Crypto has never stood still for long.

In just over a decade, it’s evolved from an obscure experiment discussed on niche forums into a global asset class held by institutions, governments, and everyday users around the world. Yet despite how far it’s come, many people still ask the same question:

Where is crypto actually going next?

The next five years will likely be the most important period in crypto’s history — not because of hype cycles or meme coins, but because this is when crypto quietly transitions from “alternative finance” into financial infrastructure.

And the biggest shift won’t be obvious at first.

Let’s take a grounded, realistic look at what crypto may look like over the next five years — and what that means for everyday users, investors, and builders.

1. Institutional Adoption Becomes the New Normal

One of the biggest misconceptions about crypto’s future is that institutional involvement is temporary.

It’s not.

The approval of Bitcoin and Ethereum ETFs wasn’t just a price catalyst — it was a structural shift. Crypto is now embedded inside traditional financial systems:

Retirement accounts

Pension funds

Asset management portfolios

Corporate treasuries

Wealth management platforms

Over the next five years, this trend accelerates.

Institutions won’t just hold crypto — they’ll build products on top of it:

Tokenized funds

On-chain settlement systems

Crypto-based yield products

Blockchain-powered back-office infrastructure

This doesn’t mean crypto becomes “centralized,” but it does mean liquidity becomes deeper, volatility becomes more structured, and markets mature.

Crypto stops behaving like a casino — and starts behaving like a financial market.

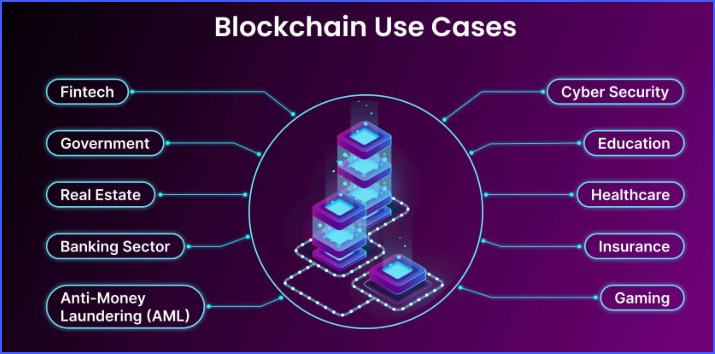

2. Real-World Assets (RWAs) Move On-Chain at Scale

One of the most important but least understood developments in crypto is the rise of real-world asset tokenization.

Over the next five years, expect to see:

Treasury bills

Bonds

Real estate

Private credit

Commodities

…increasingly represented as tokens on blockchain networks.

Why?

Because blockchains allow assets to be:

Settled faster

Traded globally

Programmed with rules

Fractionalized

Audited transparently

Traditional finance is inefficient. DeFi rails are not.

As regulation clarifies and infrastructure improves, RWAs will likely become one of crypto’s largest sectors — not driven by retail speculation, but by institutional demand for efficiency.

This is one of the clearest signals that crypto is moving beyond pure speculation.

3. DeFi Becomes Safer, Simpler, and More Regulated

Early DeFi was powerful — but chaotic.

High yields, confusing interfaces, hacks, rug pulls, and complex mechanics scared off many users. Over the next five years, that changes.

Expect DeFi to evolve in three major ways:

1. Better UX

Wallets and protocols will feel more like traditional apps.

Users won’t need to understand gas, bridges, or smart contracts to participate.

2. More Risk Transparency

Audits, insurance, circuit breakers, and standardized risk disclosures will become normal — especially as institutional capital flows in.

3. Regulatory Guardrails

Not heavy-handed control — but clearer rules around disclosures, compliance, and custody.

The end result?

DeFi becomes usable by normal people, not just power users.

This is also why understanding DeFi fundamentals now matters so much — because as it becomes mainstream, the people who understand how it works will have a massive edge.

For a better understanding of DeFi check out my 9 module video course “DeFi Demystified” for only $97 USD.

4. AI and Crypto Quietly Converge

AI and crypto are often discussed separately, but their convergence is one of the most underestimated trends in tech.

Over the next five years, crypto will increasingly act as the trust layer for AI systems, enabling:

Data verification

Decentralized compute markets

Autonomous agent payments

Permissionless coordination

Transparent model incentives

AI needs:

Verifiable data

Neutral infrastructure

Automated payments

Blockchains provide all three.

