Elliott Wave Theory and Crypto: Unlocking the Secrets of Market Patterns

Introduction

The cryptocurrency market is renowned for its volatility, offering traders both incredible opportunities and significant risks. Amidst this chaos, technical analysis tools help traders make sense of market movements. One such tool is the Elliott Wave Theory—a powerful framework that identifies recurring patterns in financial markets.

In this post, we’ll dive deep into Elliott Wave Theory, its relevance to cryptocurrency trading, and how it can help you anticipate price movements with precision. Whether you’re a beginner or a seasoned trader, understanding these wave patterns could give you a significant edge in navigating the crypto market.

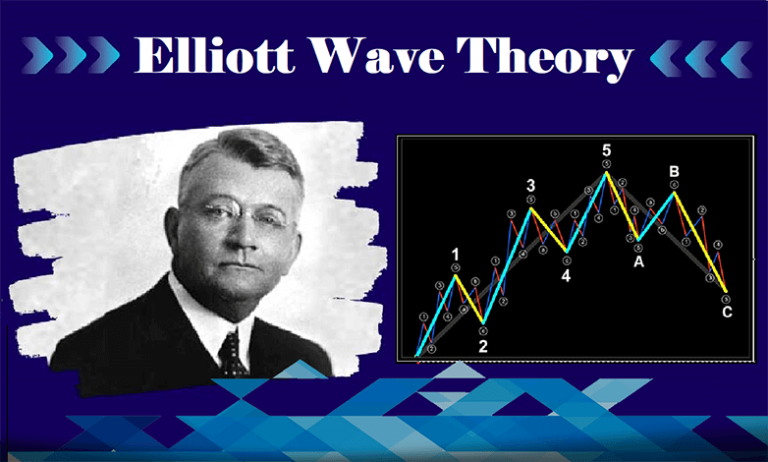

1. What is Elliott Wave Theory?

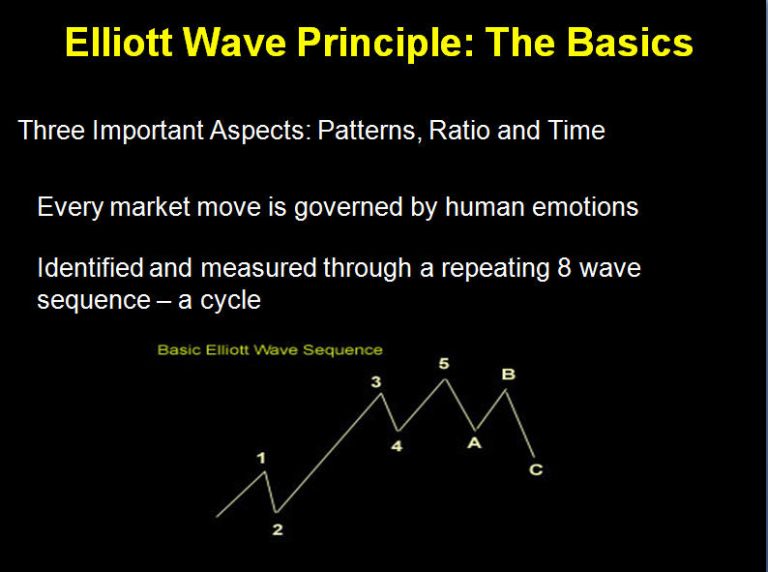

Developed by Ralph Nelson Elliott in the 1930s, Elliott Wave Theory is based on the idea that financial markets move in predictable cycles or “waves,” influenced by crowd psychology. Elliott discovered that market trends often follow specific patterns of five waves in the direction of the primary trend (impulse waves) and three waves against it (corrective waves).

These waves repeat across various timeframes and are fractal in nature, meaning that smaller wave patterns mirror larger ones.

2. The Two Types of Elliott Waves

1. Impulse Waves (5-Wave Structure)

Impulse waves consist of five distinct waves moving in the direction of the larger trend:

- Wave 1: The initial move in the trend’s direction, often driven by early adopters or initial positive sentiment.

- Wave 2: A corrective pullback, but not enough to erase the gains of Wave 1.

- Wave 3: The strongest and longest wave, driven by broad market enthusiasm or fear of missing out (FOMO).

- Wave 4: A smaller correction as traders lock in profits, but the trend remains intact.

- Wave 5: The final push in the trend’s direction, often marked by euphoria and reduced momentum.

2. Corrective Waves (3-Wave Structure)

Corrective waves occur in the opposite direction of the larger trend and consist of three waves:

- Wave A: The initial counter-trend movement, often seen as a “pause” in the trend.

- Wave B: A partial recovery, leading traders to mistakenly believe the trend will continue.

- Wave C: A decisive move against the trend, completing the correction.

3. Elliott Wave Patterns in Cryptocurrency

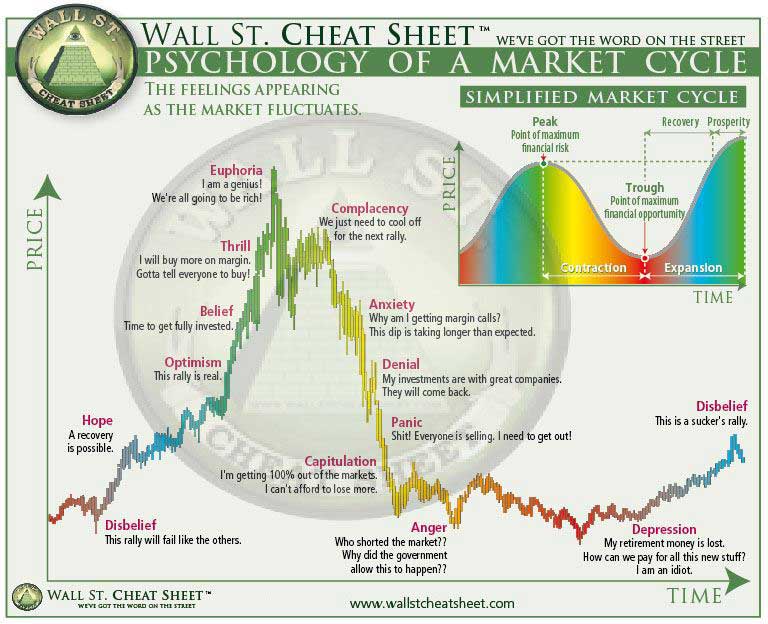

Cryptocurrency markets, being highly speculative, exhibit clear Elliott Wave patterns due to the strong influence of crowd psychology. Fear and greed drive market behavior, leading to impulsive rallies and sharp corrections that align with Elliott’s framework.

