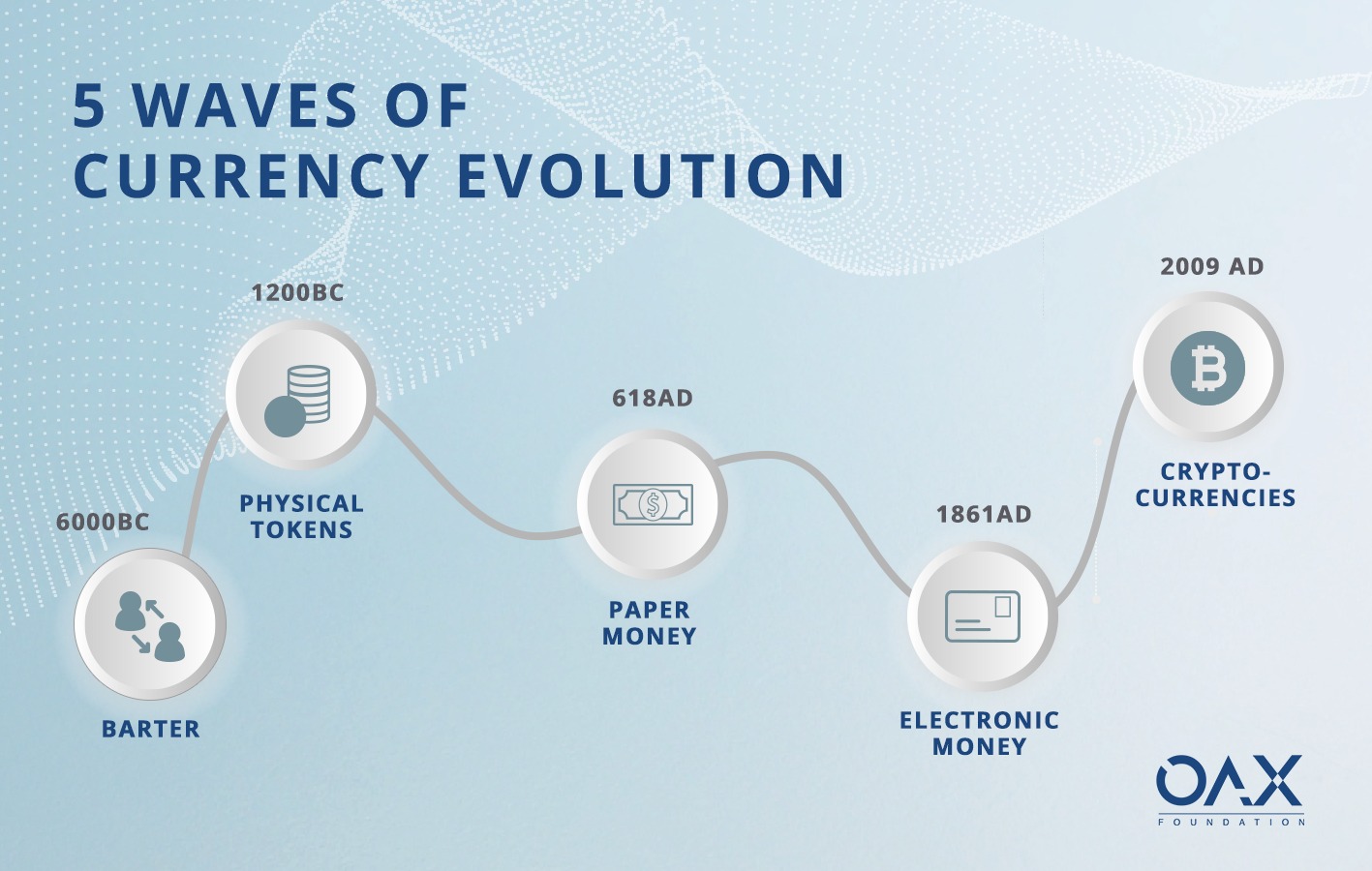

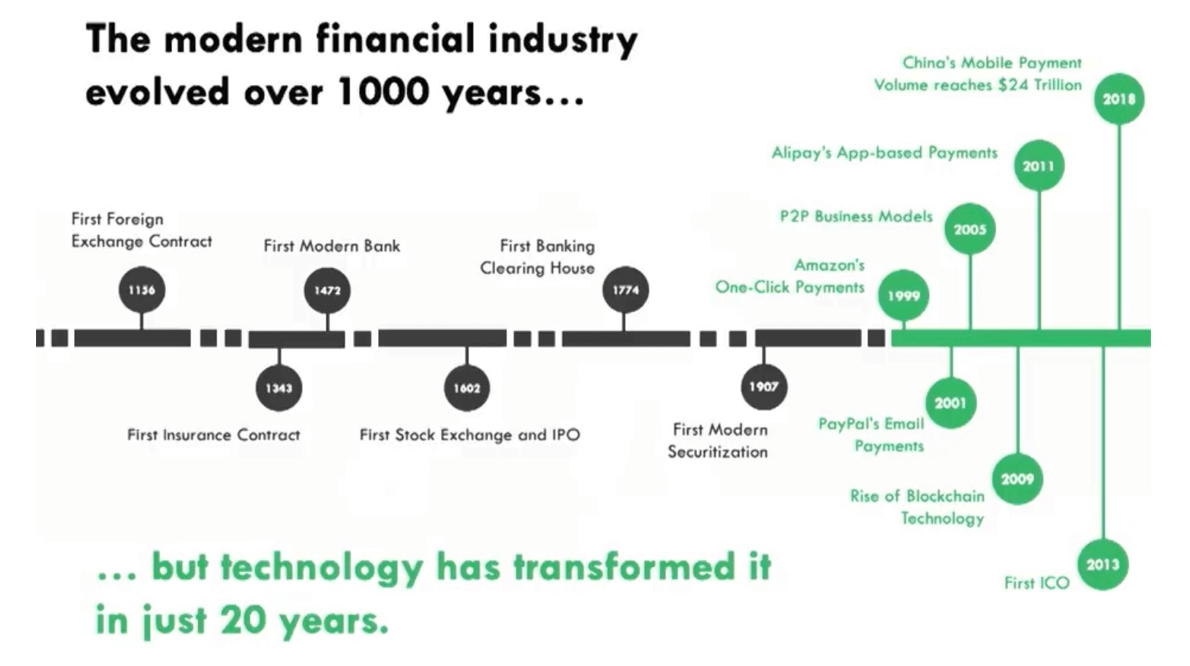

Crypto is often framed as a disruptive force meant to replace legacy financial institutions. For years, the narrative has been simple: blockchains will disintermediate banks, payment processors, and card networks.

But this framing misses a critical reality.

Some of the biggest winners from crypto adoption are not startups or token holders—they’re incumbents who understand where crypto actually adds value. And few companies illustrate this better than Visa.

While headlines focus on Bitcoin price cycles, meme coins, and speculative narratives, Visa has been quietly positioning itself at the center of crypto’s most important transformation: how money settles globally.

This is not a story about hype.

It’s a story about infrastructure, margins, and strategic adaptation.

Visa’s Core Business: Settlement, Not Swiping

Most consumers think Visa is a payments company. In reality, Visa is a global settlement network.