This doesn’t mean every “AI coin” succeeds — most won’t.

But the integration of AI + blockchain will become invisible infrastructure powering tools people use every day.

Just like most people don’t think about TCP/IP when using the internet, future users won’t think about blockchains when using AI-powered apps.

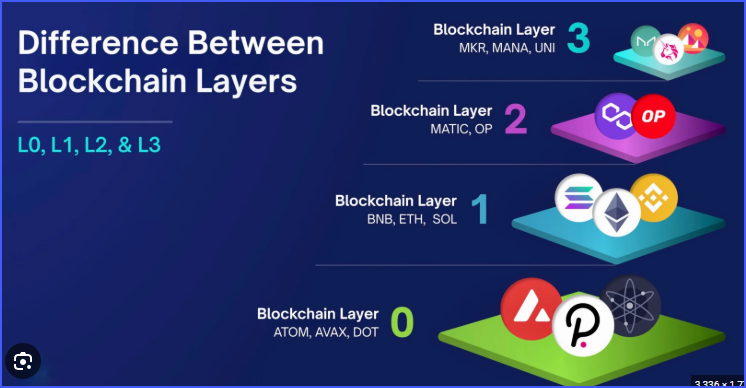

5. Layer 2s Become the Real Home of Crypto Activity

Ethereum won the smart contract war — but it won’t scale alone.

Over the next five years:

Layer 2 networks handle the majority of transactions

Fees drop dramatically

UX improves

App-specific chains flourish

Most users won’t know (or care) which chain they’re on.

They’ll care about:

Speed

Cost

Reliability

This shift allows crypto to scale to hundreds of millions of users without sacrificing decentralization at the base layer.

The future isn’t one chain to rule them all — it’s an ecosystem of interoperable networks.

6. The 4-Year Cycle Loses Its Power

Historically, crypto markets moved in clean four-year boom-bust cycles tied to Bitcoin halvings.

Over the next five years, that pattern weakens.

Why?

Because markets are now influenced by:

Macroeconomics

Interest rates

Institutional flows

ETF demand

Liquidity cycles

Halvings still matter — but they’re no longer the dominant force.

Crypto begins to behave more like:

A macro asset class

A technology sector

A financial infrastructure layer

This means fewer parabolic blow-offs — but more sustained opportunity for people who understand market structure and fundamentals.

7. Most People Will Use Crypto Without Realizing It

This may be the biggest shift of all.

In five years, many people will:

Send money

Earn yield

Own tokenized assets

Use blockchain-powered apps

…without ever saying, “I’m using crypto.”

Crypto becomes invisible infrastructure.

Just like most people don’t think about how the internet works — they just use it — blockchain fades into the background while powering the experience.

This is how true adoption happens.

👉So What This Means for You!

The next five years of crypto won’t be defined by hype alone.

They’ll be defined by:

Understanding

Skill

Adaptability

Fundamentals

The biggest opportunities won’t come from guessing the next meme coin — they’ll come from understanding how crypto fits into the broader financial system.

That’s especially true when it comes to DeFi.

As more assets move on-chain and more users enter the ecosystem, people who understand DeFi mechanics — yield, risk, protocols, and structure — will be far better positioned than those who don’t.

🎯 A Quick Note on Learning DeFi (Without the Overwhelm)

If you’ve ever felt like DeFi should make sense but doesn’t yet, you’re not alone.

That’s actually why I created DeFi Demystified — a 9-module video course designed to explain DeFi clearly, practically, and without unnecessary complexity.

It walks through:

What DeFi actually is

How yield works (and where risk hides)

How to navigate protocols safely

How DeFi fits into crypto’s future

No hype.

No jargon overload.

Just clarity.

You can learn more about it here if you’re curious:

Final Thoughts

Crypto’s future isn’t about replacing everything overnight.

It’s about integration.

Over the next five years, crypto becomes:

More mature

More useful

More regulated

More invisible

More powerful

The wild-west phase fades, and the infrastructure phase begins.

And the people who thrive won’t be the loudest — they’ll be the ones who took the time to understand how the system really works.

The future of crypto isn’t disappearing.

It’s quietly arriving.