Ripple Effect: Understanding How One Token’s Price Impacts Its Pair in Liquidity Pools

Introduction

Cryptocurrency trading has come a long way since Bitcoin’s early days, and with the advent of decentralized finance (DeFi), new financial mechanisms are being adopted by crypto investors and enthusiasts alike. Among these innovations, liquidity pools stand out as a foundational component of decentralized exchanges (DEXs) and yield farming platforms. But for those diving into liquidity pools, understanding how the value of one token affects its paired counterpart is essential.

Liquidity pools often feature token pairs, meaning two assets are locked together to facilitate trading and liquidity on the platform. For instance, you may find a liquidity pool for a pair like ETH/DAI on a DEX such as Uniswap. The value of one token in the pair directly influences the other in a dynamic and complex relationship. This ripple effect between tokens in a liquidity pool can have a significant impact on both traders and liquidity providers (LPs), making it vital to understand how these interdependent price movements work.

In this post, we’ll delve into the mechanics of liquidity pools, how token pairs interact, and the factors that drive their interdependent price dynamics.

1. What is a Liquidity Pool?

A liquidity pool is a smart contract that contains a pair of tokens that users can trade. These pools are a core part of DeFi platforms, enabling decentralized exchanges to operate without traditional market makers. Instead, LPs deposit pairs of tokens into the pool, allowing others to trade those tokens directly with the contract.

Liquidity pools function on the principle of an Automated Market Maker (AMM). Instead of relying on order books like centralized exchanges, AMMs use algorithms to determine token prices based on the ratio of assets in the pool. This makes trading faster and more accessible, but it also creates unique price dynamics between the token pairs.

2. How Does One Token’s Price Affect Its Pair in a Pool?

When one token’s value changes in the open market, it creates a chain reaction that affects its counterpart within the liquidity pool. Here’s how:

1. Price Ratio and Arbitrage

Liquidity pools operate based on a balance between the two tokens, typically following the constant product formula in popular DEXs. For example, in an ETH/DAI pool, the product of ETH and DAI quantities remains constant. If the market value of ETH rises or falls outside the pool, the ratio between ETH and DAI within the pool becomes skewed. This creates an opportunity for arbitrage—traders who take advantage of the price difference between the pool and the broader market.

- Example: Let’s say the market price of ETH increases, making the ETH/DAI ratio in the pool appear undervalued relative to the broader market. Arbitrageurs will buy ETH from the pool and add DAI, balancing the pool ratio until it matches the market.

2. Liquidity Pool Balancing

When arbitrageurs buy or sell tokens to balance the price ratios in the pool, it alters the quantities of each token. This process, known as rebalancing, keeps the pool’s ratio aligned with market prices but also affects the price impact on both tokens.

For LPs, this shift can lead to impermanent loss—a temporary loss in value due to the fluctuating ratio of tokens in the pool. Impermanent loss becomes permanent if LPs withdraw their funds during a significant price imbalance.

3. Key Factors Driving Token Pair Dynamics

Several factors play into how one token’s price affects its counterpart within a liquidity pool:

1. Token Volatility

The more volatile a token, the greater the potential for its value to shift significantly within a short period. When one token in a pair is volatile, its fluctuations can cause major shifts in the pool’s ratio, impacting the stable token as well. Volatile token pairs create high risk for LPs but also provide more arbitrage opportunities.

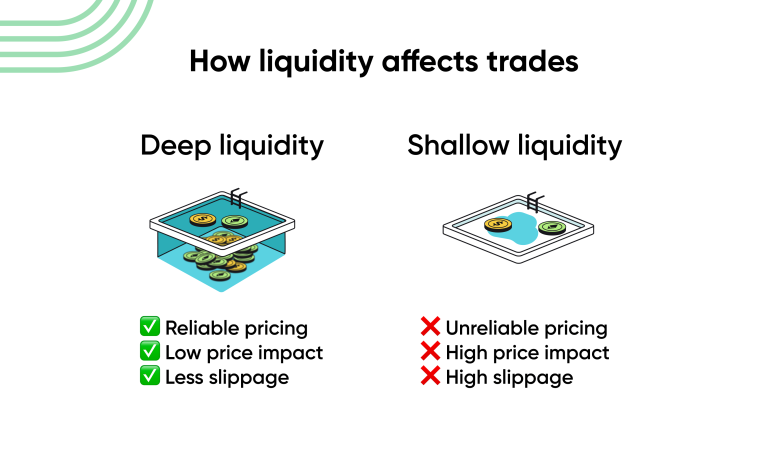

2. Liquidity Depth

The depth of the liquidity pool—meaning the total value locked (TVL)—is crucial. Larger pools with high liquidity experience less extreme price impact when one token’s price changes. For example, in a small pool, a slight increase in one token’s value could disproportionately impact the other token. Conversely, large pools help buffer these price swings, leading to a more stable ratio.

