Crypto trading in 2026 looks very different than it did just a few years ago.

The nonstop hype has faded.

The “get rich overnight” narratives don’t work anymore.

And markets have matured in a way that rewards discipline, structure, and simplicity.

That’s why many traders are returning to something surprisingly basic:

Trading crypto using just one indicator — Bollinger Bands.

In a more mature market environment, simple tools often outperform complicated strategies. This article breaks down how Bollinger Bands work, why they’re still reliable in 2026, and how traders use them as part of a clean, repeatable trading process — without staring at charts all day.

No hype. No prediction. Just clarity.

Why Simpler Trading Works Better in 2026

One of the biggest mistakes traders still make is assuming that success comes from more indicators.

One of the biggest mistakes traders still make is assuming that success comes from more indicators.

In reality, most losses come from:

Conflicting signals

Overtrading

Emotional decision-making

Analysis paralysis

As crypto markets matured, volatility became more structured. Institutions entered. Liquidity improved. Price behavior became more readable — not easier, but cleaner.

This shift favors tools that:

Adapt to volatility

Work across timeframes

Don’t rely on constant tweaking

Bollinger Bands check all of those boxes.

What Are Bollinger Bands (Plain English)

Bollinger Bands consist of three lines:

Middle Band – a moving average (usually 20-period, BUT WE USE 50.)

Upper Band – the moving average + volatility

Lower Band – the moving average – volatility

Instead of predicting price direction, Bollinger Bands show you when price is relatively high or low compared to recent behavior.

They expand when volatility increases.

They contract when volatility decreases.

That adaptability is exactly why they remain useful in 2026.

Why Bollinger Bands Are Still Reliable in Crypto

Bollinger Bands work well in crypto for three main reasons:

1. They Adapt to Volatility

Crypto volatility changes constantly. Bollinger Bands automatically adjust, unlike fixed indicators that become unreliable when conditions shift.

2. They Work in Both Trends and Ranges

Whether the market is trending or consolidating, Bollinger Bands help traders understand context, not just signals.

3. They Encourage Patience

Bollinger Bands naturally reduce overtrading by waiting for price to reach extremes instead of chasing moves.

In a market where discipline matters more than speed, that’s a major advantage.

The Biggest Misunderstanding About Bollinger Bands

Many beginners misuse Bollinger Bands by assuming:

Touching the upper band = sell

Touching the lower band = buy

That’s not how professionals use them.

Bollinger Bands are not buy/sell buttons.

They are context tools.

The real value comes from observing:

How price behaves near the bands

Whether volatility is expanding or contracting

How price reacts after touching or riding a band

This shifts trading from guessing to probability-based decision-making.

A Simple Bollinger Band Trading Framework for 2026

Here’s a clean, beginner-friendly way traders approach Bollinger Bands today.

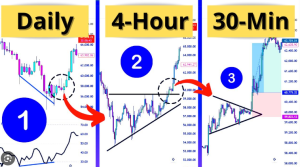

Step 1: Use Higher Timeframes for Clarity

In 2026, most traders who want clarity and consistency don’t forget:

4-hour charts

Daily charts

Lower timeframes are used for scalping profits. Higher timeframes add clarity.

Step 2: Identify Market State

Step 2: Identify Market State

Ask one question:

Is price trending or ranging?

In ranges, Bollinger Bands help identify extremes

In trends, Bollinger Bands help identify continuation

This single distinction prevents many bad trades.

Step 3: Watch Volatility

When Bollinger Bands contract, volatility is low.

When they expand, volatility is increasing.

Low volatility often precedes strong moves — but direction matters less than preparation.

Step 4: Plan the Trade Before Entry

Before entering, traders define:

Entry zone

Stop loss

Exit target

Risk per trade

If this isn’t clear, the trade is skipped.

That’s trading — not gambling.

Why Bollinger Bands Fit the 2026 Crypto Environment

Crypto in 2026 rewards:

Patience

Risk management

Consistency

Emotional control

Bollinger Bands naturally reinforce all four.

They:

Slow traders down

Highlight extremes instead of chasing price

Reduce the need for constant screen time

Encourage planning over reaction

This makes them ideal for:

9–5 workers

Parents

Traders who want structure without stress

What Bollinger Bands Won’t Do

It’s important to be honest.

Bollinger Bands will NOT:

Predict tops or bottoms perfectly

Win every trade

Eliminate losses

What they do provide is:

A repeatable framework

Better timing

Clearer risk boundaries

And over time, those things matter far more than flashy indicators.

The Role of Education (This Is Where Most Traders Struggle)

Even simple strategies fail without education.

Most traders don’t lose because the tool is bad — they lose because they:

Don’t understand risk

Overtrade

Ignore structure

Trade emotionally

That’s why many people start with structured, simplified education instead of jumping straight into live trading.

If you’re looking for a clear introduction to crypto trading fundamentals, there’s a free 1-day trading course that walks through:

Market structure

Risk management

Simple trading frameworks

How to avoid common beginner mistakes

👉 Access the free 1-day crypto trading course here:

https://earncryptoprofits.com

(No hype. Just education you can build on.)

How Traders Use This as a Starting Point

Many traders in 2026 don’t try to master everything at once. You don’t need to know everything to make substantial profits in crypto.

They:

Learn one tool well

Focus on risk management

Trade fewer, higher-quality setups

Review and improve over time

Bollinger Bands fit perfectly into this approach.

Simple doesn’t mean easy — it means repeatable.

Final Thoughts

Crypto trading in 2026 doesn’t reward complexity.

It rewards:

Clear thinking

Simple frameworks

Emotional control

Consistency over time

Bollinger Bands remain reliable because they align with how modern crypto markets actually behave — structured, volatile, and unforgiving to impulsive decisions.

You don’t need more indicators.

You need better execution.

And that starts with simplicity.

Step 2: Identify Market State

Step 2: Identify Market State