If you’ve ever asked, “Where is most of the crypto trading actually happening?”, the simplest starting point is daily (24h) spot trading volume. Volume isn’t everything (liquidity quality, regulation, proof-of-reserves, and user safety matter a lot), but it does show where the market’s action and capital flow concentrate.

In this post, you’ll get a WordPress-ready breakdown of the top 10 crypto exchanges by reported 24-hour spot trading volume using a widely referenced public dashboard, plus what each platform is known for, who it tends to serve, and what to consider before you choose one.

Data note (important): Exchange volumes change constantly and different trackers use different methodologies. The figures below reflect reported 24h spot trading volume from CoinMarketCap’s “Top Cryptocurrency Spot Exchanges” page at the time of this snapshot.

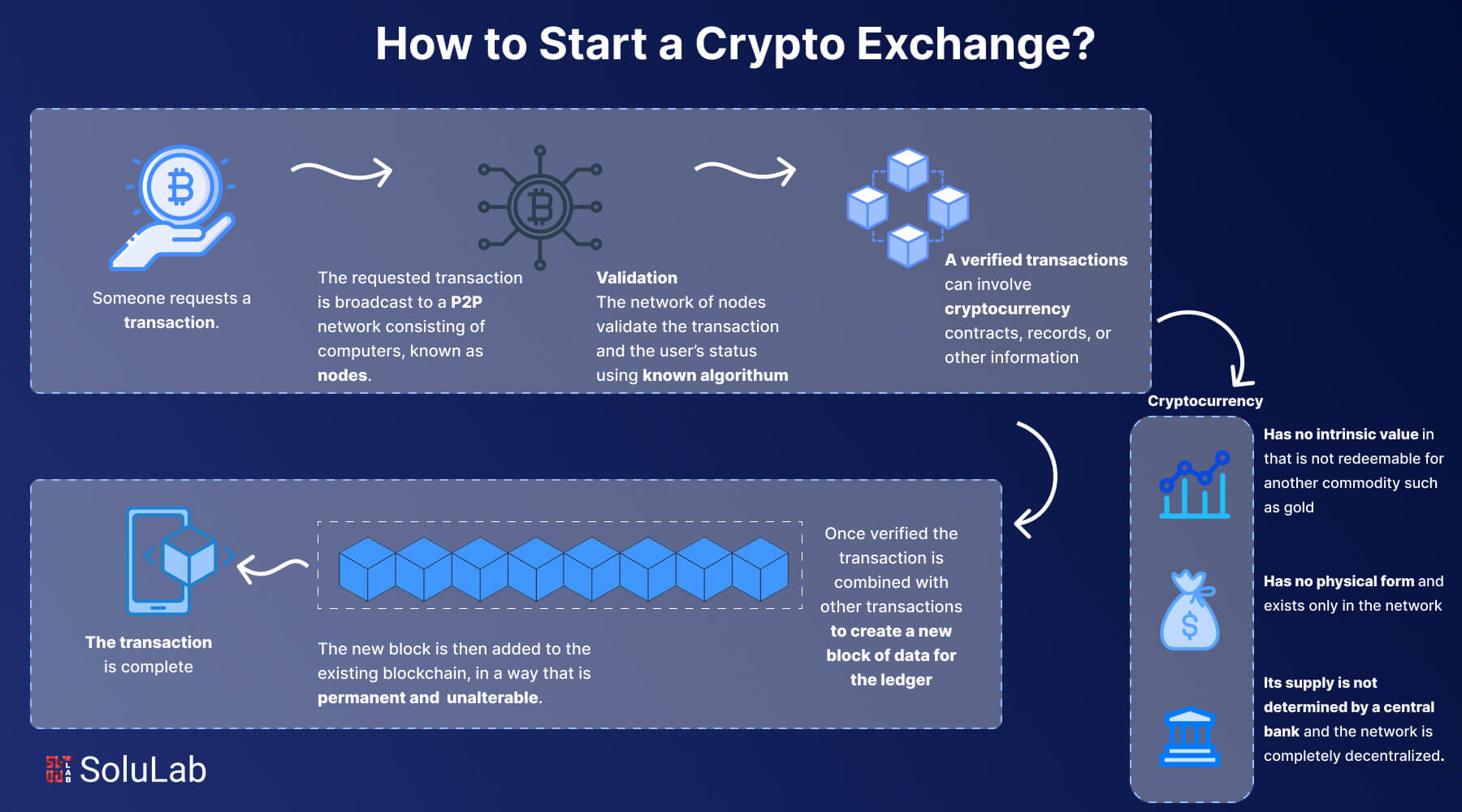

What “Daily Volume” Really Means (and Why It Matters)

