For many people, the idea of crypto trading sounds exhausting.

✅Endless charts.

✅Constant alerts.

✅Watching five-minute candles like your future depends on them.

If you have a full-time job, family responsibilities, or simply don’t want crypto to become your entire life, this style of trading feels unrealistic — and honestly, unnecessary.

Here’s the truth most people don’t hear enough:

🎯You do not need to watch charts all day to trade crypto effectively.

In fact, constantly staring at price action often leads to worse decisions, more stress, and unnecessary losses. The most consistent traders usually do the opposite — they simplify.

This article breaks down how to approach crypto trading in a way that fits into real life, reduces screen time, and focuses on structure instead of noise.

Why Watching Charts All Day Hurts Most Traders

Many beginners assume more screen time equals better results.

In reality, excessive chart watching often leads to:

Overtrading

Emotional decision-making

Entering trades too late

Exiting too early

Chasing moves that already happened

When you stare at charts constantly, every small move feels important — even when it isn’t.

When you stare at charts constantly, every small move feels important — even when it isn’t.

Markets don’t reward attention.

They reward patience, planning, and discipline.

Trading Isn’t About Constant Action

One of the biggest mindset shifts successful traders make is understanding that trading is mostly waiting.

Good trading looks like:

Identifying high-probability areas

Planning entries and exits ahead of time

Waiting for price to come to you

Accepting that many days require no action

Bad trading looks like:

Clicking buttons out of boredom

Forcing trades because “something has to happen”

Reacting instead of planning

The market doesn’t pay you for effort.

It pays you for correct decisions.

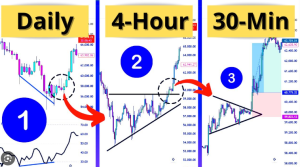

The Power of Higher Timeframes

If you don’t want to watch charts all day, the first adjustment is simple:

Stop trading lower timeframes.

Lower timeframes (1-minute, 5-minute charts) are noisy, emotional, and demanding. They require constant monitoring and lightning-fast decisions.

Higher timeframes (4-hour, daily, weekly) offer:

Cleaner structure

Fewer false signals

More time to think

Less emotional pressure

Most people with real lives should focus on swing trading, not day trading.

Most people with real lives should focus on swing trading, not day trading.

Swing trading allows you to:

Analyze once or twice a day

Set alerts instead of watching screens

Let trades develop over days or weeks

This alone eliminates 80% of unnecessary stress.

Build a Simple Trading Plan (This Is Everything)

If you want to trade crypto without staring at charts, you must have a plan before entering a trade.

A basic trading plan answers three questions:

Where am I entering?

Where am I wrong? (Stop loss)

Where am I taking profit?

If you don’t know these answers before entering, you’re guessing — not trading.

A simple plan removes the need to constantly monitor price because:

Your risk is already defined

Your exit points are already chosen

Your emotions are removed from the process

Once a trade is planned, your job is mostly done.

Alerts > Screen Time

Professional traders don’t watch charts all day — they use alerts.

Professional traders don’t watch charts all day — they use alerts.

Instead of staring at price:

Set alerts at key levels

Get notified when price reaches your zone

Re-evaluate only when necessary

Alerts allow you to:

Stay productive during the day

Avoid emotional reactions to small moves

Trade only when it matters

You’re no longer glued to a screen.

You’re simply responding to planned situations.

Fewer Trades, Better Results

Another key to reducing screen time is trading less, not more.

Most traders lose money because they:

Take too many trades

Trade low-quality setups

Feel the need to always be “in something”

Consistency improves when you:

Trade fewer setups

Focus on higher probability situations

Accept that doing nothing is often the right move

One good trade per week can outperform ten emotional trades per day.

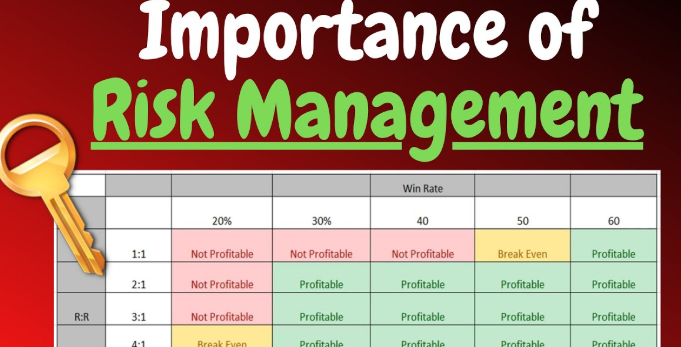

Risk Management Does the Heavy Lifting

When risk is managed correctly, you don’t need to babysit trades.

Proper risk management means:

Risking a small, fixed percentage per trade

Never needing to “check” price constantly

Accepting losses calmly when they happen

If one trade can emotionally ruin your day, you’re risking too much.

Lower risk = clearer thinking = better decisions.

Why Most People Overcomplicate Crypto Trading

Social media makes trading look complex on purpose.

Indicators stacked on indicators.

Constant predictions.

“Urgent” trade calls every hour.

Complexity keeps people dependent.

In reality, profitable trading often relies on:

Market structure

Support and resistance

Trend direction

Patience

Simple systems are easier to follow, easier to repeat, and easier to manage alongside a normal life.

Simple systems are easier to follow, easier to repeat, and easier to manage alongside a normal life.

A More Realistic Way to Learn Crypto Trading

If you’re serious about trading crypto without turning it into a second job, education matters — but it needs to be practical.

The goal isn’t:

To memorize every indicator

To catch every move

To trade all day

The goal is:

To understand structure

To manage risk

To trade calmly and consistently

That’s why I recommend Crypto Trading FREE 1 Day Trading Course — it focuses on clarity and structure, not hype or constant screen time.

👉 Check out FREE Crypto Trading 1 Day Course Here: earncryptoprofits.com

It’s designed for people who want to trade intelligently, not obsessively.

Final Thoughts

You don’t need to watch charts all day to trade crypto.

In fact, doing so usually leads to:

Worse decisions

More stress

Lower consistency

The most sustainable approach to crypto trading is:

Fewer trades

Higher timeframes

Clear plans

Strong risk management

Crypto trading should support your life — not consume it.

If you want a calmer, smarter approach, start with education, keep things simple, and let structure do the heavy lifting.