Artificial intelligence is no longer an experimental edge in financial markets — it is rapidly becoming the default operating system. Nowhere is this transformation more dramatic than in AI crypto trading, where algorithms analyze markets, execute trades, and manage risk faster than any human ever could.

As AI-driven crypto trading systems grow more powerful, a pressing question emerges:

What happens to human relevance in financial markets when machines trade better, faster, and without emotion?

This article explores how AI crypto trading is reshaping the industry, which human roles will disappear, which will evolve, and why humans may still matter — but in very different ways.

The Rise of AI Crypto Trading

Crypto markets are uniquely suited for artificial intelligence.

They operate 24/7, generate massive amounts of real-time data, and are notoriously volatile. For AI systems trained on pattern recognition, statistical arbitrage, and machine learning, crypto is the perfect environment.

Why AI Thrives in Crypto Markets

AI crypto trading systems outperform humans in several key areas:

- Speed: Algorithms react in milliseconds

- Scale: AI can monitor thousands of assets simultaneously

- Emotionless execution: No fear, greed, or panic selling

- Data processing: AI ingests on-chain data, order books, news, and sentiment in real time

What once required teams of traders, analysts, and risk managers can now be executed by a handful of engineers and machines.

This shift isn’t theoretical — it’s already happening.

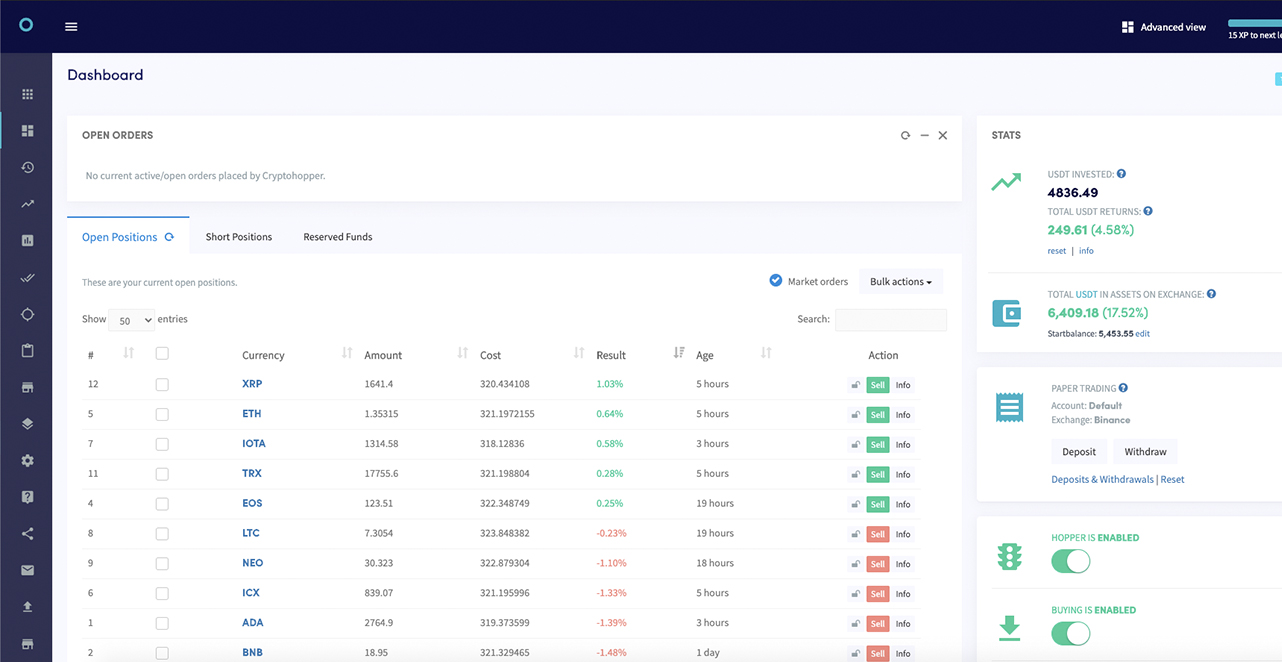

How AI Crypto Trading Works

AI crypto trading is not a single technology, but a stack of interconnected systems.

Core Components of AI Crypto Trading

- Data Collection

AI systems pull data from:- Price feeds and order books

- On-chain metrics (wallet activity, flows, gas fees)

- Social media sentiment

- News and macroeconomic indicators

- Machine Learning Models

These models identify patterns humans cannot see, such as:- Microstructure inefficiencies

- Behavioral crowd signals

- Early trend reversals

- Automated Execution

Trades are executed automatically based on predefined strategies, risk parameters, and probability thresholds. - Continuous Learning

Advanced AI models adapt in real time, updating strategies as market conditions change.

