or decades, bank deposits have been the default place to park cash. Savings accounts, money market accounts, and certificates of deposit were considered safe, boring, and reliable — exactly what people wanted for idle money.

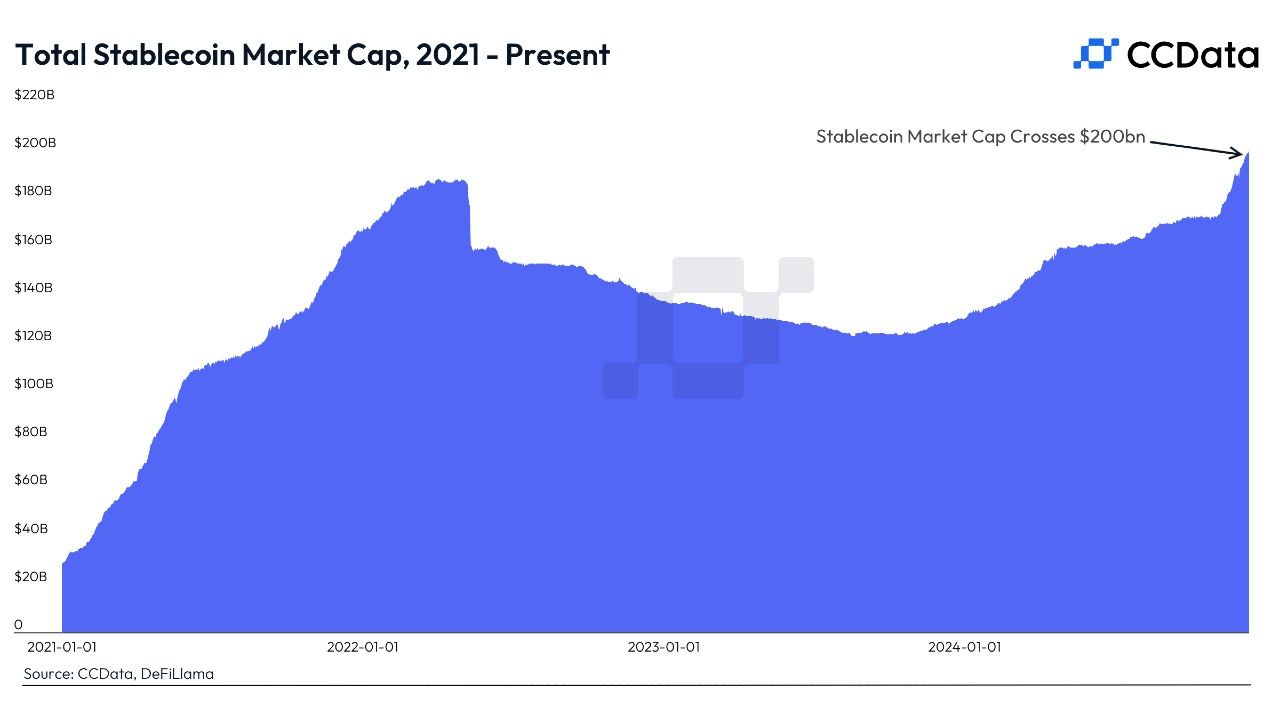

But in recent years, a new competitor has quietly emerged from the crypto ecosystem: yield-bearing stablecoins.

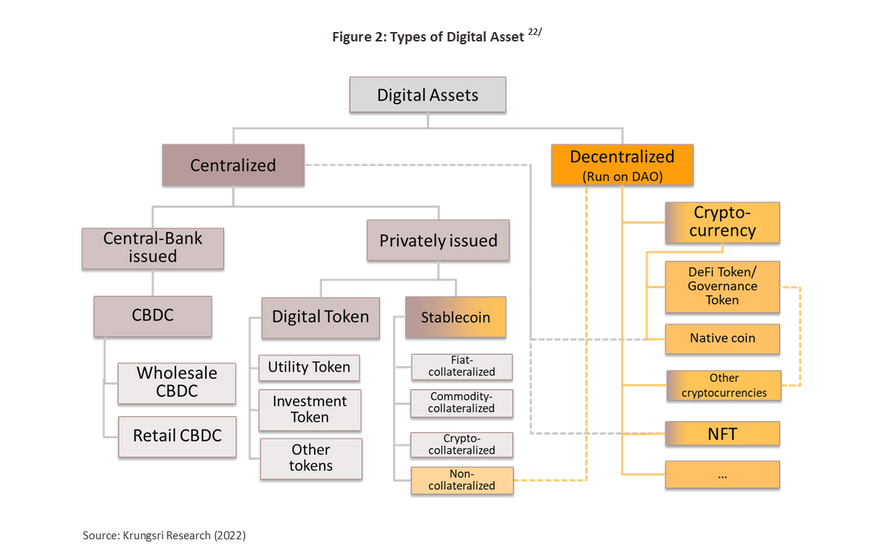

Unlike volatile cryptocurrencies, stablecoins are designed to maintain a stable value (usually pegged to the U.S. dollar). What makes them disruptive is not price appreciation — it’s yield. Many yield-bearing stablecoins now offer returns that rival or exceed traditional bank deposits, often with fewer intermediaries and more transparency.