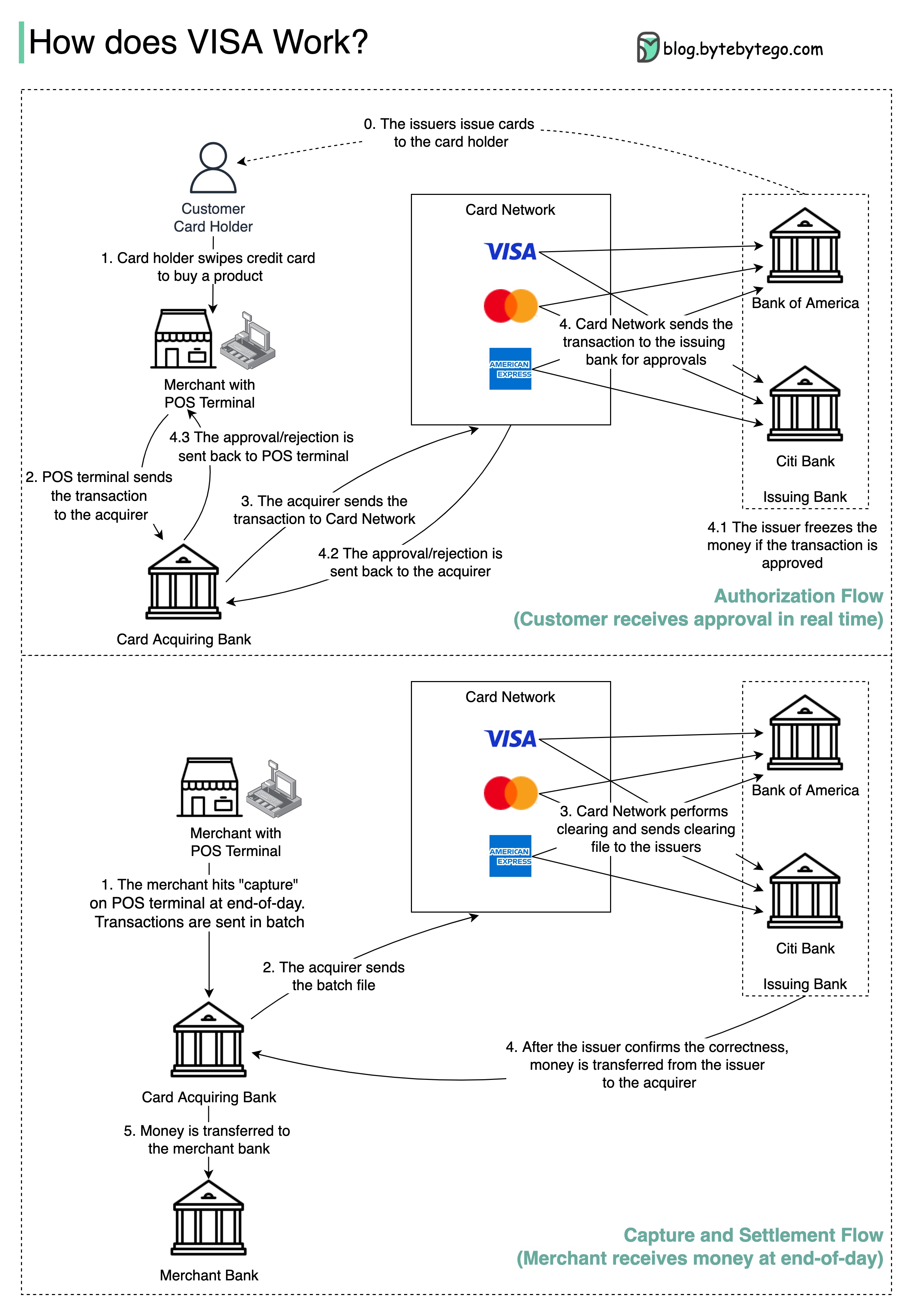

When you swipe a Visa card:

- The merchant gets authorization

- Banks communicate across Visa’s network

- Funds settle days later across multiple intermediaries

Visa earns its revenue by:

- Facilitating authorization

- Coordinating settlement

- Managing fraud, compliance, and trust

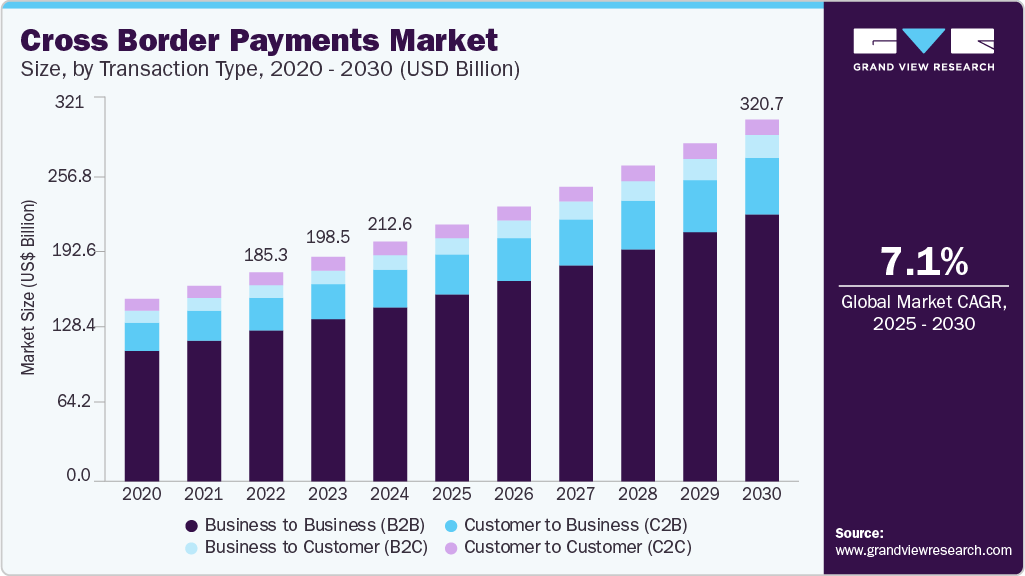

This model has worked for decades, but it has weaknesses—especially in cross-border payments, where settlement is slow, expensive, and fragmented.

That weakness is exactly where crypto enters the picture.