The result: self-improving trading systems that get better with every cycle.

Human Roles AI Crypto Trading Is Already Replacing

The most immediate impact of AI crypto trading is job displacement — particularly in roles built around speed, repetition, and pattern recognition.

1. Manual Crypto Traders

Retail and even professional discretionary traders struggle to compete with AI systems that:

- Never sleep

- Never hesitate

- Never miss market signals

Manual trading is increasingly becoming a losing battle against automation.

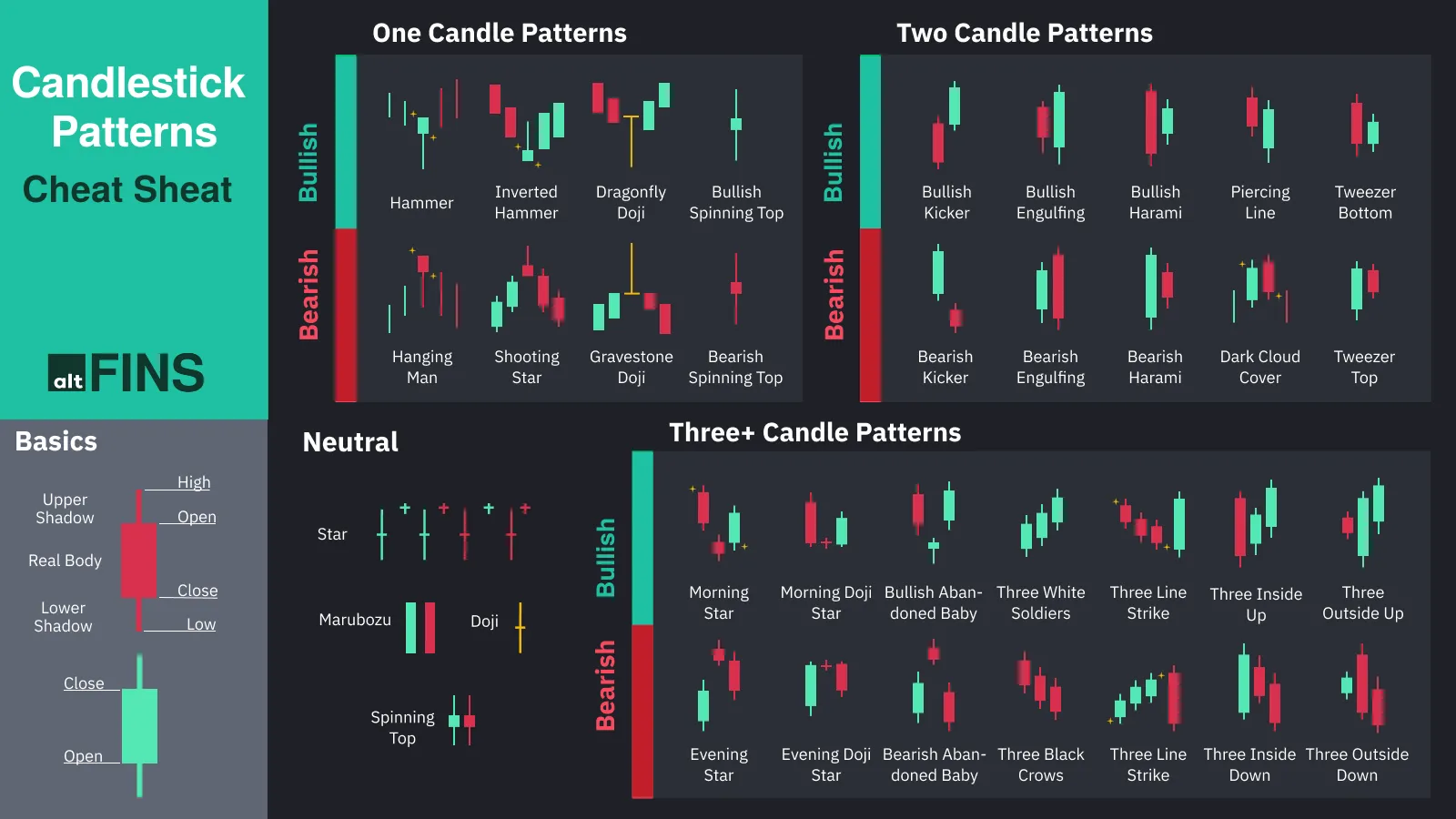

2. Technical Analysts

Chart-based analysis — once a cornerstone of trading — is easily replicated and enhanced by AI.