3. Trading Volume and Demand

A higher trading volume for a token pair can also influence price dynamics. When demand spikes for one token, traders are likely to buy or sell it from the pool, changing the quantities and affecting the pool’s ratio. As trading volumes increase, arbitrage opportunities rise, influencing the balancing act between the two tokens.

4. Arbitrage Efficiency

The speed at which arbitrageurs act on price discrepancies plays a role in stabilizing the pool. More efficient arbitrage helps to minimize the ripple effect on the token pair, restoring the pool balance faster. Arbitrageurs play a crucial role in maintaining market efficiency, but for LPs, this also means frequent adjustments in token quantities.

4. Practical Example of Token Pair Influence: ETH/DAI

Let’s consider a common DeFi pair: ETH/DAI. Assume an LP has deposited ETH and DAI into a Uniswap liquidity pool. Here’s how a change in ETH’s price would impact DAI in the pool:

Market Change: ETH’s price rises on the open market due to increased demand.

Price Imbalance in the Pool: The ETH/DAI pool now has ETH priced lower than the broader market due to the constant product formula maintaining the previous ratio.

Arbitrage Opportunity: Traders notice this imbalance and start buying ETH from the pool, adding DAI in return.

Pool Adjustment: As ETH gets bought up, its quantity decreases while DAI’s quantity increases in the pool, rebalancing the price ratio until it aligns with the market price.

For LPs, this process affects the overall value of their staked assets. They now hold more DAI and less ETH due to the rebalancing, and if they withdraw during this imbalance, they could face impermanent loss.

5. Mitigating Risks as an LP in Token Pairs

For LPs, understanding the risks involved in token pair price dynamics is essential. Here are a few ways to mitigate these risks:

1. Choose Stablecoin Pairs

Pairs involving stablecoins, like USDC/DAI or USDT/DAI, experience lower volatility. This means less dramatic fluctuations in the pool’s ratio, reducing impermanent loss.

2. Diversify Across Pools

Instead of committing all assets to one pair, LPs can spread their funds across multiple pools to diversify risk. Balancing exposure between volatile and stable pairs can offer stability while allowing some potential for high returns.

3. Monitor Market Movements

Staying informed about market trends and news that might affect token prices can help LPs anticipate changes. For example, an anticipated surge in ETH’s price might lead to adjustments in ETH pairs.

4. Use Yield Aggregators

Platforms like Yearn Finance and Balancer help LPs optimize returns by reallocating funds based on yield opportunities, allowing them to adjust to market changes more efficiently.

6. The Long-Term Impact of Token Pair Interactions on DeFi

The interplay between token pairs is more than just a trading mechanism; it’s a foundational aspect of DeFi’s liquidity structure. This ripple effect provides the basis for decentralized trading, lending, and yield farming. Here’s a look at the bigger picture:

Greater Market Efficiency: Arbitrage in token pairs brings market efficiency, ensuring that token prices remain balanced with the open market.

Increased Liquidity: As more users become LPs, liquidity pools deepen, making DeFi platforms more robust and stable.

Incentives for Liquidity Providers: By understanding how token pairs work, LPs can make more informed choices and maximize returns, leading to a steady flow of liquidity across DeFi ecosystems.

Final Thoughts

The ripple effect between token pairs in a liquidity pool is a complex, yet fascinating aspect of the DeFi ecosystem. Price changes in one token affect its paired counterpart, creating opportunities and challenges for traders and LPs alike. From arbitrage dynamics to impermanent loss, understanding these interactions is essential for anyone involved in liquidity provision.

As DeFi continues to grow, the interactions within liquidity pools will become even more refined, potentially offering new ways for LPs to mitigate risk and enhance returns. So whether you’re an LP, trader, or crypto enthusiast, knowing how one token impacts its pair can provide valuable insights for navigating the DeFi space.