Crypto traders often fall into one of two camps: those who rely heavily on technical indicators and those who swear by pure price action. If you’ve been trading for a while, you’ve probably experimented with both — maybe even combined them — and wondered which approach actually delivers consistent results.

For intermediate traders, this question isn’t about what indicators or what candlestick patterns exist. It’s about how markets move, what information matters most, and how to avoid analysis paralysis in a market that never sleeps.

In this article, we’ll break down indicators vs price action in crypto trading, explore the strengths and weaknesses of each, and explain how experienced traders often combine them for better decision-making.

What Is Price Action Trading?

Price action trading focuses exclusively on price itself — how it moves, where it stalls, and where it accelerates. Instead of relying on lagging calculations, price action traders study raw candlestick data to understand market behavior in real time.

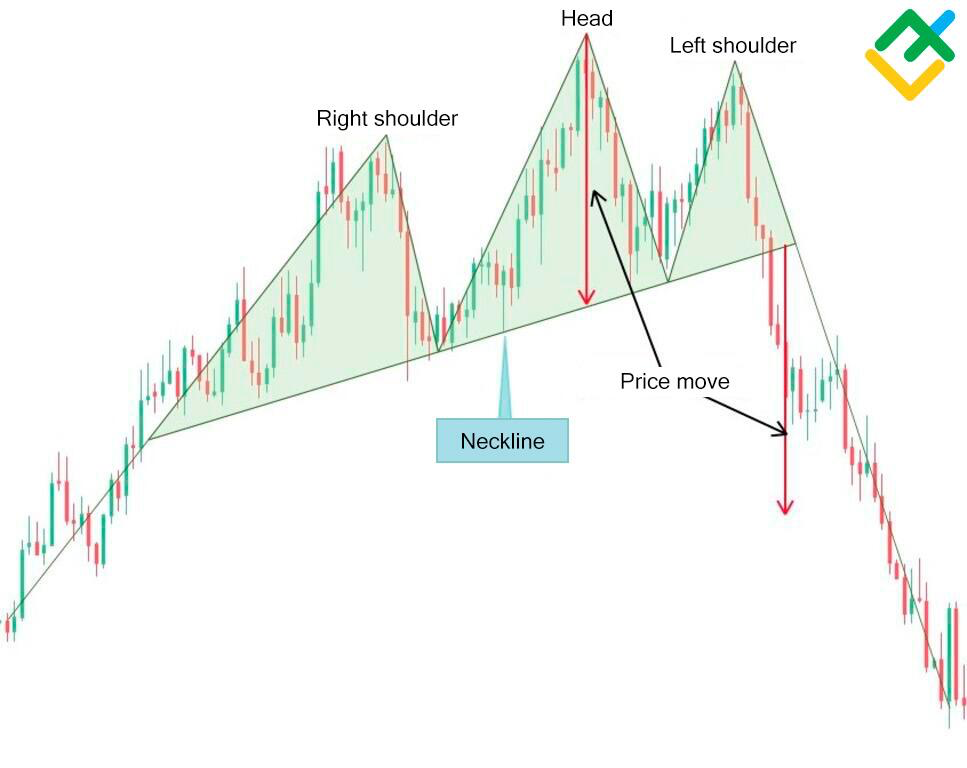

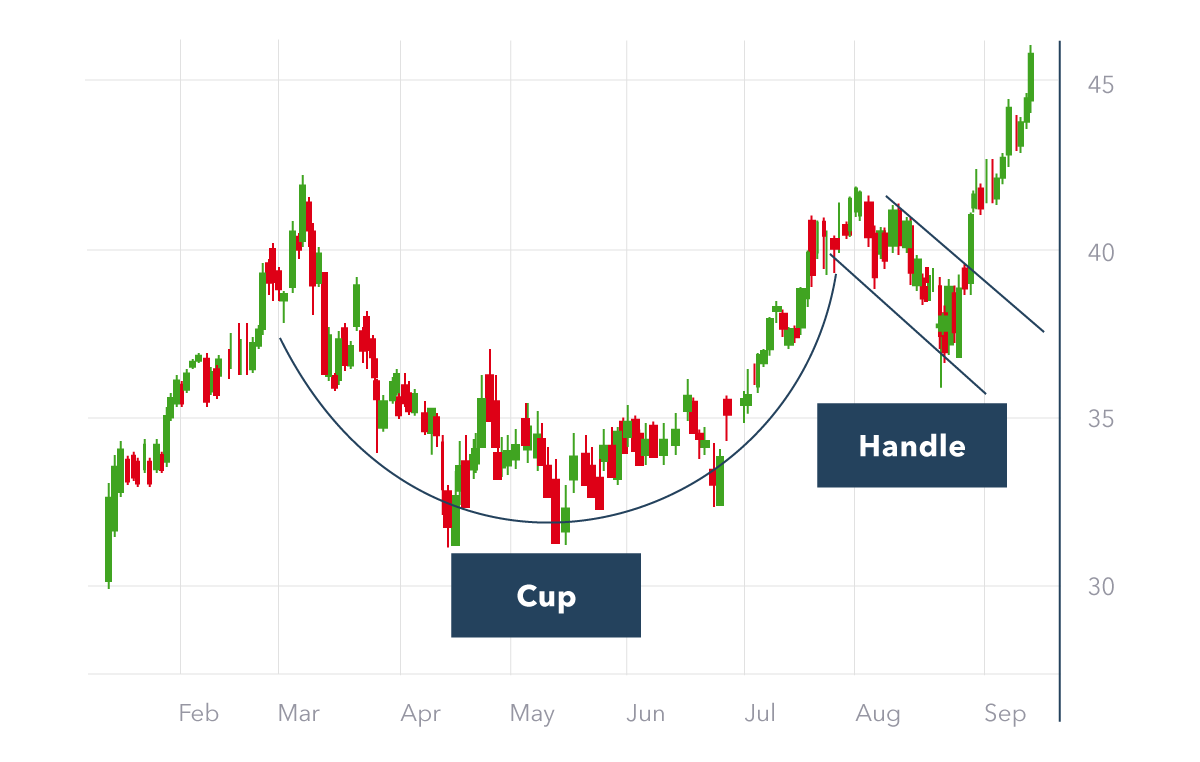

Common price action concepts include:

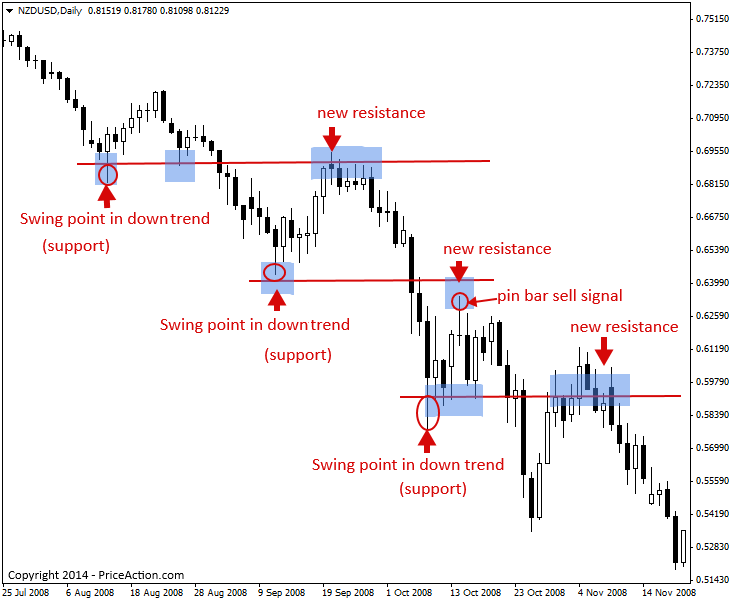

- Market structure (higher highs, lower lows)

- Support and resistance

- Trendlines and channels

- Candlestick patterns (engulfing candles, pin bars, inside bars)

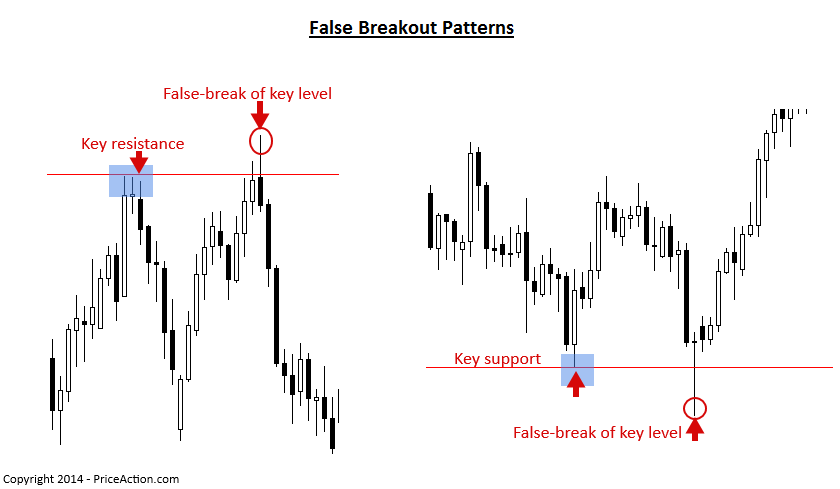

- Breakouts and false breakouts

At its core, price action is about interpreting order flow indirectly. Every candle represents a battle between buyers and sellers. By learning how that battle unfolds, traders aim to anticipate the next move rather than react after it happens.

