1. Understanding Crypto Market Cycles: Bulls, Bears, and Everything In Between

2. What is Torus.win? A Deep Dive into the Mechanics

At its core, Torus.win is a DeFi protocol on Ethereum that blends the best of crypto innovations into a simple, wealth-generating system. Founded by @CRYPTOGRFX, it launched with the mission to make portfolio growth effortless and resilient. Unlike typical tokens, TORUS isn’t just held—it’s actively created and staked to unlock rewards from the TORUS Pool.

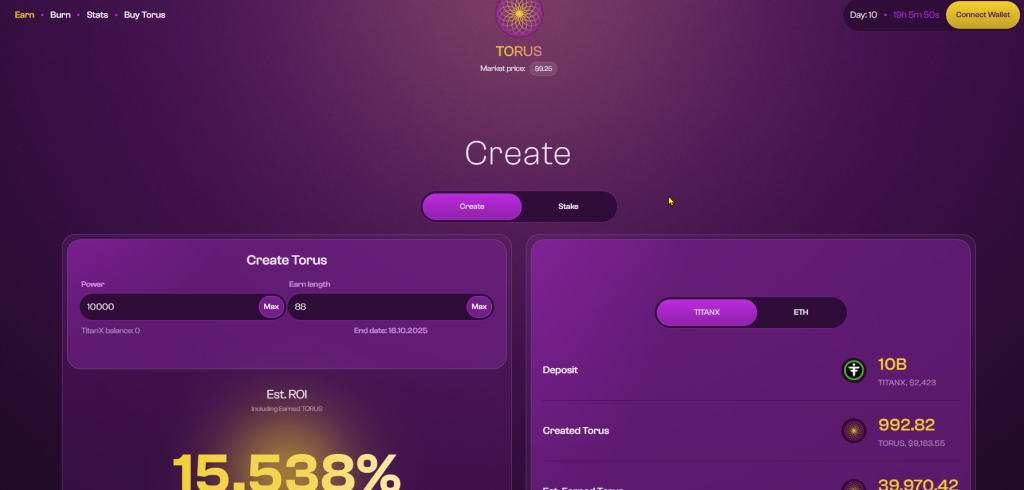

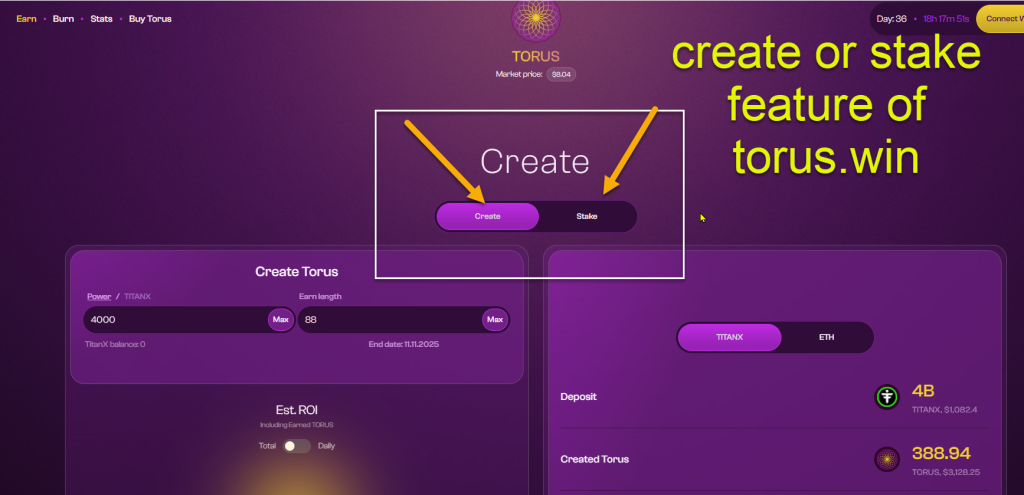

Here’s how it works: Users interact via two primary actions—Create and Stake—both granting shares in the daily-rewarding TORUS Pool. The pool distributes TORUS tokens proportionally to your share count, which depends on the amount locked and duration (1-88 days).

- Create TORUS: Convert TitanX or ETH into TORUS upfront. You get a base principal plus bonus tokens from the pool over time. This action triggers the “Buy, Burn & Build” mechanism: 84% of funds buy and burn TORUS (reducing supply), 8% builds liquidity by pairing TORUS with TitanX, 4.31% burns TitanX directly, another 4.31% uses ETH to buy and burn more TitanX, and 3.69% goes to a Genesis address. This deflationary design—92% focused on supply reduction and liquidity—drives scarcity and stability.

- Stake TORUS: Lock existing TORUS with a 5% fee (in TitanX or ETH) to compete for pool rewards. No new tokens are minted here, but you earn from the pool based on shares.

The immutable smart contracts ensure transparency and security. Tokenomics are deflationary by default: Every creation or stake burns tokens, shrinking supply while enhancing liquidity. As of August 15, 2025, TORUS trades around $8, with a market cap reflecting growing adoption.

Community dashboards on Dune (created by Mike Dean@MikeDeanLive) show real-time metrics, like daily creations hitting 67 in a single day— a record signaling rampant interest. YouTube tutorials abound, guiding users on optimizing ROI, which can exceed 100% in favorable conditions.

What sets Torus apart? Its market-agnostic design. In any cycle, the pool rewards provide passive income, while burns counteract selling pressure. It’s like a self-sustaining ecosystem where user activity fuels value appreciation.

3. Thriving in Bull Markets: Compounding with Torus.win

Strategy tips:

- Maximize Duration: Lock for 88 days to boost shares and rewards. One user created 1200 TORUS, sold for TitanX, then recreated for another 88 days—pure compounding genius.

- Leverage ETH/TitanX Flexibility: Use appreciating assets to enter, then claim rewards at peaks.

- Monitor Dune Dashboard: Track creations and burns to time entries when momentum builds.

Real-world example: During a July 2025 mini-bull, TORUS creations ramped to 67/day, burning millions in supply and driving a 20% price surge. Users who created early claimed rewards worth double their input, turning $500 into $1,000+ in weeks.Torus.win’s liquidity building (8% of funds) ensures smooth trades, avoiding slippage that plagues other DeFi tokens in hype phases. No more watching gains evaporate due to illiquid pools—Torus builds as it grows.

4. Surviving Bear Markets: Staking Your Way to Strength

- Passive Growth: Rewards accrue even as prices stagnate, providing a hedge against drawdowns.

- Deflationary Pressure: With 84% buy/burn on every action, supply shrinks faster than demand wanes, countering sell-offs.

- Low-Risk Entry: Use existing holdings; no need to buy at highs.

- Stake Long-Term: 88-day locks maximize shares during low-activity periods.

- Reinvest Rewards: Claim and restake to compound through the bear.

- Diversify Inputs: Use TitanX, which often holds value in ETH bears due to its own mechanics.

5. Overall Benefits and Advanced Strategies

Advanced TIPS:

- Use ETPs (Encapsulated TORUS Positions) for transferable stakes, enabling secondary markets.

- Monitor X for updates—posts show wild growth, like day 22 of 89 with explosive burns.Risks? Smart contract vulnerabilities (though audited) and market dependency.

- Always DYOR.

Conclusion

From bull euphoria to bear despair, Torus.win keeps your crypto portfolio strong through innovative creation, staking, and burns. It’s not just surviving—it’s thriving.

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research (DYOR).