Introduction: A Company Redefined by Bitcoin

Few public companies have undergone a strategic transformation as dramatic as MicroStrategy. Once known primarily as an enterprise analytics and business intelligence firm, MicroStrategy is now widely viewed as the corporate Bitcoin bellwether.

Under the leadership of Michael Saylor, the company has accumulated one of the largest Bitcoin treasuries in the world, financing purchases through operating cash flow, equity issuance, and billions of dollars in debt. For supporters, this makes MicroStrategy a visionary first mover in a Bitcoin-standard future. For critics, it represents a dangerous concentration risk that ties the company’s fate almost entirely to the price of Bitcoin.

This raises a central question for investors and the crypto ecosystem alike:

Is MicroStrategy too big to fail — or simply too exposed to Bitcoin?

This article takes a neutral, analytical look at MicroStrategy’s Bitcoin strategy, the financial mechanics behind it, and the risks and protections embedded in the company’s balance sheet.

MicroStrategy’s Evolution: From Software to Bitcoin Treasury

MicroStrategy was founded in 1989 and built its reputation selling enterprise analytics software to governments and large corporations. For decades, its revenue model was straightforward: licenses, subscriptions, and services tied to data analytics.

That changed in 2020.

Facing low interest rates, inflation concerns, and what Saylor described as a “melting ice cube” cash position, the company adopted Bitcoin as its primary treasury reserve asset. What began as a cash management decision quickly evolved into a full-scale capital allocation strategy.

Today:

- Bitcoin holdings dominate the balance sheet

- Market perception of MSTR is driven more by BTC price than software revenue

- The stock often trades like a leveraged Bitcoin instrument

MicroStrategy did not abandon its core business, but in capital markets terms, Bitcoin became the company’s defining feature.