AI systems can analyze:

- Multiple timeframes simultaneously

- Complex indicator combinations

- Historical patterns across entire market cycles

This reduces the need for human technical analysts focused purely on charts.

3. Execution and Arbitrage Roles

High-frequency arbitrage, market making, and execution optimization are now dominated by algorithms. Humans simply cannot compete at machine speed.

But Humans Are Not Becoming Irrelevant — They’re Becoming Different

While AI excels at execution and optimization, it still lacks key human capabilities.

This is where human relevance shifts rather than disappears.

New Human Roles in the AI Crypto Era

1. Strategy Architects

Humans define why a strategy exists, not just how it executes.

AI can optimize a strategy, but humans:

- Choose objectives

- Define risk tolerance

- Decide ethical and regulatory boundaries

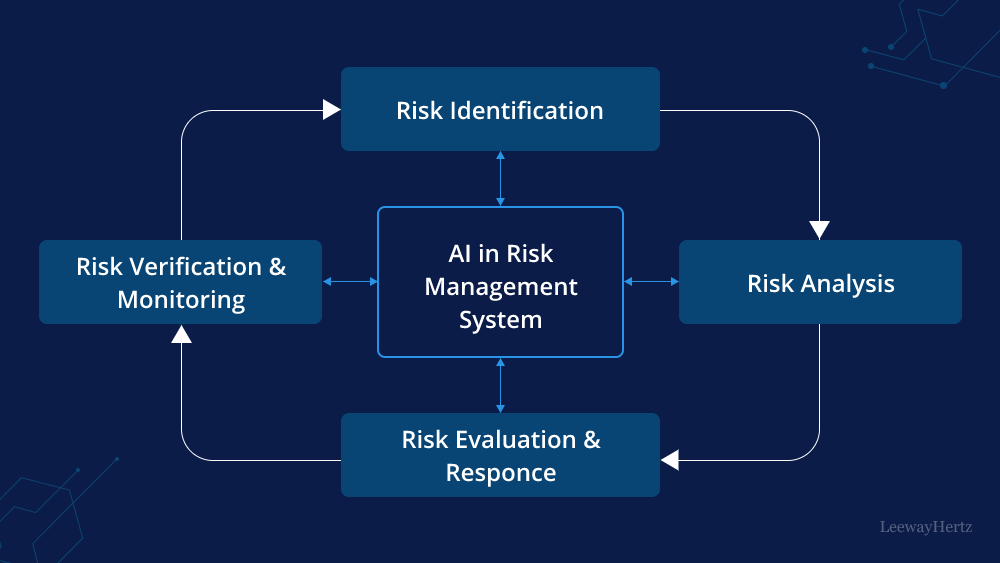

2. AI Supervisors and Risk Controllers

AI systems require oversight.

Humans are needed to:

- Monitor model behavior

- Detect abnormal or unintended actions

- Shut down systems during extreme events

The 2010 Flash Crash remains a powerful reminder of what happens when automated systems spiral without human intervention.

3. Macro and Narrative Interpreters

AI struggles with:

- Geopolitical nuance

- Regulatory intent

- Long-term social and cultural shifts

Humans excel at understanding context, not just data.

The Psychological Divide: Humans vs Machines

One of the most under-discussed aspects of AI crypto trading is the psychological shift.

Humans Trade Emotionally

Even experienced traders are affected by:

- Fear during crashes

- Overconfidence during rallies

- Confirmation bias

AI Trades Probabilistically

AI does not care about:

- Headlines

- Personal beliefs

- Past losses

It simply follows probability distributions.

This creates a widening gap between human intuition and machine logic — one that many traders find difficult to accept.