Stablecoins Are a Threat—But Only to the Wrong Layer

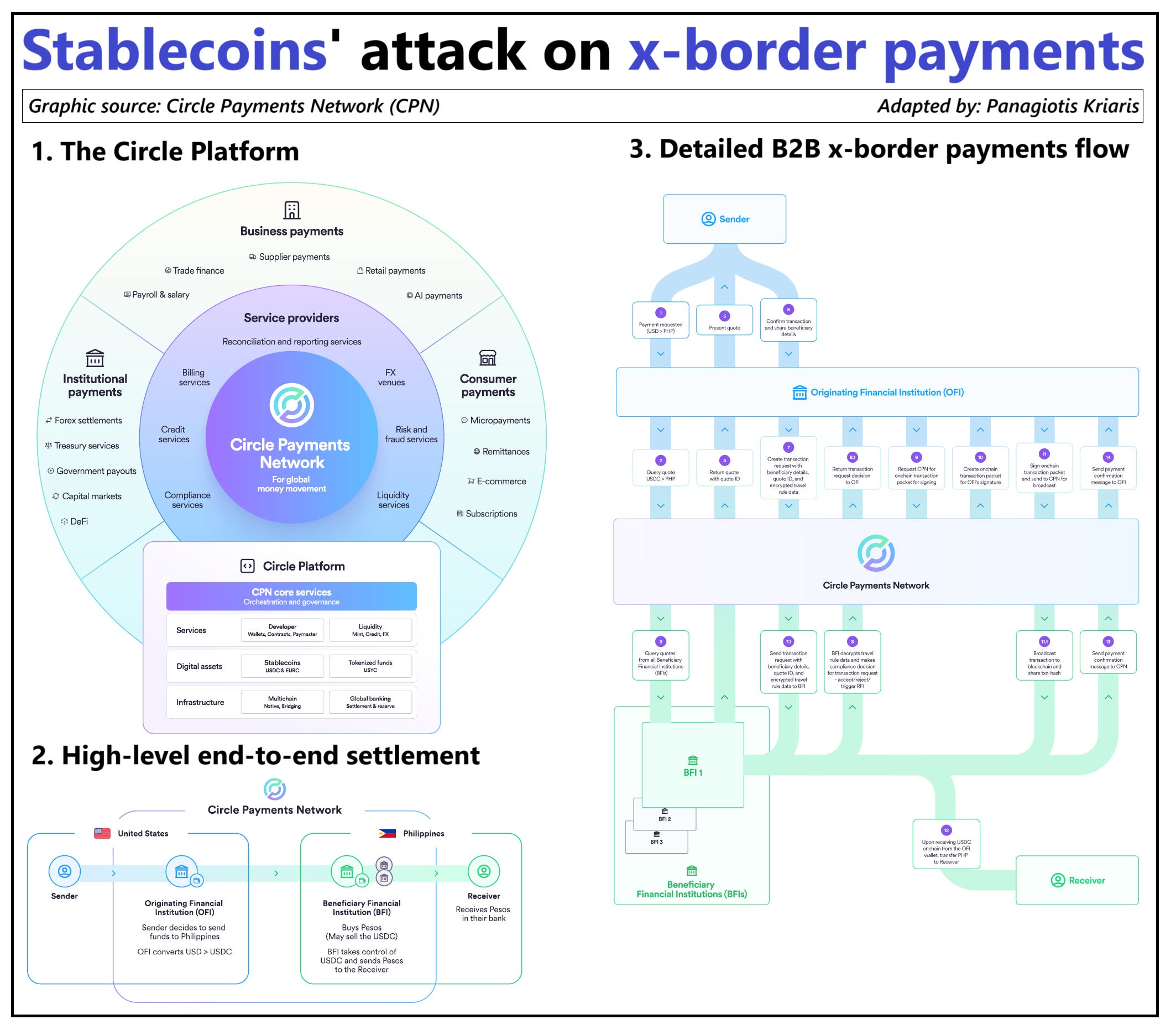

Stablecoins allow value to move:

- Instantly

- 24/7

- Globally

- Without correspondent banking chains

At first glance, this looks existential for Visa.

If banks and businesses can settle directly using stablecoins, why would they need a card network?

The key insight:

Stablecoins threaten settlement rails, not consumer payment experiences.

Consumers still want:

- Chargebacks

- Fraud protection

- Rewards

- Familiar UX

Merchants still want:

- Compliance

- Dispute resolution

- Integration with existing systems

Visa operates exactly at that intersection.

