As crypto regulation continues to take shape in 2026, one thing has become increasingly clear: traditional banks are deeply uncomfortable with stablecoins.

Publicly, banks frame their opposition around consumer protection, financial stability, and systemic risk. Privately — and sometimes not so quietly — the real concern is much simpler: stablecoins threaten bank deposits.

Stablecoins don’t just represent a new asset class. They represent a new form of money movement, one that bypasses the traditional banking system entirely. And for banks, that’s an existential issue.

In this article, we’ll break down why banks oppose stablecoin-friendly regulation, what “deposit flight” actually means, and why this battle matters for the future of finance.

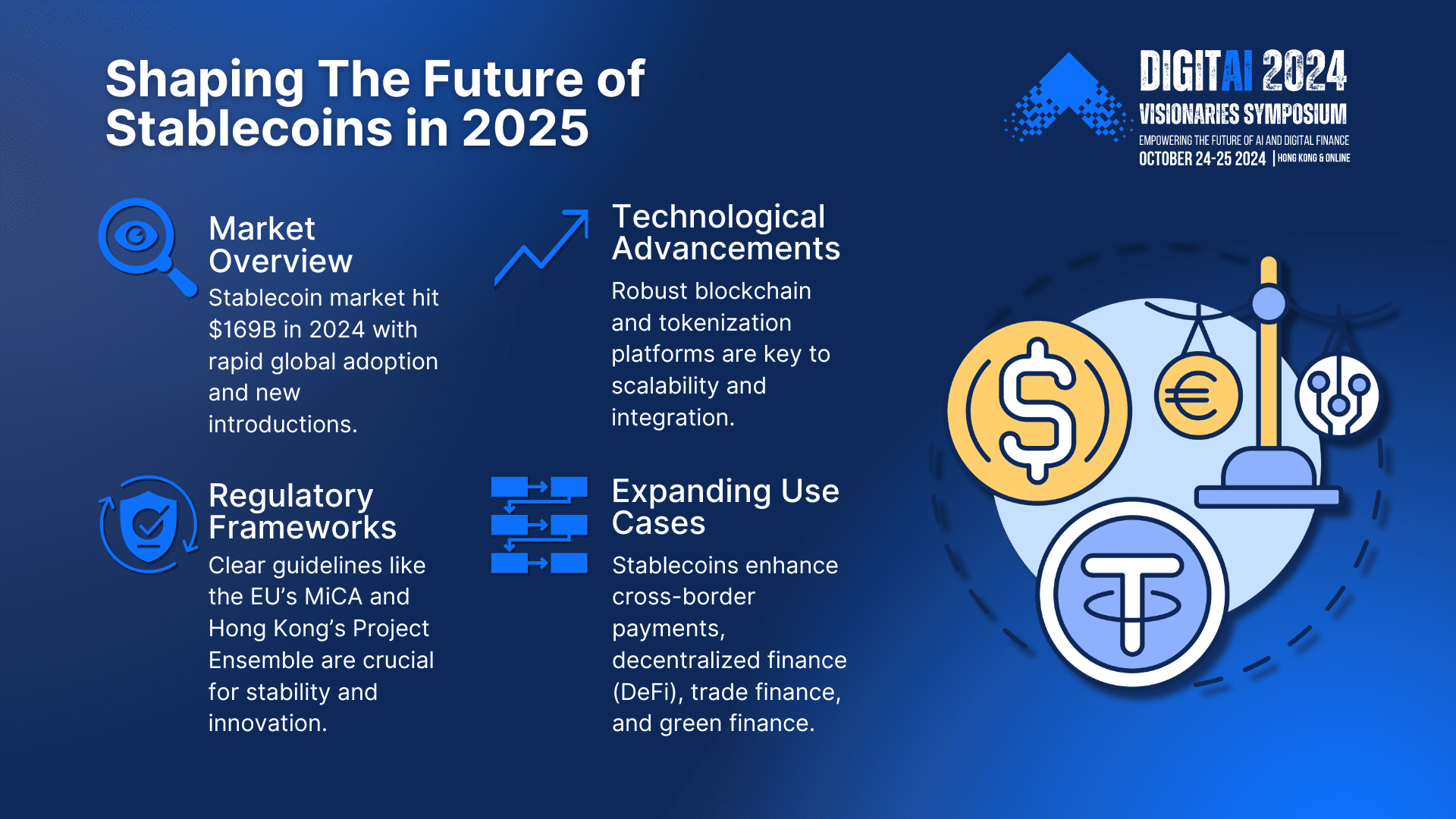

What Are Stablecoins — and Why Do They Matter?