This isn’t a fringe experiment anymore. It’s a structural challenge to how banks attract and monetize deposits.

What Are Yield-Bearing Stablecoins?

Yield-bearing stablecoins are digital assets that maintain a stable value (typically $1) while generating returns for holders.

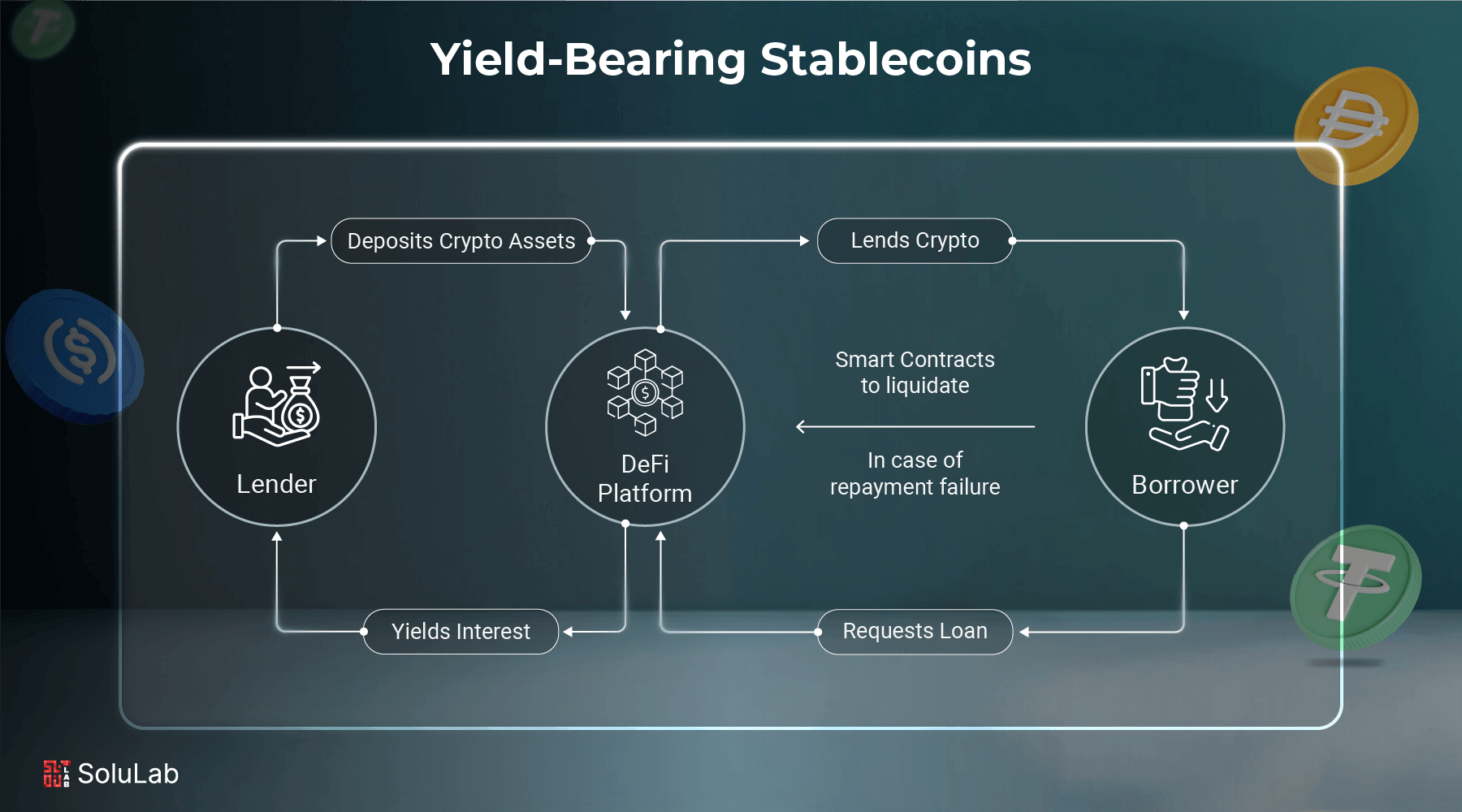

Unlike standard stablecoins that simply sit idle in a wallet, yield-bearing versions are designed to earn income automatically or through simple mechanisms, such as:

- On-chain lending

- Treasury-backed yield distribution

- DeFi protocol integration

- Tokenized real-world assets (like short-term government bonds)

The key idea is simple:

Your stablecoins work for you instead of sitting idle.

How Traditional Bank Deposits Actually Work

To understand why stablecoins are disruptive, you first need to understand how banks use deposits.

