Crypto adoption in 2026 is no longer a single global story. Instead, it is a set of regional playbooks shaped by regulation, monetary policy, consumer behavior, and how crypto is actually used in everyday finance.

In some countries, crypto functions primarily as a regulated investment product. In others, it is a payments rail, a remittance tool, or a hedge against currency instability. Understanding these differences is essential if you want to analyze the crypto market accurately in 2026.

This article examines three major adoption archetypes shaping the global crypto landscape today:

- Japan: a compliance-first, trust-driven market

- Europe: a harmonized regulatory environment under MiCA

- Emerging markets: utility-driven adoption powered by stablecoins and payments

Along the way, we translate these regional trends into practical insights for investors, builders, and analysts.

Why Crypto Adoption in 2026 Is Fragmented — and Why That Matters

Crypto adoption is no longer best measured by price alone. In 2026, adoption is functional. People adopt crypto for different reasons:

- Store of value (Bitcoin and digital gold narratives)

- Regulated market access (ETFs, licensed exchanges, custody)

- Payments and settlement (stablecoins, cross-border transfers)

- Tokenization (real-world assets, funds, and securities)

As regulation matures in developed markets and utility expands in developing ones, crypto is increasingly shaped by regional incentives, not global hype cycles.

The key takeaway:

Crypto in 2026 is a map, not a monolith.

Japan: Compliance-First Crypto Adoption Built on Trust

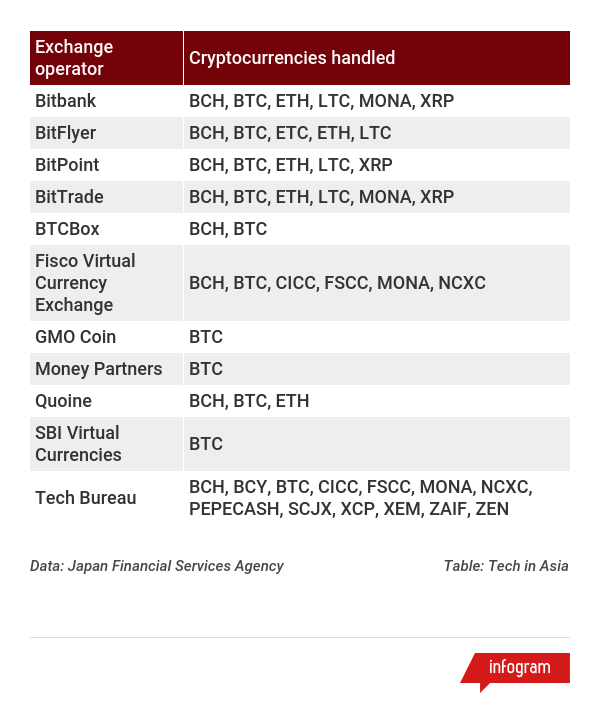

Japan remains one of the most structurally mature crypto markets in the world because it embraced regulation early. Licensing, custody standards, consumer protection, and strict AML requirements define how crypto businesses operate.

This approach limits speculative excess but builds long-term trust with both retail users and institutions.

How Japan’s Crypto Market Works in Practice

Japan’s regulatory model rewards:

- Licensed exchanges with strong compliance frameworks

- Strict custody and asset segregation standards

- Conservative token listings with governance review

- Clear accountability for operators

As a result, Japan tends to experience fewer consumer-level failures compared to less regulated markets. The trade-off is slower innovation and reduced exposure to high-volatility assets.

What to Watch in Japan in 2026

Key trends shaping Japan’s crypto market this year include:

- Expansion of regulated stablecoin frameworks

- Gradual growth of tokenized financial instruments

- Institutional-grade custody and settlement infrastructure

- Consolidation among compliant exchanges

Investor takeaway:

Japan favors infrastructure, compliance, and longevity over hype. It is an early indicator of what fully regulated crypto markets may look like elsewhere.

Europe: MiCA Is Turning Crypto Into a Regulated Financial Sector

Europe’s defining crypto story in 2026 is MiCA — the Markets in Crypto-Assets Regulation. MiCA aims to standardize crypto rules across the EU and transform crypto into a clearly regulated financial category.

European Union-wide regulation changes not only who can operate, but how products are designed.

Why MiCA Matters for Crypto Adoption in 2026

MiCA reshapes the competitive landscape in three important ways:

- Compliance becomes a moat

Firms that secure authorization early gain durable market access. - Institutional participation increases

Banks, asset managers, and payment firms engage once rules are clear. - Token design becomes more conservative

Stablecoins and token issuers must meet transparency, reserve, and governance standards.

Europe’s Adoption Model: Regulated Access Over Speculation

Crypto adoption in Europe increasingly grows through:

- Licensed exchanges and brokers operating cross-border

- Bank-crypto partnerships for custody and trading

- Tokenization pilots tied to traditional capital markets

- Supervised stablecoin issuance

This environment reduces certain risks but compresses margins and raises operating costs.

What to Watch in Europe in 2026

- Licensing bottlenecks and supervisory capacity

- Stablecoin issuer competition under reserve rules

- Consistency of enforcement across member states

- Market exits by undercapitalized firms

Investor takeaway:

Europe rewards scale, compliance, and balance-sheet strength. Expect fewer explosive narratives — but more institutional durability.