Daily trading volume is the value of trades executed over the last 24 hours. Higher volume can imply:

- More active markets (more buyers and sellers)

- Potentially tighter spreads on major pairs

- Better odds of fast execution (especially for large orders)

But here’s the catch: volume is not a perfect quality metric. Some exchanges may report volumes that vary by methodology, incentives, and market structure. That’s why professional traders also look at:

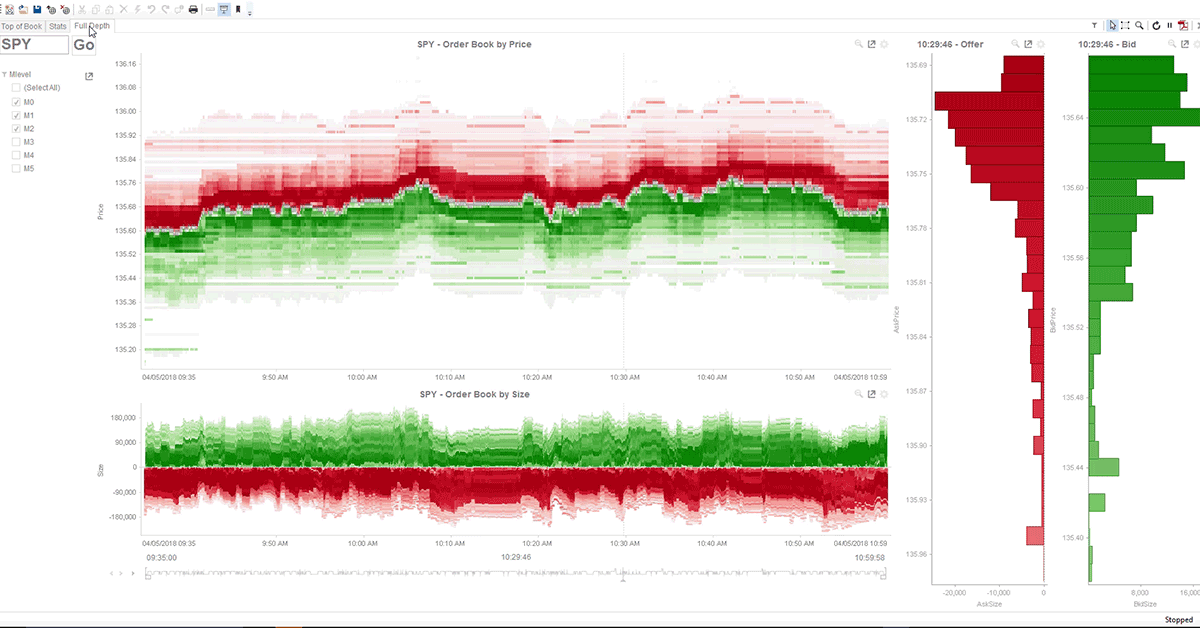

- Order book depth

- Liquidity score

- Regulatory standing

- Custody practices and proof-of-reserves

- Reputation and incident history

CoinMarketCap itself states it ranks and scores exchanges using multiple factors (traffic, liquidity, volume, and confidence in legitimacy).

Top 10 Crypto Exchanges by Reported 24h Spot Volume (CoinMarketCap Snapshot)

Below are the 10 exchanges shown at the top of CoinMarketCap’s spot exchange leaderboard in this snapshot, along with their reported 24h spot volumes.