What Are Indicators in Crypto Trading?

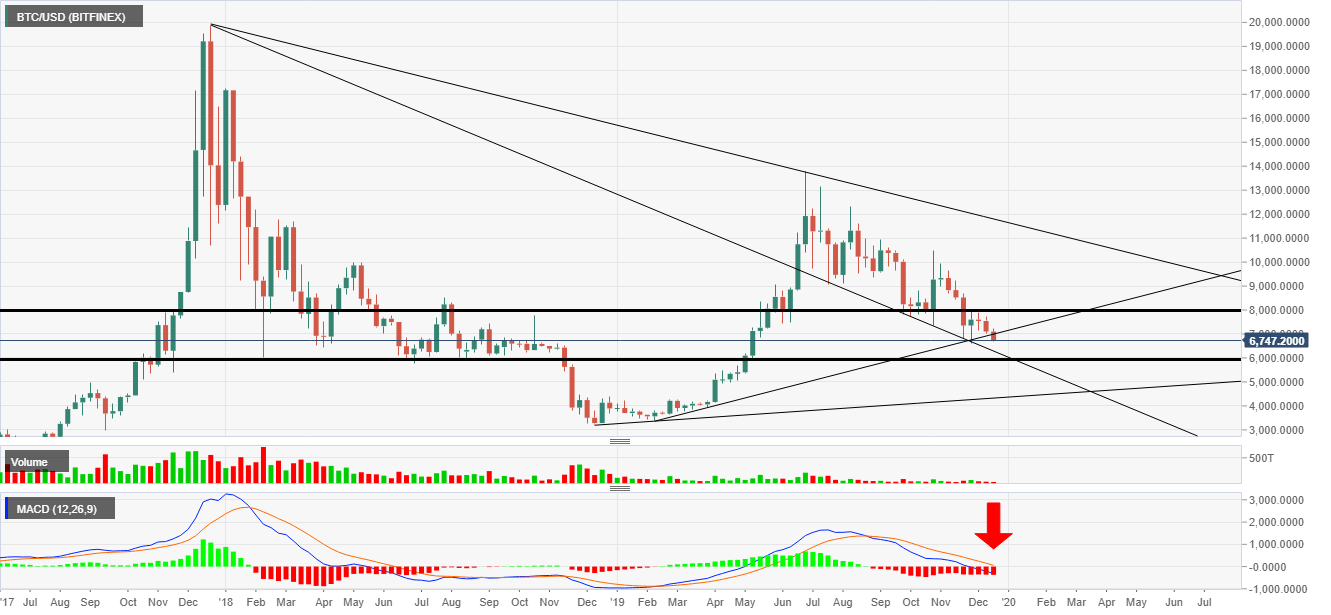

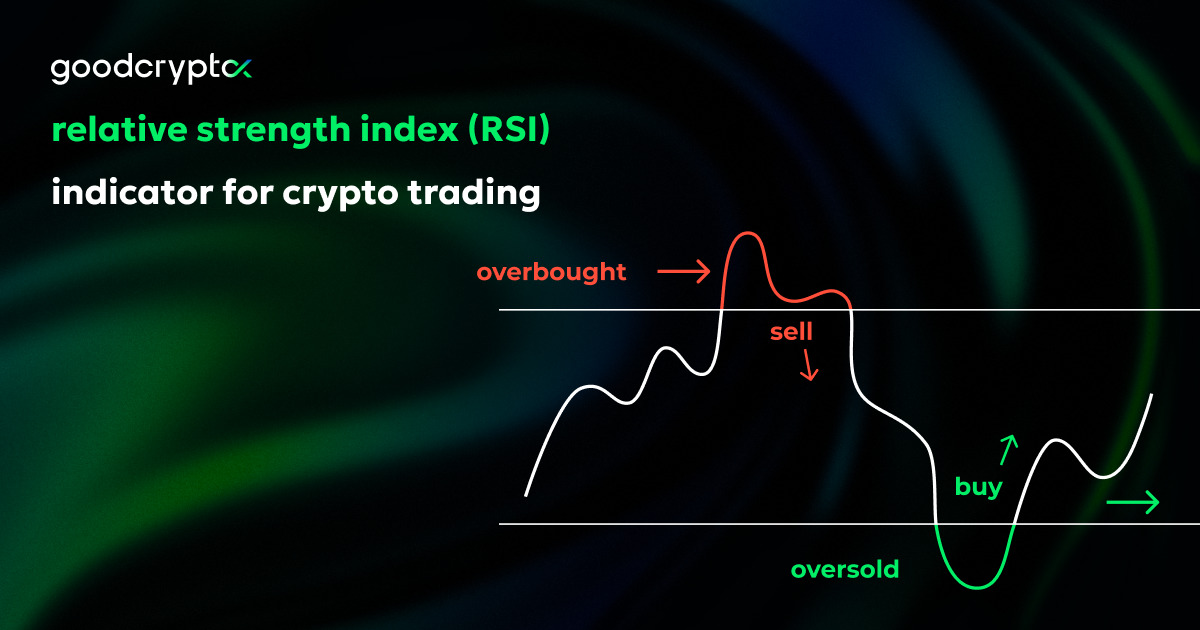

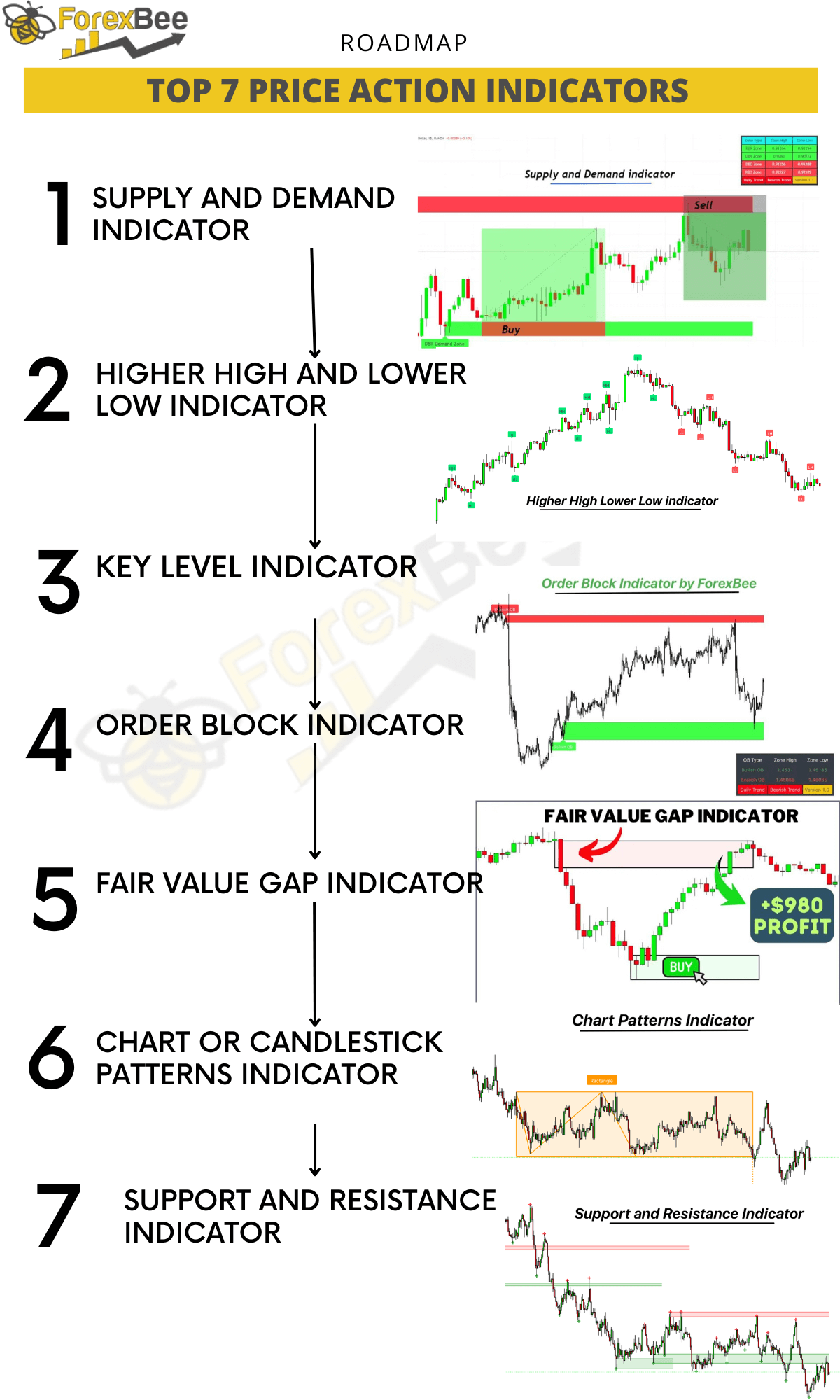

Indicators are mathematical calculations derived from price, volume, or both. They are