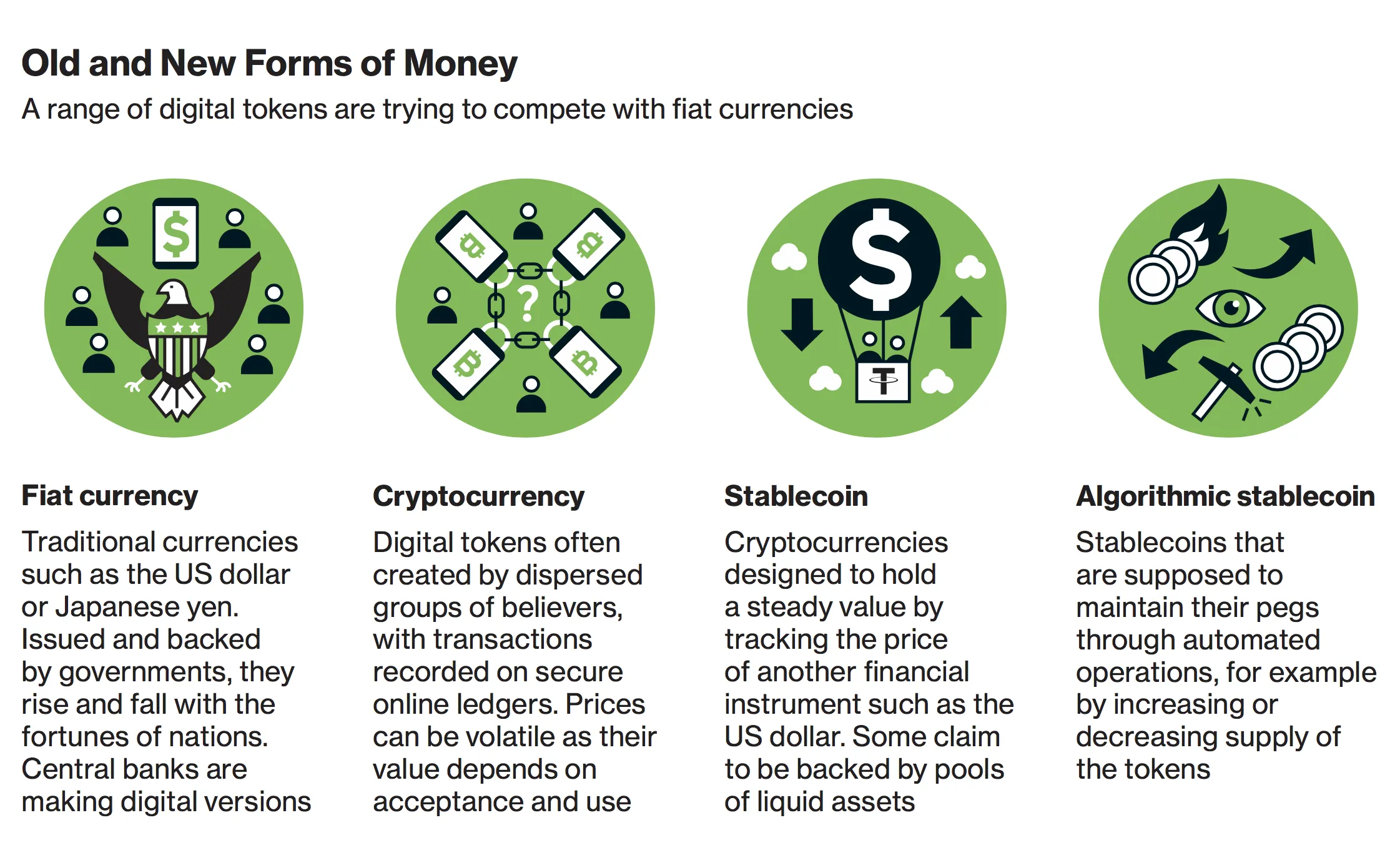

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged 1:1 to a fiat currency like the U.S. dollar. Examples include USD-backed tokens that allow users to hold, send, and settle dollars on blockchain networks.

Unlike volatile cryptocurrencies, stablecoins function more like:

- Digital cash

- Settlement layers

- Payment rails

- Store-of-value alternatives to bank balances