1) Binance — Reported 24h Volume: ~$11.016B

Reported 24h spot volume: $11,016,285,174

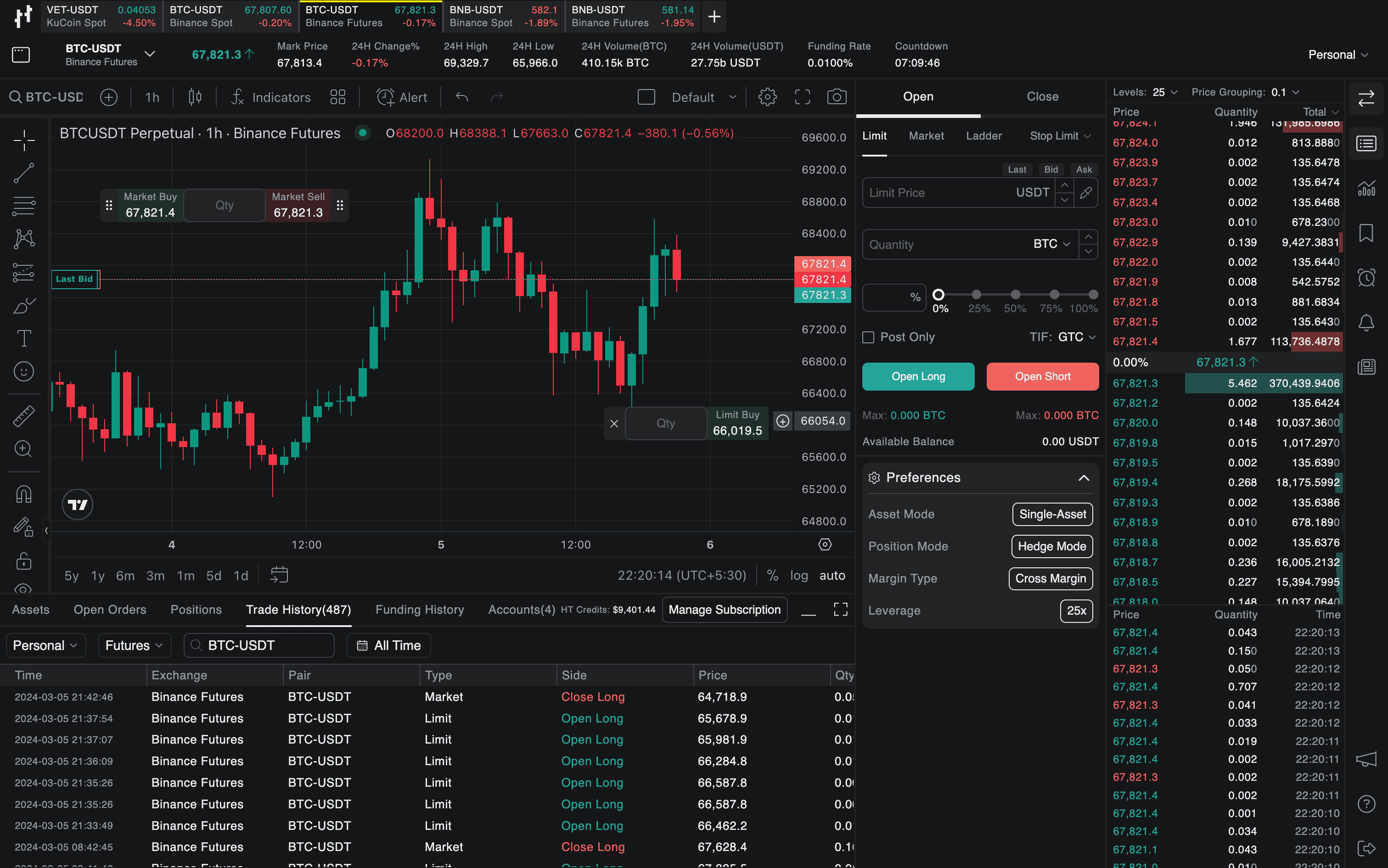

Binance is frequently cited as the world’s largest exchange by trading activity. It offers broad market coverage (many coins/pairs) and an ecosystem that spans spot, derivatives, staking/earn products, and more.

Often best for:

- Traders who want deep market access

- People who value huge coin selection

- Users who want a wide feature set in one place

Watch-outs:

- Regulations differ by jurisdiction, and features can vary by region

- Complexity can overwhelm beginners

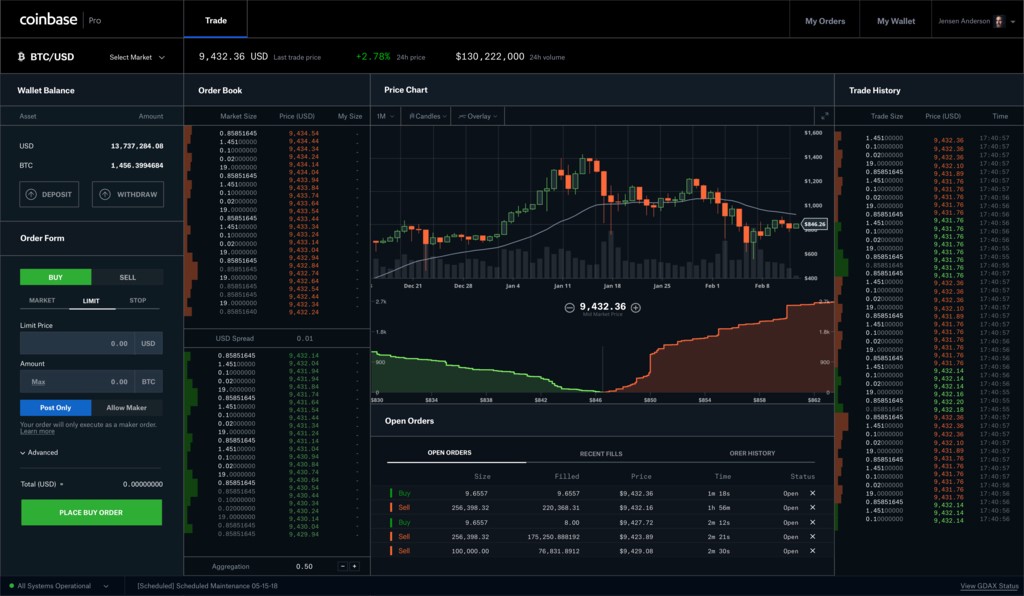

2) Coinbase Exchange — Reported 24h Volume: ~$1.822B

Reported 24h spot volume: $1,822,460,779

Coinbase is one of the most recognized brand names in crypto, especially in the U.S. It’s often associated with a more compliance-forward approach and a simpler on-ramp experience.

Often best for:

- Users who prioritize brand recognition

- Traders who want access to major liquid assets

- People who value a more “traditional finance” feel

Watch-outs:

- Fees can be higher depending on product and region

- Asset listings may be narrower than some global competitors

3) Upbit — Reported 24h Volume: ~$1.467B

Reported 24h spot volume: $1,467,135,914

Upbit is a major exchange particularly known for strong activity in the South Korean market. Regional exchanges can see powerful volume surges depending on local demand and fiat rails.

Often best for:

- Traders focused on KRW markets

- Users who want exposure to regionally popular assets

Watch-outs:

- Regional access limitations

- Liquidity can be concentrated in certain pairs

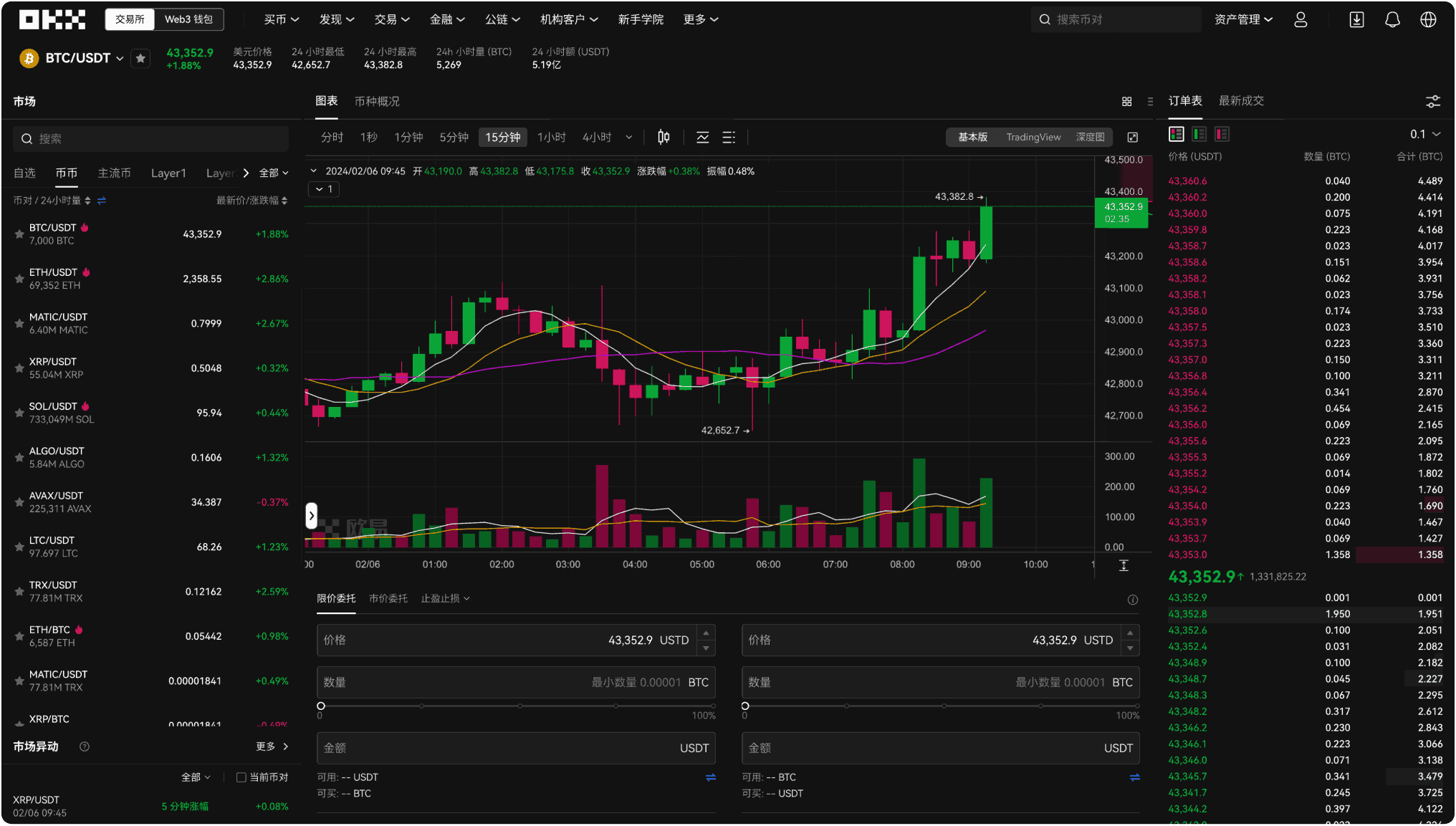

4) OKX — Reported 24h Volume: ~$1.441B

Reported 24h spot volume: $1,441,185,890

OKX is a global exchange known for a robust platform offering, including advanced trading tools and a wide range of crypto products in many regions.

Often best for:

- Intermediate-to-advanced traders

- Users who want a more feature-rich trading terminal

Watch-outs:

- Product availability differs by country

- New users may face a learning curve

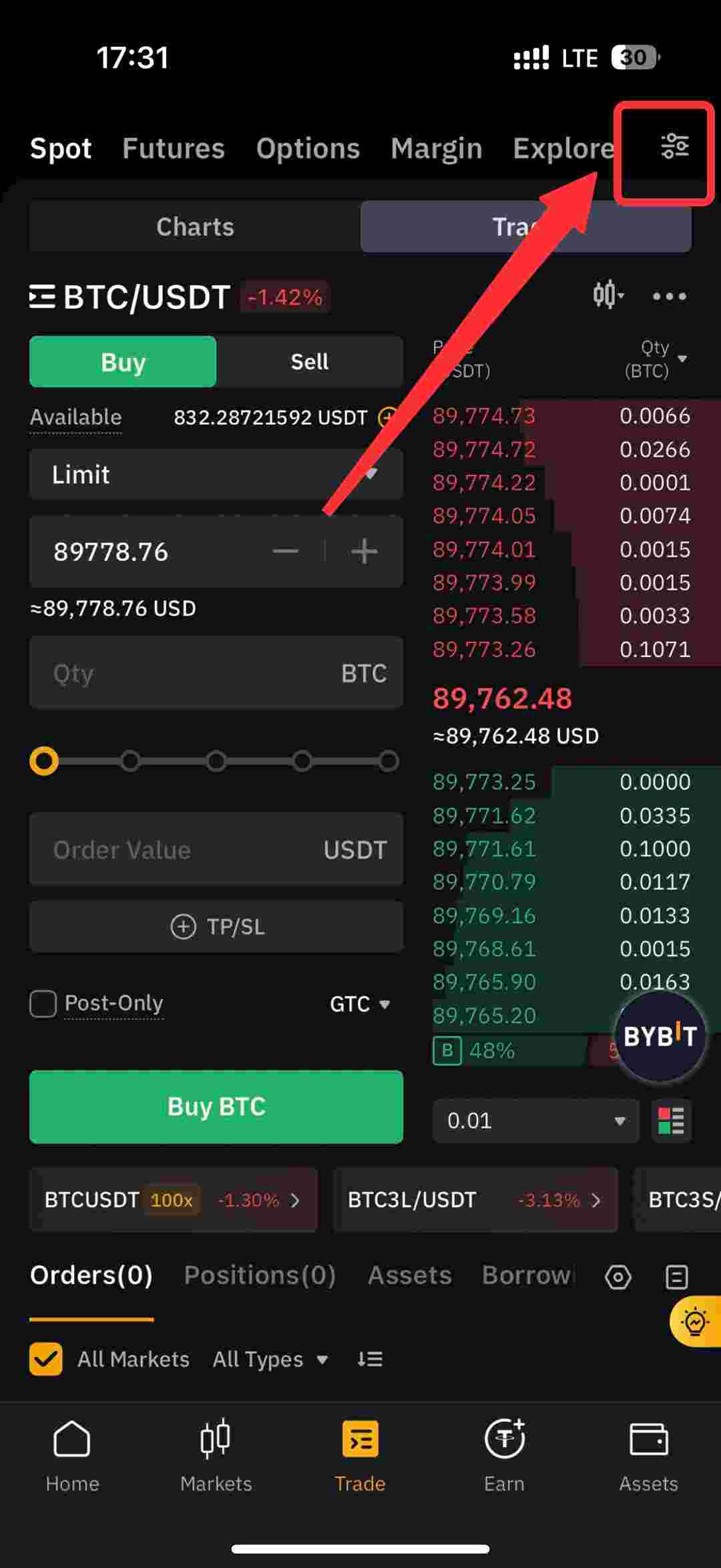

5) Bybit — Reported 24h Volume: ~$2.653B

Reported 24h spot volume: $2,653,454,580

Bybit is widely associated with active traders and has been known for strong engagement among derivatives users, while also maintaining significant spot activity.

Often best for:

- Traders who like fast-moving markets

- Users who want a platform designed for active trading

Watch-outs:

- Leverage products can amplify risk

- Regulatory availability varies

6) Bitget — Reported 24h Volume: ~$1.780B

Reported 24h spot volume: $1,779,543,210

Bitget has built a strong presence among active traders and is often mentioned in the context of social/copy trading features (availability depends on region and product configuration).

Often best for:

- Traders who like feature-heavy platforms

- Users exploring social-style trading tools

Watch-outs:

- Understand fee schedules and product risks

- Ensure your region supports desired features

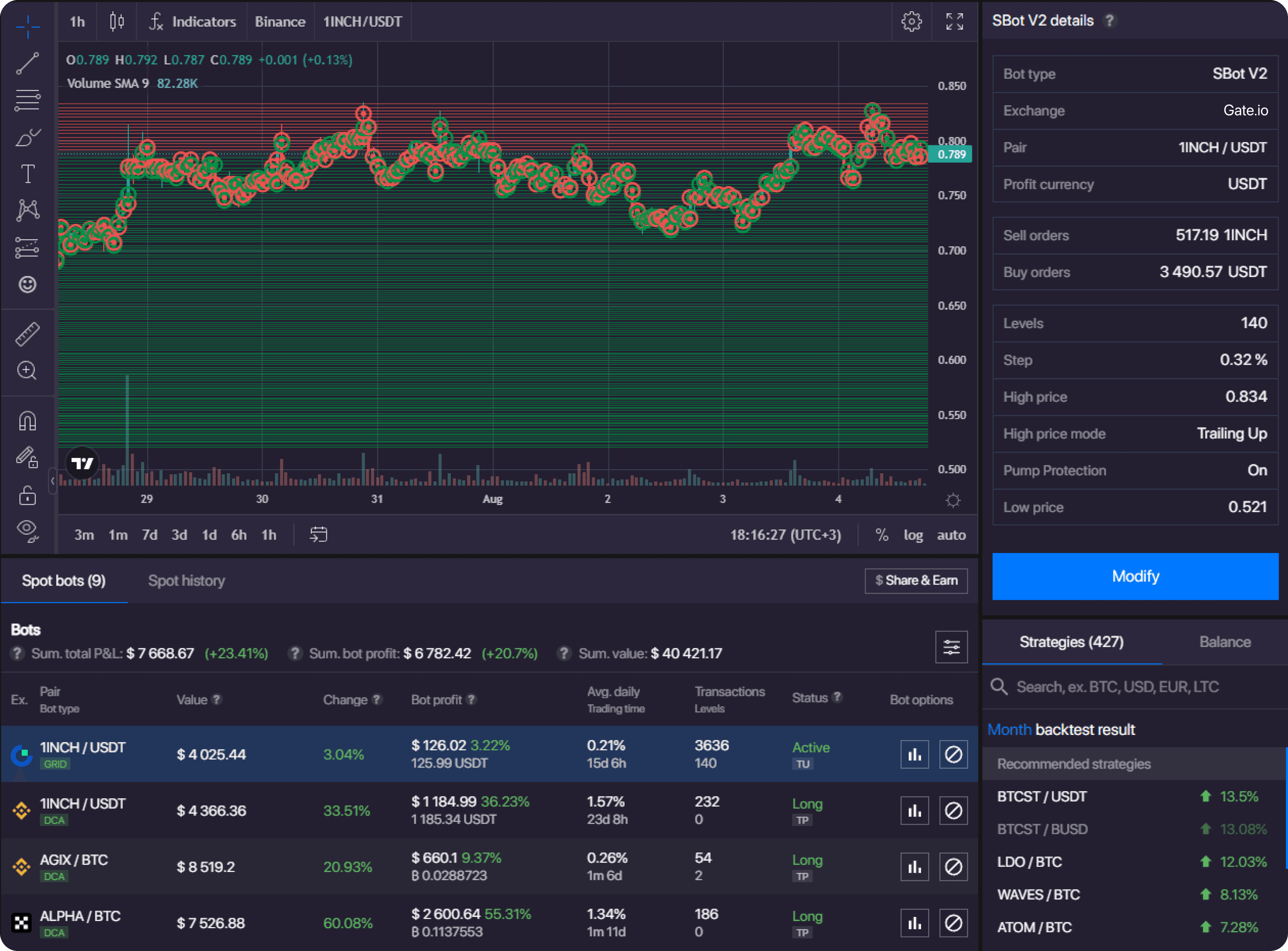

7) Gate — Reported 24h Volume: ~$2.553B

Reported 24h spot volume: $2,553,336,628

Gate (Gate.io) is known for listing a large number of assets and offering broad market access for traders who want exposure beyond the biggest coins.

Often best for:

- Users seeking wider altcoin coverage

- Traders who want many markets in one place

Watch-outs:

- Smaller assets can mean higher volatility and thinner liquidity in some pairs

- Always verify listing quality and risk

8) KuCoin — Reported 24h Volume: ~$2.298B

Reported 24h spot volume: $2,298,499,436

KuCoin is a long-running exchange brand that’s often associated with broad asset access and a global user base.

Often best for:

- Users who want access to a wide catalog of tokens

- Traders looking for many spot pairs

Watch-outs:

- Regional restrictions can apply

- Always use strong security settings (2FA, withdrawal whitelists)

9) MEXC — Reported 24h Volume: ~$2.855B

Reported 24h spot volume: $2,855,022,209

MEXC is frequently mentioned by traders who want broad token availability and active markets in a large range of pairs.

Often best for:

- Traders who want many listed assets

- Users who hunt for emerging tokens (higher risk)

Watch-outs:

- Emerging tokens can be extremely volatile

- Always confirm liquidity and spreads before trading

10) HTX — Reported 24h Volume: ~$2.089B

Reported 24h spot volume: $2,089,045,844

HTX (formerly associated with the Huobi brand) remains a high-activity exchange across many markets, with significant reported volume.

Often best for:

- Traders who want another major global venue

- Users seeking diverse markets

Watch-outs:

- Like all exchanges, features can differ by jurisdiction

- Assess transparency and security posture before committing funds

How to Choose Between High-Volume Exchanges (Practical Checklist)

If you’re picking an exchange in 2026, don’t choose based on volume alone. Use this checklist:

1) Regulation & Access

- Is it available in your country?

- Does it support your local fiat on/off ramps?

2) Fees & Spreads

- Compare maker/taker fees

- Check spreads on the pairs you trade most

3) Security Features

- 2FA + passkeys where available

- Withdrawal allowlists

- Proof-of-reserves / audits (when provided)

4) Liquidity Where You Trade

- An exchange can have huge global volume but weak liquidity in your specific pair

