DeFi Explained: Why Decentralized Finance

Could Be the Future of Banking!

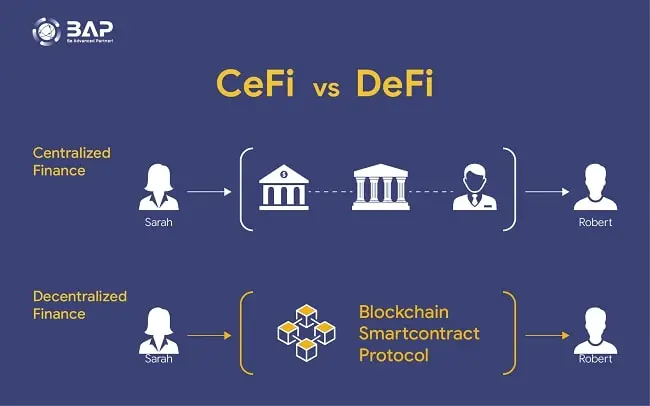

In recent years, the financial landscape has been revolutionized by blockchain technology, with one of its most disruptive innovations being Decentralized Finance (DeFi). While traditional banking systems have dominated global finance for centuries, DeFi offers a completely new paradigm—one that could reshape the future of banking and financial services. At its core, DeFi removes intermediaries, decentralizes financial activities, and provides open access to financial services on a global scale. But what exactly is DeFi, and why is it hailed as the future of finance?

This blog will break down the fundamentals of DeFi, explore its potential, and assess why it could become the backbone of tomorrow’s financial systems.

1 - What is DeFi?

Decentralized Finance, or DeFi, refers to a collection of financial services, applications, and protocols built on blockchain technology—primarily on Ethereum. Unlike traditional financial institutions that require intermediaries like banks or brokers, DeFi leverages smart contracts to execute transactions autonomously. These smart contracts are self-executing agreements written into code that do not require a middleman, reducing costs, increasing transparency, and lowering the barriers to entry for financial services.

Some of the core components of DeFi include:

- Decentralized exchanges (DEXs): These platforms allow users to trade cryptocurrencies without relying on a central authority or custodian.

- Lending and borrowing protocols: Platforms like Aave and Compound enable users to lend their crypto assets and earn interest or borrow without a traditional credit check.

- Yield farming: Users can stake or lend assets to liquidity pools in exchange for rewards, typically in the form of cryptocurrency.

- Stablecoins: Cryptocurrencies pegged to a stable asset like the U.S. dollar provide a reliable medium of exchange for those wary of the volatility of traditional cryptocurrencies.

By removing the need for traditional financial institutions, DeFi aims to democratize finance, offering open, permissionless access to anyone with an internet connection.

2 - The Current Banking System and Its Limitations

To understand the revolutionary potential of DeFi, it’s essential to first grasp the limitations of traditional finance. Conventional banking systems rely heavily on intermediaries such as banks, payment processors, and other financial institutions to facilitate transactions, manage loans, and provide access to capital markets. While this structure has worked for centuries, it has several drawbacks:

- Centralization: Traditional financial systems are centralized, meaning that a small number of institutions control access to services and are prone to inefficiencies, failures, or even manipulation.

- High costs: Intermediaries charge significant fees for services such as money transfers, foreign exchange, and loans, which can make financial services expensive, particularly for underserved populations.

- Limited access: A significant portion of the global population remains unbanked or underbanked due to lack of access to physical banking infrastructure or the stringent requirements for opening accounts and securing loans.

- Slow processes: Traditional banking services can be slow, particularly cross-border transactions, which often take days and require multiple verification steps.

3 - Why DeFi is a Game-Changer

a. Elimination of Intermediaries

One of the most significant advantages of DeFi is that it eliminates intermediaries in financial transactions. In the current system, if you want to transfer money internationally, you might go through a bank or a third-party payment processor like PayPal. These intermediaries charge fees and can take days to process the transaction. With DeFi, smart contracts handle the transaction, making it faster, cheaper, and more transparent.

For instance, decentralized exchanges (DEXs) like Uniswap allow users to trade cryptocurrencies directly from their wallets without a central entity overseeing the process. This peer-to-peer system reduces the friction, cost, and vulnerability to third-party risks that come with centralized platforms.

b. Global and Permissionless Access

DeFi is inherently global and permissionless. Anyone with a smartphone and an internet connection can access DeFi platforms, regardless of geographic location, financial status, or credit history. This is a critical advantage, particularly for people in developing countries who are often excluded from traditional financial systems due to a lack of identification, insufficient banking infrastructure, or unstable political environments.