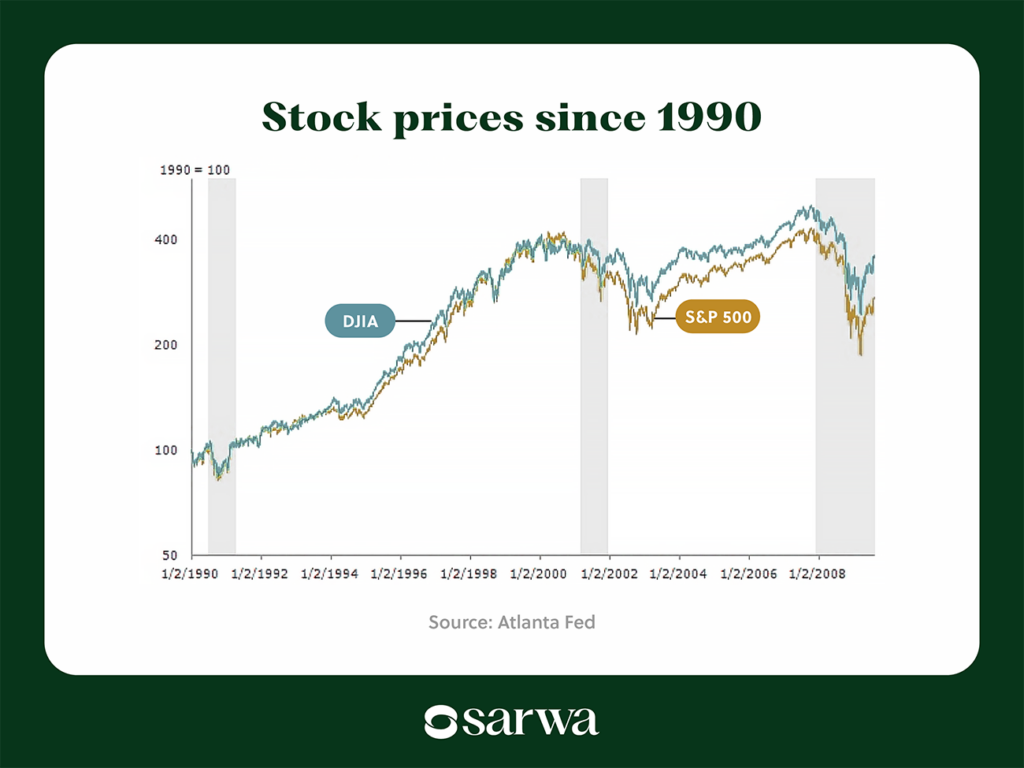

The Risks of AI Crypto Trading Dominance

AI crypto trading is powerful — but not without serious risks.

1. Model Herding

When many AI systems are trained on similar data and strategies, they can behave identically.

This can:

- Amplify volatility

- Create sudden liquidity vacuums

- Trigger cascading liquidations

2. Black Swan Blindness

AI models are trained on historical data.

Events that have never occurred — regulatory bans, protocol failures, geopolitical shocks — can break models entirely.

3. Concentration of Power

AI trading favors:

- Firms with capital

- Access to data

- Advanced infrastructure

This risks centralizing market power in the hands of a few players.

Retail Traders in an AI-Dominated Market

For retail traders, AI crypto trading changes the rules of the game.

What Retail Traders Should Not Do

- Compete on speed

- Day trade against algorithms

- Rely solely on technical indicators

What Still Works for Humans

- Long-term investing

- Thematic and narrative-driven trades

- Risk-managed portfolio allocation

- Using AI as a tool, not an opponent

Retail relevance depends on adapting, not resisting.

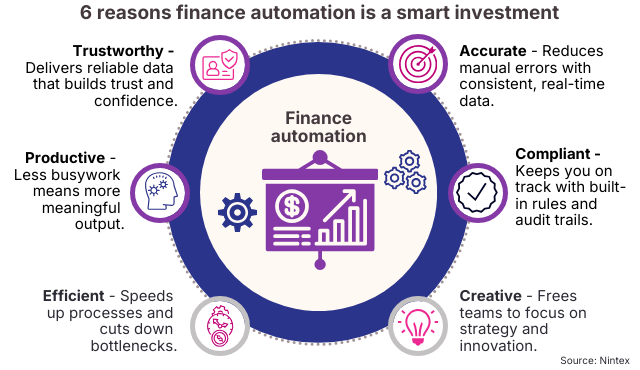

The Future: Human + AI, Not Human vs AI

The most successful financial systems of the future will not eliminate humans — they will redefine them.

The Hybrid Model

In the emerging model:

- AI handles execution, optimization, and monitoring

- Humans handle strategy, ethics, oversight, and adaptation

This partnership combines:

- Machine precision

- Human judgment

Together, they outperform either alone.

Will AI Fully Replace Human Traders?

The short answer: No — but it will replace the old version of them.

The human trader of the future is:

- Less emotional

- More strategic

- Technologically fluent

- Focused on systems, not single trades

Those who refuse to adapt will be left behind. Those who evolve will thrive.

Final Thoughts: Human Relevance Is Changing, Not Ending

AI crypto trading is not the end of human relevance in financial markets — but it is the end of business as usual.

Humans are no longer the fastest, the most disciplined, or the most data-driven participants. But they remain the most context-aware, ethical, and adaptive.

The future belongs to those who understand one simple truth:

In crypto markets, AI will trade — but humans will still decide what matters.