When you deposit money into a bank:

- The bank pays you a small interest rate

- The bank lends or invests that money elsewhere

- The bank keeps the spread between what it earns and what it pays you

This model has existed for centuries.

The Core Issue for Depositors

Banks often earn significantly more on your money than they return to you — especially during periods of high interest rates.

Yield-bearing stablecoins challenge this imbalance by reducing intermediaries and increasing transparency.

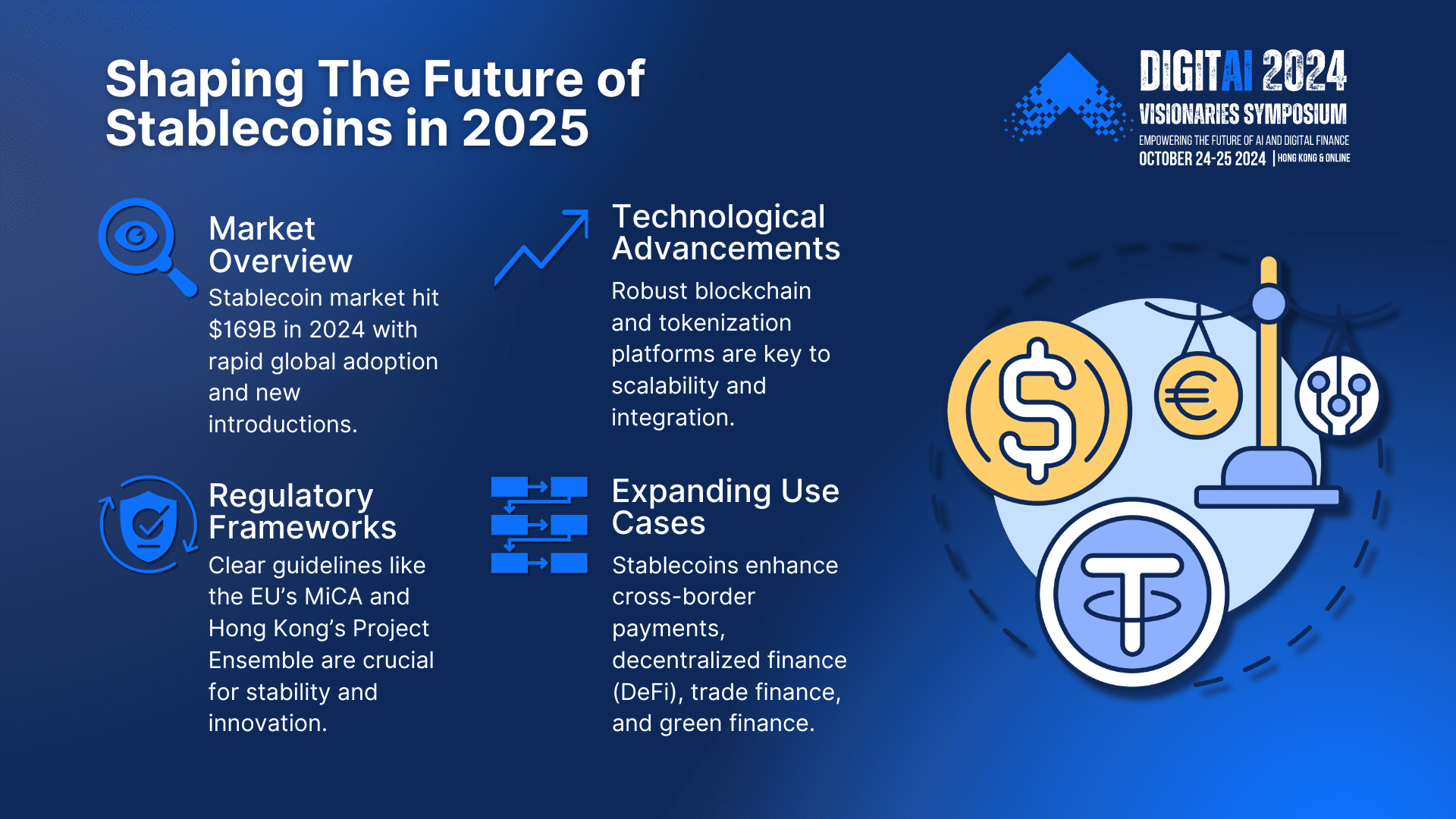

Why Yield-Bearing Stablecoins Are Gaining Attention

Yield-bearing stablecoins aren’t popular because they’re flashy. They’re gaining traction because they solve real problems for savers.

Key Drivers of Adoption

- Persistently low bank savings rates

- Increased financial transparency demands

- Global access to digital dollars

- Programmable, automated yield distribution

- Faster settlement and liquidity

For many users, the question has shifted from “Is crypto risky?” to

“Why is my bank paying me so little?”