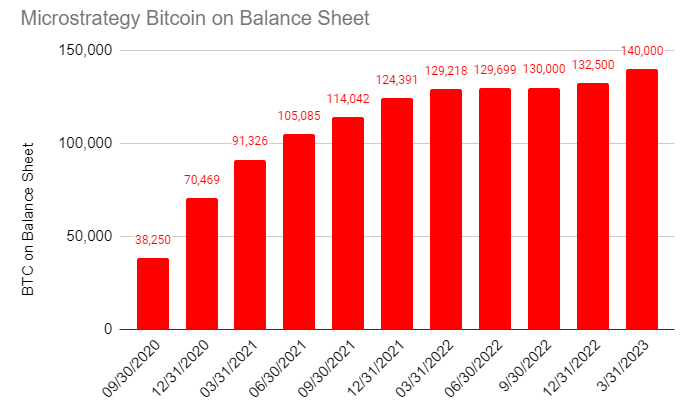

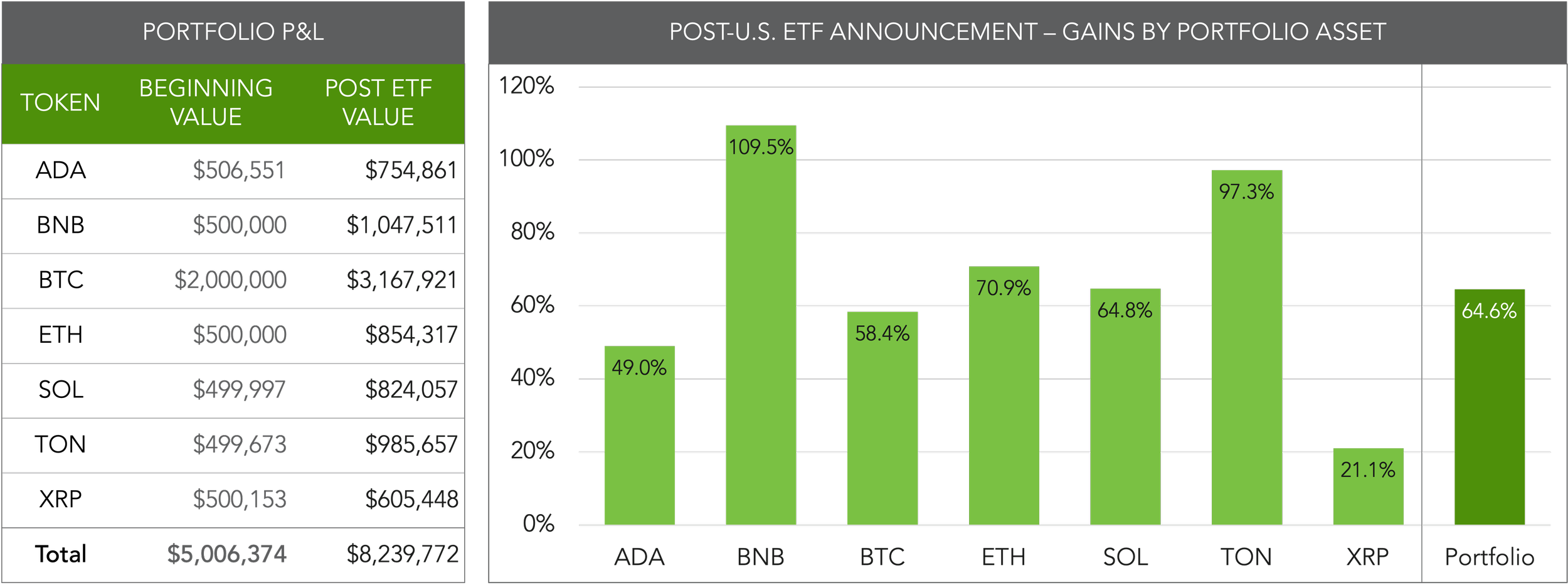

The Scale of the Bitcoin Bet

MicroStrategy owns hundreds of thousands of BTC, purchased across multiple market cycles at varying prices. The company publicly discloses:

- Total BTC held

- Aggregate purchase cost

- Average cost basis

This transparency allows investors to model downside and upside scenarios with unusual clarity.

However, scale cuts both ways. Because MicroStrategy’s holdings are so large:

- Small BTC price movements materially impact market capitalization

- Investor sentiment swings rapidly with crypto cycles

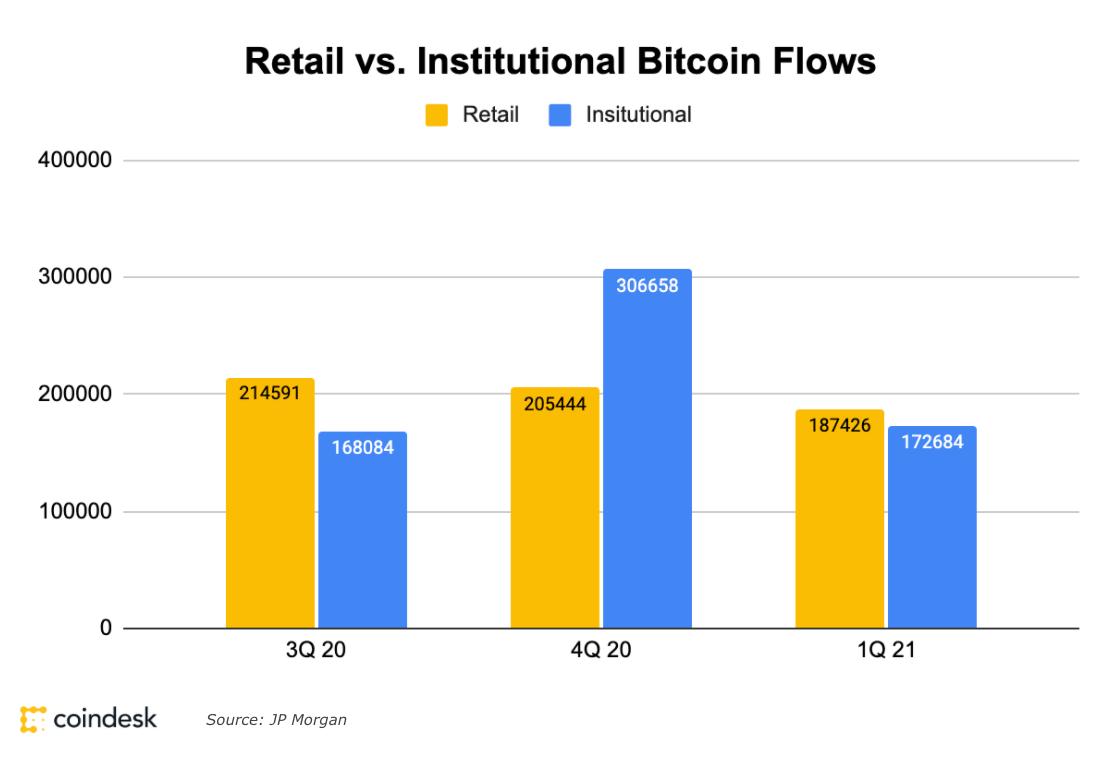

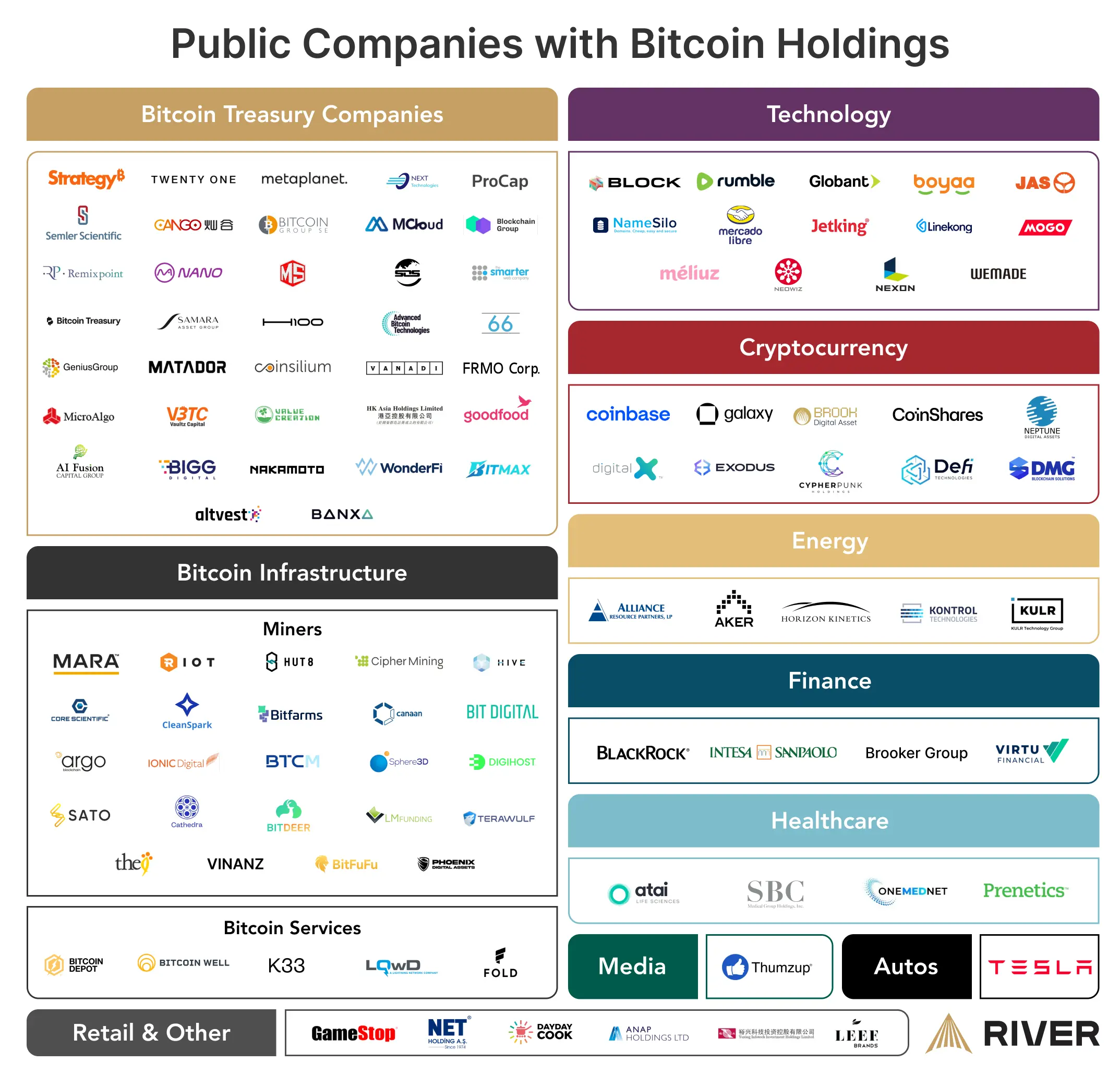

- The company has become a proxy for institutional Bitcoin adoption

At this point, MicroStrategy’s Bitcoin exposure is not a side bet — it is the bet.