What makes stablecoins powerful isn’t just price stability — it’s accessibility. Anyone with an internet connection can hold and transfer value without needing a bank account.

That’s exactly where the tension begins.

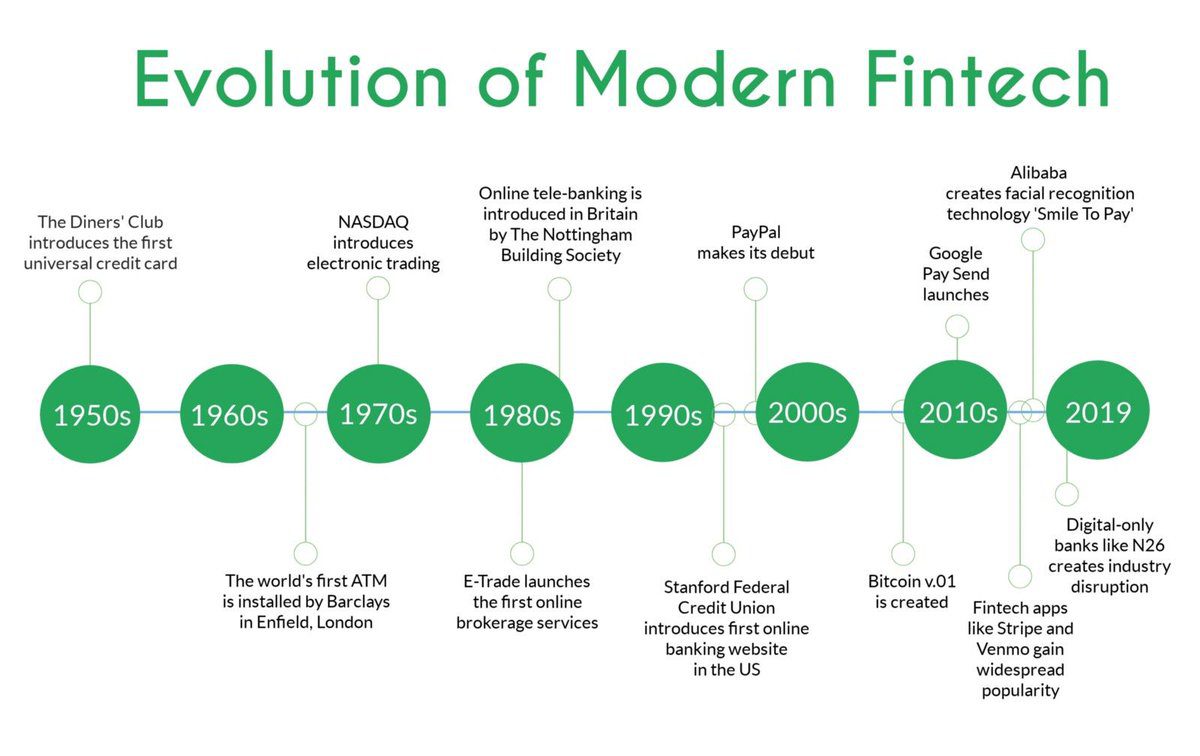

Banks Don’t Just Hold Money — They Depend on It

To understand why banks oppose stablecoins, you need to understand how banks make money.