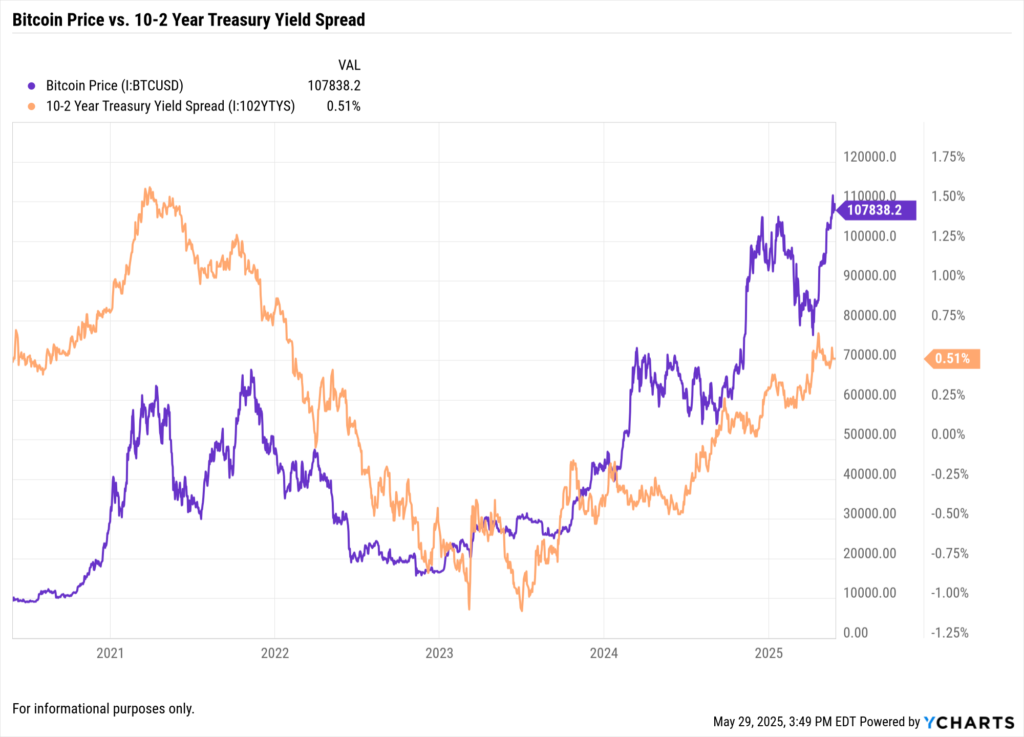

Yield Comparison: Stablecoins vs Bank Deposits

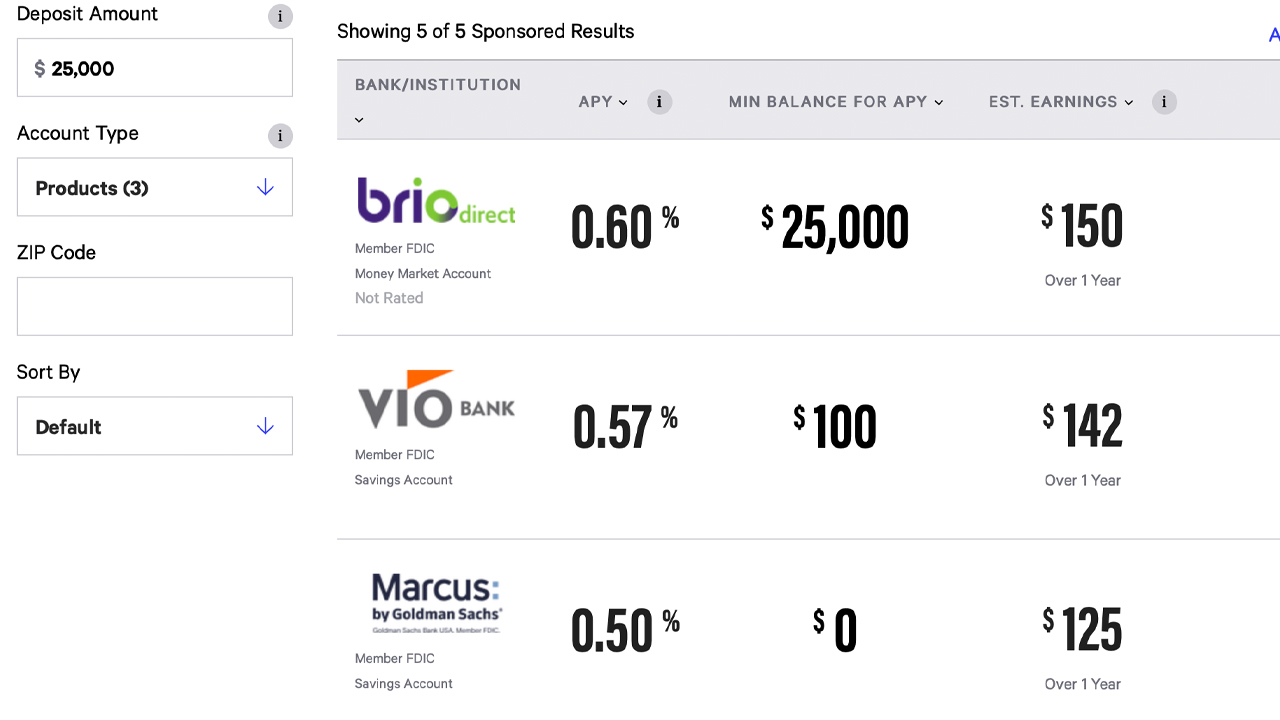

While rates fluctuate, yield-bearing stablecoins often provide higher returns than traditional savings accounts.