Understanding the “Too Big to Fail” Argument

The idea that MicroStrategy might be “too big to fail” rests on several assumptions.

1. Market Significance

MicroStrategy has become symbolically important:

- It is the most prominent corporate Bitcoin holder

- It is frequently cited in institutional adoption narratives

- Its collapse would damage confidence in corporate crypto strategies

Because of this, some believe markets would be reluctant to let MicroStrategy fail outright.

2. Long-Term Debt Structure

Much of MicroStrategy’s debt:

- Is unsecured or lightly collateralized

- Has long maturities

- Comes in the form of convertible notes

This means there are no traditional margin calls tied to Bitcoin price fluctuations. Even if BTC falls below the company’s average purchase price, MicroStrategy is not automatically forced to sell.

3. Strategic Optionality

In extreme scenarios, the company could:

- Refinance debt

- Issue equity

- Sell a small portion of BTC (though Saylor strongly opposes this)

- Spin out or monetize software assets

Together, these factors reduce near-term existential risk.

The Counterargument: Structural Bitcoin Exposure Risk

While MicroStrategy may not face immediate liquidation risk, long-term exposure carries real structural challenges.

Concentration Risk

MicroStrategy’s balance sheet is heavily concentrated in a single volatile asset. Unlike diversified financial institutions, there is no hedge against prolonged Bitcoin underperformance.

Duration Risk

If Bitcoin were to:

- Remain below cost basis for many years

- Enter a prolonged secular bear market

The company’s ability to refinance debt on favorable terms would weaken.

Equity Dilution

In adverse conditions, raising capital often means issuing more shares. This can:

- Dilute existing shareholders

- Cap upside even if BTC later recovers

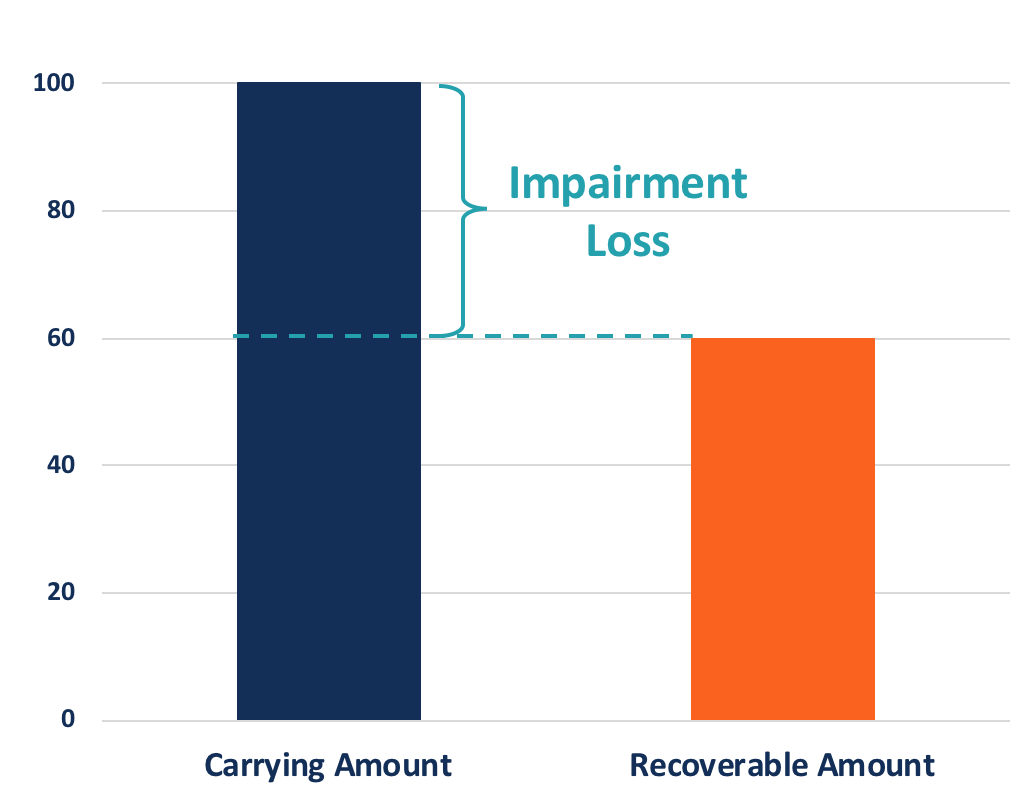

Accounting Rules and the Illusion of Losses

A major source of confusion around MicroStrategy is accounting treatment.

Under current accounting standards:

- Bitcoin is classified as an intangible asset

- Price declines trigger impairment charges

- Price recoveries cannot be written back up

As a result:

- Financial statements often show large losses during drawdowns

- These losses are non-cash

- They do not affect operational liquidity

This disconnect fuels negative headlines, even when the company’s underlying position is unchanged.

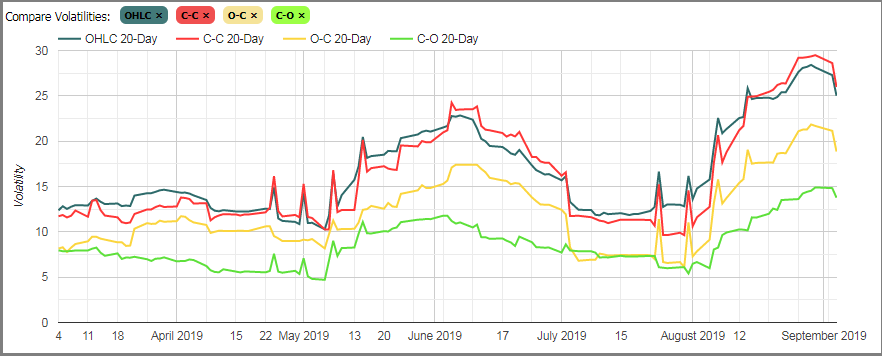

How MSTR Stock Amplifies Bitcoin Moves

Historically, MicroStrategy stock:

- Outperforms Bitcoin during bull markets

- Underperforms Bitcoin during bear markets

This is due to:

- Embedded leverage

- Equity risk layered on top of asset risk

- Investor psychology

For traders, MSTR is often treated as a high-beta Bitcoin vehicle, not a traditional software stock.

Michael Saylor’s Role: Strength or Single Point of Failure?

Michael Saylor is inseparable from MicroStrategy’s Bitcoin thesis.

Strengths

- Clear, consistent long-term narrative

- Strong capital markets execution

- High conviction reduces panic selling

Risks

- Strategy heavily dependent on one individual’s vision

- Limited signaling flexibility during downturns

- Polarizing figure among investors

While Saylor’s conviction reassures Bitcoin believers, it can deter more conservative institutional investors.