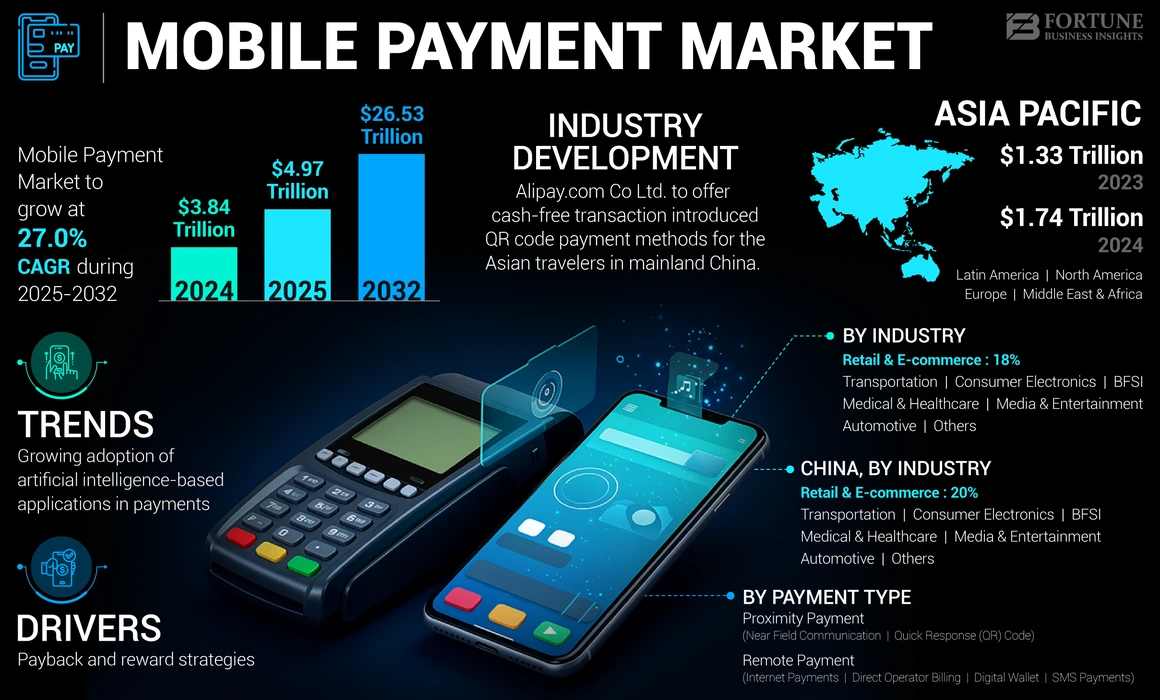

Emerging Markets: Utility-Driven Crypto Adoption Through Stablecoins

In many emerging markets, crypto adoption is not ideological or speculative. It is practical.

Where inflation is high, currencies are volatile, or banking access is limited, crypto — especially stablecoins — fills real economic gaps.

Stablecoins as Digital Dollars

Stablecoins function as:

- A hedge against local currency depreciation

- A substitute for inaccessible USD accounts

- A mobile-native savings and transaction tool

In these markets, users often hold stablecoins briefly — converting in, transferring value, and cashing out locally.

Key metrics to watch:

- Stablecoin transaction volume

- On-chain velocity

- Local liquidity and spread compression

Remittances and Cross-Border Settlement

Cross-border payments remain expensive and slow in many regions. Crypto rails increasingly replace traditional intermediaries for:

- Freelancer and contractor payments

- Small business trade settlement

- Family remittances

Crypto’s advantage is speed and availability, not ideology.

On-Chain Payroll and Commerce Experiments

In some markets, startups and exporters are experimenting with:

- Stablecoin payroll

- Supplier invoicing on-chain

- Merchant acceptance through mobile apps

Adoption accelerates when banking friction is high and mobile penetration is strong.

Investor takeaway:

Emerging markets show the strongest real-world usage signals — but also carry higher regulatory and infrastructure risk.

Comparing Japan, Europe, and Emerging Markets

Primary Adoption Drivers

- Japan: trust and consumer protection

- Europe: regulatory clarity and institutional access

- Emerging markets: utility, payments, and currency protection

What “Winning” Looks Like

- Japan: licensed operators and custody providers

- Europe: authorized platforms with bank partnerships

- Emerging markets: distribution, liquidity, and cash-out networks

Key Risks

- Japan: slower innovation and limited upside

- Europe: compliance costs and licensing delays

- Emerging markets: regulatory volatility and banking access

Metrics That Matter More Than Price

- Japan/Europe: licenses, custody AUM, institutional flows

- Emerging markets: stablecoin velocity, remittance corridors, liquidity depth

What This Means for Investors and Builders in 2026

For Investors

- Separate regulated adoption from utility adoption

- Track stablecoins as a macro signal, not just a crypto metric

- Monitor regulatory milestones as market catalysts

For Builders

- Design compliance-first for Japan and Europe

- Design liquidity-first for emerging markets

- Localize products aggressively — there is no single “global” user

For Content Creators and Analysts

- Stop framing crypto as one global cycle

- Expect regional divergence to increase

- Focus on rails, not headlines

FAQ: Global Crypto Adoption in 2026

Is crypto adoption still growing in 2026?

Yes, but unevenly. Growth in developed markets is regulation-driven, while emerging markets are powered by stablecoins and payments utility.

Why are stablecoins so important in emerging markets?

They provide access to dollar-denominated value, faster transfers, and lower transaction friction.

Does MiCA make Europe safer for crypto?

MiCA increases transparency and consumer protection, but raises costs and operational complexity.

Which region offers the most growth potential?

Emerging markets show the strongest usage growth, while Japan and Europe offer regulatory durability.

Final Thoughts: Crypto in 2026 Is About Geography

Crypto adoption in 2026 reflects three realities:

- Japan demonstrates compliance-driven stability

- Europe demonstrates institutional normalization

- Emerging markets demonstrate real-world utility

Understanding where adoption is happening — and why — matters more than ever. The future of crypto will be built on licensing regimes, stablecoin rails, banking integration, and local distribution networks.

Those are the signals that will shape the market beyond 2026.