Typical Ranges (Illustrative, Not Guarantees)

- Traditional savings accounts: ~0.5%–4% (varies widely)

- High-yield bank accounts: ~4%–5% (often capped or conditional)

- Yield-bearing stablecoins: ~4%–10%+ (depending on structure and risk)

The difference becomes meaningful at scale. Over time, even a few percentage points can dramatically impact purchasing power.

Transparency: The Silent Advantage of Stablecoins

One of the most underappreciated advantages of yield-bearing stablecoins is transparency.

With Stablecoins:

- Transactions are visible on-chain

- Yield sources can often be audited

- Smart contracts define rules openly

- Settlement happens in real time

With Banks:

- Balance sheets are opaque to depositors

- Deposit usage is abstracted

- Yield decisions are centralized

This transparency shifts trust from institutions to verifiable systems.

Accessibility and Global Reach

Bank deposits are geographically constrained. Stablecoins are not.

Stablecoins Enable:

- Access without a traditional bank account

- Participation from emerging markets

- Dollar exposure in unstable currencies

- 24/7 access to funds

For millions of users globally, yield-bearing stablecoins represent the first realistic way to earn dollar-denominated yield.

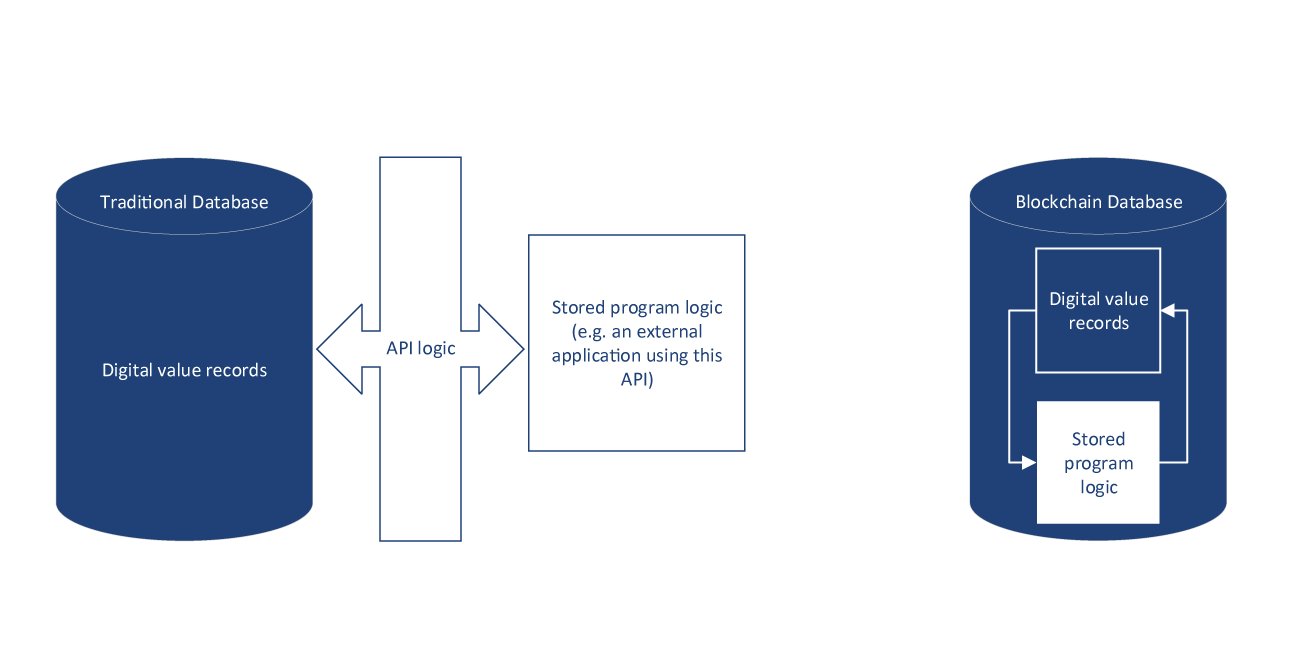

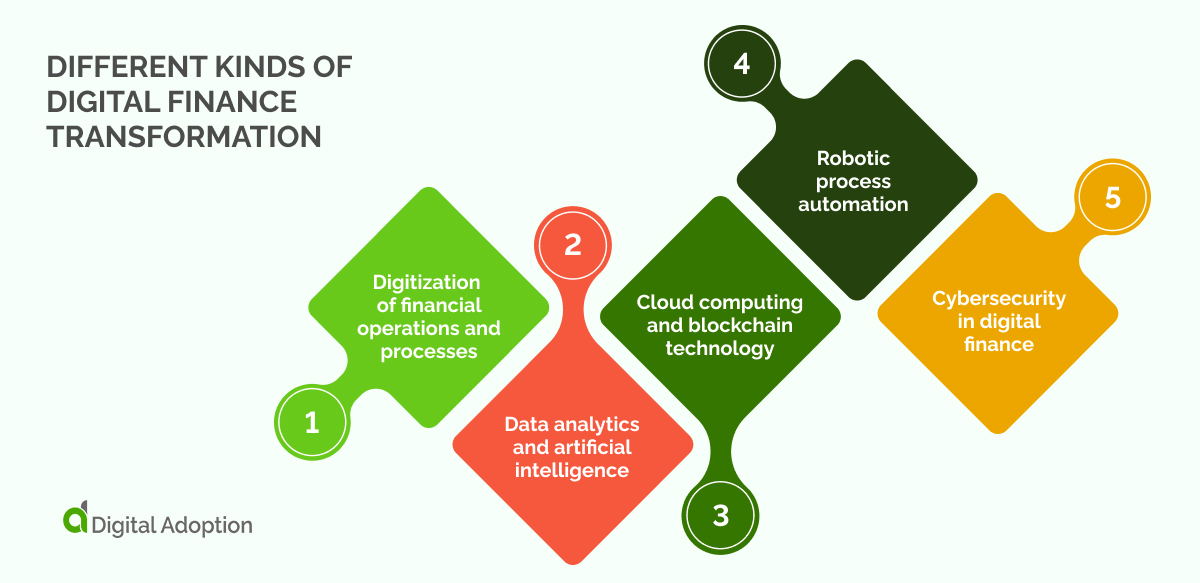

Programmable Money Changes Everything

Stablecoins are programmable.

That means:

- Yield can be distributed automatically

- Rules are enforced by code, not policy

- Funds can move instantly when conditions are met

Banks still rely heavily on:

- Batch processing

- Business hours

- Manual reconciliation

Programmability gives stablecoins a structural advantage that goes beyond interest rates.

The Risk Question: Stablecoins vs Banks

Higher yield always raises one question: risk.

Bank Deposit Risks

- Inflation erosion

- Bank failure (mitigated by insurance limits)

- Withdrawal restrictions in extreme scenarios

Stablecoin Risks

- Smart contract vulnerabilities

- Issuer or protocol risk

- Regulatory uncertainty

- Custody and wallet security

Neither system is risk-free. The difference is where risk lives and how visible it is.