For example:

- Bull Markets: During a Bitcoin or Ethereum bull run, you’ll often see the classic five-wave structure, as investors pile in with increasing confidence.

- Bear Markets: In a downtrend, the three-wave corrective structure can help traders identify when the market might stabilize.

4. Applying Elliott Wave Theory to Crypto Trading

To effectively use Elliott Wave Theory in cryptocurrency trading, follow these steps:

1. Identify the Trend

Start by determining whether the market is in an uptrend or downtrend. Look for higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

2. Label the Waves

Using price charts, label the waves according to Elliott’s rules. Start with the most prominent moves and then zoom in to identify smaller wave patterns. Use the following guidelines:

- Wave 3 is typically the strongest and longest wave in an uptrend.

- Wave 4 should not overlap with Wave 1 in an impulse wave structure.

- Corrective waves often follow common Fibonacci retracement levels (38.2%, 50%, 61.8%).

3. Use Fibonacci Levels

Combine Elliott Wave Theory with Fibonacci tools to validate wave structures. For instance:

- Wave 2 often retraces 50-61.8% of Wave 1.

- Wave 4 typically retraces 38.2% of Wave 3.

- Wave C in corrective waves may extend to 1.618 times the length of Wave A.

4. Confirm with Other Indicators

Use other technical indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to confirm wave patterns. Divergences between price and RSI, for example, can signal the end of a wave.

5. Set Targets and Stops

Based on your wave analysis, set profit targets and stop-loss levels. For example:

- Exit partially after Wave 3 if you’re riding an uptrend.

- Place a stop-loss below the start of Wave 1 to minimize risk.

5. Real-World Example: Bitcoin’s Elliott Wave Pattern

Let’s consider a hypothetical Bitcoin scenario to illustrate how Elliott Wave Theory can be applied:

- Wave 1: Bitcoin rises from $20,000 to $30,000 as early adopters drive demand.

- Wave 2: A correction pulls the price back to $25,000, retracing 50% of Wave 1.

- Wave 3: News of institutional adoption causes Bitcoin to surge to $50,000, the longest and strongest wave.

- Wave 4: Profit-taking causes a mild correction to $45,000, retracing 38.2% of Wave 3.

- Wave 5: The final rally pushes Bitcoin to $60,000, accompanied by widespread euphoria.

After this impulse wave, a corrective phase begins:

- Wave A: Bitcoin drops to $50,000.

- Wave B: A partial recovery to $55,000 occurs as traders believe the bull market isn’t over.

- Wave C: Bitcoin declines sharply to $40,000, completing the correction.

6. Benefits of Elliott Wave Theory in Crypto

- Improved Timing: Understanding wave patterns helps traders identify when to enter or exit positions.

- Fractal Nature: The fractal structure allows traders to analyze both macro and micro trends.

- Risk Management: Clear wave structures enable better placement of stop-loss and take-profit orders.

- Psychological Insights: Elliott Wave Theory aligns with market sentiment, helping traders predict behavioral shifts.

6. Challenges and Limitations

While Elliott Wave Theory is a powerful tool, it’s not without its challenges:

- Subjectivity: Correctly identifying wave patterns can be difficult, especially in volatile markets.

- Complex Corrections: Crypto often experiences irregular corrections, such as expanded or double zigzag patterns, which can confuse traders.

- Reliance on Complementary Tools: Elliott Wave Theory works best when combined with other technical indicators.

- Emotional Bias: Traders may mislabel waves due to personal biases or hopes for a particular outcome.

7. Tips for Mastering Elliott Wave Theory

- Start Small: Focus on major wave structures before analyzing smaller subwaves.

- Use Multiple Timeframes: Analyze charts on daily, 4-hour, and hourly timeframes for a comprehensive view.

- Practice with Historical Data: Study past crypto price charts to refine your wave labeling skills.

- Stay Disciplined: Avoid overanalyzing or forcing wave patterns to fit your expectations.

8. Combining Elliott Wave Theory with Other Strategies

For better results, integrate Elliott Wave Theory with complementary strategies:

- Support and Resistance Levels: Align wave targets with key price levels.

- Fibonacci Retracements: Validate corrective wave levels with Fibonacci ratios.

- Momentum Indicators: Use RSI or MACD to confirm wave strength.

- News Analysis: Combine wave analysis with fundamental news to anticipate major market moves.

Conclusion

Elliott Wave Theory provides a framework for understanding the cyclical nature of cryptocurrency markets, making it an invaluable tool for traders. By identifying wave patterns and combining them with other strategies, traders can anticipate market movements with greater accuracy and make more informed decisions.

While mastering Elliott Wave Theory takes practice, the effort is worthwhile for those looking to unlock the secrets of market patterns and trade crypto with confidence.

Remember, trading is as much an art as it is a science, and Elliott Wave Theory is a tool that can help you stay ahead in the ever-changing world of cryptocurrency.

Happy trading, and may your waves always trend in the right direction!