Visa’s Strategic Pivot: From Rails to Orchestration

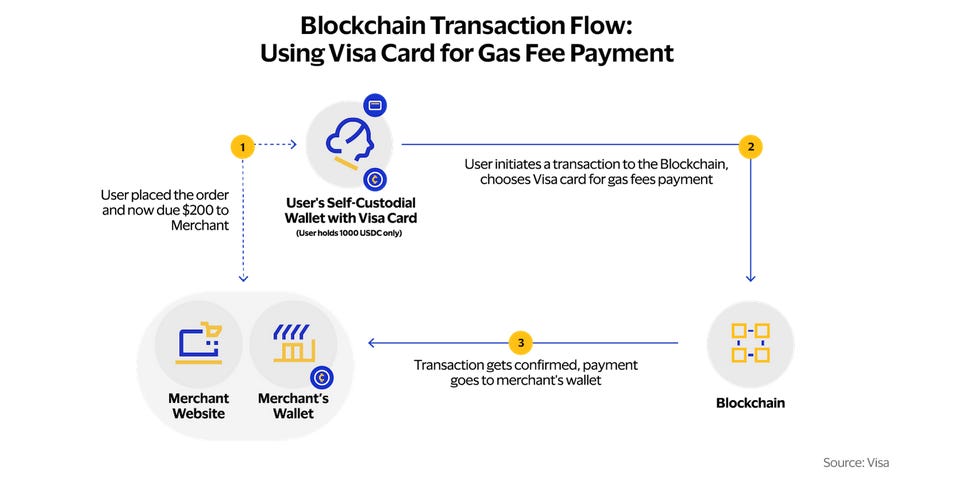

Rather than fighting crypto, Visa made a subtle but powerful decision: embrace blockchains as backend infrastructure.

Visa now:

- Supports stablecoin settlement

- Experiments with on-chain transaction clearing

- Treats blockchains as alternative settlement rails

This reframes Visa’s role.

Instead of owning every rail, Visa becomes:

- A network orchestrator

- A trust and compliance layer

- A traffic controller for value movement

Crypto doesn’t eliminate Visa—it reduces Visa’s costs while preserving its pricing power.

Why Visa Is Positioned Better Than Crypto-Native Payment Startups

Crypto payment startups often promise cheaper, faster payments. Many fail.

Why?

Because payments are not just about moving money. They require:

- Regulatory compliance

- Fraud mitigation

- Consumer protections

- Merchant tooling

- Global licensing

Visa already has:

- Deep regulatory relationships

- Decades of fraud data

- Merchant integration at scale

- Institutional trust

Crypto startups try to build these layers from scratch. Visa simply plugs crypto into an existing moat.

Stablecoins Strengthen Visa’s Margins Long Term

Ironically, stablecoins may improve Visa’s profitability.

Traditional cross-border settlement involves:

- Multiple banks

- FX intermediaries

- Delayed reconciliation

On-chain settlement:

- Reduces capital lockup

- Lowers operational costs

- Improves liquidity efficiency

Visa can pass some savings to partners while preserving fees tied to:

- Network access

- Risk management

- Brand trust

This is margin defense—not disruption.

Why Crypto Investors Miss This Entirely

Crypto narratives overemphasize tokens and underemphasize infrastructure adoption.

The uncomfortable truth:

- The biggest beneficiaries of crypto may not issue tokens

- They may already be profitable Fortune 500 companies

Visa doesn’t need a token to win.

It needs transaction volume, regardless of whether value moves via SWIFT or stablecoins.

From Visa’s perspective:

Every dollar settled on-chain that still touches Visa’s network is a win.

Crypto Isn’t Replacing Visa—It’s Upgrading It

The “crypto vs Visa” narrative is outdated.

The real story is:

- Crypto replaces inefficient settlement layers

- Visa absorbs crypto into a higher-level abstraction

This mirrors how the internet didn’t kill telecom companies—it changed how they routed data.

Visa is doing the same with value.

Long-Term Implications for the Financial System

If Visa’s strategy succeeds, the future looks like this:

- Consumers still swipe cards

- Merchants still trust Visa

- Settlement increasingly happens on-chain

- Fees shift from rails to orchestration and risk

Crypto becomes invisible—but foundational.

That is the most dangerous kind of disruption for competitors.

Final Takeaway: The Quiet Winners Matter Most

Crypto headlines reward spectacle. Infrastructure rewards patience.

Visa understood early that:

- Blockchains are tools, not enemies

- Stablecoins are rails, not brands

- Trust is more valuable than speed alone

While retail investors debate the next cycle, Visa is building quietly—positioning itself as one of crypto’s most underappreciated winners.

And that may be exactly why nobody notices.