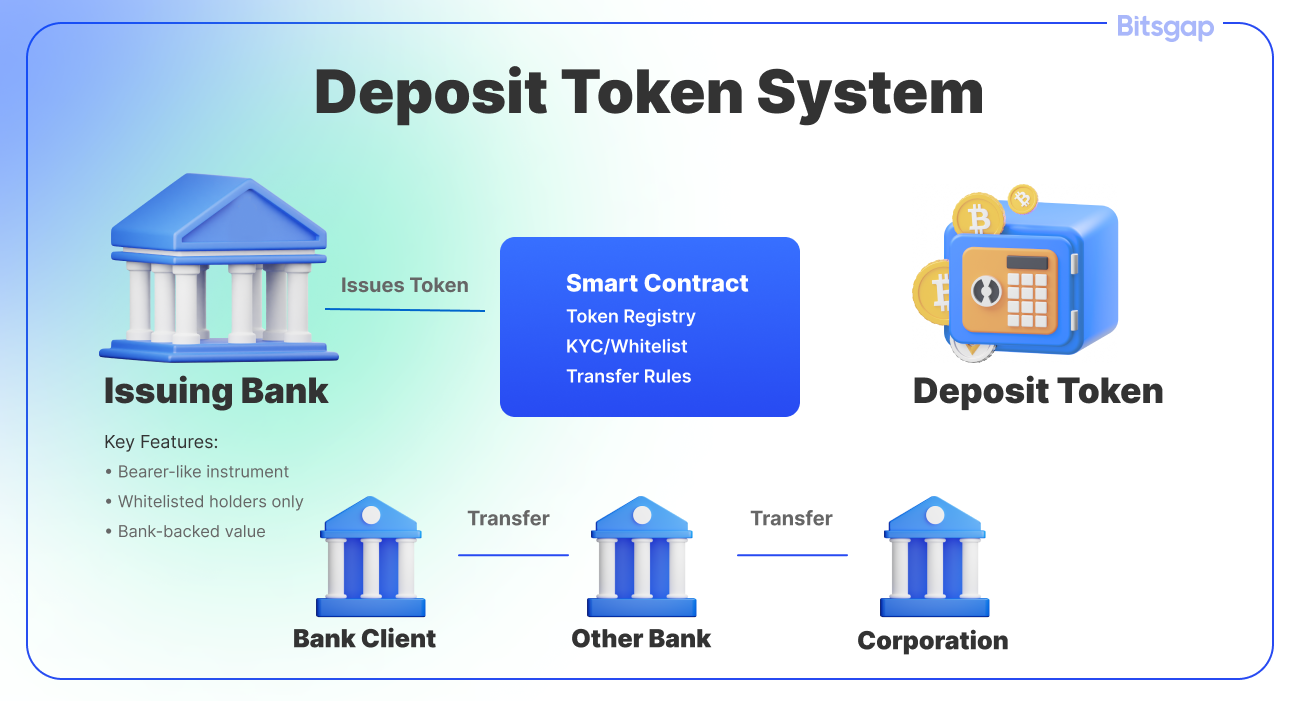

Why Banks Are Taking Stablecoins Seriously

Banks are not ignoring yield-bearing stablecoins — they’re watching closely.

Why Banks Feel the Pressure

- Deposits are their cheapest funding source

- Stablecoins compete for the same idle cash

- Younger users are more comfortable with digital assets

- Transparency expectations are rising

Some banks are already:

- Exploring tokenized deposits

- Partnering with blockchain platforms

- Experimenting with digital yield products

The competition is real.

