For much of its early life, crypto felt like the financial Wild West.

There were no clear rules, no big players, and very little oversight. Prices moved violently, narratives shifted overnight, and retail traders dominated market behavior. Gains were massive, losses were brutal, and volatility was simply the cost of participation.

Fast forward to today, and crypto looks very different.

✅Banks are involved.

✅ETFs exist.

✅Asset managers hold Bitcoin.

✅Governments regulate access.

Crypto hasn’t lost its edge — but it has grown up.

This shift didn’t happen by accident. It happened because institutions arrived, and their presence fundamentally reshaped how crypto behaves, how it’s traded, and how it fits into the global financial system.

Let’s break down how crypto evolved from a speculative frontier into a structured, institution-influenced market — and what that means going forward.

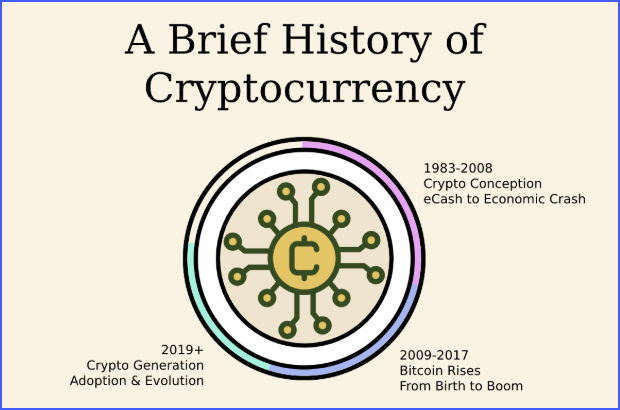

1. Crypto’s Early Days: A Retail-Driven Market

In its early years, crypto was almost entirely retail-driven.

Bitcoin, Ethereum, and early altcoins were traded primarily by:

Individuals

Hobbyists

Early adopters

Tech enthusiasts

Speculators

Liquidity was thin, infrastructure was limited, and even small amounts of capital could move prices dramatically.

This created a market defined by:

Extreme volatility

Rapid hype cycles

Parabolic bull runs

Brutal crashes

Minimal protection for users

Back then, narratives mattered more than fundamentals.

Community sentiment often mattered more than utility.

And risk management was the exception, not the rule.

This environment produced life-changing gains for some — and devastating losses for many.

But it also laid the groundwork for something bigger.

2. Why Institutions Initially Avoided Crypto

For years, institutions stayed on the sidelines.

Crypto was seen as:

Too volatile

Too risky

Too unregulated

Too technically complex

Too reputationally dangerous

There were also real barriers:

Lack of compliant custody solutions

Unclear regulatory frameworks

Inconsistent liquidity

Security risks

Unreliable market data

For institutions managing billions — or trillions — of dollars, crypto simply wasn’t ready.

That began to change once infrastructure caught up.

3. The Infrastructure Shift That Opened the Door

Before institutions could enter crypto, several things had to happen:

➡️Custody Improved

Institutional-grade custody providers emerged, offering insured, regulated storage for digital assets.

➡️Regulation Became Clearer

While still evolving, governments began defining what crypto is — and isn’t — allowing institutions to operate within legal frameworks.

➡️Market Liquidity Increased

Exchanges matured, derivatives markets developed, and pricing became more reliable.

➡️Compliance Tools Improved

KYC, AML, reporting, and audit tools made crypto compatible with traditional finance requirements.

Once these pieces were in place, institutions didn’t just dip their toes in.

They stepped in decisively.

4. ETFs Changed Everything

The approval of spot Bitcoin ETFs marked one of the most important moments in crypto history.

For the first time, institutions could gain exposure to Bitcoin through:

Regulated vehicles

Familiar brokerage platforms

Traditional retirement accounts

This removed friction entirely.

Investors no longer needed:

Wallets

Private keys

Exchanges

Technical knowledge

They could simply buy Bitcoin exposure like any other asset.

The result?

Massive capital inflows.

Long-term holders replacing short-term speculators.

Bitcoin becoming a mainstream portfolio allocation.

And once Bitcoin crossed that threshold, the rest of the market followed.

5. How Institutional Money Changed Market Behavior

When institutions entered crypto, the market didn’t just get bigger — it got different.

Here’s how:

👉Volatility Became More Structured

Prices still move aggressively, but less randomly. Liquidity is deeper, and market reactions follow macro events more closely.

👉Macro Factors Matter More

Interest rates, inflation, liquidity cycles, and economic data now influence crypto alongside internal factors like halvings and network growth.

👉Longer-Term Thinking Emerged

Institutions accumulate slowly and deliberately. They don’t chase hype — they position.

👉Derivatives Gained Influence

Futures, options, and structured products now play a major role in price discovery. Crypto began behaving less like a casino and more like a financial market.

6. The Rise of “Institutional Narratives”

Retail narratives are emotional:

“This coin is going to 100x”

“Everyone is talking about this”

“Don’t miss out”

Institutional narratives are strategic:

Tokenized real-world assets

On-chain settlement

Yield-bearing crypto products

Infrastructure plays

Scalability solutions

As institutions entered, capital shifted toward:

Networks with real usage

Protocols generating revenue

Infrastructure over speculation

This doesn’t mean meme coins disappeared — but it does mean serious capital flows elsewhere first.

7. DeFi and Institutions: A Complicated Relationship

Decentralized finance was built as an alternative to traditional finance — yet institutions are now engaging with it.

Why?

Because DeFi offers:

Faster settlement

Programmable finance

Transparent yield

Reduced intermediaries

However, institutions don’t interact with DeFi the same way retail users do.

They prioritize:

Audited protocols

Risk-managed exposure

Permissioned environments

Compliance-ready platforms

This is pushing DeFi to evolve:

Better UX

Better security

More transparency

Hybrid models combining decentralization with safeguards

DeFi isn’t being replaced — it’s being refined. This 32 page ebook shows how ‘the average Joe’ can get started in DeFi!

⭐ 8. What Crypto Lost — and Gained — in the Transition

Some people argue institutional involvement “ruined” crypto.

In reality, it changed it.

➡️What Crypto Lost

Some of its chaos

Some extreme retail-driven volatility

Some purely speculative excess

➡️What Crypto Gained

Stability

Legitimacy

Capital depth

Global access

Long-term adoption pathways

This tradeoff is normal for any emerging technology.

The internet went through the same transition — from anarchic experimentation to structured infrastructure.

Crypto is following that path.

🎯9. What This Means for Everyday Users and Investors

For everyday participants, this new era creates both challenges and opportunities.

The Challenges

Simpler strategies no longer work

Blind hype is punished faster

Market timing requires more understanding

The Opportunities

Better tools

Safer platforms

More predictable trends

Real yield opportunities

Long-term growth potential

The key difference now is education.

Understanding how institutions think, allocate, and manage risk matters more than ever.

10. Crypto’s Future: Not Replaced, But Integrated

Crypto didn’t become Wall Street.

Wall Street came to crypto.

And in doing so, crypto became something bigger than speculation — it became financial infrastructure.

Over time:

More assets will move on-chain

More users will interact with crypto unknowingly

More institutions will build on blockchain rails

The loudest phase of crypto may be behind us — but the most impactful phase is just beginning.

Final Thoughts

The story of crypto is no longer just about rebellion or speculation.

It’s about integration.

From Wild West to Wall Street, crypto’s evolution reflects maturity, not failure. The technology didn’t abandon its roots — it expanded its reach.

And for those willing to learn how this new market works, the opportunities remain massive.

Crypto hasn’t disappeared.

It has arrived.