For example, platforms like MakerDAO enable users to borrow against their cryptocurrency holdings without needing a bank’s approval. This opens up financial opportunities for millions of people who previously had no access to loans or credit facilities.

c. Transparency and Security

In traditional finance, the inner workings of banks, credit institutions, and exchanges are often opaque. Users must trust that these institutions will act in their best interests, a trust that has been betrayed numerous times through events like the 2008 financial crisis, where a lack of transparency led to systemic failures.

In contrast, DeFi platforms operate on public blockchains, where all transactions and smart contract operations are transparent and immutable. This transparency reduces the risk of fraud and ensures that users can verify transactions and smart contract code themselves. Moreover, decentralization increases security, as DeFi platforms are not reliant on a single point of failure.

d. Programmability and Flexibility

DeFi is highly programmable, thanks to the use of smart contracts, which allow for the automation of complex financial transactions without needing human oversight. Developers can build decentralized applications (dApps) that facilitate everything from lending and borrowing to insurance, payments, and derivatives trading.

For instance, yield farming—a popular DeFi activity—allows users to earn interest by providing liquidity to different protocols. This programmability enables sophisticated financial strategies and products that would be impossible or highly inefficient in the traditional financial world.

4 - Real-World Applications of DeFi

DeFi is not just a theoretical concept; it already has practical applications across a range of financial services:

Lending and Borrowing: Platforms like Compound and Aave allow users to lend their crypto assets in return for interest. These platforms also enable borrowing, often without a credit check, as users collateralize their loans with crypto holdings.

Payments and Transfers: Stablecoins like USDC and DAI are increasingly being used for cross-border payments and remittances, offering faster, cheaper alternatives to traditional bank transfers.

Decentralized Exchanges: DEXs like SushiSwap and PancakeSwap have transformed crypto trading, allowing users to swap tokens directly from their wallets without intermediaries, reducing the costs associated with centralized exchanges.

Insurance: Platforms like Nexus Mutual offer decentralized insurance for smart contracts and other DeFi protocols, providing a decentralized alternative to traditional insurance models.

Synthetic Assets: Platforms like Synthetix allow users to create synthetic assets that track the price of real-world assets like stocks or commodities, bringing traditional financial products into the decentralized world.

5 - Challenges and Risks of DeFi

While DeFi holds tremendous promise, it is not without challenges:

Regulatory Uncertainty: DeFi operates in a regulatory gray area in many jurisdictions. Governments around the world are grappling with how to regulate DeFi platforms, and future regulations could impact their development.

Security Risks: Smart contracts, while secure, are not infallible. Bugs in the code or vulnerabilities can be exploited, leading to significant losses. Hackers have stolen millions from DeFi platforms due to coding errors.

Volatility: Many DeFi platforms rely on volatile cryptocurrencies as collateral, which can pose significant risks during sharp market downturns. If the value of the collateral drops too quickly, it could lead to liquidation and losses for users.

Scalability: As DeFi grows, blockchain networks like Ethereum are struggling to keep up with the demand, leading to high gas fees and slow transaction times during peak usage. Solutions like Ethereum 2.0 and Layer 2 scaling solutions are being developed to address these issues, but they remain challenges for the ecosystem.

Conclusion - The Future of Banking?

DeFi has the potential to transform the financial industry as we know it. By removing intermediaries, reducing costs, increasing access, and providing unprecedented transparency, DeFi is laying the groundwork for a more inclusive and efficient financial system. However, it also faces significant hurdles, including regulatory challenges, security risks, and scalability issues.

If these challenges can be addressed, DeFi could very well be the future of banking, offering a global, open, and transparent financial system that serves everyone, regardless of their location or financial status. It’s still early days, but the foundations are being built for a new financial era, one that could be more equitable, efficient, and innovative than ever before.

In conclusion, DeFi represents a major shift in how we think about financial services. While the road ahead may be bumpy, its potential to revolutionize banking is immense. For those willing to embrace it, DeFi offers a glimpse into a future where finance is decentralized, democratized, and accessible to all.