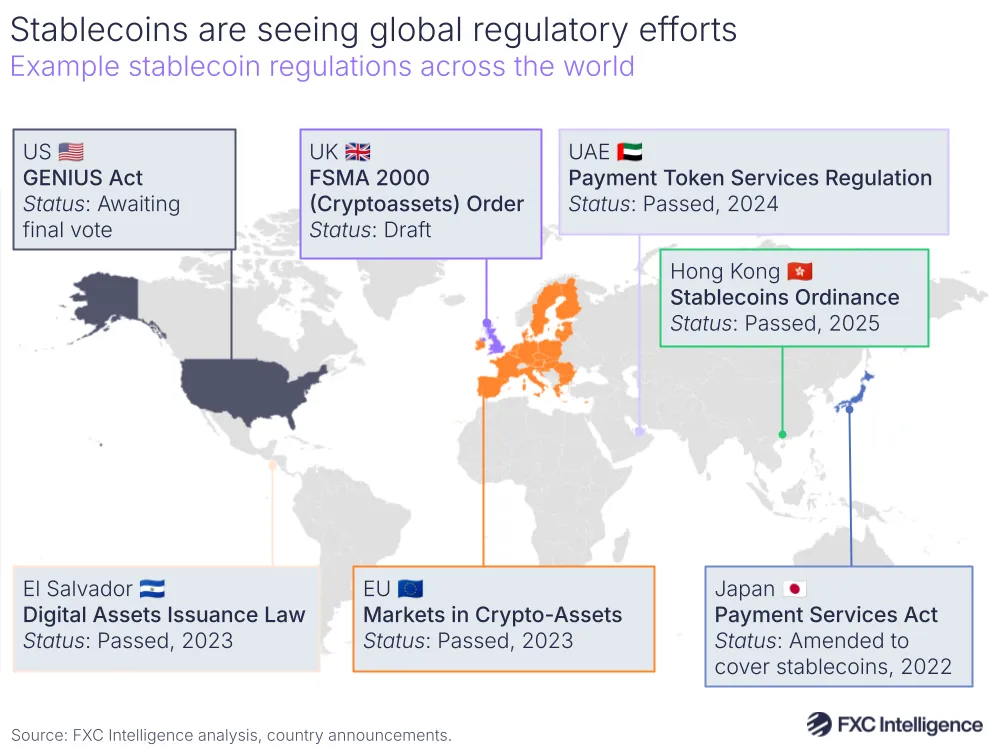

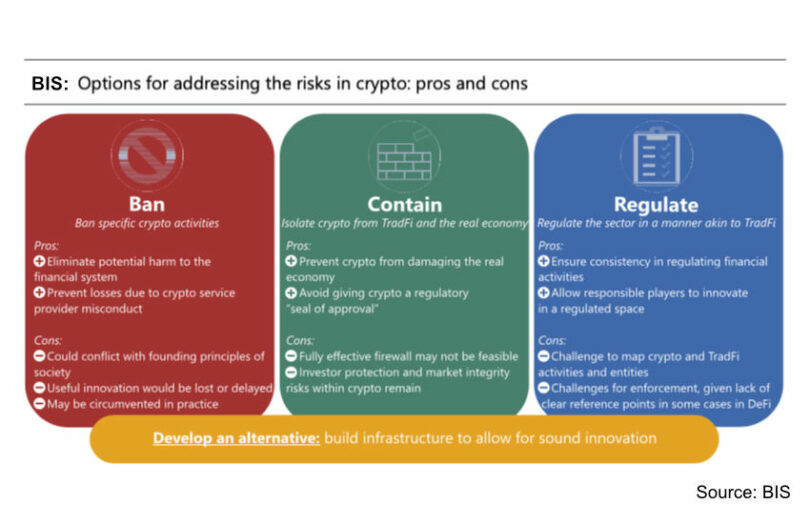

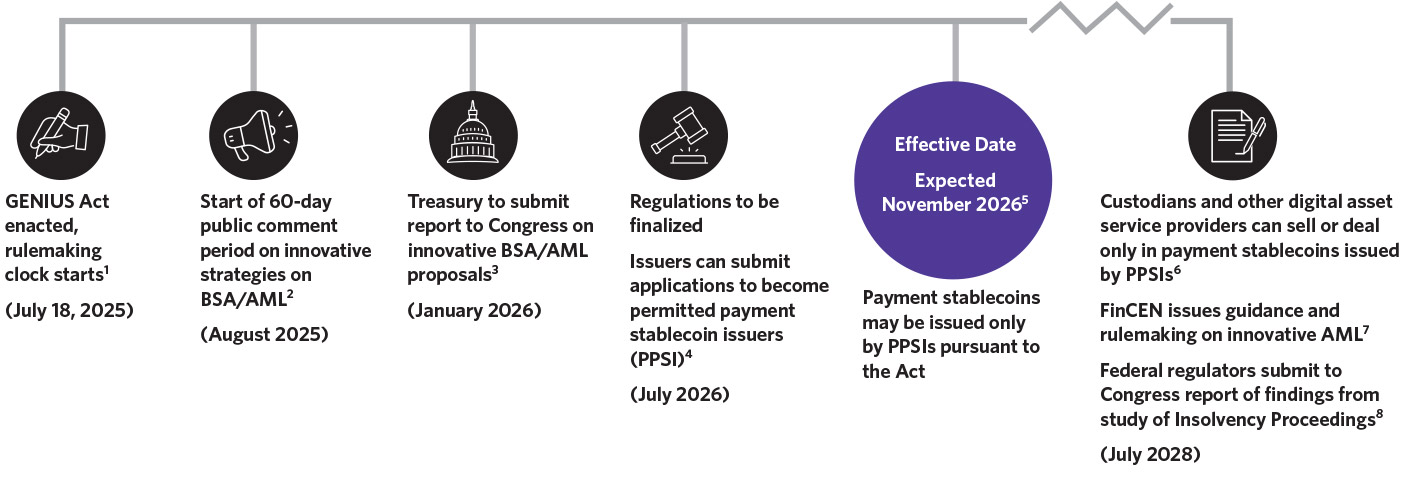

Regulation: The Next Battleground

Regulation will play a defining role in how this competition unfolds.

Key Regulatory Questions

- How are stablecoin yields classified?

- What disclosures are required?

- How are consumer protections enforced?

- Can stablecoins coexist with banking rules?

Rather than banning stablecoins, many regulators are moving toward integration and oversight, acknowledging their growing importance.

Why This Matters for the Future of Savings

This isn’t just a crypto story. It’s a savings story.

Yield-bearing stablecoins challenge the assumption that:

- Savings must be slow

- Yield must be opaque

- Access must be restricted

They introduce a model where:

- Yield is transparent

- Access is global

- Money is programmable

That forces banks to evolve — or lose relevance.

Will Stablecoins Replace Bank Deposits?

The answer is nuanced.

Yield-bearing stablecoins are unlikely to replace bank deposits entirely in the near term. Banks still offer:

- Deposit insurance

- Credit services

- Integrated financial products

But stablecoins don’t need to replace banks to change them.

They only need to compete.

The Hybrid Future: Banks + Stablecoins

The most likely outcome is a hybrid system:

- Banks adopt tokenized deposits

- Stablecoins gain clearer regulation

- Yield competition benefits consumers

- Transparency becomes standard

In this future, savers win.

What Savers Should Consider Today

Before choosing between stablecoins and bank deposits, consider:

- Your risk tolerance

- Your need for liquidity

- Regulatory protections in your jurisdiction

- How much transparency you value

Diversification — across both systems — may be the most rational approach.

Final Thoughts: A Quiet but Powerful Disruption

Yield-bearing stablecoins are not flashy. They don’t promise overnight riches. But they quietly challenge one of the most entrenched pillars of finance: bank deposits.

By offering:

- Competitive yields

- Greater transparency

- Global accessibility

- Programmable functionality

They force banks to confront a simple truth:

Savers now have alternatives.

This competition doesn’t weaken the financial system — it modernizes it.

And that’s why yield-bearing stablecoins aren’t just another crypto trend.

They’re a serious challenge to how money works.