designed to simplify market data and highlight potential trends, momentum shifts, or overbought and oversold conditions.

Some of the most widely used crypto indicators include:

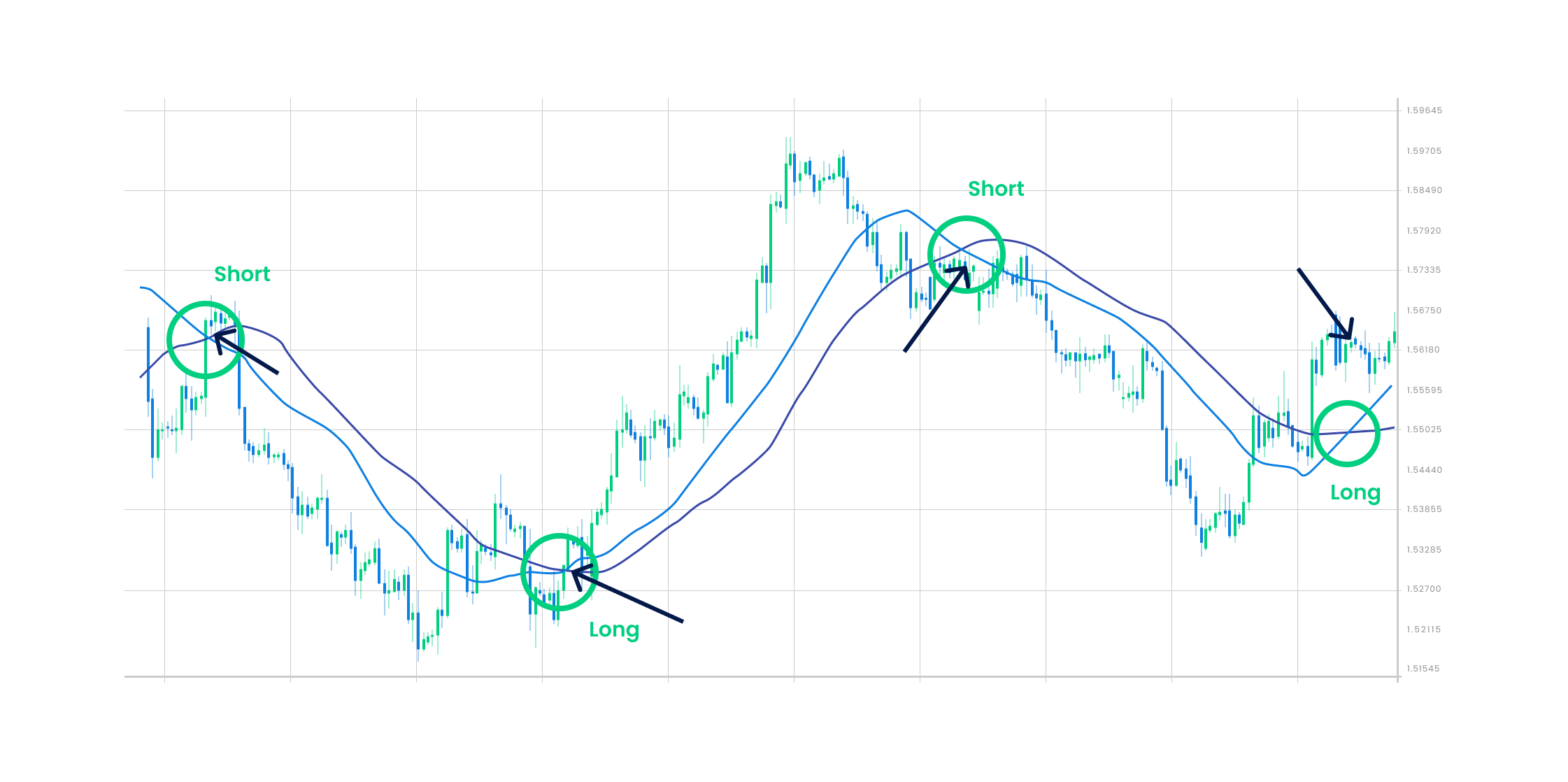

- Moving Averages (EMA, SMA)

- RSI (Relative Strength Index)

- MACD

- Bollinger Bands

- Volume-based indicators

- Stochastic Oscillator

Indicators can be powerful tools — especially in fast-moving crypto markets — but they come with an important caveat: most indicators lag price.