- Test with small orders first

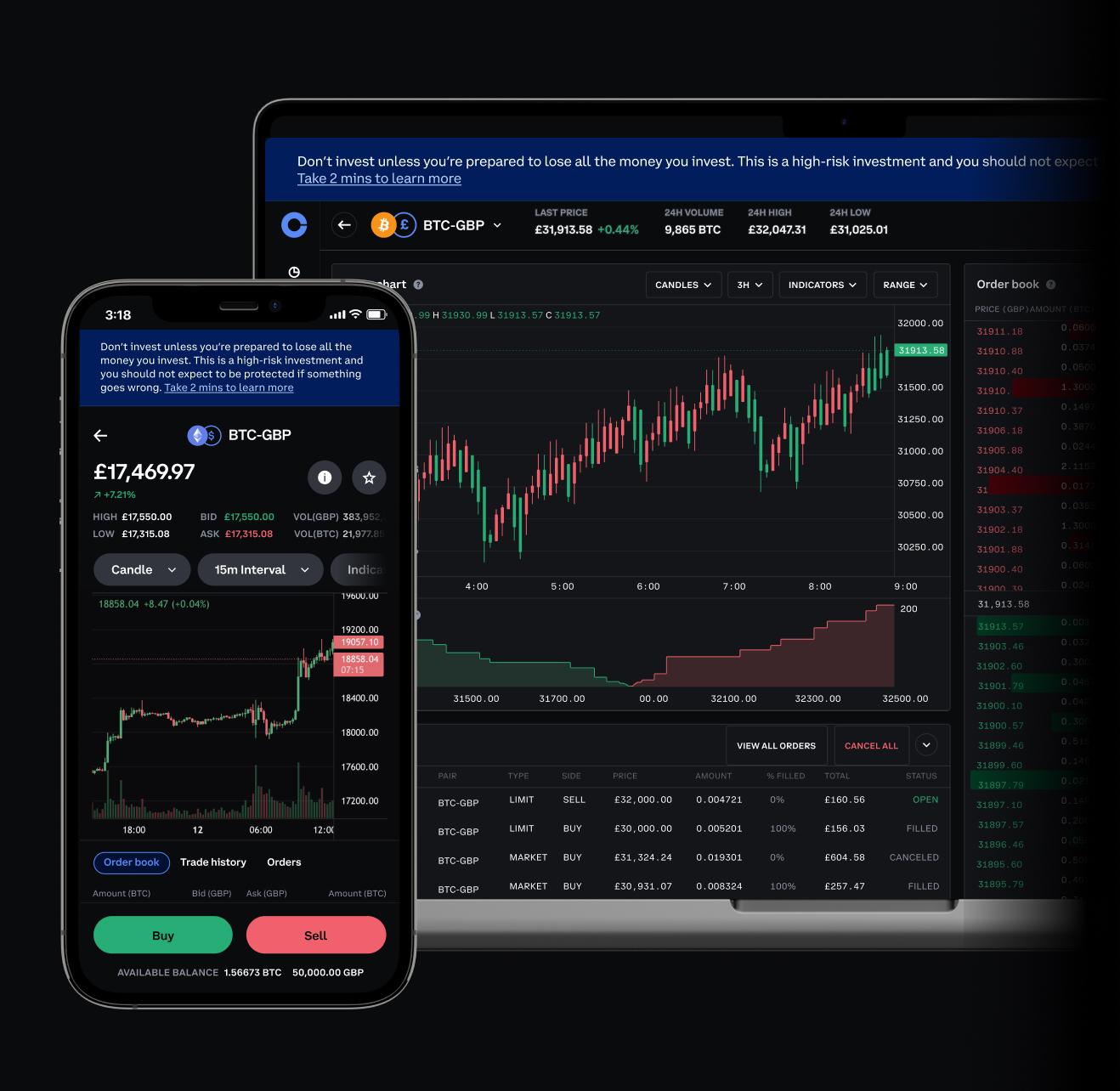

5) UX & Support

- If you’re active, you want stable apps, fast order matching, and responsive support

FAQ: Top Crypto Exchanges by Volume

Are the “top exchanges” always the safest exchanges?

Not necessarily. “Top by volume” measures trading activity—not customer protection, regulatory strength, or security practices. Use volume as one input, not the only one.

Why does “24h volume” change so much?

Crypto trades 24/7 globally. Volume shifts with volatility, news events, market cycles, and regional trading hours.

Spot vs derivatives volume — which matters more?

For many exchanges, derivatives markets can be larger than spot. This post focuses on spot trading volume, which more directly reflects immediate buying/selling of assets (not leveraged contracts). CoinMarketCap also has separate derivatives leaderboards.

Final Take: Volume Shows Where Liquidity Lives — But Choose for Fit

The exchanges above represent major hubs of crypto activity by reported 24h spot volume on a widely used public ranking page.

But the “best” exchange for you depends on:

- your region,

- the assets you trade,

- your risk tolerance,

- and how much you value simplicity vs advanced tools.

If you tell me your country/region and whether you trade spot only or also derivatives, I can recommend the best-fit 2–3 exchanges from this list and write a matching “How to choose” section tailored to your audience.