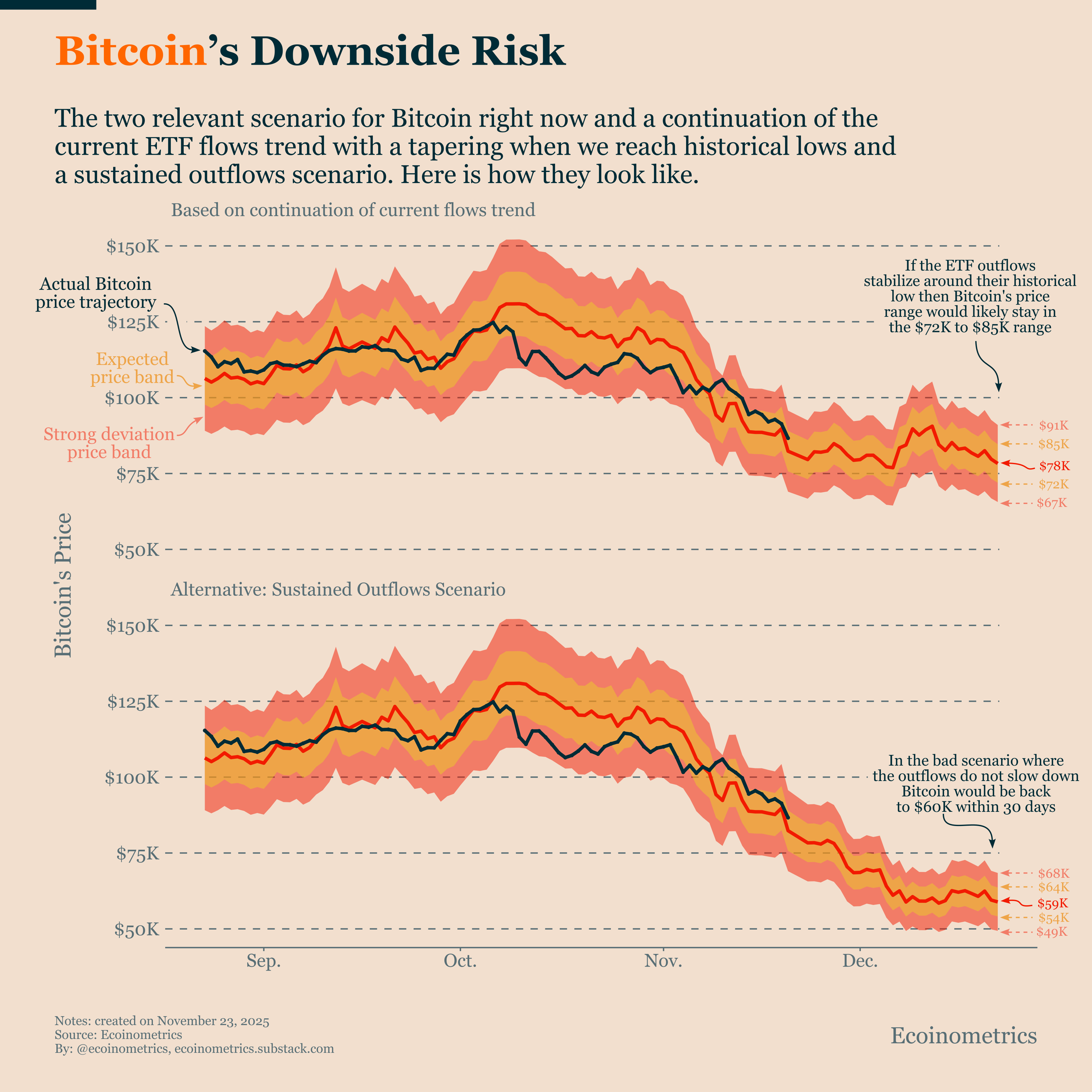

Scenario Analysis: What If Bitcoin Drops Far Below Cost Basis?

If Bitcoin were to fall significantly and remain depressed:

Short term

- Stock price volatility spikes

- Negative press intensifies

- Impairment losses grow

Medium term

- Credit spreads widen

- Refinancing costs rise

- Equity dilution risk increases

Long term

- Strategy viability questioned

- Corporate Bitcoin adoption slows

- MicroStrategy becomes a case study — positive or negative

Notably, none of these outcomes guarantee failure. They do, however, test the limits of the strategy.

Why MicroStrategy Still Has Defenders

Supporters argue:

- Bitcoin is a long-duration asset

- Volatility is the cost of asymmetrical upside

- MicroStrategy is aligned with a multi-decade thesis

From this perspective, short-term drawdowns are irrelevant noise.

Conclusion: Too Big to Fail or Too Exposed?

MicroStrategy occupies a unique position in financial markets.

It is:

- Not immune to risk

- Not on the brink of forced liquidation

- Not a traditional software valuation story

Calling MicroStrategy “too big to fail” overstates its protection. Calling it reckless ignores the deliberate structure of its strategy.

A more accurate assessment is this:

MicroStrategy is not too big to fail — but it is intentionally exposed.

Its future will rise or fall with Bitcoin’s long-term adoption as a global monetary asset. Whether that proves visionary or excessive will only be clear in hindsight.