The Core Difference: Reaction vs Interpretation

The key distinction between indicators and price action lies in timing and interpretation.

- Price action traders interpret what is happening right now based on structure and behavior.

- Indicator traders react to signals that are calculated from past price data.

This doesn’t mean indicators are useless — far from it. But it does mean that relying on indicators alone can cause you to:

- Enter trades late

- Exit too early

- Miss context around key levels

Price action, on the other hand, requires more discretion and screen time, which can make it harder to master but often more adaptable.

Advantages of Price Action in Crypto

1. Real-Time Market Feedback

Crypto markets move fast, especially during high volatility. Price action gives you immediate feedback without waiting for confirmation from lagging tools.

2. Works Across All Timeframes

Whether you trade the 5-minute chart or the daily chart, price action principles remain consistent.

3. Cleaner Charts, Clearer Decisions

Removing excessive indicators reduces noise and helps you focus on what actually moves the market: price and liquidity.

4. Better Adaptation to Market Regimes

Crypto frequently shifts between trending, ranging, and highly volatile conditions. Price action adapts more naturally than rigid indicator rules.

Limitations of Price Action

Despite its strengths, price action isn’t perfect.

- It’s subjective — two traders may read the same chart differently.

- It requires experience and screen time to interpret consistently.

- Beginners often struggle without objective confirmation.

For intermediate traders, the biggest challenge is avoiding overconfidence. Just because you see a setup doesn’t mean the market owes you a move.

Advantages of Indicators

1. Objective Signals

Indicators provide clear, rule-based signals that reduce emotional decision-making.

2. Momentum & Trend Confirmation

Indicators like RSI and MACD are excellent at confirming momentum strength and divergence — something price action alone can sometimes miss.

3. Faster Decision Frameworks

For traders who prefer structured systems, indicators simplify execution and backtesting.

4. Useful in Ranging Markets

Oscillators often perform better than price action during sideways consolidation phases.

The Problem With Indicator Overload

Many crypto traders stack indicator after indicator, hoping for certainty. The result is usually the opposite: conflicting signals and delayed entries.

Common mistakes include:

- Using too many indicators that measure the same thing

- Ignoring key support and resistance levels

- Trading signals without broader market context

- Optimizing indicators to past data only

Indicators should support decisions, not replace market understanding.

Price Action vs Indicators: Which Is Better?

For most intermediate traders, the answer isn’t either/or — it’s hierarchy.

Experienced crypto traders typically:

- Use price action to identify context

- Use indicators for confirmation or timing

- Manage risk independently of both

For example:

- Price action identifies a bullish structure near support

- RSI confirms momentum isn’t overextended

- Moving averages confirm trend alignment

This approach avoids blind signal-following while still benefiting from quantitative tools.

How to Combine Price Action and Indicators Effectively

Here’s a simple framework many intermediate traders use:

Step 1: Start With Structure

Identify the market trend, key levels, and liquidity zones using price action alone.

Step 2: Add One or Two Indicators

Choose indicators that complement, not duplicate, your analysis:

- RSI for momentum

- Moving averages for trend direction

- Volume for confirmation

Step 3: Use Indicators as Filters

Instead of entering because of an indicator, use it to filter out bad trades.

Step 4: Focus on Risk Management

No method works without proper risk control. Position sizing and stop placement matter more than whether you use indicators or price action.

Final Thoughts: Master the Market, Not the Tools

Indicators and price action are just lenses through which you view the same thing: market behavior. The traders who struggle are usually those searching for the perfect indicator instead of understanding why price moves the way it does.

If you’re an intermediate crypto trader, your edge likely comes from:

- Strong market structure reading

- Selective use of indicators

- Consistent risk management

- Emotional discipline

In the end, the best approach is the one that helps you execute consistently, manage risk effectively, and stay objective — regardless of market conditions.