In this approximately 1500-word guide (word count: 1523), I’ll explain what TORUS is, how the platform works, and provide a detailed, step-by-step tutorial on staking your TORUS tokens, and a video tutorial of actually creating a LIVE Torus Stake. We’ll cover prerequisites, rewards, fees, risks, and strategic tips to help you make informed decisions. Whether you’re a seasoned DeFi user or a newcomer, this post will equip you with the knowledge to get started.

1. What is TORUS and Torus.win?

This deflationary design aims to increase token scarcity over time, potentially boosting value. TORUS is immutable, meaning its smart contracts can’t be altered post-launch, adding a layer of security and trust.

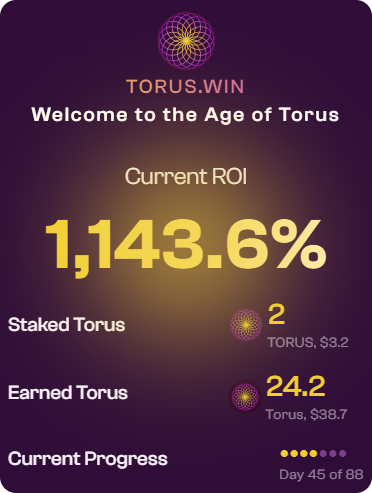

Torus.win is the user-friendly dApp interface for interacting with the protocol. It features an estimated staking ROI of over 3,000% in some scenarios, though this varies with market conditions and participation.

2. Prerequisites for Staking TORUS

Before you stake, ensure you meet these requirements to avoid issues:

- Wallet Setup: You’ll need an Ethereum-compatible wallet like MetaMask, WalletConnect, or Trust Wallet. TORUS operates on the Ethereum mainnet, so confirm your wallet is connected to Ethereum and has sufficient ETH for gas fees. Gas costs can fluctuate, so check current rates on sites like Etherscan.

- Acquire TORUS Tokens: You can’t stake without holding TORUS. Obtain them by Creating on torus.win (using TitanX or ETH), buying on decentralized exchanges (though liquidity might be limited early on), or through secondary markets. If you’re new, start by purchasing ETH or TitanX on exchanges like Uniswap or centralized platforms.

- TitanX or ETH for Fees: Staking requires a 5% fee paid in TitanX or ETH, based on the “Creation cost” equivalent. For example, if staking 1,000 TORUS for 88 days, the fee might be 500M TitanX if the Creation cost is 10B TitanX.

- Understanding Terms: Familiarize yourself with key concepts. The “TORUS Pool” is the reward source, distributing tokens daily based on your shares. “Shares” are calculated as Staked TORUS × (Length in Days)^2, rewarding longer commitments.

“Difficulty” increases costs over time—after 5 years, fees rise by 331%, making early participation advantageous. - Risk Awareness: Crypto staking involves smart contract risks, market volatility, and potential impermanent loss. Ensure you’re comfortable with these before proceeding.

With these in place, you’re ready to stake.

3. Step-by-Step Guide to Staking TORUS on Torus.win

Staking on torus.win is straightforward, but always double-check transactions to avoid errors. Here’s the process:

- Visit the Platform: Go to https://www.torus.win/ and connect your wallet. Click “Connect Wallet” in the top right, select your provider, and approve the connection. This links your address to the dApp without giving up control of your funds.

- Navigate to Staking Section: Once connected, head to the “Stake” tab or section (it might be under “Earn” or a dedicated staking page). The interface is intuitive, showing current ROI estimates and pool stats.

- Input Staking Details: Enter the amount of TORUS you want to stake. Choose a duration between 1 to 88 days—the maximum lock-up period. Longer durations yield higher shares due to the squared length formula. For instance, staking 100 TORUS for 88 days gives 100 × 88² = 774,400 shares, far more than a 1-day stake.

- Pay the Fee: The dApp will calculate the 5% fee based on the equivalent Creation cost. Approve the payment in TitanX or ETH from your wallet. Confirm the transaction and pay gas fees.

- Confirm and Lock: Review all details—amount, duration, fee, and estimated rewards. Sign the transaction. Once mined (usually in seconds to minutes), your TORUS is staked, and you’ll start accruing shares in the TORUS Pool.

- Monitor Your Stake: Use the dashboard to track progress, earned rewards, and end date. You can also view community dashboards for broader insights.

This process typically takes under 5 minutes, but factor in network congestion.

The Video Below gives a LIVE DEMO of How to Stake Torus.

4. How Rewards Work

5. Fees and Costs

6. Early Withdrawal Options and Penalties

Need to exit early? You can after 50% completion (minimum 2 days). Claimable rewards = ((Completion % – 50) × 2)%. For 75% completion, claim 50% of earned rewards.

Penalties: 50% of unclaimed rewards burn, 50% return to the pool. This discourages short-term flipping while supporting token scarcity.

7. Risks and Considerations

Staking TORUS isn’t risk-free. Smart contract vulnerabilities, though audited (assume standard for Ethereum projects), could lead to losses. Market volatility affects TORUS value—prices can drop, reducing staked asset worth. Difficulty increases make future staking pricier, and Ethereum gas fees add unpredictability. Regulatory changes in crypto could impact accessibility. Always use hardware wallets for security and diversify holdings. The platform warns of no guarantees, emphasizing DYOR (Do Your Own Research).

Additionally, as a new project (launched July 2025), liquidity might be thin, leading to slippage on trades.

8. Strategic Tips for Maximizing Returns

To optimize:

- Time Your Stakes: Stake during a bear market for high ROI; use the dApp’s estimator. The 88 day stake is the maximum to generate higher returns and earning more Torus.

- Compound Rewards: Re-stake earnings to multiply shares.

- Leverage Length: Always aim for 88 days for max shares, unless liquidity needs dictate otherwise.

- Diversify Inputs: Use ETH for fees if TitanX is expensive.

- Community Insights: Follow YouTube tutorials for visual guides and join Telegram for tips.

- Long-Term View: With burns reducing supply, holding through difficulty ramps could yield high returns.

Experiment with small amounts first to learn the ropes.

Final Thoughts

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research (DYOR).