Banks operate on a fractional reserve model:

- You deposit money into a bank

- The bank lends most of it out

- The bank earns interest on loans

- You earn little (or nothing) on your deposit

Deposits are not idle cash — they are the raw material of banking. Fewer deposits mean:

- Less lending capacity

- Lower profits

- Higher borrowing costs

- Reduced influence over capital flows

Stablecoins introduce a direct competitor to this model.

The Core Fear: Deposit Flight

“Deposit flight” refers to money leaving traditional bank accounts and moving elsewhere — in this case, into stablecoins.

Unlike moving money between banks, stablecoin outflows:

- Can happen instantly

- Don’t require business hours

- Aren’t limited by geography

- Don’t stay within the banking system

A user who moves funds into a stablecoin is effectively saying:

“I don’t need a bank to hold my money.”

At scale, this becomes a serious problem for banks.

Why Stablecoins Are More Dangerous Than Crypto Volatility

Banks aren’t losing sleep over speculative crypto trading. Volatility doesn’t threaten deposits — utility does.

Stablecoins are dangerous to banks because they:

- Act like digital dollars

- Are easy to understand

- Can be used for payments, savings, and settlement

- Integrate with DeFi, exchanges, and payment apps

Once users trust stablecoins as “money,” banks lose their monopoly over deposit accounts.

This is why regulatory attention is heavily focused on stablecoins rather than speculative tokens.

The Yield Problem: When Stablecoins Compete With Savings Accounts

One of the most contentious issues in recent regulatory debates is stablecoin rewards or yield.

Some crypto platforms offer:

- Rewards for holding stablecoins

- Yield through DeFi integrations

- Incentives that resemble interest

From a bank’s perspective, this crosses a red line.

Banks argue:

- Stablecoins offering yield look like unregulated deposits

- Crypto firms aren’t subject to capital or liquidity requirements

- Consumers may not understand the risks

But beneath these arguments is a competitive reality:

If stablecoins offer better returns than savings accounts, deposits will move.

“Financial Stability” vs Market Control

Banks often frame their opposition in terms of systemic risk. They warn that widespread stablecoin adoption could:

- Weaken bank balance sheets

- Increase the risk of bank runs

- Reduce credit availability

- Create a “shadow banking system”

Some of these concerns are valid. But critics argue that banks are less concerned about instability and more concerned about losing control over money flows.

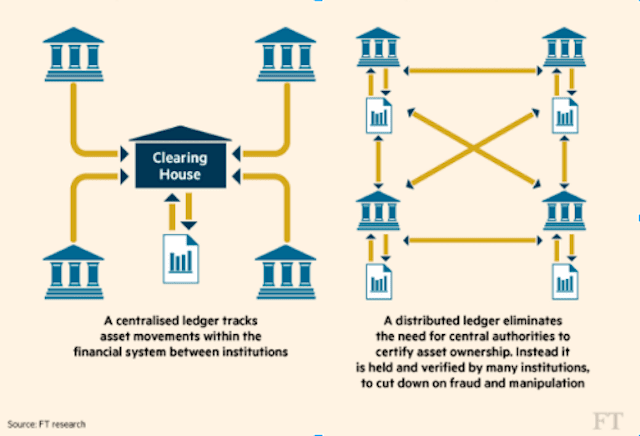

Stablecoins reduce banks’ role as:

- Gatekeepers

- Intermediaries

- Settlement authorities

That shift represents a fundamental power change.

