Introduction

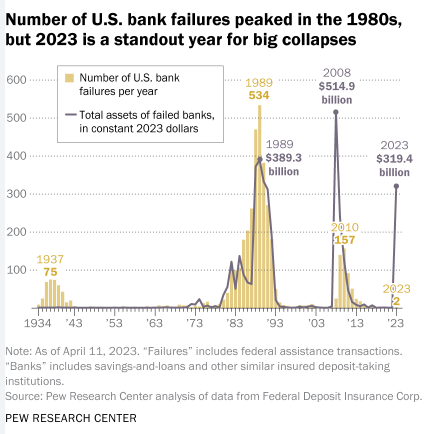

The phrase “bank run” used to be something out of a black-and-white history documentary. But in 2023, 2024, and now into 2025, America has witnessed a stunning return of bank collapses, reminiscent of the 2008 financial crisis. With regional banks shuttering seemingly overnight, consumer confidence in traditional financial institutions is eroding fast. As the financial system buckles under economic strain, Americans are seeking safety elsewhere. Surprisingly, many are finding it in an unlikely place: stablecoins.

Stablecoins—cryptocurrencies pegged to the U.S. dollar or other stable assets—are emerging as a new form of savings account. These blockchain-based instruments offer speed, transparency, and increasingly attractive yields. As trust in banks wanes, stablecoins are becoming more than just a crypto tool; they’re a lifeline for financial stability.

Chapter 1: The Rise of Bank Failures in America

A Brief Timeline

In the past two years, major regional banks like Silicon Valley Bank, Signature Bank, and First Republic have gone under. Whether due to mismanaged portfolios, high exposure to tech sector downturns, or simple liquidity crises, these collapses shocked the public.

The FDIC Struggles

While the Federal Deposit Insurance Corporation (FDIC) covers deposits up to $250,000, not all customers feel reassured. When banks fail, access to funds is frozen, creating panic. Delays in reimbursement further reduce confidence in the system.

Economic Uncertainty

With inflation still hovering above target levels, interest rates staying high, and GDP growth showing volatility, banks are under stress. As traditional savings accounts offer minimal interest, customers are exploring higher-yield alternatives.

Chapter 2: What Are Stablecoins?

Definition and Types

Stablecoins are digital assets designed to maintain a 1:1 peg with a fiat currency, most commonly the U.S. dollar. The main types include:

Fiat-backed Stablecoins (e.g., USDC, USDT): Backed by actual reserves of fiat and short-term securities.

Crypto-collateralized (e.g., DAI): Backed by crypto assets like ETH held in smart contracts.

Algorithmic Stablecoins (e.g., FRAX): Maintain their peg through supply-and-demand mechanisms.

Key Players

USDC (USD Coin): Issued by Circle, widely adopted, and audited.

USDT (Tether): The largest by market cap but controversial due to transparency concerns.

DAI: Decentralized and governed by MakerDAO.

Stablecoins combine the speed and programmability of crypto with the perceived stability of fiat currencies.

Chapter 3: Why Stablecoins Are Becoming the New Savings Accounts

1. Instant Liquidity

Unlike traditional banks that may delay access during times of stress, stablecoins offer instant liquidity. You can send USDC or USDT to anyone, anytime, from a crypto wallet, often for pennies in transaction fees.

2. Higher Yields

Through decentralized finance (DeFi) protocols, stablecoin holders can earn 4% to 12% APY by staking or lending their tokens. Compare that to the average U.S. savings account interest rate of less than 1% in most banks.

3. Programmability

Smart contracts allow for automation of interest payments, recurring deposits, and transfers. This programmability mimics but vastly improves upon legacy banking.

4. Global Access

Stablecoins are borderless. Anyone with internet access and a wallet app can use them. This is revolutionary for the underbanked or people in areas without reliable banking services.

5. Transparency and Auditability

Unlike opaque banking practices, many stablecoin issuers publish real-time proof of reserves, audited monthly or quarterly.

Chapter 4: The Rise of DeFi Savings Protocols

Anchor Protocol, Aave, Compound, and More

DeFi platforms like Aave and Compound allow users to deposit stablecoins and earn yield through decentralized lending. Others like Yearn Finance and Curve optimize returns across protocols.

Centralized Solutions Too

Companies like Coinbase and Gemini offer yield on stablecoins through institutional lending desks—making it simple for less tech-savvy users to participate.

Risks to Consider

Smart Contract Bugs

Platform Insolvency

Regulatory Risk

Despite risks, many users feel that the transparent, non-custodial nature of DeFi is safer than opaque bank operations.

Chapter 5: Stablecoins vs. Banks: A Side-by-Side Comparison

| Feature | Traditional Banks | Stablecoins/DeFi |

|---|---|---|

| Interest Rates | 0.01% – 0.50% APY | 4% – 12% APY |

| Access to Funds | Limited during crisis | 24/7 Global Access |

| Transparency | Low | High (on-chain data) |

| Fees | Hidden or monthly | Often minimal or zero |

| Inflation Protection | Poor | Moderate to High |

| Risk | Institutional failure | Smart contract/platform |

Chapter 6: Regulation and the Future of Stablecoin Savings

The Legal Landscape

U.S. Treasury and SEC have proposed stablecoin regulations.

The Stablecoin TRUST Act is under review in Congress.

Stablecoins may soon be fully integrated into financial oversight, making them even more appealing to the general public.

Banks Are Noticing

JPMorgan has issued its own stablecoin (JPM Coin) for institutional use. Expect more banks to enter the space or partner with stablecoin issuers to offer hybrid products.

CBDCs on the Horizon

Central Bank Digital Currencies (CBDCs), like the Fed’s proposed digital dollar, could compete with or complement stablecoins. However, CBDCs may lack the open-source ethos and yield benefits that make stablecoins attractive.

Chapter 7: How to Get Started with Stablecoin Saving

Step-by-Step Guide

Choose a Wallet: MetaMask, Coinbase Wallet, or Trust Wallet.

Buy Stablecoins: Use exchanges like Coinbase, Binance US, or Kraken.

Choose a Platform: For DeFi, platforms like Aave or Yearn. For centralized, try Coinbase Earn or Nexo.

Deposit and Earn: Transfer your stablecoins and begin earning interest.

Stay Safe: Use 2FA, hardware wallets, and stay up to date on platform security.

Conclusion: The Future of Saving is Decentralized

We are witnessing a paradigm shift in how people think about saving and preserving wealth. With banks failing and inflation rising, the traditional savings account is no longer sacred. In its place, stablecoins offer a compelling alternative: accessible, yield-generating, and resistant to institutional failure.

As blockchain technology matures and regulation catches up, stablecoins are well-positioned to redefine personal finance in America. They may not replace banks entirely, but for a growing number of users, they already feel like the smarter, safer choice.

The next time you think about where to put your savings, ask yourself: Is your bank truly safer than a blockchain?