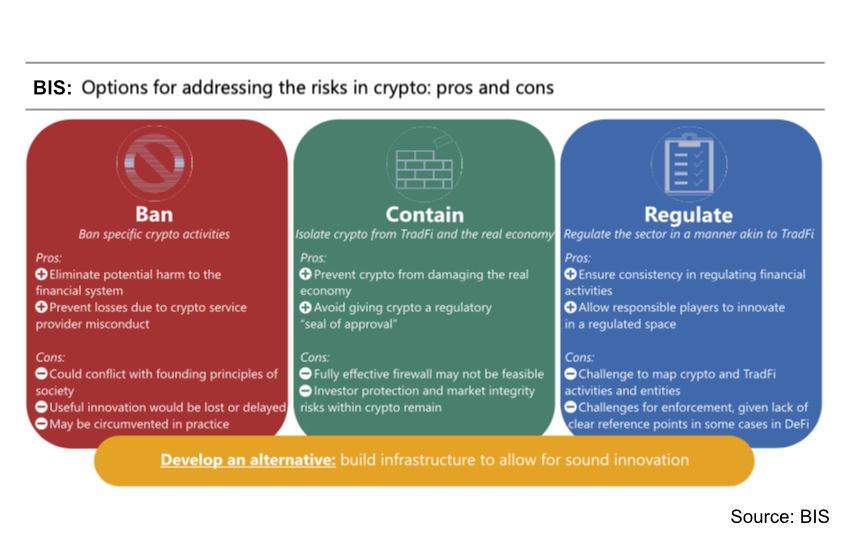

Why Regulators Are Caught in the Middle

Regulators face a difficult balancing act:

- Encourage innovation

- Protect consumers

- Preserve financial stability

- Prevent regulatory arbitrage

Banks lobby for strict stablecoin rules that would:

- Limit who can issue stablecoins

- Restrict yield or incentives

- Require bank-like regulation

- Preserve traditional financial dominance

Crypto firms argue that:

- Stablecoins increase efficiency

- Competition improves consumer outcomes

- Blockchain settlement reduces systemic risk

- Banks shouldn’t have exclusive rights to digital money

The resulting regulations often reflect compromise — but not without friction.

Are Stablecoins Actually Draining Bank Deposits?

So far, large-scale deposit flight into stablecoins has been gradual, not explosive. But banks think long-term.

They are looking at:

- Younger generations avoiding traditional banking

- Global adoption of blockchain payments

- Corporate interest in tokenized dollars

- Cross-border use cases where banks are inefficient

From that perspective, stablecoins aren’t a current crisis — they’re a future one.

The Bigger Picture: Who Controls the Money?

At its core, this debate isn’t about crypto versus banks. It’s about who controls money in a digital world.

Banks want:

- Money to stay within regulated institutions

- Deposits to remain the foundation of credit creation

- Incremental innovation under their control

Stablecoins offer:

- Programmable money

- Borderless settlement

- Reduced reliance on intermediaries

- New financial rails entirely

That clash is unavoidable.

What This Means for Crypto, Banks, and Users

For crypto:

- Stablecoins are the bridge to mainstream adoption

- Regulation will shape growth, not stop it

- Institutional use is accelerating

For banks:

- Competition is inevitable

- Adapting may be safer than resisting

- Digital assets are forcing structural change

For users:

- More choice

- Faster payments

- Potentially better returns

- Greater responsibility

The outcome of stablecoin regulation will influence how money moves for decades.

Final Thoughts: Follow the Incentives

When banks oppose stablecoin regulation, it’s important to look beyond the headlines.

Yes, there are real concerns about risk and consumer protection. But incentives matter — and the incentive for banks is clear:

Stablecoins threaten deposits, and deposits are the lifeblood of banking.

As regulation evolves, expect continued resistance, compromise, and lobbying. The fight isn’t over crypto prices or speculation — it’s over who controls digital dollars in the future financial system.